Report Overview

Global Fishing Reels Market Highlights

Fishing Reels Market Size:

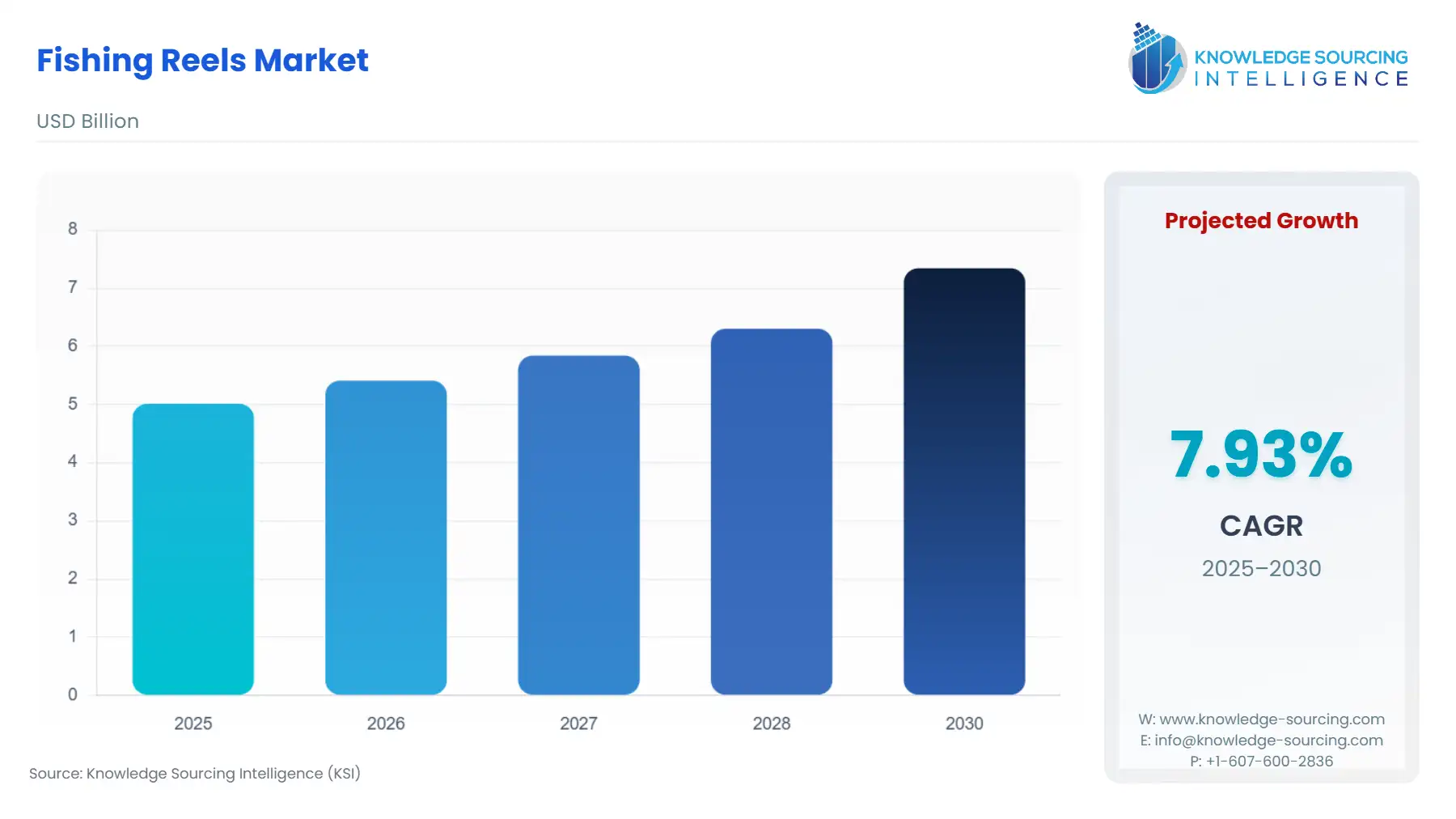

Global Fishing Reels Market, growing at a 7.93% CAGR, is projected to achieve USD 7.344 billion by 2030 from USD 5.014 billion in 2025.

The global fishing reels market operates as a core component of the broader recreational fishing and sporting goods industry, serving a diverse consumer base ranging from novice recreationalists to professional tournament anglers. The fishing reel functions as the critical interface between the rod and the line, with technological sophistication—including gear ratios, drag system materials, and frame construction—directly correlating to performance and price. The market is currently undergoing a pronounced bifurcation, driven by technology adoption at the high end and cost sensitivity at the mass market level. Performance-driven demand for Baitcasting Reels and specialised Fly Fishing systems commands significant capital expenditure from dedicated enthusiasts. Concurrently, the operational environment is complicated by global trade policy and evolving environmental regulations, which impose verifiable cost and material constraints on manufacturers. The following analysis isolates these dynamics, focusing explicitly on how macro-level shifts in consumer behaviour, manufacturing inputs, and regulatory oversight directly shape the purchasing behaviour and segment-specific demand for fishing reels globally.

EUV Lithography Market Analysis:

- Growth Drivers

The primary driver is the demonstrable expansion of recreational fishing participation across major global economies, translating directly into a foundational volume demand for new and replacement Spinning Reel and Baitcasting Reel units. This growth is sustained by the increasing availability and accessibility of fishing equipment through expanded Online Sales channels, which lowers the barrier to entry for novice anglers. Furthermore, continuous, aggressive product innovation, particularly the incorporation of lighter-weight materials such as carbon fibre composites and precision CNC-machined aluminium for reel frames and rotors, directly stimulates replacement demand among existing, dedicated anglers. These technological improvements offer verifiable enhancements in sensitivity, power-to-weight ratio, and long-term corrosion resistance, compelling enthusiasts to upgrade their existing gear to gain a competitive or functional edge, thereby creating a reliable churn in the premium segment.

- Challenges and Opportunities

The chief constraint facing the market is the upward pressure on retail pricing, exacerbated by the cumulative effect of global trade tariffs, particularly the existing U.S. tariffs on imported components. This constraint directly impacts the mass-market segment by increasing the final price of entry-level and mid-range Spincast Reel and Spinning Reel models, potentially dampening volume growth among cost-sensitive new entrants. However, this challenge generates an adjacent opportunity in advanced materials science. The regulatory imperative to eliminate toxic components, such as lead in sinkers and lures, indirectly increases demand for reels featuring enhanced Direct-Drive and Anti-Reverse mechanisms that can handle the heavier, non-toxic alternative weights and the corresponding stress on the drive train. This opportunity drives product differentiation based on durability and material compatibility, shifting demand toward higher-margin, specialised reels.

- Raw Material and Pricing Analysis

The pricing of fishing reels is heavily influenced by two primary raw material inputs: aluminium (specifically high-grade, corrosion-resistant alloys) and carbon fibre composites. Aluminium, used for reel frames, spools, and handles in mid-to-high-end models, exhibits pricing sensitivity to global commodity markets and regional trade policy. Carbon fibre, increasingly used in premium models for its superior strength-to-weight ratio in rotor and body construction, is subject to complex, global supply chains, often experiencing pricing volatility based on its demand in other high-tech industries, such as aerospace and automotive. The final reel price structure embeds significant costs associated with precision manufacturing, including CNC machining of gears and high-tolerance components, which require specialised machinery and skilled labour. This manufacturing complexity, rather than raw material volume alone, dictates the substantial price premium observed in advanced Baitcasting Reel and Salt-Water Fishing models over basic Spincast Reel products.

- Supply Chain Analysis

The global supply chain for fishing reels is characterised by its high degree of geographical concentration in the Asia-Pacific, specifically in major manufacturing hubs in China, South Korea, and Japan. Companies like Shimano Inc. and Daiwa Corporation anchor this region, controlling both design and high-precision manufacturing. Logistical complexity arises from the necessity of coordinating the sourcing of specialised materials—like high-grade aerospace aluminium billets and specialised carbon fibre prepregs—from multiple global suppliers for final assembly. A critical dependency exists on highly specialised subcontractors for CNC machining of the intricate gear trains and drag components, where tolerances are measured in microns to ensure the smooth function required by consumers. This supply chain, while efficient, is acutely vulnerable to geopolitical trade friction (e.g., US-China tariffs) and regional logistics disruptions, which can swiftly inflate the landed cost of goods, particularly for North American and European retailers.

Fishing Reels Market Government Regulations:

Government regulations primarily influence the Fishing Reels Market through environmental mandates concerning the use of toxic materials in ancillary tackle, which, in turn, impacts reel specifications and material selection. Furthermore, regional trade regulations and tariffs directly affect the cost structure and competitive positioning of imported reels. The US federal tax, while not a prohibition, serves as a consistent revenue stream for conservation, reinforcing the recreational infrastructure that drives participation and, consequently, demand for reels.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Sport Fish Restoration Act (1950) / Excise Tax |

Imposes a 10% federal excise tax on the wholesale price of fishing rods and reels. This revenue directly funds the Sport Fish Restoration Program, improving fish stocking, habitat, and public access points. This directly stimulates demand by enhancing the fishing experience and accessibility, encouraging new and existing anglers to purchase equipment. |

|

United States (Select States) |

Various State-Level Bans (e.g., NY, MA) on Lead Tackle |

Bans the use or sale of lead fishing weights below a certain size (e.g., less than 1 ounce). This creates an indirect demand for high-strength, durable fishing reels and components. Anglers shifting to non-toxic alternatives (like tungsten or bismuth) use heavier materials for the same volume, necessitating stronger frames, upgraded Drag Systems, and more robust gears to handle the increased stress and weight. |

|

European Union |

REACH Regulation (Draft Restrictions on Lead in Tackle) |

Consultations on restricting lead in fishing sinkers and lures (e.g., to $<1\%$ lead by weight). The potential regulation accelerates the opportunity for manufacturers to launch and market reels specifically designed for environmental compliance and heavy-duty use with alternative materials, driving a technical upgrade cycle within the European Fresh-Water Fishing and Salt-Water Fishing segments. |

|

United States |

Section 301 Tariffs (Office of the U.S. Trade Representative) |

Imposed tariffs on a wide range of goods imported from China, including finished fishing tackle and components. This directly increases the landed cost for U.S. importers and retailers. The resulting higher retail price for Spinning Reels and Baitcasting Reels acts as a short-term constraint on price-sensitive consumer demand, particularly in the entry-level market. |

Fishing Reels Market Segment Analysis:

- By Type: Baitcasting Reel Analysis

The Baitcasting Reel segment is a critical barometer for technological progress and dedicated angler demand, consistently commanding the highest average selling price (ASP) across the market. Demand for baitcasting reels is primarily driven by experienced anglers targeting specific species in both freshwater fishing and saltwater fishing environments, where precise lure control and high drag capacity are non-negotiable performance requirements. The direct demand is created by continuous innovation in casting distance and management of heavy lines and lures. Manufacturers frequently introduce models leveraging advanced Magnetic and Centrifugal Braking Systems and specialised spool designs (e.g., shallow spools for finesse fishing, deep spools for heavy cover). The segment’s growth is fundamentally tied to the willingness of anglers to pay a significant premium for specialised construction, such as single-piece aluminium frames that prevent flex under load, and carbon-fibre drag washers that provide smooth, high-max-drag power. For a committed angler, the Baitcasting Reel is a precision tool, and its replacement cycle is dictated by the availability of new features offering marginal but distinct performance improvements.

- By Fishing: Salt-Water Fishing Analysis

The Salt-Water Fishing segment generates demand for the most technologically robust and durable reels, driven by the highly corrosive nature of the marine environment and the pursuit of powerful, large game fish. The primary demand driver is the absolute necessity for corrosion resistance and maximum power-to-weight performance. This translates directly into procurement of reels constructed from aircraft-grade, forged, and anodised aluminium or marine-grade Stainless Steel, featuring high-tolerance sealing mechanisms to protect the gears, bearings, and Direct-Drive systems from salt intrusion. The need for high line capacity to manage long runs by large fish species (like Tuna or Marlin) also dictates the physical size and complexity of these reels. Furthermore, the specialised sub-segment of jigging and popping creates demand for high-speed ratio reels that utilise specialised Anti-Reverse systems to handle the extreme intermittent torque loads. This segment's demand is inelastic with respect to price, as the cost of reel failure in offshore fishing is substantial, compelling anglers to invest in proven, high-reliability equipment.

Fishing Reels Market Geographical Analysis:

- US Market Analysis

The US market is the largest and most dynamic, characterised by high participation rates in both freshwater fishing (Bass, Trout) and saltwater fishing (Offshore, Surf). Local demand is uniquely influenced by a strong, deeply ingrained culture of competitive angling and a robust regulatory framework that supports conservation through the Sport Fish Restoration Act excise tax. This stable funding enhances fishing infrastructure, consistently reinforcing participation. Critically, the market is highly sensitive to the quality and technology of premium products, driving the rapid adoption of new Baitcasting Reel and high-end Spinning Reel innovations. However, demand is simultaneously affected by the cost impact of U.S. Section 301 tariffs on imported Chinese tackle, which raises wholesale prices, placing short-term pressure on volume sales in the price-sensitive mass retail channels.

- Brazil Market Analysis

Brazil's market is characterised by strong regional demand for freshwater fishing, particularly in the Amazonian basin, focusing on species like the Peacock Bass. Local demand drivers are highly skewed toward durable, robust equipment capable of handling large, aggressive tropical species and the often-harsh, remote fishing environments. This creates a specific, high-end demand for large Baitcasting Reels and heavy-duty Spinning Reels models with high gear strength and line capacity, often favouring mechanical simplicity and ease of maintenance in remote locations. The market segment for Fly Fishing remains relatively nascent. Overall demand volume is constrained by macroeconomic volatility and lower average disposable income compared to North America, resulting in a market structure that is generally more price-elastic and often favours mid-range, proven reel technology over the absolute newest innovations.

- UK Market Analysis

The UK market is dominated by the sophisticated Fly Fishing and coarse (freshwater) angling segments. Demand for Fly Fishing reels is intensely specific, driven by traditional craftsmanship, aesthetic appeal, and material precision (e.g., sealed, large-arbour designs and fully machined aluminium construction). This preference creates a high-value, niche demand for specialised reel types. The ongoing regulatory environment concerning lead tackle, aligned with broader European environmental standards, forces a localised shift toward compatible tackle setups. This regulation, combined with a strong conservation culture, sustains a consistent demand for premium, durable equipment, where the replacement cycle is driven less by technological obsolescence and more by a preference for high-quality, long-life, purpose-built reels. The market also exhibits a preference for mid-sized, high-quality Spinning Reels for general coarse fishing.

- South Africa Market Analysis

South Africa serves as a key regional hub for both intense Salt-Water Fishing (targeting Tuna, Marlin, and sharks) and specialised Fresh-Water Fishing (Bass). Local demand is defined by the necessity for extreme durability and heavy-duty performance to manage powerful game fish in challenging coastal conditions. This drives concentrated demand for large, robust, high-capacity Salt-Water Fishing reels, often featuring lever-drag systems and advanced corrosion protection. Economic volatility and the presence of significant import tariffs affect the price of high-end, imported Daiwa Corporation and Shimano Inc. products, often creating a robust secondary market. Demand resilience in the premium segment is maintained by the dedicated charter fishing and specialised sports fishing tourism sectors, which require professional-grade equipment for their operations.

- Japan Market Analysis

Japan represents the global epicentre of technical fishing innovation and is home to market leaders like Shimano Inc. and Daiwa Corporation. The local demand is characterised by extreme technological sophistication and segment specialisation, driving the world's highest frequency of product launches and fastest adoption of new features. Angler demand is highly segmented, ranging from ultra-light finesse Baitcasting Reels for bass to highly complex electric reels for deep-sea saltwater fishing. This market acts as a proving ground for innovations in frame materials (e.g., carbon composites, magnesium alloys), micro-precision gearing, and advanced drag components. Demand is fundamentally fueled by a culture of specialisation, where anglers often possess multiple reels dedicated to narrow applications, ensuring a consistently high replacement and first-purchase volume for technologically advanced reels.

Fishing Reels Market Competitive Environment and Analysis:

The Global Fishing Reels Market is dominated by two primary, technologically sophisticated Japanese manufacturers, Shimano Inc. and Daiwa Corporation, who compete aggressively across all product categories from Spincast Reel to high-end Baitcasting Reel segments. The competitive strategy revolves around relentless annual product innovation, technological integration (e.g., digital counting systems, advanced gear concepts), and global distribution scale. The remaining competitive landscape consists of major global entities (e.g., Pure Fishing Inc., Rapala VMC Corporation) and specialised niche players (e.g., Accurate Fishing, Orvis Company, Inc.), who compete primarily on brand heritage, price-to-performance value, or specialisation in a single category like Fly Fishing. Market entry barriers remain high due to the necessity of mastering precision CNC machining and securing access to high-grade, lightweight composite materials.

Fishing Reels Market Company Profiles

- Shimano Inc.

Shimano Inc. maintains a formidable strategic position as one of the world's leading manufacturers of high-end fishing reels, characterised by its proprietary technologies like HAGANE Gear (a cold-forged gear concept for extreme strength and durability) and X-Ship (a gearing support system that enhances gear engagement under load). The company’s verifiable strategic positioning focuses on engineering excellence and cross-segment dominance, exemplified by the launch of new Spinning Reel and Baitcasting Reel models annually that push the boundaries of lightweight design and drag performance. Their key products, such as the Stella (high-end Spinning) and Metanium (high-end Baitcasting) lines, directly drive premium demand among enthusiasts by offering verifiable improvements in feel, smoothness, and casting distance, making them a benchmark for competitive performance in both Fresh-Water Fishing and Salt-Water Fishing.

- Daiwa Corporation

Daiwa Corporation is a direct and relentless competitor to Shimano, distinguishing itself through an emphasis on innovative reel body and rotor designs, primarily utilizing proprietary lightweight carbon materials like Zaion and Zaion V. Their strategic positioning centers on leveraging advanced design concepts such as Monocoque (MQ) Body (a single-piece frame that enhances strength and sealing) and the Airdrive Design (which minimizes rotor and bail weight for reduced rotational inertia). Key product launches, like the Saltiga series for Salt-Water Fishing and the Steez series for Fresh-Water Fishing Baitcasting Reels, create direct demand by offering demonstrably lighter and more responsive reel performance. Daiwa’s commitment to new materials and sealed componentry targets the Salt-Water Fishing segment, where corrosion resistance is a primary purchase driver, securing a reliable, high-margin customer base.

- Pure Fishing Inc.

Pure Fishing Inc. is strategically positioned as a portfolio manager, leveraging a broad array of iconic brands (e.g., Abu Garcia, Penn, Pflueger) to capture significant market share across all price points and Fishing Reel Types (Spinning Reel, Baitcasting Reel, Spincast Reel). The company’s strength lies in its extensive global distribution network and its ability to offer high-volume, reliable products from the entry-level Spincast Reel segment to the heavy-duty professional Salt-Water Fishing gear (e.g., Penn’s conventional reels). Pure Fishing’s demand is driven by its accessibility and brand recognition, particularly in the North American and European mass markets. Its corporate strategy includes key mergers and acquisitions, such as the 2021 closure of the Plano Synergy Holdings Inc. purchase, to enhance its product offerings and distribution reach in key geographical markets.

Fishing Reels Market Developments:

- August 2024: Daiwa Releases 2024/25 Product Catalogue with New Light Tackle Reels

Daiwa Corporation unveiled its 2024/25 product catalogue, confirming the product launch of several new reels, including the 23 EMERALDAS RX LT and 22 INFEET X. These specific Spinning Reel models are built on the lightweight LT Concept (Light and Tough) and feature the new ATD Type-L drag system, which is specifically designed for ultra-light lines and finesse applications in Fresh-Water Fishing (e.g., trout, bream). This launch directly creates demand among specialist light-tackle anglers who require superior drag finesse and reduced start-up inertia to protect very thin lines, demonstrating the company's commitment to continuous segmentation and technological improvement.

Fishing Reels Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.014 billion |

| Total Market Size in 2031 | USD 7.344 billion |

| Growth Rate | 7.93% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Mechanism, Fishing, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Fishing Reels Market Segmentation:

- FISHING REELS MARKET BY TYPE

- Spinning Reel

- Spincast Reel

- Baitcasting Reel

- FISHING REELS MARKET BY MECHANISM

- Direct-Drive

- Anti-Reverse

- FISHING REELS MARKET BY FISHING

- Salt-Water Fishing

- Fresh-Water Fishing

- Fly Fishing

- Others

- FISHING REELS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America