Report Overview

Global Fog Detectors Market Highlights

Fog Detectors Market Size:

Global Fog Detectors Market is expected to grow at a 4.18% CAGR, achieving USD 3.235 billion in 2031 from USD 2.530 billion in 2025.

Fog Detectors Market Introduction:

The fog detectors market, a vital segment of the visibility sensor market, addresses critical safety needs in transportation and aviation. Atmospheric visibility sensors, integral to weather detection systems, measure fog density to provide real-time data for low-visibility warning systems. These technologies enhance road safety by alerting drivers to hazardous conditions and support airport visibility solutions for safe aircraft operations. With increasing climate variability and stringent safety regulations, demand for reliable fog detection systems is growing. Innovations in sensor accuracy and integration with smart infrastructure position this market as essential for mitigating risks in fog-prone environments.

Fog Detectors Market Trends:

Devices that detect the features of the environment and the presence of fog or mist are called fog detectors. Various sensors and technologies are combined into the devices to measure variables like visibility, fog density, and distribution of particle sizes. These detectors are essential for improving security, safety, and operational effectiveness in fields and use where fog can present significant difficulties. Since they offer real-time information regarding the presence of fog, fog detectors are frequently used in the maritime, aviation, and road transportation industries. The operators can plan their flight preparation and landing, navigation, and traffic management using this data.

The fog detectors market is advancing with cutting-edge technologies, enhancing safety and efficiency. Predictive fog analytics leverage AI to forecast visibility conditions, enabling proactive measures. Real-time visibility data ensures timely alerts for the transportation and aviation sectors. Edge computing for fog detection processes data locally, reducing latency and improving response times. Smart infrastructure sensors integrate with urban systems to optimize traffic flow and enhance weather-induced accident prevention. These trends reflect the industry’s shift toward data-driven, interconnected solutions, addressing the growing need for reliable, scalable systems to mitigate risks associated with low-visibility conditions in volatile environments.

Fog Detectors Market Growth Drivers:

Rising foggy conditions and increasing government regulations

The danger of accidents and risks in numerous industries rises as a result of the drastically reduced visibility caused by fog. Fog detection systems are increasingly being used as a way to protect people, property, and business operations. Accurate and fast information on foggy conditions is crucial for sectors including aviation, transportation, and manufacturing. These industries can take preventative action and lessen the negative effects of decreased visibility on their operations thanks to fog detectors. Further, to reduce the hazards involved with accidents caused by fog, governments all over the world are putting in place strict laws and safety standards, which are increasing the global fog detectors market.

Rising technological advancements

Fog detectors are becoming more accurate and reliable thanks to ongoing developments in sensor technologies like LiDAR and infrared sensors. These developments have improved the functionality and effectiveness of fog detection systems. Moreover, due to shifting climatic trends, more fog-related incidents are occurring in several places. To lessen the inconveniences brought on by foggy conditions, this is an increased need for fog-detecting devices in foggy locations.

High investment and limited awareness

Fog-detecting systems have significant installation and maintenance expenses, particularly for small and medium-sized businesses. For some organizations, the hefty initial cost serves as a barrier to adoption. The advantages and uses of fog-detecting devices are largely unknown to many sectors and organizations. A barrier to market expansion is a lack of understanding of the technology and its possible effects on operations and safety. Further, technical issues with current fog detection systems could include false alarms or a challenge in effectively identifying fog in specific weather conditions. These restrictions may reduce the systems' dependability and efficiency, which may impede the global fog detectors market size.

Integration and management challenges

It is difficult and time-consuming to integrate fog-detecting systems with current systems and infrastructure. Fog detection solutions implementation can be difficult for organizations, especially those with outdated systems. For maximum operation, fog detection devices need to be calibrated and maintained regularly. Some organizations, especially those with low resources, may be constrained by the expenses and labor required for upkeep.

Rising collaboration and application diversification

Fog detector manufacturers, sensor technology suppliers, and industry stakeholders can work together to develop specialized applications and solutions. Partnerships can aid in addressing particular industrial needs and extending the market for fog detection systems. Fog detection systems promise unexplored markets in developing nations with major fog-related problems. Fog detector usage presents chances to improve safety precautions and operational effectiveness due to the expanding industrial sectors in these areas. Fog-detecting systems may have uses outside of conventional industries. Fog detection system makers may find new markets opened up by emerging uses in industries including agriculture, sporting events, and outdoor enjoyment.

Rising demand for real-time monitoring

The global fog detectors market share is expanding as the demand for sophisticated fog detection systems is being driven by the necessity for real-time fog monitoring. Organisations can move quickly and make wise decisions using real-time data to maintain operational continuity and safety. Further, many cloud and IoT platforms are integrating fog detectors to enable smooth data gathering, analysis, and storage. Through this interface, stakeholders can remotely access real-time fog data and support data-driven decision-making.

Increasing adoption of wireless communication and data analytics

A large amount of data is produced by fog detection systems about atmospheric characteristics and foggy conditions. Utilizing cutting-edge data analytics techniques enables businesses to uncover insightful patterns and trends that increase operational effectiveness and safety measures. Fog detection systems are incorporating wireless communication technologies like Wi-Fi and cellular networks for seamless connectivity and data transmission. Wireless communication makes it possible for remote monitoring and real-time notifications, increasing the overall efficiency of fog detection devices.

Fog Detectors Market Geographical Outlook:

The fog detectors market is witnessing significant growth globally, segmented into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. Fog detectors, critical for transport safety and visibility monitoring, utilize advanced sensors like LiDAR, infrared, and ultrasonic technologies to enhance safety in aviation, road transport, and maritime operations.

North America: Projected to hold the largest share, North America, led by the United States and Canada, drives the fog detectors market through strict safety regulations and a focus on transport safety. The region’s advanced infrastructure and high adoption of cutting-edge technologies support market growth. R&D initiatives by key players, such as Xylem and Sabik Marine, advance sensor accuracy and real-time monitoring, particularly for aviation safety and road traffic management (U.S. Department of Transportation, 2024). Government investments in smart infrastructure further boost demand.

Asia-Pacific: Rapid growth is expected due to urbanization and infrastructure development in China, India, and Japan. Fog-prone regions drive demand for visibility sensors to ensure road safety and aviation efficiency. Government initiatives promoting smart cities enhance adoption (Ministry of Urban Development, India, 2024).

Europe: Countries like Germany and the UK contribute through regulatory compliance and technological innovation, focusing on public safety and smart transportation systems (European Commission, 2024).

South America, and Middle East and Africa: Emerging markets show steady growth, driven by infrastructure investments and safety concerns in fog-prone areas.

Challenges like high installation costs persist, but AI-driven analytics and wireless technologies improve efficiency and cost-effectiveness. The fog detectors market thrives on safety regulations, technological advancements, and infrastructure development, with North America leading due to its robust ecosystem and R&D focus.

Fog Detectors Companies:

Sabik Marine (Carmanah)

Orga

Sice Srl

Xylem (Tideland)

Pharos Marine Automatic Power

Fog Detectors Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

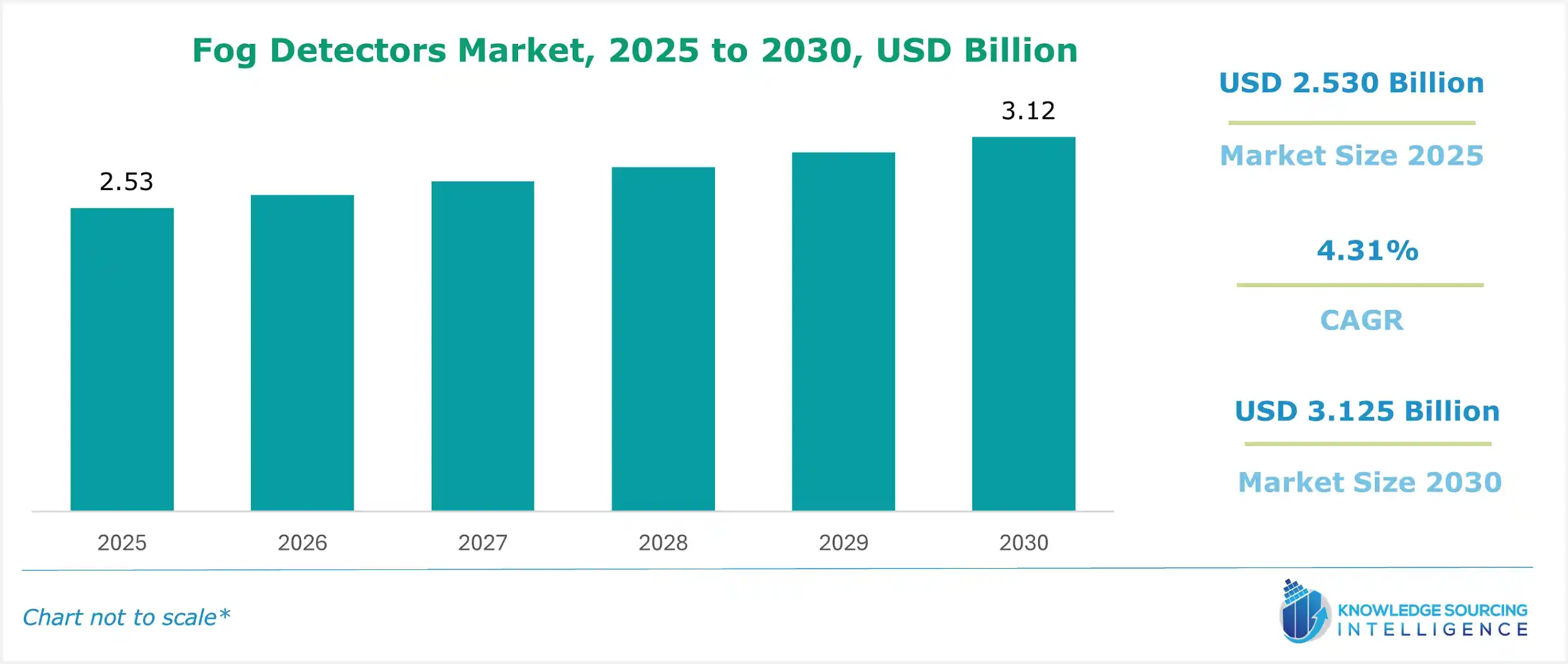

Fog Detectors Market Size in 2025 | USD 2.530 billion |

Fog Detectors Market Size in 2030 | USD 3.125 billion |

Growth Rate | CAGR of 4.31% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Fog Detectors Market |

|

Customization Scope | Free report customization with purchase |

Key Segment:

By Technology

LIDAR Based

Infrared Based

Ultrasonic Based

Microwave Based

Others

By Application

Aviation

Transport and Logistics

Industrial Facilities

Public Safety

Others

By End-User Industry

Aerospace

Transportation

Manufacturing and Warehouse

Oil and Gas

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation