Report Overview

Food Blister Packaging Market Highlights

Food Blister Packaging Market Size:

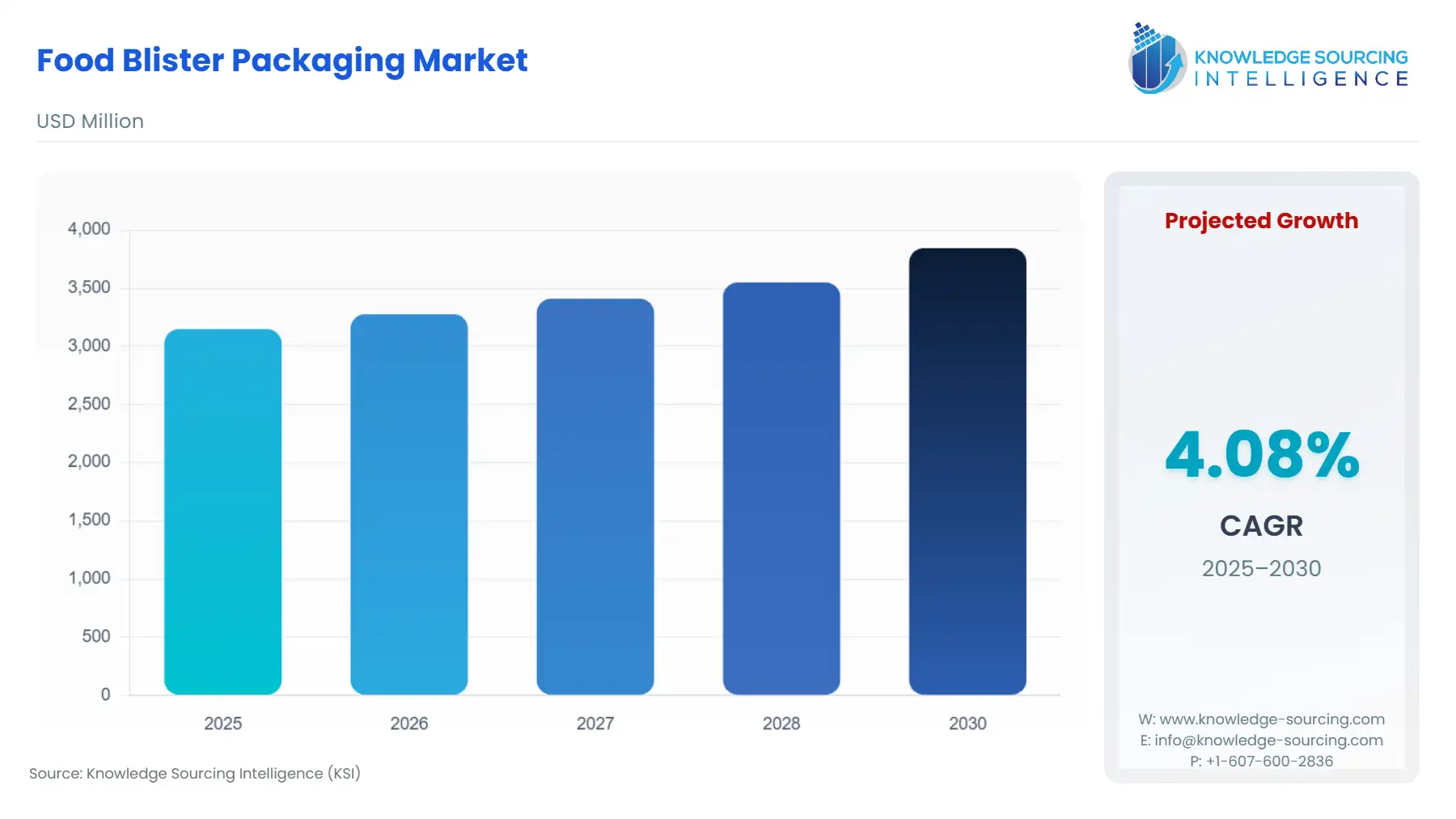

The global food blister packaging market is estimated to grow at a CAGR of 4.08% to attain US$3,845.615 million in 2030 from US$3,148.895 million in 2025.

Blister packages, which display products and make them simple to reach, dispense, and use, consist of a thermoformed plastic sheet with a paper, cardboard, or foil covering. Top manufacturers who compete in this global market continuously improve the blister packaging format by integrating cutting-edge packaging technologies like thermoforming and cold forming. Additionally, it is anticipated that the need for blister packaging with high barrier film for superior air, moisture, and light resistance will increase in the future, further fueling the expansion of blister packaging manufacturers. The rapid industrialization of developing countries and the increased demand for packaged meat and fruit products are expected to propel market growth.

Food Blister Packaging Market Overview & Scope:

The global food blister packaging market is segmented by:

- Type: By type, the global food blister packaging market is categorized into compartments, slides, and wallets. The compartment category is estimated to grow notably.

- Material: By material, the market is divided into PVC, PVDC, PP, and others. The PVC category is forecasted to grow significantly. The PVC blister packaging offers a higher level of protection to the food products and ensures resistance to light, moisture, and other environmental factors.

- Technology: By technology, the global food blister packaging market is categorized into cold-form and thermoformed. The cold-form category is estimated to attain a greater market share. This technology ensures an impermeable barrier to light, moisture, and other types of gases, increasing the shelf life of the food products.

- Region: The North American region is estimated to attain a greater market share during the forecasted timeline. Increasing demand for convenient food products and growing utilization of the e-commerce platform are among the key factors pushing the demand for food blister packaging in the region.

Top Trends Shaping the Global Food Blister Packaging Market:

- Technological advancement

The growing advancement in the blister packaging sector is among the major factors boosting the market’s expansion during the estimated timeline. With the rising demand for blister packaging in the food sector, innovations in the sector have increased.

Food Blister Packaging Market Growth Drivers vs. Challenges

Opportunities:

- Lower cost of packaging: Polyvinyl Chloride (PVC) is a low-cost thermoplastic with many uses. It has great impact strength, good dimensional stability, is oxygen permeable, and functions as a barrier to oil and grease. It can be either stiff or flexible. PVC is used to make blister packaging for gum or breath mints and tubing for food and beverage applications. Brands are exploring alternatives as the price per pound of PVC rises due to extraordinary demand.

- Increasing hygiene concerns: The rising hygiene concerns of consumers are among the major factors pushing the market growth during the forecasted timeline. The blister packaging offers a tamper-proof and quality-control packaging solution to the food industry.

Challenges:

- Strict regulatory compliance: The introduction of strict regulatory policies aimed at enhancing food safety is among the key factors challenging the global food blister packaging market growth during the forecasted timeline.

Food Blister Packaging Market Regional Analysis:

- Asia Pacific: The Asia Pacific region is estimated to grow more rapidly during the forecasted timeline. The increasing demand for food and beverage products in the region, especially in countries like India, China, Japan, and South Korea, is among the key factors pushing the demand for food blister packaging. Similarly, the growing utilization of e-commerce platforms and individuals' health and hygienic concerns are also among the key factors propelling the market expansion. The blister packaging offers the consumer a temperature-proof and quality-controlled product, enhancing the hygiene of the food product.

Food Blister Packaging Market Competitive Landscape:

The market is fragmented, with many notable players, including Abhinav Enterprises, Sonic Packaging, Competent Packaging Industries, Vinpac Innovations, Real Packaging, Sudham Packaging Industries, Thermopack, Macpac Ltd., Dongguan Jiasheng Plastic Packaging Products Co., Ltd., and Jiangyin Jiaou New Materials Co., Ltd., among others.

Food Blister Packaging Market Developments:

- July 2025: Romaco Group’s Noack N 760 blister-packaging machine introduces PET mono-material production. At the slate of trade fairs (including PPMA Total), Romaco showcased the Noack N 760 machine capable of manufacturing blister packs from PET/PET mono-material (PVC-free) with equivalent barrier properties to traditional PVC/Aluminium blister packs.

- May 2025: SÜDPACK develops recyclable blister solution for nutraceuticals/food-adjacent market. SÜDPACK announced a recyclable blister film solution tailored for nutraceuticals (which often straddle food and pharma) and that development underscores the shift toward sustainable blister packaging across food-adjacent segments.

- March 2025: Atlantic Packaging launches “Paperform” paper-based blister packs as a sustainable alternative to single-use plastic blisters. The company announced a new version of its blister pack for food-/consumer-goods applications that rely on fiber-based material rather than conventional plastics.

Food Blister Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Food Blister Packaging Market Size in 2025 | US$3,148.895 million |

| Food Blister Packaging Market Size in 2030 | US$3,845.615 million |

| Growth Rate | CAGR of 4.08% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Food Blister Packaging Market |

|

| Customization Scope | Free report customization with purchase |

Food Blister Packaging Market Segmentation:

- By Type

- Compartment

- Slide

- Wallet

- By Material

- PVC

- PVDC

- PP

- Others

- By Technology

- Cold-Form

- Thermoformed

- By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa