Report Overview

Global Functional Flours Market Highlights

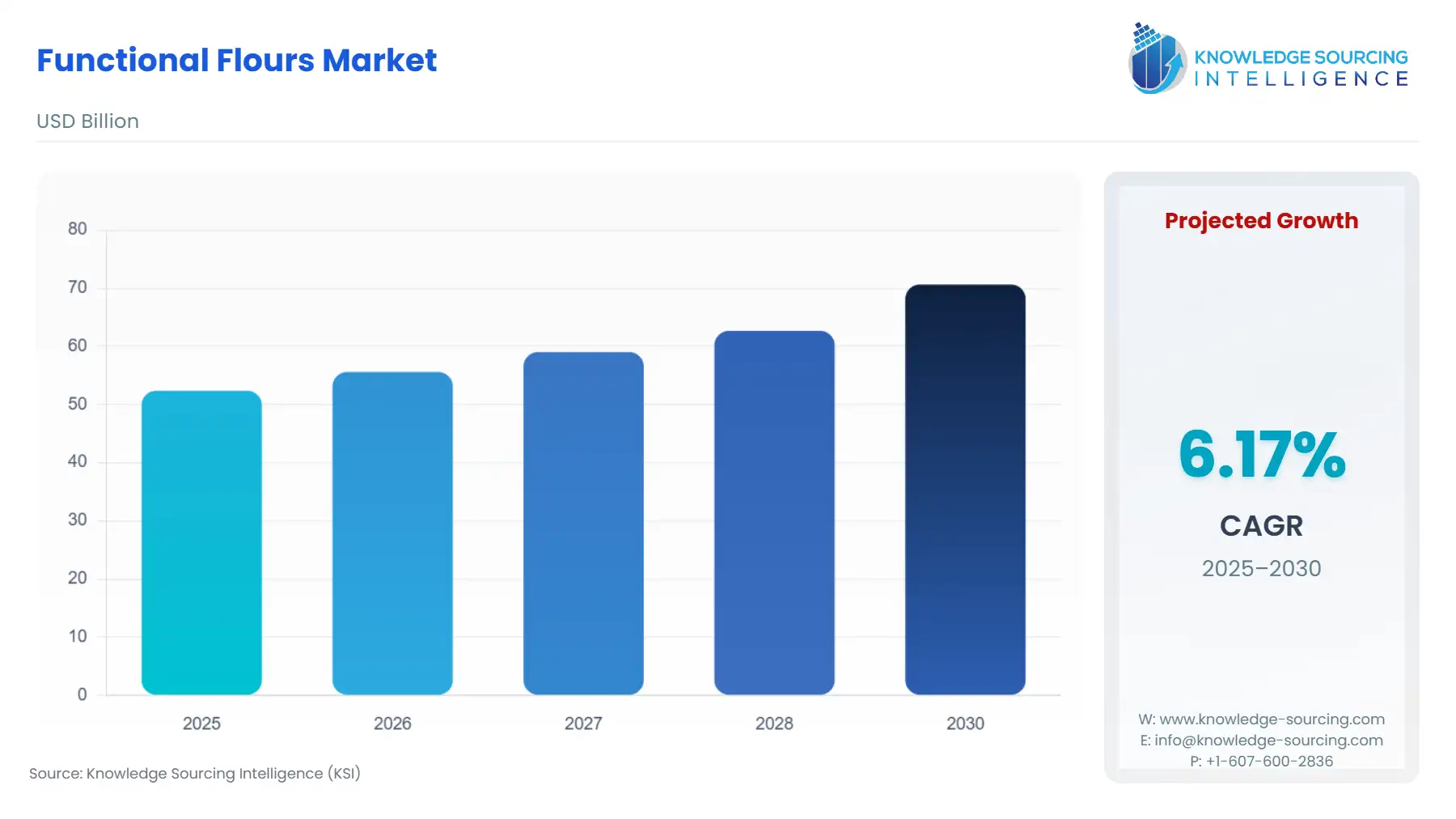

Functional Flours Market Size:

The global functional flour market, with a 6.17% CAGR, is anticipated to reach USD 70.648 billion in 2030 from USD 52.370 billion in 2025.

Following the highlights, the introduction sets context for a demand-focused, evidence-only analysis that follows. This report examines verified corporate announcements and government sources to explain how ingredient innovation, raw-material dynamics, regulations and supply-chain structure have changed demand patterns for functional flours used across bakery, snacks, soups/sauces and RTE products.

Global Functional Flours Market Analysis

- Growth Drivers

Three verifiable drivers increased demand for functional flours in 2024: (1) Clean-label and nutritional claims—manufacturers sought ingredients that enable “simple” labels and higher protein/fiber content, prompting launches of citrus-fiber and pulse flours (company press releases). (2) Plant-protein and gluten-free product development—R&D investments by large ingredient firms supplied textured and milled flours that permit wheat replacement in bakery and RTE formulations. (3) Availability improvements from ingredient producers—capacity additions and acquisitions by grain processors increased commercial volumes available to food manufacturers. Each driver maps directly to demand: formulators adopt functional flours to attain label claims, nutrition targets, or cost/ingredient-risk mitigation in reformulation programs.

- Challenges and Opportunities

U.S. tariff policy exerts a limited cost burden on most functional flours because cereal- and pulse-based flours fall under long-standing agricultural tariff schedules that apply low, stable import duties for most trading partners. The absence of restrictive tariff measures enables global suppliers to access the U.S. market without significant price distortion, allowing food manufacturers to evaluate imported functional flours—such as specialty wheat, rice, or pulse-derived variants—primarily on performance, formulation value, and supply reliability rather than duty-driven cost differences. This tariff environment supports broader ingredient diversification, lowers barriers for specialty flour imports, and sustains consistent demand from U.S. bakery, snack, and RTE producers seeking technical or clean-label functionality not always available in domestic commodity flours.

Primary headwinds: raw-material price volatility and input logistics created margin pressure that reduced some buyers’ willingness to switch away from commodity wheat; regulatory complexity (GRAS/Novel Foods/fortification rules) slowed market entry for novel flours in constrained jurisdictions. Opportunities: verified product launches of multifunctional fibres and pulse flours create immediate formulation pathways for bakery and alternative-protein segments; processors can monetize by offering technical support and pre-blended functional flour systems. Net impact on demand: cost headwinds temper rapid volume substitution, while formulation-enabling product launches accelerate higher-value, claim-driven demand where regulatory clearance exists.

- Raw Material and Pricing Analysis

Functional flours derive from cereals (wheat, rice) and pulses/legumes (peas, chickpeas, faba). FAO and USDA data show cereal price declines during 2024 while U.S./Canadian pulse harvests and per-capita availability rose in 2024, exerting downward pressure on some pulse grower prices. These verified commodity movements altered formulators’ ingredient economics: lower cereal prices reduced immediate cost incentive to substitute wheat, while improving pulse availability and lower pulse grower prices in parts of 2024 reduced cost barriers to pulse flour adoption. Large ingredient firms’ investments in milling and fractionation capacities (company announcements) reduced unit costs for specialized flours, further influencing buyer demand.

- Supply Chain Analysis

The supply chain spans farm → primary milling/fractionation → ingredient processing (texturizing, micronization) → co-packers/food manufacturers. Key production hubs include North American pulse-producing regions and European cereal processors; logistical complexities include seasonality of harvests, containerized shipping for processed flours, and fractionation capacity concentration at a handful of global ingredient firms. Dependencies: access to fractionation (protein isolation) and clean-label processing lines determines which customers can secure stable supply. Verified capacity additions by agribusinesses in 2024 improved regional supply security for processors that buy functional flours, directly expanding demand where throughput increased.

Functional Flours Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

U.S. Food and Drug Administration (FDA) — GRAS framework; nutrition labeling guidance |

The GRAS process and FDA dietary-fiber labeling rules determine whether novel or isolated flour ingredients can carry fiber/protein claims; clearance (or GRAS notification) enables market entry and demand from branded manufacturers. (FDA guidance on dietary fiber and GRAS). |

|

European Union |

European Commission / EFSA — Regulation (EU) 2015/2283 (Novel Foods) |

Novel-status assessments and Union List entries constrain which new pulse-derived isolates or novel cereal fractions can be sold in the EU; approved novel foods unlock demand across EU markets. |

|

India |

Food Safety and Standards Authority of India (FSSAI) — Fortification/Labeling standards |

FSSAI fortification policies and fortified-wheat programs specify permitted fortificants and labeling for staple flours, shaping demand for fortified functional flours in institutional programs and retail. |

Functional Flours Market Segment Analysis

- By Application — Bakery

Bakery is the primary commercial adopter for functional flours because bakers require structure, water retention and label-friendly nutrition upgrades. Verified product launches of pulse flours and multifunctional fibers provide formulators with direct substitutes for wheat or functional extenders to boost protein/fiber claims while maintaining crumb structure and shelf life. Demand drivers in bakery are technical (protein/gluten replacement, staling control), commercial (ability to market “high-protein” or “gluten-free”), and regulatory (nutrient-content claims depend on jurisdictional labeling rules). Reduced cereal prices in parts of 2024 tempered immediate cost-driven substitution, but ingredient suppliers’ technical support and pre-blended solutions (company product pages and launches) lowered formulation risk and therefore increased uptake among mid-size and premium bakers seeking differentiation. As a result, demand in bakery shifts from simple cost substitution to value-added adoption—bakers buy functional flours to enable premium claims and extended shelf life rather than solely to reduce raw-material spend.

- By Source — Cereals (selected as second major segment)

Cereal-derived functional flours (wheat, rice, waxy rice) serve dual demand roles: they are low-risk label-acceptable carriers for texture and cost control, and they are the default base for many industrial formulations. Ingredion’s verified launches of waxy rice-based functional starches and rice flours demonstrate supplier focus on cereal sources that supply texturizing and fat-replacement functions while keeping simple ingredient lists. Demand drivers for cereal flours are formulation resilience (predictable rheology), label familiarity (consumers accept “rice flour”), and regulatory simplicity where cereals are longstanding foodstuffs (no novel-food barrier in most jurisdictions). While pulse flours rise for protein/fiber positioning, cereal flours retain large volume demand because they integrate into existing production lines with minimal process change, leading to steady, high-frequency purchases from large food manufacturers. Thus demand dynamics show cereals as volume anchors and pulses/fibers as higher-margin, claim-driven add-ons.

Functional Flours Market Geographical Analysis

- US Market Analysis

U.S. demand reflects regulatory clarity (FDA GRAS) and strong R&D adoption; manufacturers used newly available functional flours in bakery and snacks in 2024, supported by USDA/ERS data on pulse availability.

- Brazil Market Analysis

Brazil’s large cereal processing base and rising interest in plant-protein formulations create steady demand for rice and wheat-derived functional flours; local sourcing reduces logistics cost.

- Germany Market Analysis

Germany’s food industry demands clean-label solutions and is sensitive to Novel-Food constraints in the EU; verified supplier launches tailored to EMEA support rapid commercial trials.

- South Africa Market Analysis

South Africa imports specialized functional flours but also sources local maize/rice fractions; demand driven by fortification programs and rising processed food consumption.

- India Market Analysis

India’s FSSAI fortification programs and growing RTE sector created institutional and retail demand for fortified and functional wheat flours; suppliers offering compliant fortified blends see higher demand in public and private channels.

Functional Flours Market Competitive Environment and Analysis

Major companies named in the Table of Contents are active ingredient suppliers and agribusiness integrators. Profiles (verifiable from company newsrooms):

- Ingredion — launched multi-benefit citrus fibres (Sep 2024) and expanded clean-label functional flours (product pages), positioning as a texture-and-label solutions provider. (Company newsroom/product pages).

- Cargill — executed regional capacity expansions and feed-mill acquisitions in 2024 that strengthen its raw-material sourcing and processing footprint, enabling scale supply of milled and fractionated ingredients. (Cargill press releases).

- Archer-Daniels-Midland (ADM) — public disclosures emphasize protein and fortification initiatives and large processing capacity that underpin supply to food manufacturers (company newsroom and investor releases).

Functional Flours Market Developments

- Sep 2024 — Ingredion launched FIBERTEX® CF 500 and CF 100 multi-benefit citrus fibres (product launch).

- Dec 2024 — Scoular opened a new oilseed crush facility and announced Idaho feed expansion (capacity addition).

- Sep 2024 — Cargill acquired two U.S. feed mills (capacity additions / acquisitions).

Functional Flours Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 52.370 billion |

| Total Market Size in 2031 | USD 70.648 billion |

| Growth Rate | 6.17% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Source, Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Functional Flours Market Segmentation:

- GLOBAL FUNCTIONAL FLOURS MARKET BY SOURCE

- Cereals

- Legumes

- GLOBAL FUNCTIONAL FLOURS MARKET BY TYPE

- Specialty Flour

- Conventional Flour

- GLOBAL FUNCTIONAL FLOURS MARKET BY APPLICATION

- Bakery

- Savory Snacks

- Soup and Sauces

- Ready To Eat Products

- Others

- GLOBAL FUNCTIONAL FLOURS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America