Report Overview

Global Hearing Aids Market Highlights

Hearing Aids Market Size:

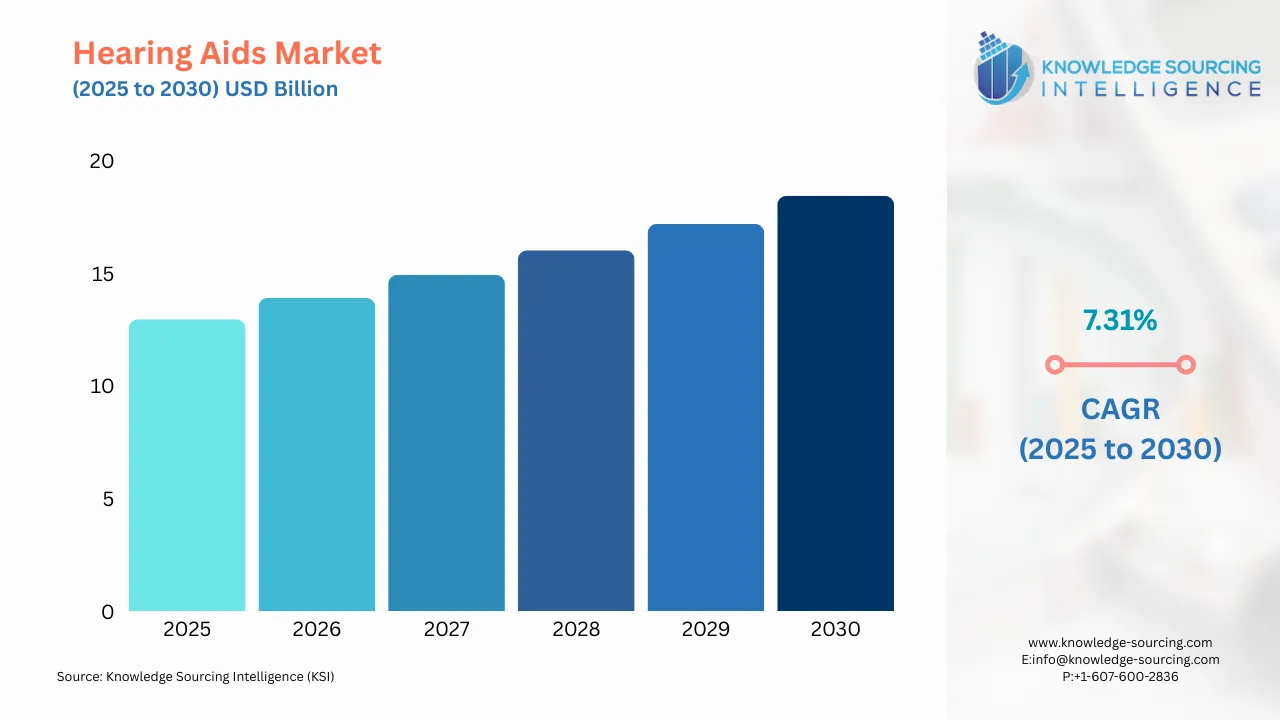

The global hearing aids market is projected to grow at a CAGR of 7.31%, from US$12.963 billion in 2025 to US$18.442 billion in 2030.

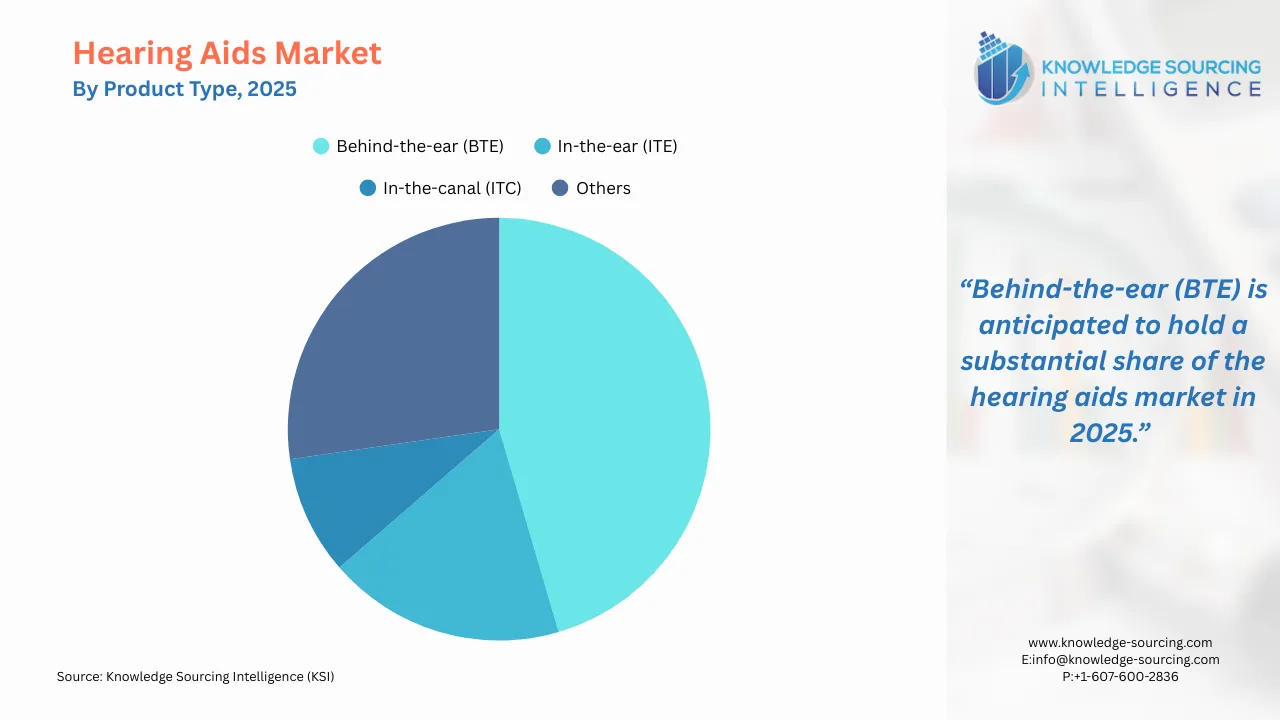

Hearing aids are small electronic devices that amplify sound for people with hearing loss. They consist of a microphone, amplifier, and speaker and work by capturing sound from the environment, amplifying it, and transmitting it to the ear to help the wearer hear more clearly. Available in various types, including behind-the-ear (BTE), in-the-ear (ITE), and completely in-canal (CIC) models, modern hearing aids feature advancements such as digital processing and wireless connectivity to enhance sound quality and functionality.

The major driving force behind the hearing aid market is the increasing age of the population, thus raising the prevalence of age-related hearing loss. Improved sound quality, connectivity, and discreet designs are making hearing aids more attractive. Increased awareness of hearing health, better insurance coverage, and government support further fuel the market growth.

Hearing Aids Market Growth Drivers:

According to the World Health Organization (WHO), there are around 466 million individuals who suffer from hearing loss, out of which around 34 million are children. WHO also estimates that the number of people with hearing loss will reach around 900 million by 2050. Hearing loss in individuals is caused by major genetic causes, complications caused at birth, certain infectious diseases, chronic ear infections, use of particular drugs, and exposure to excessive noise, among other factors. It has also been found that about 1.1 billion young children have suffered hearing losses due to exposure to loud noises and sound levels in recreational settings.

In addition, the expenditure that needs to be spent on hearing loss and unaddressed hearing loss problems takes the total cost to US$750 billion globally in a year. Individuals benefit from early detection of hearing loss so they can be given hearing aids and no damage occurs to their ears in the future. Different solutions are being implemented and recommenced by the patients, such as cochlear implants and assistive devices, among others. Therefore, this is increasing patient awareness, creating a surge in the demand for hearing aids, and propelling the market growth over the forecast period.

- Increasing the organization's efforts to promote the usage and adoption of hearing aids among patients

Some organizations are involved in assisting by setting up programs to decrease the cases of hearing loss and prevent further damage that can be caused to individuals due to a lack of awareness. For example, the World Health Organization (WHO) assists member states in developing ear and hearing care programs that must be integrated into the primary healthcare system of every country. Some of the work WHO is carrying out includes providing technical support in the member states for facilitating the development of national plans for hearing care. It also includes taking steps and measures to provide the necessary resources to effectively guide healthcare providers and healthcare workers regarding hearing care.

It provides technical resources and guidance to train healthcare workers on hearing care. Additionally, it is distributing recommendations to address the major and preventable causes of hearing loss. It is also undertaking advocacy efforts to raise awareness about the increasing prevalence of hearing loss and its impacts.

Some of the key points and platforms that are being focused on are building effective partnerships, hearing care programs, and taking effective initiatives to make hearing aids and other hearing assistance solutions more affordable to the low-income population as well. The World Health Organization (WHO) is promoting the WHO-ITUY global standard, which includes recommended hearing levels and basic standards for home audio equipment and devices. This initiative aims to encourage safe listening practices and prevent ear damage, aligning with their Make Listening Safe campaign. Hence, the presence of such safety guidelines and the continuous efforts being made by organizations such as WHO, among others, are leading to an increased demand for hearing aids and thus contributing to the market growth further over the forecast period.

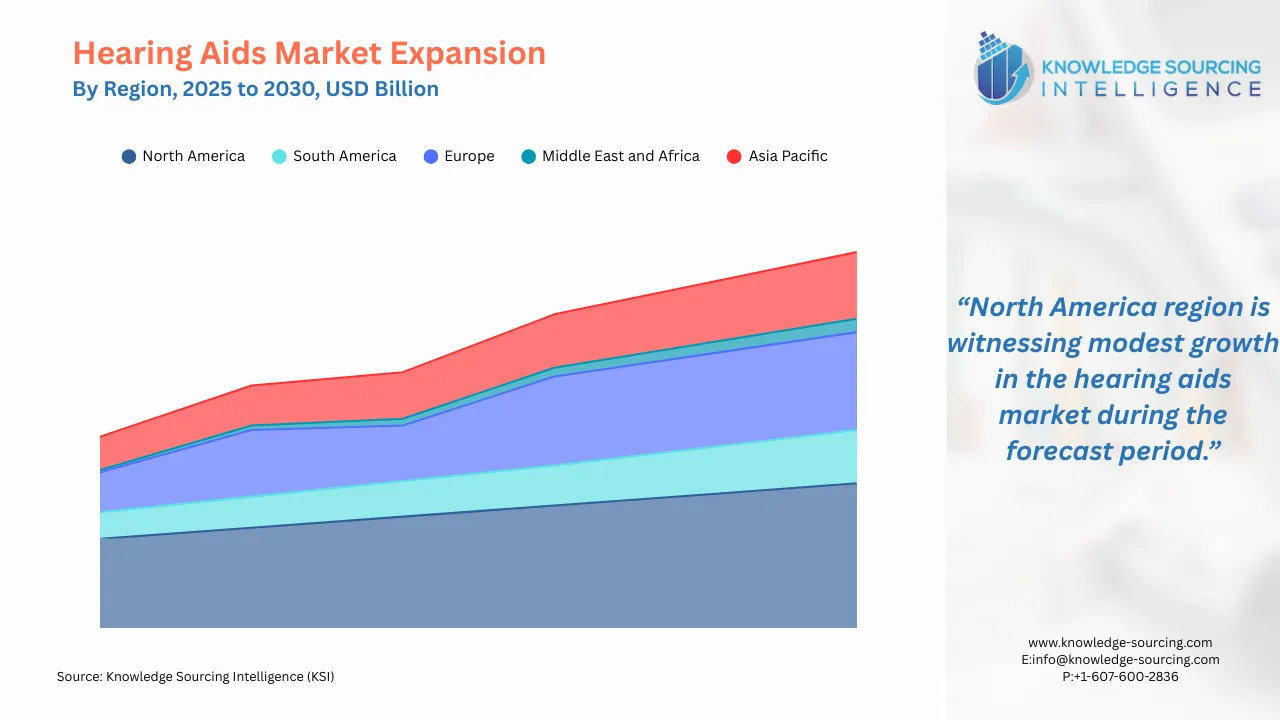

Hearing Aids Market Geographical Outlook:

- The global hearing aids market is segmented into five regions worldwide

Geography-wise, the global hearing aid market is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The key drivers of the European market include an aging population, advancements in hearing aid technology, and an increased awareness of hearing health. Given the increase in the percentage of elderly people in different countries, especially aging-oriented nations such as Germany and Italy, a greater percentage of them demand hearing aids for the common problem of age-related hearing loss. For instance, in terms of the proportion of the population that is 65 years of age or older, the highest shares were found in Italy (24.0%), Portugal (24.0%), Finland (23.3%), Bulgaria (23.5%), Croatia (22.7%), and Greece (23.0%), while the lowest shares were found in Luxembourg (14.9%) and Ireland (15.2%). As people age, deafness becomes more common. More than 25% of adults over 60 suffer from debilitating hearing loss. Advanced technological innovations, like digital hearing aids, rechargeable models, devices with good sound quality, and smartphone connectivity, make hearing aids attractive and accessible to people.

Deafness is also one of the reasons propelling the hearing aid market in the projected period. For instance, according to the Consortium for Research in Deaf Education, approximately 45,671 children were deaf in the United Kingdom in 2023. London has the highest number of deaf people in the country, standing at 7,654, followed by North West, where 6,308 children are suffering from deafness. Hence, the increasing prevalence of deafness in the country is anticipated to fuel the market growth in the projected period.

Awareness of early detection and treatment of hearing loss and an increased concern for improving the quality of life for patients with hearing disorders are boosting the market growth. The increased coverage for health insurance of hearing aids and initiatives by the government in supporting health through public programs have also fuelled the need. Growing consumer demand for discreet hearing aids has increased comfort, while the market for hearing aids targeting younger populations affected by noise-induced hearing loss continues to expand in Europe.

Hearing Aids Market Key Developments:

- In September 2024, Nano Hearing Aids announced its latest product range additions. The Completely in Canal (CIC) hearing aids are available in both 2 and 4 program formats.

- In August 2024, Sonova Holding AG launched two new platforms under the company's lead brand, Phonak, called Audéo Infinio and Audéo Sphere Infinio. These new platforms mark a new generation of hearing aids based on a real-time AI-based technology platform. Audéo Sphere Infinio is a natural progression of Sonova's new, proprietary dual-chip technology.

List of Top Hearing Aids Companies:

- Phonak - A Sonova brand

- Starkey

- WIDEX A/S

- GN Store Nord A/S

- Sivantos Pte. Ltd.

Hearing Aids Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Hearing Aids Market Size in 2025 | US$12.963 billion |

| Hearing Aids Market Size in 2030 | US$18.442 billion |

| Growth Rate | CAGR of 7.31% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Hearing Aids Market |

|

| Customization Scope | Free report customization with purchase |

Hearing Aids Market Segmentation:

- By Product Type

- Behind-the-ear (BTE)

- In-the-ear (ITE)

- In-the-canal (ITC)

- Completely-in-the-Canal (CIC)

- Invisible-in-the-Canal (IIC)

- Others

- By Technology Type

- Analog

- Digital

- By End-User

- Adults

- Infants

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America