Report Overview

Herbaceous Legumes Market - Highlights

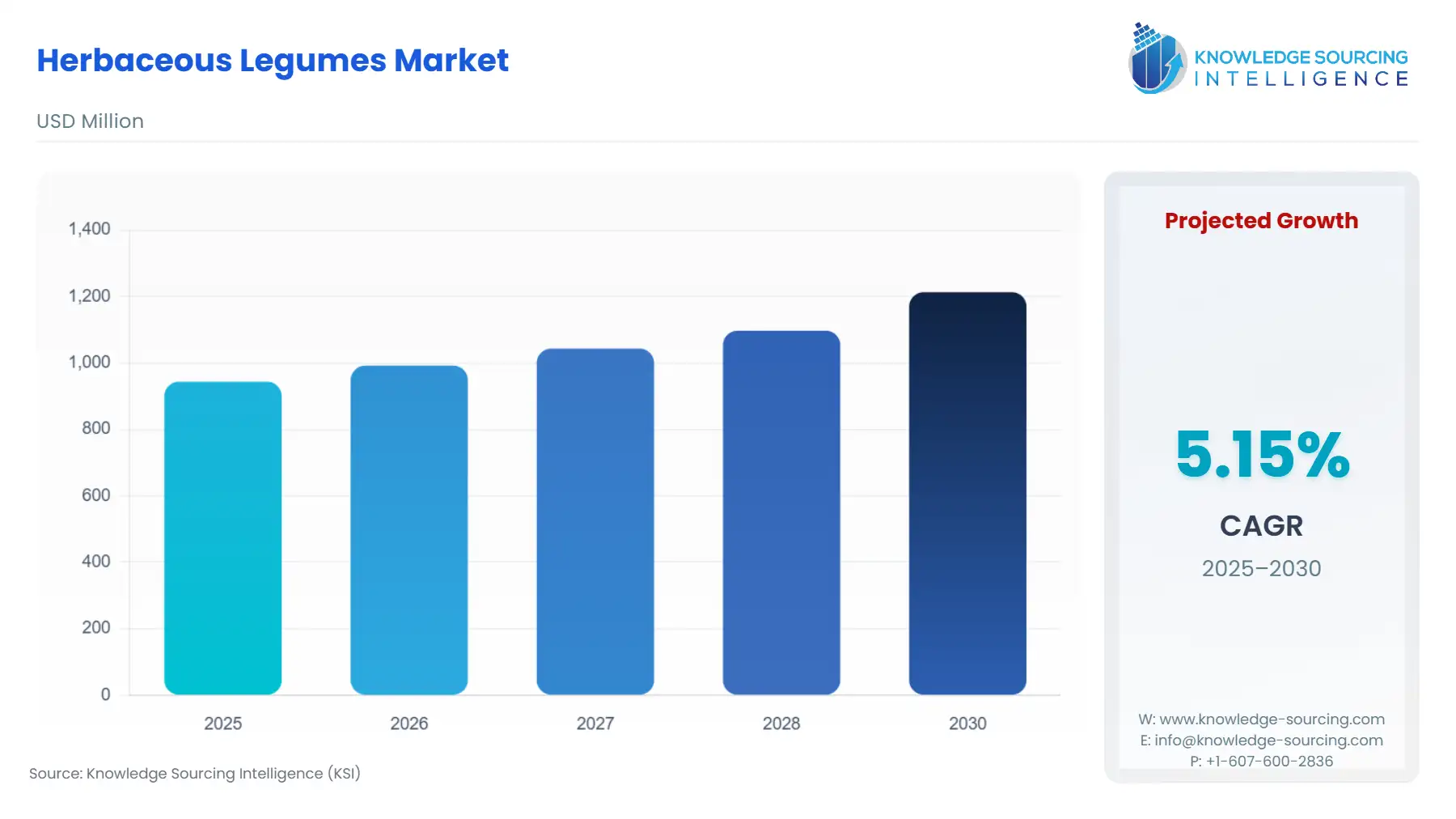

Herbaceous Legumes Market Size:

The herbaceous legumes market is expected to grow at a 5.0% CAGR, achieving USD 1264.429 million in 2031 from USD 943.779 million in 2025.

Herbaceous Legumes Market Growth Drivers:

Increasing preferences will drive market growth

The prevalence of chronic ailments brought on by poor dietary practices, greater consumption, and broad modernity is the main driver maintaining the herbaceous legumes market’s consistent expansion. Herbaceous legumes have produced a rich supply of high crude protein and fibres for people and ruminants, which has increased the concentration of ruminal microorganisms. Consumer interest in eating herbaceous legumes is increasing as a consequence, which is fueling the herbaceous legumes market’s expansion.

Using herbaceous legumes for livestock feeding

Cattle production in East Nusa Tenggara (ENT) is constrained by an erratic supply of high-quality forage, especially late in the dry season. Animals on locally available feeds frequently have low rates of live-weight gain, primarily because of low nitrogen (N) levels within feeds during the dry season, supplementing with forage from tree legumes such as Leucaena leucocephala and Sesbania grandiflora, which improves animal performance. These factors are impacting the herbaceous legumes market growth.

Utilization of herbaceous legumes in cereal systems

Herbaceous legumes can be cultivated in rotation with cereals or as a relay crop inside cereal crops. After the harvest of the grain crop, the legumes can continue to grow into the early dry season on conserved soil moisture (when cultivated in tandem). Fresh or frozen fodder can be provided to cattle at any time throughout the dry season. It is practical to store the legume fodder as hay. Introduced legumes seem to nodulate successfully and fix nitrogen with local soil microorganisms, and highly positive impact on the herbaceous legumes market growth.

Increasing adoption of herbaceous legumes by farmers is acting as a growth driver for the market

Herbaceous legumes are more likely to be grown by farmers who are actively involved in the production of animals and have access to a scarce supply of high-quality animal feed, which is the key driver for herbaceous legumes market growth. Farmers must have enough seed on hand to sow herbaceous legumes. For legumes to be quickly adopted, farmers and extension personnel must be educated on their advantages and proper cultivation.

It is essential for the effective implementation of the technology to provide farmers with ongoing support throughout the process of producing legumes. Adoption will be sped up by on-farm demonstrations of legumes and the advantages they offer in the herbaceous legumes market.

Crockett germplasm herbaceous mimosa is gaining popularity

The USDA-Natural Resources Conservation Service, East Texas Plant Materials Centre, Nacogdoches, Texas, released Crockett Germplasm herbaceous mimosa for conservation plantings in the Western Coastal Plain region of Texas and Louisiana. At the Louisiana State University, AgCenter Red River Research Station in Bossier Parish, Louisiana, Crockett Germplasm was also interested in warm-season, imported grasses (bahiagrass and Bermudagrass) to assess their potential as a pasture legume. The findings show that Crockett Germplasm is palatable to cattle, withstands directed grazing, is compatible with bahiagrass and bermudagrass, and offers a legume choice for long-term fodder management systems, boosting herbaceous legumes market share.

Herbaceous Legumes Market Geographical Outlook:

Asia Pacific is anticipated to dominate the herbaceous legumes market

Asia-Pacific is anticipated to hold a monopoly on the herbaceous legumes market, due to the region's rapidly expanding population and strong demand for and consumption of legumes in food and associated goods. Asia-Pacific has seen a huge surge in the production of herbaceous legumes in recent years and is anticipated to continue through the projected period. Furthermore, North America is predicted to see lucrative growth in the forecast period, due to the rising demand for foods high in protein and fibre in the area.

Herbaceous Legumes Market Key Developments:

May 2023, Lawns 2 Legumes has been running since 2019, but a $4 million environmental budget that was approved during the current parliamentary session will allow it to continue for many more years.

Herbaceous Legumes Market Segmentation:

By Type

Perennial

Shrubs

Grass

Others

By Crop Type

Peas

Beans

Lentils

Others

By Application

Animal Feed

Human Food & Nutrition

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others