Report Overview

Global High Temperature Composite Highlights

High-Temperature Composite Material Market Size:

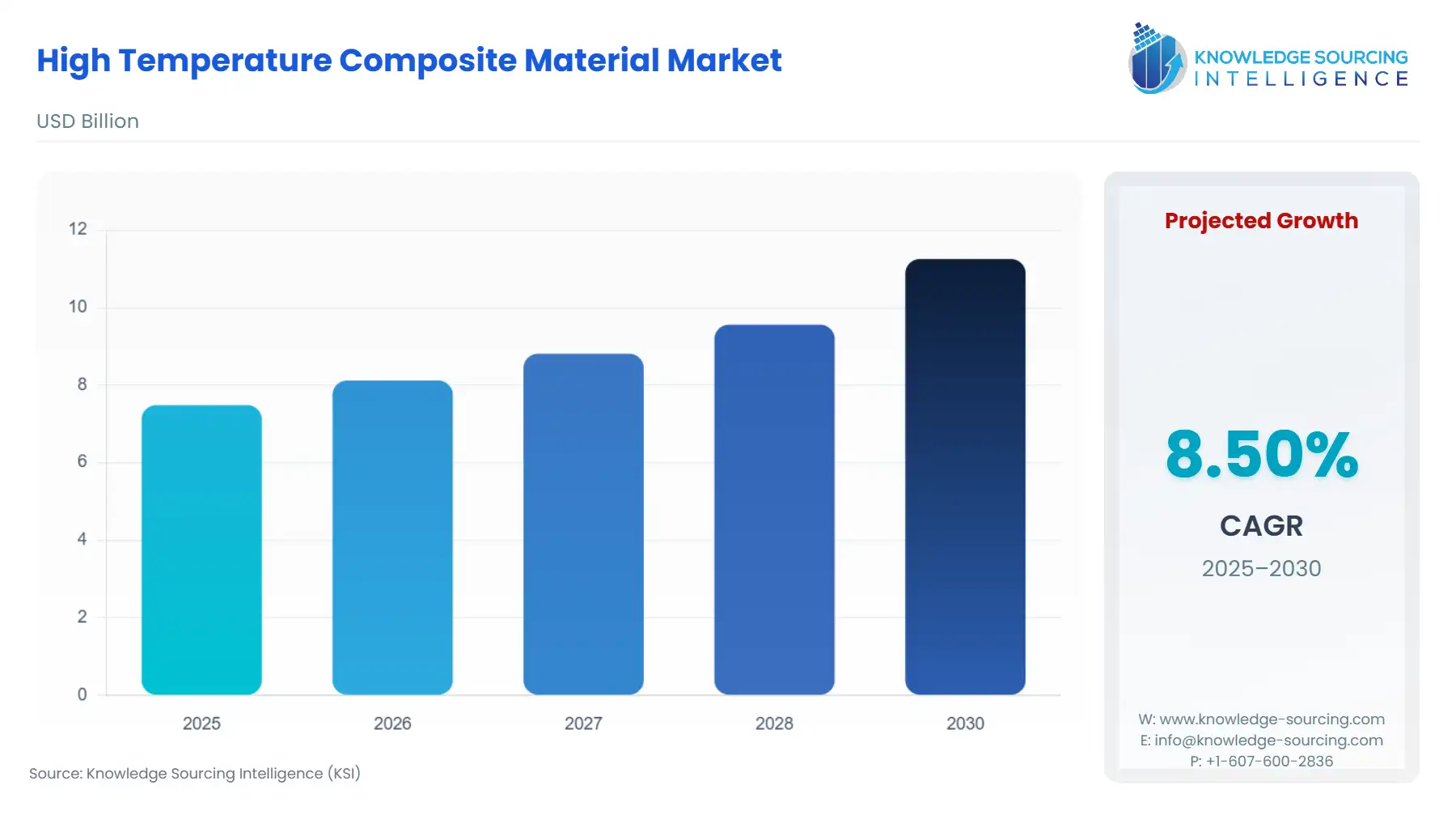

The global high-temperature composite material market is expected to grow at a compound annual growth rate of 8.50% (CAGR) from USD 7.485 billion in 2025 to USD 11.255 billion in 2030.

High Temperature Composite Material Market Trends:

A composite material is made up of two or more elements with markedly different chemical and physical properties, which, when combined, generate a material with qualities that are distinct from the individual elements. High-Temperature Composite Materials are usually described by their maximum application temperature about the melting temperature of the material, which is highly dependent on the applied stress level and corrosive environment resistance.

The composites are the ideal products for operation under high temperatures; strength and lightweight are required. The major driving demand for high-temperature composite material can be seen in the automobile sector, the aerospace and defense sector, and the electrical and electronic sectors. The growing demand for aircraft from both civilian and military aviation is calling for the appropriate raw materials for the manufacturing of the parts. The aviation industry in many countries is showing significant growth. In India, there has been a surge in the induction of new aircraft to meet the demand for the growing air transport demand.

Due to increased use in the electronics and electrical, automotive, and transportation sectors, the market for high-temperature composite materials will grow rapidly in the coming years. The aviation industry has made great achievements as a result of falling fuel prices and increased air traffic levels, complementing the need for commercial aircraft. The market will be aided by the increasing number of national investments in defence equipment. They are widely used in the automobile industry to meet the growing demand for lightweight, fuel-efficient vehicles.

Because of the increased need for ceramic matrix composite materials in the aerospace and military industries, they now hold the majority of the market share. Piston recess walls, bearings, brake discs, and cylinder sleeves are all made of high-temperature ceramic. Ceramic matrix composite materials are becoming more popular as their applicability in petrochemical and nuclear fission, and inertial confinement fusion expands. Due to qualities such as low weight, decreased fuel consumption, less nitride oxide emission, and reduced noise, the aerospace and defence sectors have been driving the development of high temperatures.

Owing to their fire, smoke, and weight reduction, polymer matrix composite materials are becoming more popular in the automotive sector. The market for high-temperature polymeric matrix composite materials is also growing because modern light passenger railways are becoming increasingly popular.

The aerospace and military sector's overall size will grow due to a considerable rise in demand for high-temperature composite fighter jets like the F-35. Interior, missiles, engine parts, aircraft exterior structures, and satellites are among the many components for which the product is being used more frequently. This is due to a growing preference for ultra-high-temperature materials, which help to shorten the duration of long-haul flights. Another major driver of the segment's growth is the increasing number of research projects involving the use of ceramics in aerospace.

North America dominates the high-temperature composite materials market, which is expected to rise during the forecast period as a result of regulatory requirements for the use of environmentally friendly materials in the aerospace and defence sectors growing demand. The global high-temperature composite materials market is also driven by reduced emissions, the introduction of new manufacturing techniques, and substantial performance.

The companies are developing and innovating for the high-temperature composite material. The aerospace and defense industry has been growing in major countries like the United States, the European Union, China, and India, helped by the respective governments to develop the sector. High-temperature composite materials are being increasingly used in the automotive industry to meet the increasing demand for lightweight and fuel-efficient vehicles.

High Temperature Composite Material Market Drivers:

- The growing demand for high-temperature composite materials in the automobile sector

The increasing automotive sector has increased the demand for high-temperature composite materials. The application of high-temperature composite material is essential for the automobile sector because of its toughness, high-temperature resistance, long life, and scrap recycling. These are very important for the automobile sector for saving fuel and longevity. The increase in the automotive sector is driven by the sales of electric vehicles. The increased sales of electric vehicles are due to the governmental policies for competitive pricing, and changes in the general perception of people are creating market demand.

Further, the sale of electric vehicles is substantially changing the dynamics of the automobile industry, as it is taking a significant percentage increase in share every year. The sale of electric cars was 18% of all cars sold in 2023, which was 14% in 2022. This was only 4% in 2020, according to the IEA (International Energy Agency). These sales are mainly from the markets of China, Europe, the United States, and India globally.

Moreover, major companies worldwide are developing advanced composite materials for application in automotive and aerospace technologies. In March 2024, Toray Advanced Composites launched a new product, Toray Cetex TC915 PA+, for sporting goods, high-performance industrial applications, automotive structure, energy, Urban Air Mobility (UAM), and Unmanned Aerial Systems (UAS) applications.

High Temperature Composite Material Market Segmentation Analysis:

- The aerospace & defense sector is growing significantly

Based on the end-user, the high-temperature composite material market is segmented into aerospace and defense, transportation and automobile, energy and power, electronics and electrical, and others. Among these, the aerospace and defense segment is projected to lead the market growth. High-temperature composite materials are becoming increasingly important in the aerospace and defense industries, providing distinct benefits in difficult operational settings. A notable example is gas-turbine engines for aircraft, and other crucial tasks where such composites perform well with temperature and mechanical stresses.

In turbine blades and vanes, the thin wallokes and high strength-to-weight ratio offer a great advantage to the whole component, adding to the total efficiency and performance of the engine. Such products are employed in airplane construction, more specifically in regions exposed to high temperatures close to the engines.

Canada is one of the world's top aerospace markets, ranking first in civil flight simulators, third in civil engines, and fourth in civil aircraft manufacturing, as stated by the International Trade Administration. In 2022, Canada was the only country to rank in the top five for civil flight simulator, engine, and aircraft sub-segments. Further, the ITA estimated that approximately 88% of Canada's aerospace sector is civil, with 12% being defense-oriented. Montréal is the world's third-largest aerospace hub, behind Seattle, Washington, and Toulouse, France, accounting for more than 75% of Canadian aerospace research and development.

Besides this, the Union Budget for the Fiscal Year 2023-24 proposed a total expenditure amounting to Rs. 45,03,097 crore. Within this budget, the Ministry of Defense has been allocated a total of Rs. 5,93,537.64 crore, constituting 13.18% of the overall budget. This allocation marks an increase of Rs. 68,371.49 crore (13%) compared to the budget for 2022-23.

Moreover, according to the Malaysian Government’s industrial and technology development plans, aerospace and military-related industries are classified as focused industries with high growth prospects. Following this, Malaysia established the Malaysian Aerospace Industry Blueprint 2030, a program to establish Malaysia as Southeast Asia's major aerospace market. Malaysia currently has about 200 aerospace firms, including both foreign and local industry participants. In addition to this, the Indonesian government's substantial investment in defense, with a budget allocation of $9.3 billion in 2022 and plans for a proposed $125 billion in loans to modernize the military, serves as a significant catalyst for market stimulation.

Additionally, military expenditure pushes up demand for high-temperature composite materials, which play an important role in improving the performance and durability of defense vehicles and equipment. Argentina's Military Spending, for instance, was 0.8% of GDP (2021), 0.8% of GDP (2020), 0.7% of GDP (2019), and 0.8% of GDP (2018), as per the Central Intelligence Agency.

Comprehensively, these materials also help improve fuel efficiency and structural integrity in airplane structures around engine regions. As technology progresses, their role in pushing the frontiers of aerospace innovation expands, offering safer and more efficient solutions for the future.

- The Indian market is expected to grow significantly

The market for high-temperature composite materials in India is growing rapidly due to several factors. The fastest-growing industrial and manufacturing industry of India is the key factor that fuels the high-temperature composite market. With the development of industrialization in the country, the call for high-temperature and severe environmental materials has increased, especially in aerospace, automobile industries, and the energy sector. High-temperature composite possesses better thermal and mechanical characteristics than conventional materials, and for this reason, it is suitable for those activities that require mechanical strength and stability in high-temperature conditions.

The last factor contributing to the growth of this market segment in India is the increasing concern of the country’s authorities with infrastructure enhancement. The rising construction of roads, bridges, and other large-scale projects has created a high-performing construction material demand, including high-temperature composites. These materials are being used in bridge decks, building façades, and industrial pipe works; this is because heat, corrosion, and weathering are important factors in these areas. India is also considered to be the fourth-largest construction market in the global market USD after the US, China & Japan. It is the single largest and the most rapidly growing construction industry in the world today. While averaging a growth rate of 7-8 % annually, India may indeed become the third-largest construction market valued at USD 1.4 trillion by 2025. Moreover, in this regard, as per Invest India, by 2030, the cities are expected to generate 70% of India’s GDP. Under NIP, India has an investment budget of $1.4 Tn on infrastructure, wherein 24% is fixed for renewable energy, 18% for roads & highways, 17% for urban infrastructure, and 12% for railways.

It is important for the high-temperature composites that the renewable energy sector is also increasing in India. A number of industries have already emerged as key consumers of these materials. However, the most rapidly developing sector is the wind energy industry that demands these materials for use in the manufacture of wind turbine blades and other components exposed to rather high temperatures and other sorts of stress.

In addition, in the Indian context, the government’s measures facilitate the use of fuels such as CNG and hydrogen, all of which call for the application of high-temperature composite materials. These materials are necessary for the production of storage tanks and pressure vessels capable of holding the mentioned fuels efficiently at high temperatures and pressures.

Based on the preliminary analysis, it can be concluded that such factors as industrialization, the development of infrastructure, the growth of renewable energy sources, as well as governmental policies, play a role in the creation of a positive background for the high-temperature composites market in India. Since the country and its partners are progressing in industrial development and increasing their industrial capacity, the usage of these superior materials is anticipated to remain consistent in the next few years.

High Temperature Composite Material Market Key Developments:

- Low VOC Resin Systems (2022): Industry trends included developing resin systems with low volatile organic compounds, enhancing sustainability.

- Lockheed Martin’s CMC Expansion (2022): Lockheed Martin expanded its facility for ultra-high-temperature ceramic matrix composites (CMCs) for defense applications.

- GE’s CMC Turbine Blades (2021): GE pioneered lightweight, heat-resistant CMC turbine blades for jet engines, capable of withstanding 2,400°F.

- Axiom Materials’ New Facility (2020): Axiom Materials opened a 3500-square-meter high-temperature composite center to expand production capacity.

High-Temperature Composite Material Market Scope:

| Report Metric | Details |

| High-Temperature Composite Material Market Size in 2025 | US$7.485 billion |

| High-Temperature Composite Material Market Size in 2030 | US$11.255 billion |

| Growth Rate | CAGR of 8.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the High-Temperature Composite Material Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation

BY MATRIX SYSTEM

- Polymer matrix composite materials

- Ceramic matrix composite materials

- Metal matrix composite materials

BY FIBER TYPE

- Carbon Fibre

- Glass Fiber

- Boron Fibers

- Silicon Fibre

- Aramid fibers

- Others

BY END USERS

- Aerospace and defense

- Transportation and Automobile

- Energy and Power

- Electronics and Electrical

- Others

BY GEOGRAPHY

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others