Report Overview

Global Laminated Labels Market Highlights

Laminated Labels Market Size:

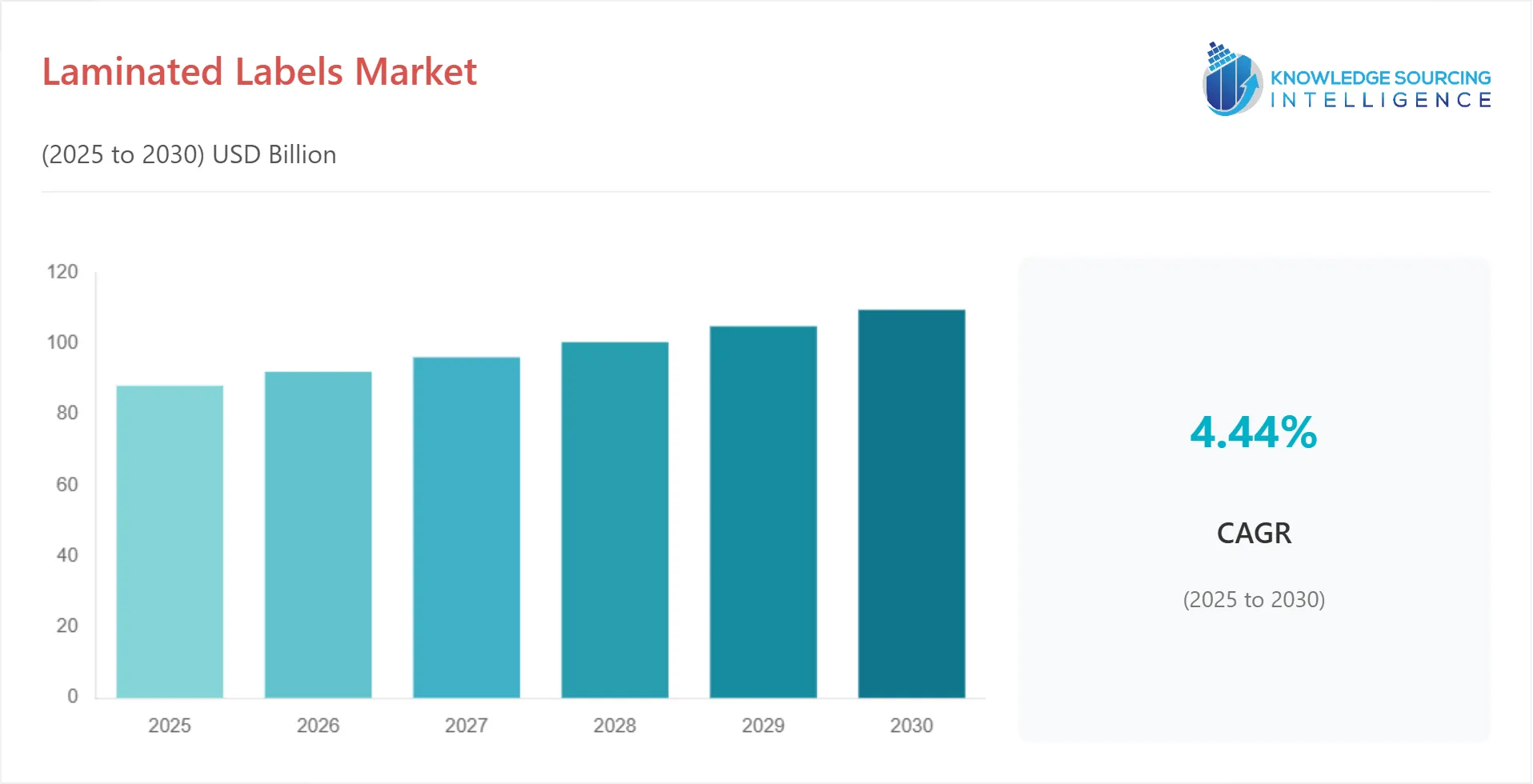

The global laminated labels market will grow at a CAGR of 4.44% to be valued at US$109.549 billion in 2030 from US$88.144 billion in 2025.

Laminated Labels Market Introduction

The Laminated Labels Market is a pivotal segment within the global packaging industry, delivering durable, visually appealing, and functional labeling solutions that enhance product branding and consumer engagement across diverse sectors. Laminated labels, characterized by their protective laminate coating, offer resistance to environmental factors such as moisture, chemicals, and UV radiation, making them ideal for food and beverage, pharmaceutical, cosmetics, and logistics applications. These labels often incorporate pressure-sensitive labels and adhesive labels, applied via label converters, to meet regulatory compliance and branding needs. The market includes flexible packaging labels, which align with the rise of flexible packaging, and linerless labels, which reduce waste and enhance sustainability. As e-commerce, sustainable packaging, and smart labeling technologies drive demand, the laminated labels market trends reflect a focus on innovation, durability, and eco-friendly solutions.

The Laminated Labels Market encompasses labels with a protective laminate layer, typically made from polyester, polypropylene, or UV-resistant films, applied over printed surfaces to enhance durability and visual appeal. These labels, often pressure-sensitive labels, consist of facestock, adhesive, and sometimes a release liner, enabling easy application to product packaging via label converters, specialized equipment that cuts and applies labels. Flexible packaging labels are integral to pouches, sachets, and wrappers, supporting the growing flexible packaging sector, particularly in food and beverage and personal care. Linerless labels, which eliminate release liners, reduce waste and logistical costs, aligning with sustainability goals. The market serves industries requiring high-quality labeling, with Asia-Pacific leading due to robust manufacturing and e-commerce growth, followed by North America and Europe. Innovations like digital printing and smart labels with QR codes or NFC tags enhance traceability and consumer interaction.

Laminated Labels vs. Other Labeling Technologies: Best Practices

Laminated labels differ from other labeling technologies, like wet-glue labels or in-mold labels, in their construction and application versatility. Wet-glue labels, applied with water-based adhesives, are cost-effective but lack the durability of laminated labels against environmental stressors like moisture or abrasion. In-mold labels, integrated during container molding, are permanent but less flexible for short-run customization compared to pressure-sensitive labels. Laminated labels, particularly adhesive labels, use self-adhesive backings for easy application via label converters, offering high durability and resistance to chemicals and UV light. Linerless labels, a subset, eliminate release liners, reducing waste and enabling high-speed application, as seen in Avery Dennison’s AD LinrSave technology. Laminated labels excel in visual quality, supporting vibrant prints and brand identity in flexible packaging. The laminated labels market trends are driven by several factors. First, the e-commerce boom increases demand for durable labels in logistics, ensuring traceability and product information during transit. Second, regulatory compliance in the food, pharmaceutical, and cosmetics industries mandates clear labeling, boosting pressure-sensitive labels. Third, sustainability trends drive the adoption of recyclable and biodegradable laminates, as seen in Constantia Flexibles’ EcoTwistPaper. Finally, digital printing advancements enable customizable, short-run labels, enhancing brand differentiation.

The Laminated Labels Market faces restraints such as high production costs due to specialized materials like polyester films and adhesives, limiting adoption in cost-sensitive markets. Supply chain disruptions, particularly for laminate films, impact production scalability, as noted in the 2024 global trade challenges. Regulatory complexities for recyclable laminates and environmental compliance increase development costs. Additionally, competition from direct printing and in-mold labeling challenges laminated labels in certain applications. Recent advancements, such as Avery Dennison’s premium labels and Constantia Flexibles’ EcoTwistPaper, underscore the market’s commitment to innovation and eco-friendly solutions. As the laminated labels market trends evolve, the market is poised to deliver high-quality, sustainable labeling solutions, meeting the needs of a rapidly changing global market.

Laminated Labels Market Overview:

Laminated labels are equipped with a protective coating that enhances their durability, enabling them to withstand harsh conditions such as moisture, chemicals, solvents, extreme temperatures, and salt spray. The global demand for laminated labels is being driven by the rising popularity of flexible packaging solutions. These labels safeguard against adverse conditions, offering a cost-effective solution for manufacturers by reducing the need to replace damaged or faded barcodes, thus saving time and resources. Their durability has led to widespread adoption across industries, including fast-moving consumer goods (FMCG), healthcare, consumer electronics, apparel and textiles, and home and personal care.

The Asia Pacific region is expected to see a surge in demand for laminated labels, fueled by high consumption rates and an increasing need for retail-ready products. Additionally, growing investments in the manufacturing sectors of developing economies like India and China are anticipated to boost the demand for laminated labels during the forecast period. The global laminated labels market is highly competitive, characterized by a large consumer base and the presence of diverse international, regional, and local players. The demand for cost-effective, durable, and visually appealing labels for product packaging and display is attracting new entrants to the market. This intense competition is prompting established companies to adopt strategic approaches to enhance their market share. Some of the major players covered in this report include Avery Dennison Corporation, CCL Design Stuttgart GmbH, 3M Company, Coveris Holdings S.A., Constantia Flexibles Group GmbH, Lintec Corporation, Mondi Plc., and FLEXcon Company Inc., among others.

Laminated Labels Market Trends:

The Laminated Labels Market is evolving rapidly, driven by innovations enhancing durability, sustainability, and functionality in packaging solutions. Digital printing for labels leads the charge, offering customizable, short-run labels with vibrant designs, as seen in Avery Dennison’s digital label advancements for luxury branding. Flexographic printing, valued for high-speed production, remains critical for flexible packaging labels, with CCL Industries’ recent European expansion optimizing food packaging. UV-curing inks enhance print durability and color vibrancy, reducing drying times, as demonstrated in ID Images’ thermal transfer labels for logistics. Sustainable label materials, such as biodegradable labels, are gaining traction, with Constantia Flexibles’ recent EcoTwistPaper offering recyclable laminates for food packaging. Smart labels, incorporating RFID labels, improve traceability and consumer engagement, as seen in UPM Raflatac’s 2025 NFC-enabled labels for e-commerce. These trends highlight the market’s focus on innovation, sustainability, and technological integration.

Laminated Labels Market Drivers & Restraints:

Drivers:

Growth in Food and Beverage Labels: The Laminated Labels Market is significantly driven by the rising demand for food and beverage labels, which require durability and regulatory compliance to ensure consumer safety and product transparency. Laminated labels, often pressure-sensitive, provide moisture resistance and clarity for ingredient lists, expiration dates, and barcodes, as mandated by regulations like the U.S. FDA’s front-of-package labeling proposal in 2025. Companies like CCL Industries leverage digital printing to produce vibrant labels for food packaging, enhancing brand visibility in competitive markets. The global surge in packaged food consumption, particularly in the Asia-Pacific region, fuels demand for flexible packaging labels that withstand environmental stressors, driving market growth through sustainable and high-quality labeling solutions.

Expansion of Pharmaceutical Labels: The increasing need for pharmaceutical labels is a key driver for the Laminated Labels Market, as drug safety and regulatory compliance necessitate tamper-evident and durable labels. Laminated labels provide chemical resistance and legibility for drug information, dosage instructions, and serialization, aligning with EU and FDA standards. Avery Dennison’s recent smart labels with RFID technology enhance traceability for pharmaceuticals, reducing counterfeiting risks. The rise in chronic diseases and pharmaceutical production, particularly in North America and Europe, drives demand for adhesive labels that ensure product integrity during storage and transport, fostering market expansion through innovative labeling and compliance-focused solutions.

Rise of E-commerce Packaging and Logistics Labels: The e-commerce packaging boom significantly drives the Laminated Labels Market, as logistics labels ensure traceability, durability, and efficient supply chain management. Laminated labels, including RFID-enabled and barcode labels, withstand abrasion and moisture during shipping, as seen in ID Images’ thermal transfer labels for logistics. The global e-commerce surge, particularly in Asia-Pacific, demands high-quality labels for product identification and consumer engagement, with UPM Raflatac’s NFC-enabled labels enhancing online retail efficiency. Logistics labels support automation in warehousing, driving market growth by addressing the needs of fast-paced online retail and global supply chains.

Restraints:

High Production Costs: High production costs pose a significant restraint for the Laminated Labels Market, as specialized materials like polypropylene films, UV curing inks, and adhesives increase manufacturing expenses. Laminated labels require advanced printing technologies, such as digital printing, which demand costly equipment and maintenance, limiting adoption in cost-sensitive markets. For instance, biodegradable labels, while sustainable, involve expensive raw materials, impacting profit margins for label converters. Smaller manufacturers struggle to achieve economies of scale, hindering market penetration for home and personal care labels and consumer durables labels, necessitating cost-effective innovations to enhance accessibility.

Supply Chain Challenges: Supply chain challenges restrain the Laminated Labels Market, as shortages of laminate films and adhesives disrupt production scalability. Global trade disruptions delay raw material deliveries, impacting flexible packaging labels for food and beverage and logistics applications. Sustainability regulations, such as the EU’s Packaging and Packaging Waste Directive, increase material costs for biodegradable labels, complicating supply chains. These restraints slow market growth, requiring diversified sourcing and robust logistics to ensure uninterrupted production and support global demand for laminated labels.

Laminated Labels Market Key Developments:

June 2025: Lecta Self-Adhesives launched a new line of labels that are free of PFAS (Per- and polyfluoroalkyl substances), also known as "forever chemicals." These labels are specifically designed for safer food packaging, reflecting the growing trend and regulatory pressure for more sustainable and environmentally friendly labeling solutions.

March 2024: This is a new biaxially oriented polypropylene (BOPP)-based barrier film. This product is a key development for the laminated labels market because it offers enhanced barrier properties for packaging, which is crucial for protecting product integrity and extending shelf life, particularly in the food and beverage industry.

June 2024: While this is a broader packaging product, it is relevant to the laminated labels market's sustainability trends. Constantia Flexibles launched a wax-free twist wrap made from paper. This product aligns with the industry's move towards sustainable materials and is an example of a packaging innovation that may influence the development of recyclable and paper-based laminated labels.

Laminated Labels Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | US$88.144 billion |

| Total Market Size in 2030 | US$109.549 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Material Type, Printing Technology, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Laminated Labels Market Segmentations:

By Material Type

Polyester

Polypropylene

Vinyl

Polycarbonate

Others

By Printing Technology

Flexography

Digital Printing

Lithography

Variable Data Printing (VDP)

Others

By End-User

Food & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Consumer Durables

Retail & E-Commerce

Others

By Regions

North America (USA, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, and Others)

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)