Report Overview

Global Machine Condition Monitoring Highlights

Machine Condition Monitoring Market Size:

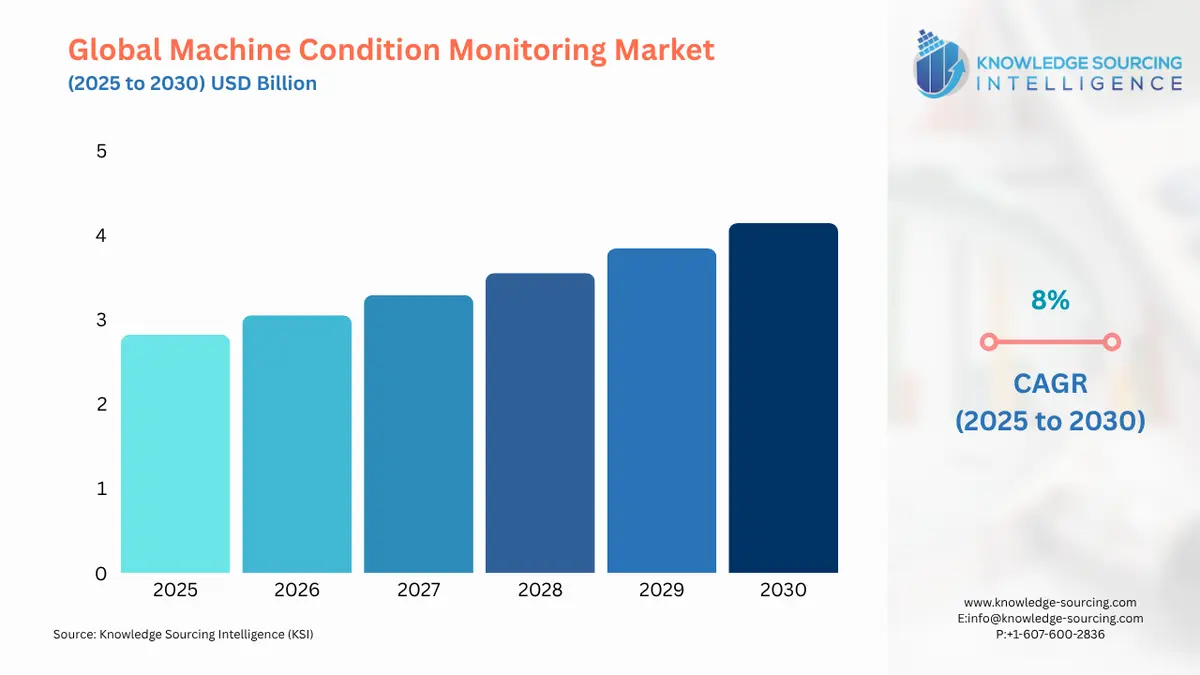

The machine condition monitoring market will grow at a CAGR of 8% to reach USD 4.144 billion in 2030 from USD 2.821 billion in 2025.

The machine condition monitoring market is a pivotal segment of industrial automation, enabling industries to optimize equipment performance, reduce downtime, and enhance operational efficiency through advanced diagnostics. Machine condition monitoring systems encompass technologies such as vibration monitoring solutions, thermography systems, oil analysis equipment, ultrasound testing systems, corrosion monitoring tools, and motor current analysis, which collectively track parameters like vibration, temperature, and lubricant health to detect potential equipment failures. These systems are integral to predictive maintenance technology, equipment health diagnostics, energy efficiency monitoring, and safety and compliance, serving industries like oil and gas, power generation, manufacturing, and automotive. The market is driven by the increasing adoption of Industry 4.0 maintenance solutions and smart factory monitoring, which leverage industrial IoT monitoring and AI-driven condition monitoring to provide real-time insights into machine health analytics. The global push for operational efficiency and asset longevity fuels market growth. Industries are transitioning from reactive to predictive maintenance technology, using real-time equipment monitoring to preempt failures, minimize scrap, and optimize maintenance schedules. The integration of wireless machine monitoring and cloud-based equipment diagnostics has revolutionized data collection, enabling remote access and centralized analysis. For instance, the automated predictive maintenance systems adopted in smart factory monitoring environments enhance productivity by reducing unplanned downtime. The International Federation of Robotics reported a notable surge in industrial robot installations over the past five years, underscoring the need for machine reliability solutions to maintain automated systems. Additionally, regulatory pressures for safety and environmental compliance, particularly in oil and gas and power generation, drive the adoption of machine condition monitoring systems to ensure safety and compliance. The market's growth is further propelled by the expansion of digital transformation initiatives, with companies integrating IoT sensors and AI analytics to enable smarter decision-making. For example, in January 2025, Puresignal launched a wireless lubrication system monitored via an app, showcasing the trend toward mobile-enabled diagnostics. However, challenges such as high initial investment costs and integration complexities with legacy systems pose barriers, particularly for small and medium enterprises (SMEs). The machine condition monitoring market is moderately concentrated, with major players like Emerson Electric Co. and Siemens AG innovating in vibration monitoring solutions and cloud-based equipment diagnostics to cater to diverse applications. The market is driven by the proliferation of industrial IoT monitoring, which enables seamless data collection and real-time analytics. The growing emphasis on predictive maintenance technology reduces costs and downtime, particularly in capital-intensive sectors like oil and gas. Advancements in sensor technology and AI-driven condition monitoring enhance diagnostic accuracy, supporting machine health analytics. Government investments in digital infrastructure, such as the UK’s Industrial Strategy, further boost the adoption of machine reliability solutions. High upfront costs for machine condition monitoring systems, including sensors and software, limit adoption among SMEs. The complexity of integrating automated predictive maintenance with legacy systems requires specialized expertise, posing a challenge. Additionally, a shortage of skilled technicians to operate real-time equipment monitoring systems hinders market growth, particularly in emerging economies.

Machine Condition Monitoring Market Overview

The machine condition monitoring market is growing steadily due to its ability to prevent machine failure and save costly repair expenditure. Repairing cost involves direct costs, such as part replacement, and collateral costs like environmental cleanup or legal fees, which might strain company finances. Employment of condition monitors helps in prevention to a great extent. The booming automation market is providing huge potential for the business. Emerging industrial IoT and data analytics sectors have significant potential. However, unpredictable maintenance periods may constrain the market. Geographically, the market is divided into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific regions. North America holds a substantial market share throughout the forecast period, propelled by the booming automotive and oil and gas industries. In the U.S., the oil and gas sector sustains 10.3 million jobs and contributes 8% to GDP, depending on condition monitoring systems to avert incidents like the 2019 Enbridge pipeline explosion in Ohio caused by corrosion. Cutting-edge technological advancements, robust infrastructure, newly discovered reserves, and the presence of major industry players further fuel market growth in this region. Meanwhile, the Asia Pacific region is experiencing notable growth, driven by the expansion of manufacturing industries that create promising opportunities. Increasing disposable incomes are also boosting demand in the automotive and construction sectors, contributing to the region's rapid market development. Key players, including Emerson Electric Co., Siemens AG, and Rockwell Automation, Inc., lead through advancements in vibration monitoring solutions, thermography systems, and ultrasound testing systems. These companies focus on industrial IoT monitoring and automated predictive maintenance to address diverse industry needs, fostering a competitive and innovative market.

Machine Condition Monitoring Market Drivers

Proliferation of Industrial IoT (IIoT): The adoption of industrial IoT monitoring significantly drives the machine condition monitoring market. IIoT enables seamless connectivity and real-time data collection from sensors monitoring vibration, temperature, and pressure. This facilitates real-time equipment monitoring, allowing industries to predict failures and optimize maintenance. Siemens enhanced its MindSphere platform with advanced machine health analytics, improving diagnostic capabilities for the oil and gas and manufacturing sectors. The integration of wireless machine monitoring reduces installation costs, making IIoT solutions scalable. As industries embrace Industry 4.0 maintenance solutions, IIoT adoption is expected to grow, driven by the need for operational efficiency and reduced downtime.

Demand for Predictive Maintenance: The shift from reactive to predictive maintenance technology is a key market driver, reducing downtime and costs in industries like automotive and power generation. Machine condition monitoring systems use AI-driven condition monitoring to analyze historical data, identifying patterns to prevent failures. In May 2024, GE Vernova’s AI-powered inspection software improved predictive maintenance for energy efficiency monitoring, minimizing outages. This approach enhances machine reliability solutions by scheduling maintenance based on real-time data, improving productivity and safety. The growing emphasis on automated predictive maintenance ensures continued market expansion.

Advancements in Sensor Technology: Innovations in sensor technology, including vibration monitoring solutions and thermography systems, propel the machine condition monitoring market. Advanced sensors offer higher accuracy and cost-effectiveness, enabling early detection of faults like misalignment or overheating. In January 2024, Microchip Technology Inc. launched multi-channel remote temperature sensors with enhanced accuracy for real-time equipment monitoring. These advancements support machine health analytics across oil and gas and manufacturing, reducing maintenance costs and improving energy efficiency monitoring. The trend toward compact, wireless sensors further drives adoption in smart factory monitoring.

Machine Condition Monitoring Market Restraints

High Initial Investment Costs: The high cost of machine condition monitoring systems, including sensors, software, and integration, restricts adoption, particularly for SMEs. Implementing vibration monitoring solutions or cloud-based equipment diagnostics requires significant capital for hardware and training. In 2024, industry reports noted that SMEs in manufacturing faced challenges affording AI-driven condition monitoring systems due to budget constraints. These costs, coupled with expenses for cloud storage and maintenance, create financial barriers, limiting market growth in cost-sensitive sectors.

Integration Complexities with Legacy Systems: Integrating machine condition monitoring systems with legacy equipment poses a significant challenge. Many industries rely on older machinery incompatible with modern industrial IoT monitoring or automated predictive maintenance solutions. In 2024, a UK manufacturing study highlighted integration difficulties, requiring specialized expertise and increasing costs. This complexity slows adoption, particularly in metals and mining, where legacy systems dominate, hindering market expansion.

Machine Condition Monitoring Market Segmentation Analysis

The need for Vibration Monitoring Systems is increasing significantly: Vibration monitoring solutions dominate the machine condition monitoring market due to their effectiveness in early fault detection. These systems use accelerometers to detect imbalances, misalignments, and bearing wear in machinery like turbines and motors, critical for predictive maintenance technology. In 2024, Acoem’s FALCON portable vibration monitoring system enhanced efficiency with wireless sensors, supporting real-time equipment monitoring in oil and gas and power generation. The technology’s ability to identify issues months before failure ensures machine reliability solutions, reducing downtime and energy waste. Its dominance is driven by widespread adoption in smart factory monitoring and Industry 4.0 maintenance solutions, particularly in the Asia Pacific.

By component, the Hardware segment will hold the largest market share: The hardware segment, including sensors and data acquisition systems, leads the machine condition monitoring market due to its critical role in data collection. Vibration sensors, temperature sensors, and ultrasound testing systems enable precise monitoring of equipment health. In January 2024, Microchip Technology Inc.’s multi-channel sensors improved accuracy for machine health analytics, supporting automated predictive maintenance in manufacturing. Hardware’s dominance stems from its necessity in industrial IoT monitoring, offering real-time data for energy efficiency monitoring and safety and compliance. The segment benefits from innovations in wireless and compact designs, driving adoption across smart factory monitoring.

By application, the Predictive Maintenance segment is rising notably: Predictive maintenance technology is the largest application segment, driven by the need to minimize downtime and optimize equipment performance. Using AI-driven condition monitoring and real-time equipment monitoring, it analyzes data to predict failures, enhancing machine reliability solutions. In May 2024, GE Vernova’s AI-powered software enabled predictive maintenance for power generation, reducing outages. The segment’s dominance is fueled by its adoption in oil and gas, automotive, and smart factory monitoring, where cost savings and efficiency are critical. NHS support for predictive analytics further drives growth in Industry 4.0 maintenance solutions.

Machine Condition Monitoring Market Key Developments:

January 2025: Puresignal launched an AI-based wireless lubrication system for machine condition monitoring systems, monitored via a mobile app with a 2-km range. It automatically adjusts lubrication based on machine operation, enhancing predictive maintenance technology and reducing downtime in manufacturing and oil and gas. The system supports real-time equipment monitoring, improving energy efficiency monitoring, and machine reliability solutions. This innovation underscores the trend toward wireless machine monitoring and smart factory monitoring.

December 2024: NKE FERSA and Nanoprecise launched a vibration monitoring solution for wind turbines, enhancing predictive maintenance technology. The system uses AI-driven condition monitoring to detect issues early, extending equipment life in power generation. It integrates industrial IoT monitoring for real-time data, supporting energy efficiency monitoring and safety, and compliance. This collaboration strengthens market penetration in renewable energy.

May 2024: GE Vernova introduced AI-powered inspection software for machine condition monitoring systems, automating equipment health diagnostics in power generation. Leveraging AI-driven condition monitoring, it analyzes data to predict failures, reducing costs and enhancing machine reliability solutions. The software supports real-time equipment monitoring, aligning with Industry 4.0 maintenance solutions and smart factory monitoring trends.

January 2024: Microchip Technology Inc. launched multi-channel remote temperature sensors for machine condition monitoring systems, improving accuracy in machine health analytics. Integrated with resistance error correction, they support real-time equipment monitoring in manufacturing and oil and gas, enhancing predictive maintenance technology and energy efficiency monitoring. This innovation drives the adoption of wireless machine monitoring in smart factory monitoring.

Machine Condition Monitoring Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 2.821 billion |

| Total Market Size in 2030 | USD 4.144 billion |

| Forecast Unit | Billion |

| Growth Rate | 8% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Companies |

|

Machine Condition Monitoring Market Segmentation:

Machine Condition Monitoring Market Segmentation by type:

The market is analyzed by type into the following:

Vibration Monitoring Systems

Thermography Systems

Oil Analysis Systems

Ultrasound Testing Systems

Corrosion Monitoring Systems

Motor Current Analysis Systems

Others

Machine Condition Monitoring Market Segmentation by component:

The report analyzes the market by components as below:

Hardware

Software

Services

Machine Condition Monitoring Market Segmentation by Application:

The market is analyzed by application into the following:

Predictive Maintenance

Equipment Diagnostics

Quality Assurance

Energy Efficiency Monitoring

Safety and Compliance

Others

Machine Condition Monitoring Market Segmentation by end-user industry:

The report analyzes the market by end-user segment as below:

Manufacturing

Oil and Gas

Power Generation

Aerospace and Defense

Automotive

Mining and Metals

Chemicals and Petrochemicals

Others

Machine condition monitoring Market Segmentation by regions:

The study also analysed the machine condition monitoring market into the following regions, with country level forecasts and analysis as below:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, Italy, and Others)

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)