Report Overview

Near Field Communication (NFC) Highlights

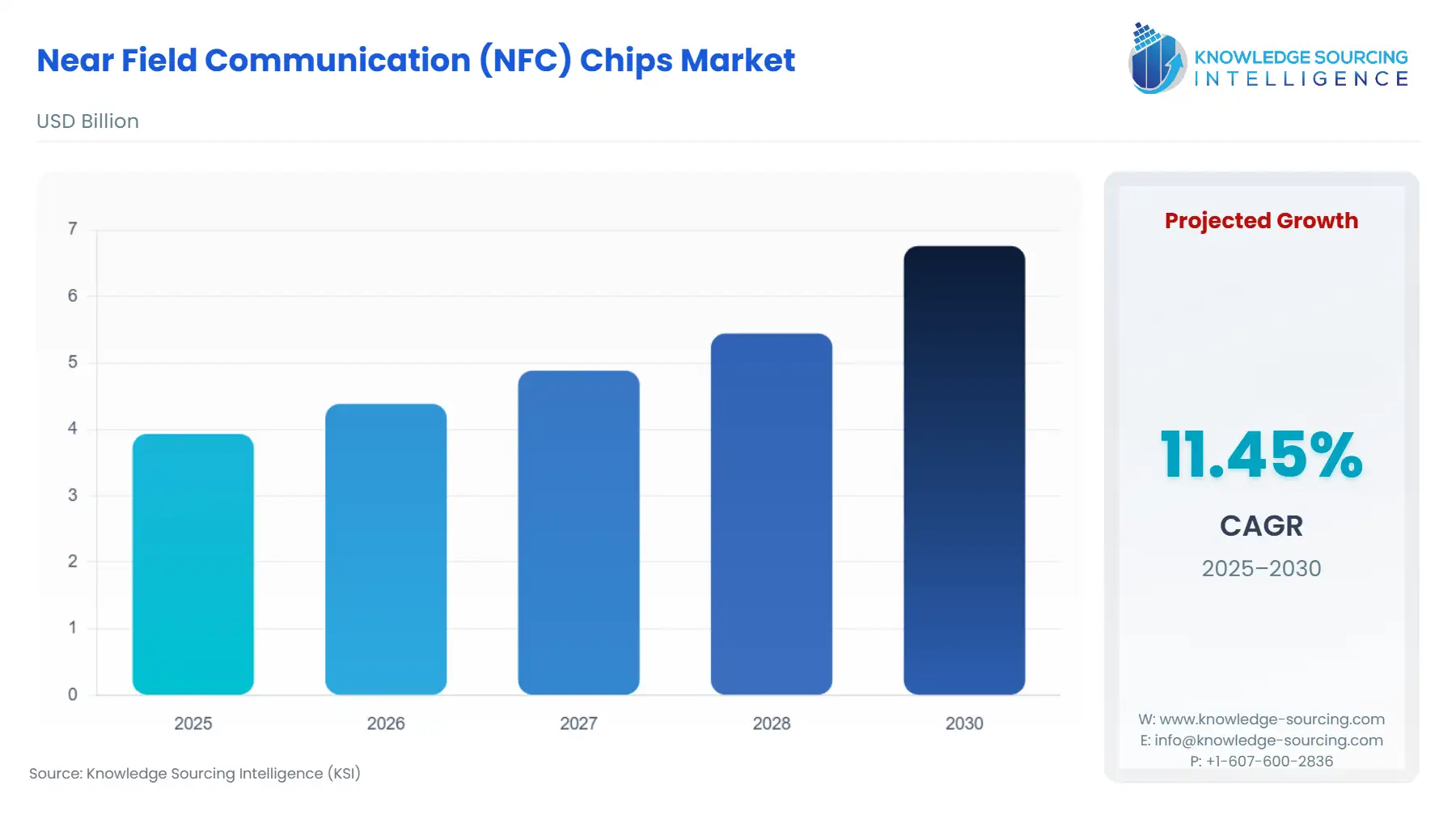

Near Field Communication (NFC) Chips Market Size:

The Global NFC Chips Market is expected to grow at a CAGR of 10.6%, reaching a market size of USD 7,449.8 million in 2031 from USD 4,499.8 million in 2026.

Near Field Communication (NFC) Chips Market Analysis

Growth Drivers

Mobile-wallet expansion and rising tap-to-pay acceptance directly increase demand for NFC controllers and secure elements across phones, wearables, and POS terminals. Regulatory support for tokenisation and higher contactless limits forces issuers to transition from legacy magnetic-stripe systems to dual-interface or secure-element-enabled cards, intensifying chip procurement. EU Digital Product Passport requirements drive adoption of memory-rich NFC tags for lifecycle traceability and authentication. Automotive OEM adoption of digital-key standards increases demand for automotive-grade NFC readers with extended security features. These converging forces shift the market toward high-security, certified NFC chip families from established semiconductor vendors.

Challenges and Opportunities

The U.S. tariff regime for Near Field Communication (NFC) chips is governed under broader semiconductor and integrated circuit classifications within the Harmonized Tariff Schedule (HTS), which generally impose low MFN duty rates on advanced microelectronic components. While NFC chips do not have a unique tariff line, most units imported into the United States qualify for zero-to-minimal base duties, reflecting the country’s longstanding commitment to semiconductor supply-chain openness and downstream innovation in mobile devices, payments infrastructure, and secure authentication systems. However, imports sourced from China continue to fall under enhanced duties associated with Section 301 actions, which can increase the effective landed cost for U.S. OEMs and module assemblers relying on Chinese front-end or back-end semiconductor fabrication. These elevated duties have accelerated supply diversification toward Taiwan, South Korea, Japan, and trusted foundries in the U.S. and Europe.

Semiconductor fabrication constraints and pricing pressure on low-end NFC tags challenge vendors dependent on commodity volumes. Certification processes for secure elements, including EMVCo and Common Criteria, extend development cycles and raise integration costs for OEMs. However, demand for secure authentication tags, DPP-compliant memory structures, and automotive-grade NFC readers offers higher-margin segments. As retailers, transit operators, and brands migrate from QR-only systems to authenticated tap-based interactions, the need for secure ICs increases. Growth opportunities also emerge from integrated sensing tags—such as tamper- or condition-sensing variants—and from NFC embedded into textiles and labels, which broadens the addressable base for premium chipsets.

Raw Material and Pricing Analysis

NFC chips—being semiconductor ICs—are costed primarily on wafer pricing, packaging complexity, and certification overhead. Foundry utilization levels influence wafer availability, particularly for secure NFC controllers requiring specialized CMOS nodes. Packaging and antenna-integration steps add further cost, especially for inlays and lamination procedures used in dual-interface cards and advanced tags. Certification requirements for secure elements and payment-grade controllers increase testing cycles, contributing to higher ASPs. OEMs facing extended lead times increasingly secure long-term foundry allocation and multi-supplier agreements. This dynamic pushes the market toward higher-value NFC chips with robust security and longer lifecycle guarantees.

Supply Chain Analysis

NFC chip design is concentrated in Europe, Japan, and the U.S., while wafer fabrication and packaging are primarily executed in Taiwan, Singapore, Malaysia, South Korea, and China. Production workflows require movement of secure firmware and test assets across borders, creating compliance and traceability burdens. Foundry dependence—especially for mature CMOS nodes used in secure elements—creates bottlenecks when global semiconductor cycles tighten. Certified testing for payment-grade and automotive-grade chips is carried out in limited accredited labs, extending time-to-market. OEMs therefore adopt multisourcing strategies and lock in long-term contracts for secure controllers to mitigate certification and supply-chain risks.

Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | Digital Product Passport (via Ecodesign for Sustainable Products Regulation) | Mandated product traceability and authentication increases demand for secure, high-memory NFC tags embedded in industrial, consumer, and apparel goods. |

United States | Federal Reserve payment modernization guidance | Faster-payment initiatives and tokenisation-readiness encourage POS terminal upgrades and NFC-enabled acceptance, increasing demand for secure NFC controllers and reader ICs. |

India | Reserve Bank of India (RBI) contactless and tokenisation framework | Regulatory support for contactless payments and device tokenisation drives large-scale issuance of contactless cards and corresponding reader and secure-element demand. |

Near Field Communication (NFC) Chips Market Segment Analysis

By Application — Card Emulation

Card emulation is the application area most directly connected to payment and transit systems, and therefore represents the highest regulatory and security burden for NFC chips. Banks and wallet providers rely on secure elements and certified NFC controllers to support EMVCo tokenisation, risk management, and offline authentication in transit environments. Whenever regulators raise contactless transaction limits or permit broader tokenisation usage, issuers must replace or upgrade card portfolios, driving increased procurement of dual-interface chips. Transit operators adopting account-based ticketing introduce new hardware requirements for gate readers capable of rapid wake-up, offline data handling, and robust CE compatibility. On the consumer device side, handset manufacturers integrate secure controllers to enable device-based EMV tokenisation for mobile tap-to-pay. This increases demand for high-performance NFC ICs with integrated security firmware and long-term support commitments. The CE segment therefore draws demand from multiple layers simultaneously: consumers upgrading devices, merchants upgrading terminals, transit agencies modernizing gates, and issuers refreshing card stock—all requiring certified, secure NFC chipsets.

By End-User — BFSI

BFSI institutions depend on certified secure elements, dual-interface controllers, and high-assurance provisioning flows, making this segment the most technologically stringent user of NFC chipsets. Regulatory oversight—such as RBI tokenisation rules and equivalent policies in Europe and the U.S.—forces banks to migrate toward contactless and device-based payment authentication, creating cyclical surges in chip procurement. Card issuers replacing magnetic-stripe cards with dual-interface models generate sustained volume for NFC ICs capable of supporting EMV transaction stacks. Merchant-acquiring banks investing in POS infrastructure require secure NFC reader chips compliant with PCI and EMV standards. As digital wallets expand, BFSI institutions increasingly issue tokenised credentials compatible with handset-side secure elements, further increasing demand for embedded NFC controllers. High compliance requirements shift purchasing patterns toward vendors offering certified silicon, secure firmware, and proven lifecycle management, reducing supply-chain risk and total cost of ownership for financial institutions.

Near Field Communication (NFC) Chips Market Geographical Analysis

United States

Federal Reserve guidance on digital payments, combined with merchant adoption of tap-to-pay, drives modernization of POS terminals and stimulates demand for secure NFC readers and controllers. Tokenisation adoption by major wallet providers further increases integration of secure elements across devices.

Brazil

Central bank initiatives promoting contactless and Pix-by-proximity payments create incentives for merchants and wallet providers to deploy NFC-capable acceptance points. This regulatory reinforcement accelerates reader and secure-controller demand.

Germany

High contactless penetration, coupled with EU digital-market rules that open handset NFC interfaces to third-party wallets, encourages increased deployment of NFC-enabled payment and transit solutions. This drives demand for certified secure elements and reader ICs.

United Arab Emirates

Fintech licensing expansion and strong contactless penetration encourage banks and merchants to integrate NFC acceptance. Financial regulators’ support for digital payments increases procurement of certified NFC readers and cards.

India

RBI’s tokenisation mandate and contactless payments framework accelerate contactless card issuance and merchant-terminal upgrades. Smartphone penetration and wallet adoption further increase demand for embedded NFC controllers and POS-side NFC reader ICs.

Near Field Communication (NFC) Chips Market Competitive Environment and Analysis

Key companies present in the market include NXP Semiconductors, STMicroelectronics, Infineon Technologies, Renesas Electronics Corporation, Qualcomm Technologies, Samsung, and Avery Dennison.

NXP Semiconductors

NXP’s portfolio includes NTAG and secure-element product families used in authentication, packaging, and payments. Recent secure tag introductions support Digital Product Passport needs and anti-counterfeit applications. Its strong EMVCo-certified product line reinforces its position in BFSI and mobile-wallet deployments.

STMicroelectronics

ST’s ST25 family covers tags, readers, and automotive-grade ICs. Product introductions in 2024–2025 include enhanced secure tags and automotive NFC readers designed for digital-key access and wireless-charging control. ST’s automotive-certified range positions it strongly in OEM sourcing cycles.

Avery Dennison

Avery Dennison integrates NFC tags into apparel, packaging, and brand-protection systems. Deployments in 2024 expanded NFC-embedded garment and label solutions, which increases overall NFC chip demand from the apparel and consumer-goods sector.

Near Field Communication (NFC) Chips Market Developments

May 2025 — NXP Semiconductors announced its NTAG X DNA secure Type-4 tag for authentication and Digital Product Passport implementations.

April 2025 — STMicroelectronics introduced new automotive-grade NFC readers (ST25R500/ST25R501) supporting digital-key and wireless-charging applications.

Near Field Communication (NFC) Chips Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4,499.8 million |

| Total Market Size in 2031 | USD 7,449.8 million |

| Forecast Unit | Million |

| Growth Rate | 10.6% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Application, Use Case, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Near Field Communication (NFC) Chips Market Segmentation:

By Product Type

NFC Tags

Single Interface

Dual Interface

NFC Readers

By Application

Reader/Writer

Peer-To-Peer

Card Emulation

Wireless Charging

By Use Case

Authentication & Access Control

Contactless Payments

Asset Tracking

Others

By End-User

Transportation

Retail

BFSI

Healthcare

Consumer Electronics

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others