Report Overview

Contactless Payment Market Size:

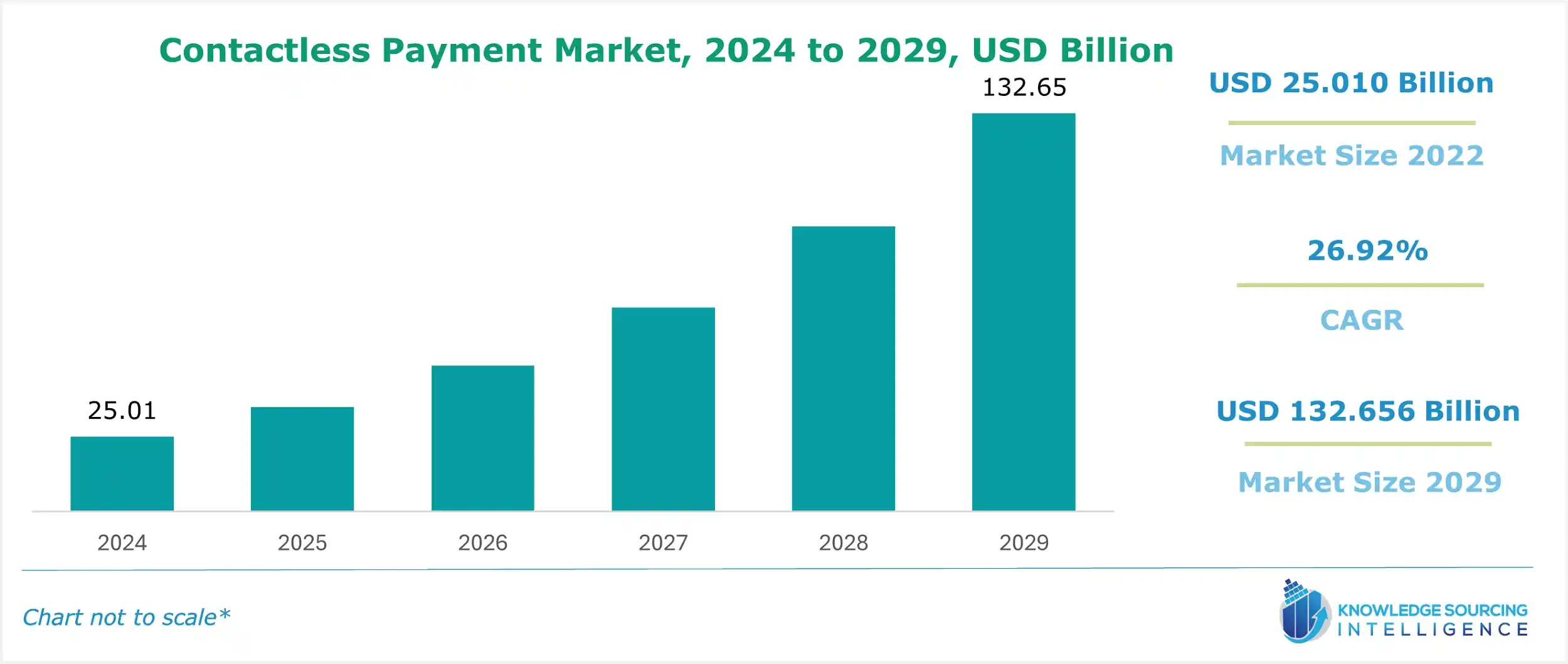

The global contactless payment market is estimated to be around US$25.010 billion in 2022 and is anticipated to grow to US$132.656 billion by 2029 at a CAGR of 26.92%.

Contactless Payment refers to a secure transition method for customers to purchase products using debit, credit, smartcards, or chip cards using radio frequency identification (RFID) or near-field communication (NFC) technology. The contactless payment options offer the users payment options without physically swiping the debit or credit card. In this payment option, the consumer has the opportunity to pay for any product or service using a smart card, smartwatch, smartphone, or other wearables. These transition methods are faster than the traditional method of swiping cards. This technology also offers an easy and safe transition process to consumers. From the perspective of the business owners, this method helps to reduce the checkout time significantly, decreasing the consumer wait time. This system also reduces the cases of fraudulent payment for business owners, as these payment systems are secure and encrypted.

One of the major drivers, that can propel the growth of the contactless payment system in the globe can be the increasing adaptation of the digital and mobile-based payment system in the world.

The global digital payment landscape has witnessed significant growth in recent years. This growth can be credited to the increase in the global adoption of the internet and mobile devices. The digital payment system offers the consumer an easy and secure payment interface that can be directly linked to the banks. Countries like India, Japan, and the USA have witnessed a significant increase in their digital payment interface.

The increase in global retail demand is also expected to boost the contactless payment system. In the retail industry, the contactless payment system offers several benefits to consumers as well as to business operators. This system offers a reduction in the checkout time, as it speeds up the transition process. This system also allows a secure and encrypted interface, preventing the transitions from any possible attacks.

The contactless payment system has to overcome various challenges and restraints to witness positive growth in the global market. Some of the major challenges to the growth of these technologies are the limitations of the payments and limited acceptance by the consumer and the business operators. Various countries like India, the Philippines, Germany, and France have restricted the maximum limits of the transitions in the contactless payment system, limiting the use of this technology. Similarly, consumers and business owners are uncertain about the acceptance of this technology, as this system has limitations and can be targeted by fraudsters. Various other limitations, like the technical barriers, the availability of the technology, and the limitations of international availability, also disrupt the growth of contactless payment systems in the global market.

Contactless Payment Market Growth Drivers:

- An increase in digital and mobile-based payment systems around the globe is expected to push the demand for the contactless payment market forward.

One of the major drivers that is expected to boost the contactless payment system is the increase in digital and mobile-based payment systems around the globe. The mobile-based payment system allows smartphone or other portable device users to carry a monetary transactions using the internet, or other means. In this, the digital payment system is among the fastest growing systems, which allows fast and secure payment options, along with an easy interface, that can be adapted easily by the consumers. The digital payment system has increased significantly in the global landscape. Countries like the USA, India, China, Japan, and Taiwan, among various others, have launched their respective digital payment infrastructures.

In India, the digital payment system witnessed significant growth since its introduction in the year in 2016. According to the National Payment Corporation of India (NPCI), the nation's monthly volume of UPI, or digital payment, was about 8,038.59 million in January 2023, which grew significantly to about 12,020.23 million in December 2023. The increase in digital and mobile-based payment systems around the globe will encourage consumers towards the cashless transition landscape, which is further expected to increase the contactless payment systems around the globe.

- An increase in global retail consumption is expected to boost the demand for the contactless payment system in the global market.

The global increase in the retail industry is expected to boost the market volume of the contactless payment system in the world. The contactless payment system offers various benefits to consumers as well as to retailers. For consumers, a contactless payment system offers a secure and easy transition and allows faster payment options as compared to conventional methods, like card swiping. Similarly, for retailers or business operators, the contactless payment system offers a quicker checkout time and also reduces the incidence of fraud.

The global retail industry witnessed a significant boost in recent few years. The Census Bureau of the US announced in January 2024 that the retail industry of the nation reached about US$ 7,040 billion in 2022, a significant increase from 2021, when the nation's retail sales were estimated to be at US$ 6,519.8 billion. Similarly, India also experienced major growth in its retail sector. The Indian Brand Equity Foundation of India stated that the nation's retail sales grew about 9% from September 2022 to 2023.

Contactless Payment Market Restraints:

- Lower transition limits and limited acceptance of these systems can act as one of the major challenges for the market.

One of the major roadblocks limiting the growth of the global contactless payment market is the limitation on the transition. Various nations like India, China, the USA, and Canada have issued limitations for the payment for contactless payment methods, as these methods have the potential for fraud and cyberattacks. India limited the transition limits of the contactless payment to about INR 5,000 (about US$ 60). Similarly, Canada and the USA have also issued a limitation of about US$ 200 each in their contactless payment systems. The Suit Me stated that Canada has the highest transitional limitation on contactless payment, followed by the USA and Japan. The data also stated that countries like Iran, Chile, Poland, and Turkey are among the various countries with the lowest transitional limits.

Similarly, the limited acceptance of these transition methods also slows the growth of the market. The American Express in an article stated that consumers are hesitant to adopt the contactless payment systems, mainly due to the limited coverage and limit on the transactions.

Contactless Payment Market: Products Offered by Key Companies:

- Google: Google, one of the global leaders in software technologies, offers a contactless payment system, Google Wallet, in the international market. This system offers a Tap-to-Pay system that the user can utilize using smartphones.

- Apple Inc.: The global technological leader Apple offers Apple Pay in its devices, like smartphones and smartwatches, which allows its users to utilize the contactless or tap-to-pay payment system using the biometric security of the devices.

Contactless Payment Market Recent Developments:

- In May 2024, Nexi Group launched its Tap-To-Pay system on iPhone devices in Germany. The company aims to increase flexibility and convenience for the merchants and the consumers.

- In March 2024, IndusInd Bank launched India's first contactless payment wearable, 'Indus PayWear', that is exclusive to the Mastercard holders of the nation.

Contactless Payment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Contactless Payment Market Size in 2022 | US$25.010 billion |

| Contactless Payment Market Size in 2029 | US$132.656 billion |

| Growth Rate | CAGR of 26.92% |

| Study Period | 2019 to 2029 |

| Historical Data | 2019 to 2022 |

| Base Year | 2024 |

| Forecast Period | 2024 – 2029 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Contactless Payment Market |

|

| Customization Scope | Free report customization with purchase |

Contactless Payment Market is analyzed into the following segments:

- By Payment Mode

- Mobile Handsets

- Smart Cards

- Point of Sale Terminals

- Others

- By Industry

- IT & Telecom

- Transportation & Logistics

- Banking & Financial Services

- Retail

- Hospitality

- Others

- By Geography

- Americas

- USA

- Canada

- Brazil

- Others

- Europe Middle East and Africa

- United Kingdom

- Germany

- France

- Netherlands

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Others

- Americas