Report Overview

Global Occlusion Devices Market Highlights

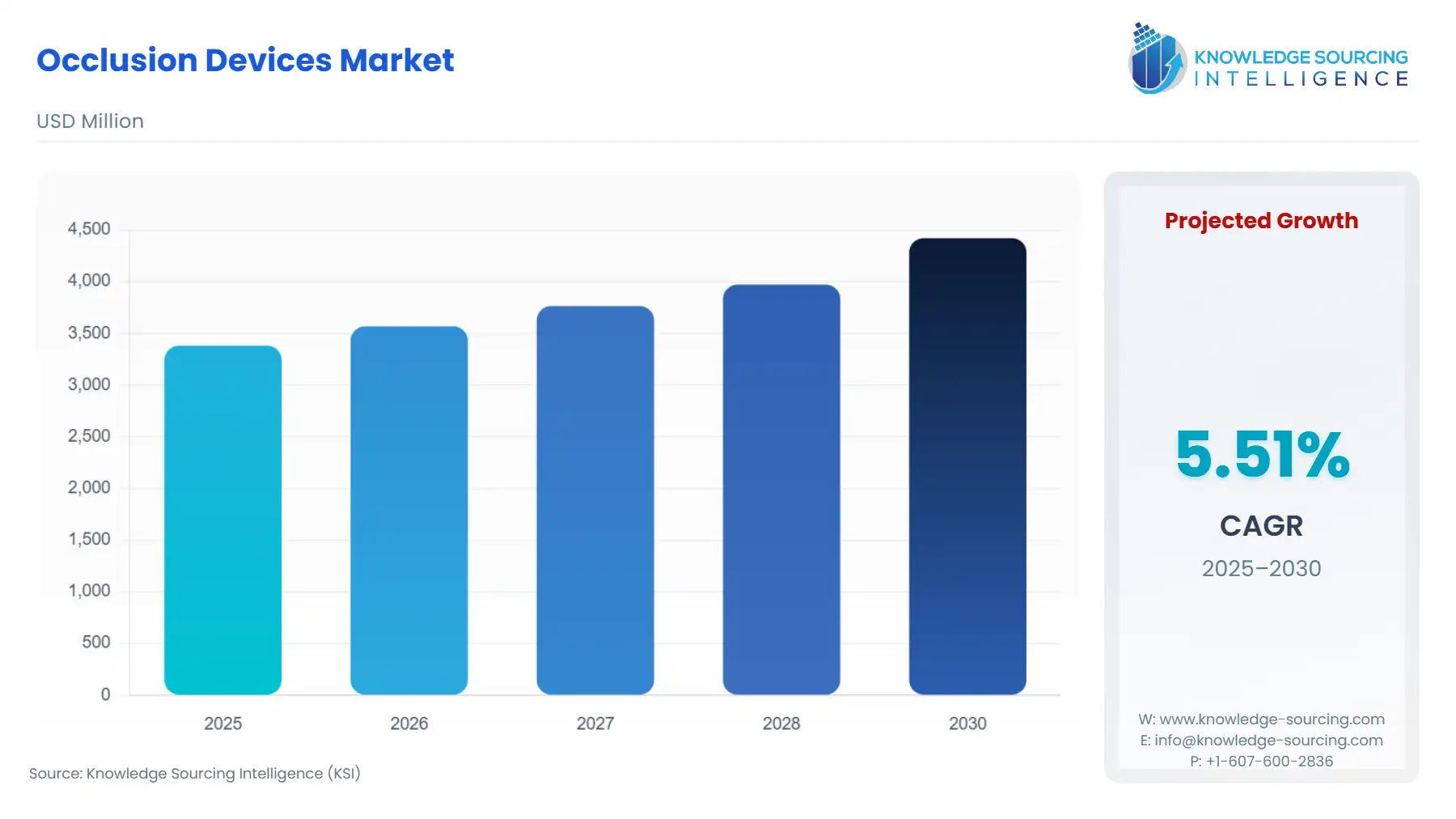

Occlusion Devices Market Size:

The global occlusion devices market is projected to rise at a 5.51% CAGR, achieving USD 4.423 billion in 2030 from USD 3.383 billion in 2025.

The Global Occlusion Devices Market operates at the critical juncture of cardiovascular and neurovascular intervention, providing indispensable therapeutic tools for controlling or arresting blood flow to a targeted vessel or organ. This market is not governed by consumer choice but by urgent clinical need, translating the documented global rise in non-communicable diseases—specifically atrial fibrillation (AFib), peripheral artery disease, and stroke—directly into market expansion.

The transition from open surgery to endovascular techniques, characterized by smaller incisions and reduced recovery times, places a premium on the continuous innovation of occlusion tools, requiring smaller profiles, enhanced steerability, and more controlled detachment mechanisms. The current trajectory underscores a strategic industry focus on developing devices that offer superior navigability and efficacy in the treatment of highly complex lesions, solidifying the market's dependence on specialized materials and high-precision manufacturing.

Global Occlusion Devices Market Analysis

- Growth Drivers

The escalating global burden of chronic cardiovascular and neurological conditions, notably acute ischemic stroke, creates immediate and non-negotiable demand for occlusion and thrombectomy devices. Stroke intervention guidelines now heavily promote rapid mechanical thrombectomy, directly translating the increased incidence of large vessel occlusion strokes into a requirement for high-performance clot removal systems. Furthermore, the documented prevalence of atrial fibrillation (AFib) and contraindications for long-term oral anticoagulants drive the adoption of Left Atrial Appendage (LAA) occlusion devices as a proven stroke risk reduction strategy. Lastly, technological advancements in material science, such as the evolution of smaller-profile, more flexible Nitinol-based delivery systems, expand the treatable patient pool by enabling access to previously inaccessible or highly tortuous anatomies, thereby increasing overall procedure volume.

- Challenges and Opportunities

A significant constraint facing the market is the substantial capital expenditure and recurring expense associated with advanced occlusion and thrombectomy platforms. This high cost profile limits the widespread adoption of premium devices in healthcare systems outside of highly developed economies, constraining overall market penetration in emerging regions. A key opportunity, conversely, lies in the convergence of device technology with artificial intelligence (AI) and robotics. Developing AI-assisted surgical navigation and robotic catheter systems can significantly enhance procedural precision and consistency, directly lowering the documented complication rates. This technological integration would reduce dependency on highly specialized expert operators, enabling market expansion into a broader network of hospitals and increasing demand for the compatible robotic-assisted occlusion tools.

- Raw Material and Pricing Analysis

Occlusion devices are complex physical products, relying critically on the specialized supply of biocompatible, high-performance materials. The core component for self-expanding plugs and coils is Nickel-Titanium (Nitinol), valued for its shape memory and super-elasticity, which demands precise, highly controlled manufacturing processes. Other key materials include platinum for coils (offering radiopacity) and specialized polymeric coatings for drug-eluting features and enhanced lubricity. Global pricing for these specialty metals is subject to commodity market fluctuations and geopolitical trade dynamics, creating persistent cost volatility for manufacturers. The necessity for high-grade, traceable materials and complex micro-manufacturing steps inherently prevents commoditization, sustaining the premium pricing structure of the final devices.

- Supply Chain Analysis

The supply chain for the Global Occlusion Devices Market is characterized by a high-value, low-volume, and exceptionally stringent quality-controlled framework. Key production hubs are concentrated in regions with specialized medical device manufacturing expertise, notably the USA, Germany, Ireland, and East Asia (Japan, South Korea). The primary logistical complexity stems from transporting delicate, sterilized, pre-loaded delivery systems, which require a strictly managed cold chain and specialized handling to prevent device damage that would compromise clinical performance. The supply chain is highly dependent on a small group of Tier 1 specialty component suppliers for raw materials like high-purity Nitinol wire, creating a dependency bottleneck that can be acutely sensitive to global trade disruptions or regulatory changes affecting single-source materials.

Occlusion Devices Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FDA Center for Devices and Radiological Health (CDRH) - Premarket Approval (PMA) / 510(k) |

FDA oversight requires rigorous clinical evidence for high-risk implants (PMA), establishing verified safety and efficacy profiles. This ensures physician confidence and channels demand toward proven devices, while the 510(k) process supports faster market entry for technology iterations. |

|

European Union |

Medical Device Regulation (EU MDR) 2017/745 |

The MDR requires mandatory clinical evidence updates and comprehensive post-market surveillance for all devices, including those previously certified. This places a significant burden on manufacturers for recertification, leading to temporary product rationalization and potentially shifting demand toward manufacturers with robust regulatory affairs infrastructure. |

|

China |

National Medical Products Administration (NMPA) |

The NMPA implements a "fast-track" approval pathway for innovative medical devices, which directly accelerates market access and adoption of cutting-edge foreign and domestic occlusion technologies, thereby fueling demand in the Asia-Pacific region. |

Occlusion Devices Market Segment Analysis

- By Application: Cardiology

The Cardiology application segment constitutes a foundational growth pillar, driven predominantly by the management of complex coronary artery disease (CAD), peripheral artery disease (PAD), and structural heart conditions. Within CAD, the use of embolic protection devices during percutaneous coronary intervention (PCI) is a key area; although current guidelines show a downgraded recommendation for routine use in saphenous vein graft (SVG) intervention, the clinical consensus supports their use in high-risk cases to mitigate distal embolization, thus creating targeted demand. The most impactful growth catalyst is the increasing need for Left Atrial Appendage (LAA) Occlusion devices in patients with non-valvular AFib who are deemed ineligible or high-risk for long-term oral anticoagulation therapy. The demonstrated long-term safety data from major clinical trials for devices like the WATCHMAN (Abbott) and Amulet (Abbott) actively validate LAA occlusion as a standard alternative, shifting demand from pharmacological management to permanent device implantation. The documented procedural success and patient-reported quality of life improvements solidify this demand structure, making the devices essential for stroke prevention in a growing, specific patient population.

- By End-User: Hospitals

The Hospitals segment represents the largest revenue generator for the Occlusion Devices Market, a structure cemented by the inherent procedural requirements. Catheter-based interventions, including stroke thrombectomy, aneurysm coiling, and pulmonary embolism (PE) management, require specialized infrastructure (hybrid operating rooms/cath labs), high-acuity support staff, and a large inventory of premium disposable devices. The demand profile is driven by volume and technological sophistication; hospitals need to maintain state-of-the-art thrombectomy and embolization systems to adhere to clinical guidelines, particularly the 2021 ACC/AHA guidelines for cardiovascular revascularization and the 2019 AHA/ASA guidelines for acute ischemic stroke. Crucially, the demand is often concentrated in regional Comprehensive Stroke Centers (CSCs) and major trauma centers, which require full inventories of high-value occlusion and clot retrieval systems to ensure 24/7 readiness. Reimbursement policies in developed markets, which favor high-value, minimally invasive procedures, further incentivize hospitals to invest in and utilize these advanced devices over older surgical methods.

Occlusion Devices Market Geographical Analysis

- US Market Analysis

The US market is the leading adopter of advanced occlusion devices, characterized by high procedural volume and rapid integration of new technology. High disease prevalence, robust reimbursement frameworks from Medicare/Medicaid and private payers for interventional cardiology and neurovascular procedures, and the presence of highly specialized Comprehensive Stroke Centers propels this growth. Local demand is critically influenced by the FDA’s streamlined device approval pathways (such as 510(k) clearance and PMA), which facilitate quicker market entry for innovative devices, pushing physician preference toward the latest generation of products like mechanical thrombectomy systems and next-generation LAA occluders. The established medico-legal environment also prioritizes best-in-class technology to mitigate liability risk, creating inelastic demand for premium devices.

- Brazil Market Analysis

The Brazilian market's need for occlusion devices is segmented, concentrated primarily in private sector hospitals within major metropolitan areas like São Paulo and Rio de Janeiro. A high prevalence of cardiovascular risk factors and neurological disease fuels its demand, yet it is constrained by healthcare infrastructure disparities and price sensitivity within the public healthcare system (SUS). Local factors include the slower regulatory approval process by the Agência Nacional de Vigilância Sanitária (ANVISA), which can delay the introduction of the latest global devices. Consequently, demand is split between highly specialized imported devices in private centers and more established, cost-effective technologies in the public sector, emphasizing durable, proven technology over incremental innovation.

- German Market Analysis

Germany represents a major demand center in Europe, distinguished by a mature, high-quality public healthcare system and a strong emphasis on clinical data. Demand is stable and driven by high procedure volumes for stroke and peripheral intervention, supported by favorable national health insurance (GKV) coverage and reimbursement rates for interventional procedures. The local market is currently navigating the rigorous compliance demands of the European Union Medical Device Regulation (EU MDR), which favors established manufacturers with extensive clinical data packages. German physician preference is strongly influenced by long-term clinical evidence and safety profiles, ensuring a consistent demand for premium, well-documented devices.

- Saudi Arabia Market Analysis

The Saudi Arabian market exhibits strong growth in demand, concentrated almost entirely within the country's modern, government-funded specialized cardiac and neuroscience centers. Demand is propelled by the significant and rising prevalence of diabetes, hypertension, and cardiovascular disease among the young population. The Ministry of Health’s investment in establishing world-class specialty hospitals and training interventional specialists directly fuels demand for high-end occlusion devices. Local market dynamics include a preference for direct purchasing from major multinational manufacturers and a need for devices that meet international quality standards (US FDA/EU CE Mark), often bypassing the need for extensive local clinical trials.

- China Market Analysis

China is the fastest-growing market by volume, with demand massively scaled by high population density and the largest global burden of stroke and hypertension. The government's "Made in China 2025" strategy and the volume-based procurement (VBP) program are the critical local demand shapers. While VBP drives down prices for mature, high-volume devices, increasing access across provincial hospitals, the NMPA's accelerated approval pathway for innovative devices simultaneously encourages the rapid adoption of cutting-edge foreign and domestic occlusion technologies, particularly those related to mechanical thrombectomy, thus driving parallel, tiered demand. This necessity is geographically expanding beyond Tier 1 cities into lower-tier metropolitan areas as infrastructure improves.

Occlusion Devices Market Competitive Environment and Analysis

The Global Occlusion Devices Market is dominated by a few large, diversified multinational medical device corporations that command significant market share through extensive product portfolios, established clinical relationships, and robust global distribution networks. Competition is focused on device miniaturization, improving deliverability through tortuous vasculature, and generating level-one clinical evidence to secure favorable regulatory and reimbursement positioning, particularly in the high-growth neurovascular and structural heart segments.

- Abbott

Abbott maintains a dominant position in the structural heart and neurovascular segments, leveraging its legacy and deep clinical expertise. The company's strategic positioning centers on pioneering devices that offer minimally invasive alternatives to open surgery. A key product is the Amplatzer Amulet Left Atrial Appendage Occluder, which competes directly in the high-growth AFib stroke prevention segment. The Amulet features a dual-seal technology designed to offer immediate and comprehensive sealing of the LAA, distinguishing it in a market focused on reducing the need for post-procedural antithrombotic therapy and driving physician demand by offering a simplified implantation technique. Abbott consistently invests in large, multinational clinical trials to validate long-term safety and efficacy, bolstering its market authority.

- Medtronic

Medtronic is a global leader in medical technology, employing a comprehensive strategy that spans cardiovascular, neurovascular, and peripheral vascular occlusion applications. The company’s core strength is its massive scale and established relationships with major hospital systems worldwide. In the neurovascular space, Medtronic competes with the Solitaire FR (Flow Restoration) stent retriever, a device critical for mechanical thrombectomy in acute ischemic stroke. The Solitaire device has been the subject of numerous pivotal clinical trials that established the efficacy of mechanical thrombectomy, fundamentally driving demand for this class of occlusion removal devices. Medtronic’s strategy involves integrating its occlusion devices with its broader portfolio of imaging and navigation technologies, offering hospitals a holistic procedural solution.

- Penumbra, Inc.

Penumbra, Inc. is strategically focused on the neurovascular and peripheral vascular markets, distinguishing itself as an innovator in mechanical thrombectomy. The company's competitive advantage is its proprietary Computer-Assisted Vacuum Thrombectomy (CAVT) technology, exemplified by the Lightning system portfolio. This system utilizes a unique combination of large-bore aspiration catheters and intelligent algorithms to differentiate between clot and blood, enhancing speed and clot removal efficiency while minimizing blood loss. This technological differentiation directly addresses the critical growth driver for faster procedure times in stroke and pulmonary embolism intervention, positioning Penumbra as a high-growth disruptor in the occlusion removal device segment.

Occlusion Devices Market Developments

- October 2025: Penumbra released results from the landmark STORM-PE RCT, which found that Computer-Assisted Vacuum Thrombectomy (CAVT) using their Lightning Flash system plus anticoagulation achieved superior reduction in right heart strain compared to anticoagulation therapy alone for pulmonary embolism.

- October 2025: Medtronic announced the full U.S. distribution of the Neuroguard IEP System, a 3-in-1 technology combining a stent, an integrated dilation balloon, and a 40-micron integrated embolic protection filter, which is purposefully built for carotid artery stenting procedures.

- April 2024: Penumbra announced the U.S. FDA clearance and launch of Lightning Flash 2, the next-generation CAVT system for venous thrombus and pulmonary embolism (PE), featuring advanced algorithms for increased speed and sensitivity to thrombus and blood flow.

Occlusion Devices Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.383 billion |

| Total Market Size in 2031 | USD 4.423 billion |

| Growth Rate | 5.51% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Occlusion Devices Market Segmentation:

- GLOBAL OCCLUSION DEVICES MARKET BY TYPE

- Occlusion Removal Devices

- Embolization Devices

- Tubal Occlusion Devices

- GLOBAL OCCLUSION DEVICES MARKET BY APPLICATION

- Cardiology

- Gynaecology

- Neurology

- Urology

- Others

- GLOBAL OCCLUSION DEVICES MARKET BY END-USERS

- Hospitals

- Ambulatory SurgIcal Centers

- GLOBAL OCCLUSION DEVICES MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others