Report Overview

Global Ophthalmic Devices Market Highlights

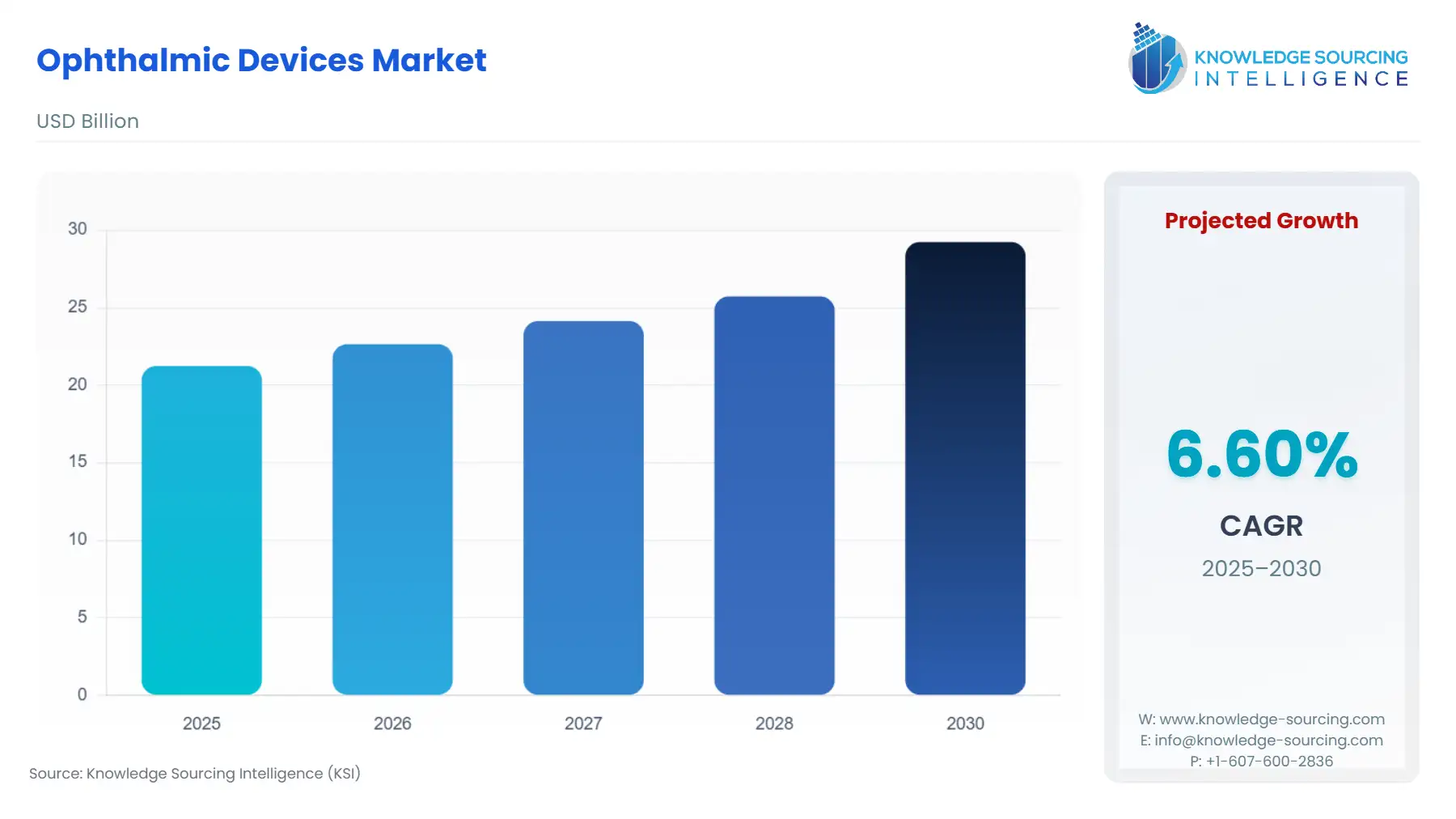

Ophthalmic Devices Market Size:

The Ophthalmic Devices Market will grow from USD 21.238 billion in 2025 to USD 29.235 billion by 2030, fueled by a 6.60% compound annual growth rate (CAGR).

The global ophthalmic devices market encompasses a diverse and technically sophisticated range of medical instruments, surgical equipment, and vision care products utilized for the diagnosis, monitoring, and treatment of various eye conditions, including refractive errors, cataracts, and glaucoma.

This market is intrinsically linked to global public health trends, driven by the escalating worldwide prevalence of chronic ocular diseases and the aging population demographic. Technological advancements are transforming the sector, shifting the clinical focus from mere treatment to high-resolution diagnostics and less-invasive surgical interventions. Market dynamics are further shaped by reimbursement policies, which often dictate the adoption rate of premium technology like advanced intraocular lenses (IOLs) and high-end diagnostic imaging equipment, setting a premium on devices that demonstrate superior long-term clinical and economic value.

Global Ophthalmic Devices Market Analysis

- Growth Drivers

The primary catalyst for sustained market growth is the global acceleration of the geriatric population, as individuals aged 60 and older are disproportionately vulnerable to age-related visual impairments, including cataracts, glaucoma, and AMD. This demographic shift creates non-discretionary demand for surgical devices, such as phacoemulsification systems and premium IOLs, used in the high volume of necessary cataract surgeries. Concurrently, the rising global prevalence of diabetes acts as a secondary, powerful driver, as diabetic retinopathy requires specialized diagnostic devices, including fundus cameras and OCTs, for early and continuous retinal screening and monitoring, ensuring a high, ongoing demand for diagnostic consumables and imaging equipment.

- Challenges and Opportunities

A significant challenge facing the market is the consistently high cost of advanced surgical and diagnostic devices, such as femtosecond lasers and state-of-the-art OCT scanners. This cost constraint often limits the adoption of premium technologies in public hospitals and emerging nations, slowing overall market penetration. The key opportunity lies in the rapid development and commercialization of teleophthalmology and AI-integrated diagnostic devices. These technologies reduce the reliance on scarce specialty manpower and mitigate geographic access barriers. AI algorithms, when integrated into fundus cameras and OCTs, facilitate automated, high-throughput screening for conditions like diabetic retinopathy, directly increasing the addressable patient population and lowering the logistical cost of mass diagnostics.

- Raw Material and Pricing Analysis

The Ophthalmic Devices Market is heavily dependent on high-specification raw materials, including specialized optical resins (like MR-series polymers) for vision care products such as contact lenses and spectacles, and ultra-high-precision surgical-grade polymers and metals for implants (IOLs) and instruments. The supply of specialty optical resins and coatings is often concentrated in East Asia (e.g., China and Japan), exposing the industry to geopolitical risks and trade disruptions. Pricing is volatile, as changes in petrochemical feedstock costs affect polymer prices. The trade war between China and the US, including elevated tariffs on certain imported components, has the potential to increase the landed cost of raw materials and finished low-end devices in the US market, which pressures manufacturers to raise prices or seek domestic sourcing alternatives.

- Supply Chain Analysis

The global supply chain for ophthalmic devices is a high-value, low-volume network characterized by manufacturing concentration in highly specialized hubs in the US, Europe (Germany, Switzerland), and Asia (Japan, China). Key production activities, such as advanced lens molding and coating (for IOLs and contact lenses) and precision machining (for surgical instruments), require controlled environments and highly skilled labor. Logistical complexities include ensuring temperature-controlled transport for certain viscoelastic substances and coordinating the distribution of high-cost, fragile diagnostic equipment. Dependence on Asian suppliers for specialty optical resins and electronic components (for diagnostic equipment) creates inherent dependencies, making the supply chain vulnerable to port closures, trade policy changes, and component shortages.

Ophthalmic Devices Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FDA Premarket Approval (PMA) / 510(k) (Food and Drug Administration) |

The FDA’s rigorous approval pathways, especially PMA for high-risk Class III devices (e.g., IOLs, certain lasers), impose high R&D and clinical trial costs, driving demand toward novel devices that qualify for the Breakthrough Devices Program, which expedites review and encourages specialized innovation. |

|

European Union |

Medical Device Regulation (MDR) |

The MDR imposes stricter clinical evidence requirements and post-market surveillance on all medical devices, including ophthalmic devices. This increases compliance costs and market entry barriers, which may incentivize consolidation and favor large companies with the financial resources to meet the enhanced regulatory burden. |

|

Global |

WHO SPECS 2030 Programme (May 2024) (World Health Organization) |

This program aims to increase the global availability of suitable spectacles. While not regulatory, it acts as a soft catalyst, encouraging government initiatives and public-private partnerships in low- and middle-income countries, thereby increasing the baseline demand for low-cost Vision Care Products and screening diagnostics. |

Ophthalmic Devices Market Segment Analysis

By Application: Cataract

Cataract surgery remains the highest volume ophthalmic procedure globally, making the Cataract application segment the central driver of demand for both surgical consumables and implants. The imperative for device demand is directly proportional to the size of the aging population, as cataract incidence increases non-linearly with age. The demand is not limited to basic IOLs; it is increasingly shifting toward premium devices, such as toric, multifocal, and extended depth of focus (EDOF) IOLs, which aim to correct pre-existing refractive errors during cataract removal. This trend is driven by patient expectation for better post-operative visual outcomes and technological advancements that transform the procedure from a sight-restoring necessity into a vision-enhancing refractive procedure. The demand for associated equipment, including sophisticated Phacoemulsification Systems and Femtosecond Lasers, is sustained by the continuous drive toward increased surgical precision and efficiency in high-volume Ambulatory Surgical Centers (ASCs).

- By End-User: Hospitals & Clinics

The Hospitals & Clinics segment, which includes Ophthalmic Clinics and large hospital departments, constitutes the dominant end-user category, especially for high-capital diagnostic and surgical equipment. The key demand driver is their function as the primary location for complex, high-acuity surgical procedures (e.g., vitreoretinal and advanced glaucoma surgery) that necessitate large, fixed-site imaging systems like Optical Coherence Tomography (OCT) and specialized surgical microscopes. Ophthalmic clinics, in particular, fuel demand for diagnostic equipment, such as Phoropters and Tonometers, due to their high patient throughput for routine and specialty examinations. The growing global shift of cataract and other high-volume procedures toward specialized, non-hospital-based Ambulatory Surgical Centers (ASCs) is also a major driver within this category, as ASCs prioritize investment in efficient, high-end equipment to maximize throughput and optimize reimbursement.

Ophthalmic Devices Market Geographical Analysis

- US Market Analysis (North America)

The US market is characterized by high adoption rates of premium technology and a robust reimbursement environment, which are the primary local demand factors. The dominance of private insurance and government programs like Medicare ensures financial coverage for a large percentage of age-related procedures, directly guaranteeing demand for premium devices like EDOF and toric IOLs. This region also acts as a primary launch site for innovative devices, driven by a well-established FDA regulatory pathway (e.g., Breakthrough Devices). However, the rising cost of healthcare and ongoing concerns over the stability of the Centers for Medicare & Medicaid Services (CMS) reimbursement rates represent persistent commercial headwinds for providers purchasing high-cost capital equipment.

- Brazil Market Analysis (South America)

Demand in Brazil is strongly influenced by its extensive public healthcare system (SUS) and fragmented private market. The major local demand factor is the sheer volume of underserved patients with cataracts and other treatable vision impairments. While the need is high, market access is constrained by the public sector's preference for cost-effective, basic devices and a slower adoption rate for premium IOLs and high-end diagnostic equipment due to budget limitations. The market for mid-range vision care products, particularly prescription spectacles, is driven by the large, urban middle class seeking affordable, quality options outside the public system.

- Germany Market Analysis (Europe)

Germany's market is highly stable, characterized by a sophisticated public insurance system that prioritizes clinical evidence and long-term device safety. Local demand is concentrated on precision diagnostic equipment from domestic and European producers, often seeking devices integrated with comprehensive digital health records (DHR) systems. The strict EU Medical Device Regulation (MDR) is a crucial local factor that, while increasing compliance cost, assures high product quality and technical excellence, channeling demand toward MDR-compliant technologies that can seamlessly integrate into advanced surgical workflows.

- Saudi Arabia Market Analysis (Middle East & Africa)

Demand in Saudi Arabia is heavily driven by large-scale government investment in healthcare infrastructure and medical tourism initiatives, which dictate procurement for high-end devices. The key local demand factor is the preference for cutting-edge, Western-manufactured surgical and diagnostic devices for private and specialized government hospitals, reflecting a strategic effort to establish the country as a regional medical hub. This strategic focus ensures high demand for premium devices, such as Femtosecond Lasers and advanced Vitreoretinal Surgery systems, often outpacing the technological adoption rate of many European markets.

- China Market Analysis (Asia-Pacific)

China’s market expansion is fueled by massive demographic scale, improving public health insurance coverage, and a major government push for local manufacturing and technology adoption. The primary local demand factor is the rising prevalence of myopia (Refractive Errors) in the youth population, driving exceptional demand for corrective Vision Care Products and myopia control devices. While high-end surgical device demand is driven by the increasing volume of cataract surgery in its rapidly aging population, government procurement policies often favor domestically-produced diagnostic equipment, creating a highly competitive environment for international device manufacturers reliant on imports.

Ophthalmic Devices Market Competitive Environment and Analysis

The Ophthalmic Devices market is dominated by a few integrated multinational corporations, characterized by their diverse product portfolios spanning surgical, diagnostic, and vision care segments. Competition is primarily based on technological innovation, clinical evidence, and the ability to offer comprehensive, end-to-end procedural workflows.

- Alcon Inc.: Alcon is a pure-play eye care leader with a dominant position across Surgical and Vision Care segments. Its strategic focus is on innovation in Cataract Surgery Devices, particularly Intraocular Lenses (IOLs), where its portfolio includes premium trifocal and toric IOLs. The company also maintains a strong presence in vitreoretinal surgery and contact lenses. Its strategy involves targeted acquisitions, such as the completed acquisition of LumiThera in September 2025, to expand its footprint in non-invasive clinical areas like dry Age-related Macular Degeneration (AMD) treatment.

- Carl Zeiss Meditec AG: ZEISS focuses on high-precision diagnostic and surgical technology, particularly excelling in imaging, diagnostic devices (e.g., OCT scanners), and advanced laser systems. Its competitive advantage is built on digital integration, creating connected workflows that link diagnostic data directly to surgical planning. The successful integration of Dutch Ophthalmic Research Center (D.O.R.C.) in April 2024 significantly broadened the company's offering in the posterior segment (retina) surgery, allowing it to provide a more complete, digitally-connected retina surgery workflow.

- Bausch + Lomb Incorporated: Bausch + Lomb maintains a diversified portfolio covering Vision Care (contact lenses, solutions), Surgical, and Ophthalmic Pharmaceuticals. The company focuses on the high-volume segments, leveraging its brand recognition in consumables. Its strategy includes continuous innovation in the Vision Care segment, exemplified by the June 2023 launch of INFUSE Multifocal silicone hydrogel daily disposable contact lenses in the U.S. market, targeting the massive presbyopia market with advanced material technology.

Ophthalmic Devices Market Developments

- September 2025: Alcon Completes Acquisition of LumiThera

Alcon completed the acquisition of LumiThera, Inc., a leader in light-based innovations. This acquisition immediately brought the Valeda photobiomodulation (PBM) device into Alcon's portfolio, a technology focused on the non-invasive treatment of early and intermediate dry Age-related Macular Degeneration (AMD). This strategic acquisition expands Alcon beyond its traditional surgical retina focus, allowing it to enter the clinical retina and dry AMD treatment space with a commercially available, non-invasive therapeutic device.

- April 2024: Carl Zeiss Meditec AG Completes Acquisition of Dutch Ophthalmic Research Center (D.O.R.C.)

Carl Zeiss Meditec AG announced the completion of the acquisition of 100% of D.O.R.C., a specialist in vitreoretinal surgical devices and consumables. Having secured all required regulatory approvals, this M&A activity significantly expands the ZEISS Medical Technology portfolio, allowing it to offer an enhanced, digitally-connected Retina Surgery Workflow. The combination positions ZEISS to become a top player by leveraging D.O.R.C.'s strong presence in the posterior (retina) surgery segment.

Ophthalmic Devices Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 21.238 billion |

| Total Market Size in 2031 | USD 29.235 billion |

| Growth Rate | 6.60% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Ophthalmic Devices Market Segmentation:

- By Type

- Surgical Device

- Needle Holders

- Forceps

- Retractors & Speculum

- Others

- Diagnostics Device

- Ophthalmoscope

- Tonometer

- Phoropter

- Others

- Vision Care Products

- Contact Lenses

- Spectacles

- Others

- Surgical Device

- By Application

- Cataract

- Glaucoma

- Refractive Errors

- Myopia

- Hyperopia

- Others

- By End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America