Report Overview

Global Oil & Gas Highlights

Oil & Gas Analytics Market Size:

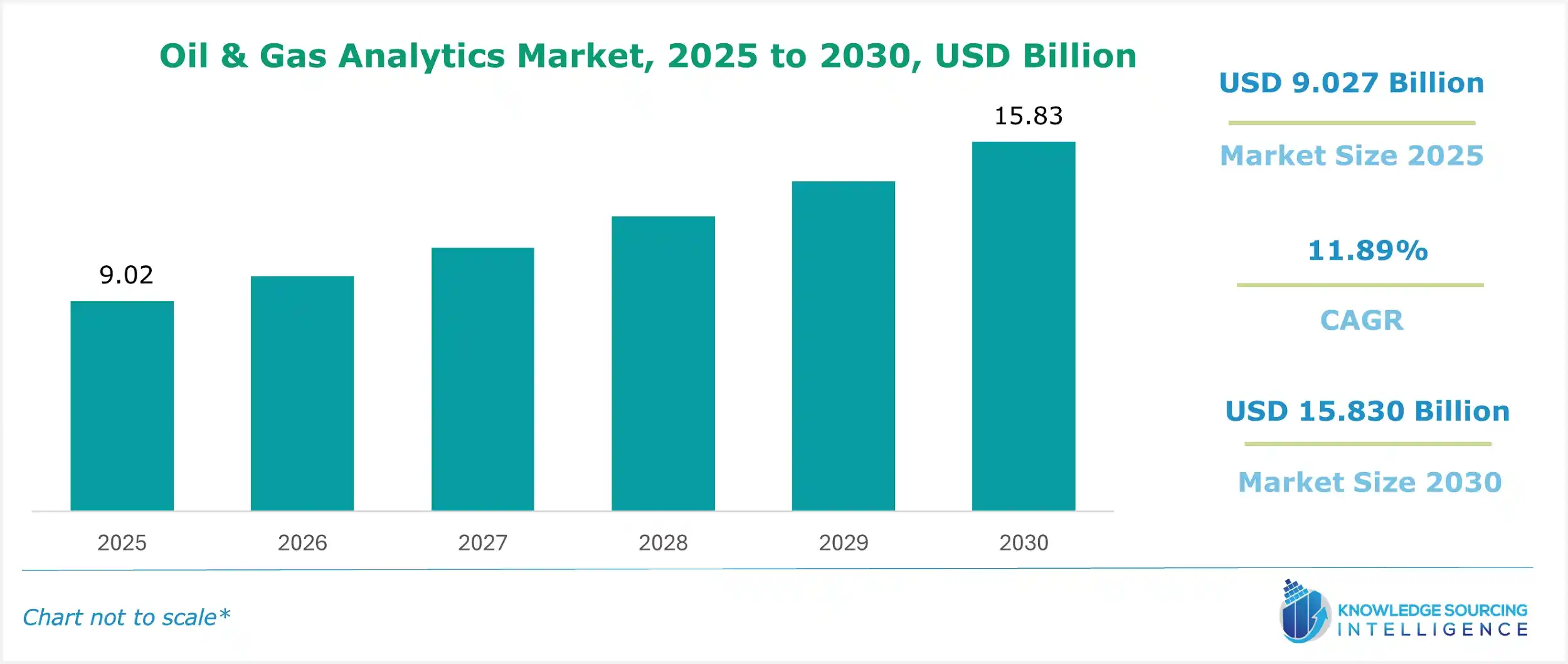

The global oil and gas analytics market is expected to grow from USD 9.027 billion in 2025 to USD 15.830 billion in 2030, at a CAGR of 11.89%.

Oil & Gas Analytics Market Key Highlights:

- Increasing oil demand is driving adoption of analytics for efficient exploration.

- Advancing AI technologies are enhancing data-driven decision-making in oil operations.

- United States is leading the market with rising natural gas production analytics.

- Growing digital oilfields are optimizing operations through real-time data insights.

- Rising IoT integration is improving monitoring and efficiency in oilfields.

- Expanding cloud computing is enabling scalable data processing for analytics.

- Evolving ESG standards are promoting analytics for sustainable oil and gas practices.

Oil & Gas Analytics Market Overview:

Oil and gas analytics enable companies operating in this field to create scenario-based decisions relating to oil exploration and production. The field is highly data-driven and uses methods such as statistical analysis, machine learning algorithms, and predictive modeling techniques for accuracy. Booming oil & gas demand, coupled with growing technological advancements in oil & gas exploration, is expected to propel the global oil and gas analytics market.

The oil and gas market is undergoing a transformative shift, driven by the integration of Big Data Analytics and AI, enhancing operational efficiency and decision-making. Machine Learning Oil & Gas and Predictive Analytics O&G enable proactive maintenance and optimized drilling, while Prescriptive Analytics O&G recommends actionable strategies. Digital Twin Oil & Gas models assets for real-time optimization, and IoT in Oil & Gas delivers continuous monitoring. Cloud Computing Energy supports scalable data processing, and Advanced Analytics Oilfield refines exploration and production.

Oil & Gas Analytics Market Trends:

The oil and gas analytics market is advancing with Digital Oilfield technologies, integrating AI and IoT for real-time asset optimization. Energy Transition Analytics supports the shift to sustainable practices, while Decarbonization O&G leverages data to reduce emissions and align with ESG Reporting Oil & Gas standards. Smart Wells enhance production efficiency through automated monitoring and control. Hydrocarbon Accounting improves accuracy in resource tracking, ensuring compliance and profitability. These trends reflect the industry’s focus on digitalization, sustainability, and operational excellence, driving data-driven strategies to navigate environmental regulations and market demands while optimizing exploration and production in a dynamic energy landscape.

Oil & Gas Analytics Market Growth Drivers:

- Increasing demand for oil and gas

The global oil and gas analytics market expansion is primarily propelled by several key factors, including the increasing need for oil and gas, heightened competition within the sector, financial resources, and heightened public oversight. According to the International Energy Agency (IEA), the oil demand in 2023 is anticipated to reach 101.2 million barrels per day, and in 2024, it is expected to reach 102.3 million barrels per day. But on the contrary, the supply is expected to remain less, signifying a demand-to-supply gap in the supply chain. According to the IEA, the supply in 2021 was 63.9 million barrels per day, and a similar trend is anticipated to continue. Furthermore, ongoing investment in oil & exploration activities and project establishments has provided a positive scope for the global oil and gas analytics market growth.

- Advancement in technology

The global oil and gas analytics market growth is expected to be driven by the escalating exploration efforts in oil and gas, as well as the global rise in oil and gas prices. The adoption of analytics-powered applications in the industry can additionally aid companies in acquiring valuable insights for investment choices and other critical aspects. The utilization of artificial intelligence and the Internet of Things (IoT) in the global oil and gas analytics industry is seen as a major catalyst for the market's expansion. Numerous oil and gas firms are prioritizing the enhancement of efficiency and productivity through comprehensive data analysis, a need that is met by oil and gas analytics solutions.

Oil & Gas Analytics Market Geographical Outlook:

- The United States is anticipated to be the fastest-growing country in the North American region

The rising focus on improving the exploration of unconventional wells is expected to impact the oil and gas analytics market growth. The oil and gas industry in the country has witnessed an upward trend with a transformation in digitalization over the past few years, where the focus on analytics has increased manifold. Further, the increasing levels of awareness related to digital oilfields and the transformation of drilling, exploration, and transportation will drive the United States oil and gas analytics industry during the forecast period.

Additionally, stringent regulatory guidelines from the government, such as the US Commercial Building Initiative (CBI) are expected to compel the producers to bring technological advancement and reduce greenhouse gas emissions. This will result in a shift towards the use of analytical platforms and Artificial intelligence tools for better management and analysis of generated data.

- Increased natural gas production in the United States

As estimated by the U.S. Energy Information Administration, U.S. natural gas production increased in 2022 by around 4% compared to the previous year, amounting to 4.9 billion cubic feet per day. This highlights favorable prospects for increasing demand for oil and gas analytics in the upcoming years, as increased production will require real-time data insights for the optimization of operations. Moreover, the demand for data analysis reduces operational costs and enhances labor productivity, coupled with customizable security protocols. These factors are anticipated to boost the oil and gas analytics market in the long term.

Oil & Gas Analytics Market Key Developments:

List of Top Oil & Gas Analytics Companies:

- Cognizant

- Rolta India Limited.

- Quantzig

- Alteryx

- IBM

Oil & Gas Analytics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Oil & Gas Analytics Market Size in 2025 | USD 9.027 billion |

| Oil & Gas Analytics Market Size in 2030 | USD 15.830 billion |

| Growth Rate | CAGR of 11.89% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Oil & Gas Analytics Market |

|

| Customization Scope | Free report customization with purchase |

Oil & Gas Analytics Market Segmentation:

- By Service

- Professional

- Cloud

- Integration

- By Deployment Mode

- On-premises

- Hosted

- By Application

- Upstream

- Midstream

- Downstream

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America

Navigation

- Oil & Gas Analytics Market Size:

- Oil & Gas Analytics Market Key Highlights:

- Oil & Gas Analytics Market Overview:

- Oil & Gas Analytics Market Trends:

- Oil & Gas Analytics Market Growth Drivers:

- Oil & Gas Analytics Market Geographical Outlook:

- Oil & Gas Analytics Market Key Developments:

- List of Top Oil & Gas Analytics Companies:

- Oil & Gas Analytics Market Scope: