Report Overview

Biomethane Market - Strategic Highlights

Biomethane Market Size:

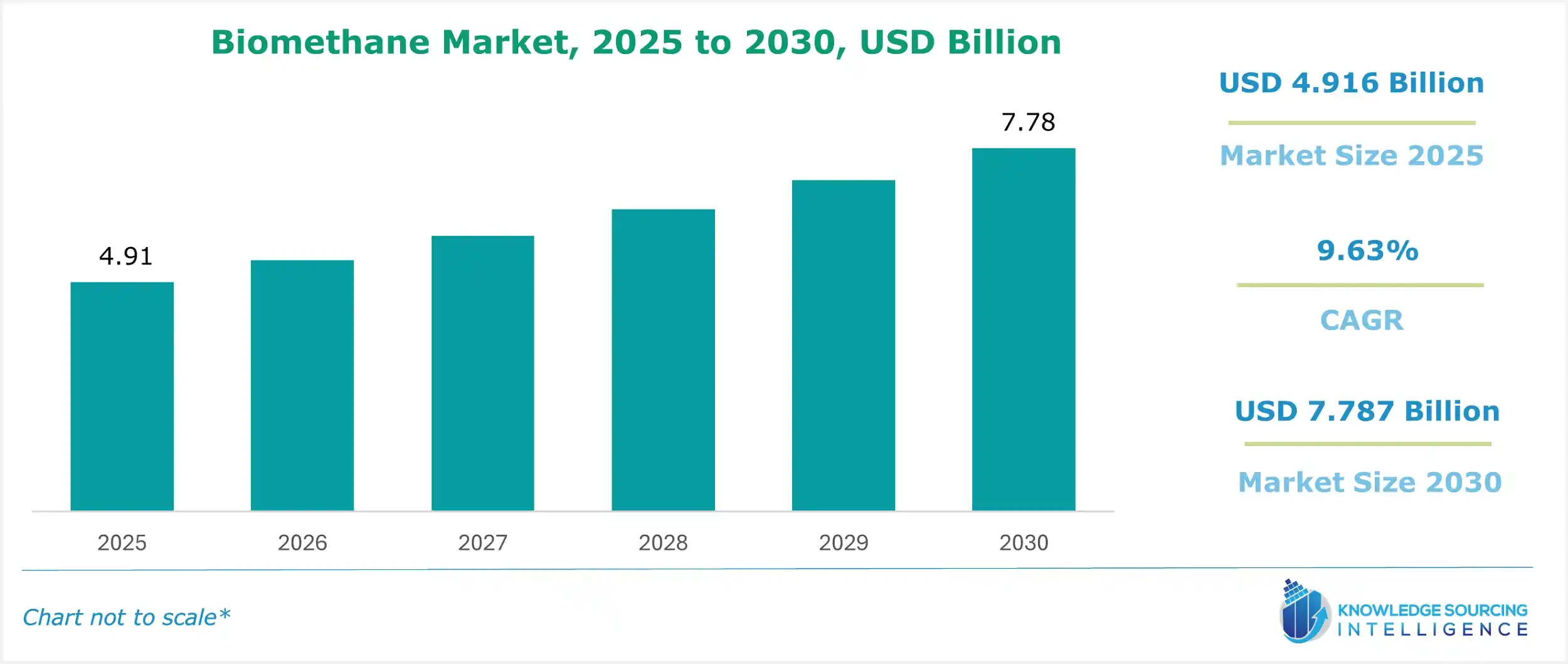

The biomethane market is estimated to attain a market size of USD 7.787 billion by 2030, growing at a 9.63% CAGR from a valuation of USD 4.916 billion in 2025.

The biomethane market is anticipated to show steady growth during the forecast period. Biomethane is a form of gas that originates from organic wastes like cow dung or animal dung, garbage waste, and sewage waste. It’s a refined form of biogas; the generated gas consists of carbon dioxide, methane, and other gases that are formed due to anaerobic disruption of organic material in an oxygen-deficient environment. Biomethane is used in various applications, including vehicle fuel and power generation, combining heat and electricity.

Biomethane is a renewable natural gas and an alternative fuel option apart from fossil fuels for sustainable growth in the future. It is also used for domestic purposes, as CNG biomethane is environmentally friendly. Increased demand for nature-friendly fuel transportation, growing investments in renewable energy, and enhanced environmental concerns and sustainability targets are the drivers for the biomethane market growth.

Biomethane Market Overview & Scope

The biomethane market is segmented by:

- Feedstock: By feedstock, the biomethane market is segmented into animal manure, organic household waste, energy crops, sewage sludge, and others. The animal manure segment has a major market share.

- Production Process: By production process, the biomethane market is segmented into anaerobic digestion, pyrolysis, and gasification. The anaerobic digestion is predicted to be the fastest-growing market share. Biomethane production helps tackle organic waste by converting agricultural, food, and industrial residues into clean energy, supporting global efforts toward a circular economy and more sustainable waste solutions.

- Application: By application, the biomethane market is segmented into automotive, power generation, and others. The power generation segment is expected to have a significant market share in this segment. With countries pushing to reduce carbon emissions and moving away from fossil fuels, there's growing interest in biomethane as a clean, renewable energy source.

- Region: Region-wise, Europe is anticipated to account for a significant share of the biomethane market due to various reasons. The economic as well as environmental factors affect the region, which has a prestigious target to tackle climate change and reduce the emission of greenhouse gases. Biomethane is one of the alternatives to reduce the carbon footprint when compared to fossil fuels like diesel and gasoline. These factors coordinate well with the region's goal towards its efforts to reduce carbon emissions.

Top Trends Shaping the Biomethane Market

1. Rising Demand from the Automotive Industry

- This makes biomethane a practical and scalable solution for decarbonizing road transport while supporting circular economy goals. According to the IEA report, the European Union’s aim for 2022’s renewable energy share in transport was 9.6%, which increased to 29% in 2030, hence, this shows the increasing trend for the requirement for biofuels in the transportation sector, inclusive of automotive.

2. Growth in Strategic Investments

- The strategic investment in biogas projects and collaboration to expand biomethane capacity across the region has further provided new growth opportunities for the biomethane market globally. For instance, as per the March 2025 press release by the American Biogas Council, for the past twelve months, 125 biogas projects came online with an overall investment of US$3 billion.

Biomethane Market Growth Drivers vs. Challenges

Drivers:

- Growing Demand for Renewable Energy: The growing requirement for sustainable energy sources, which is renewable energy, is promoting the demand for biomethane globally. Hence, effort to reduce greenhouse gas emissions and shift away from fossil fuels is expected to boost the biomethane production demand for energy production. Biomethane is a low-carbon energy source that supports the net-zero emission goal of 2050, which states a reduction of carbon dioxide emissions by about 45 percent by 2030 from the 2010 level of CO2, and reach net zero by 2050 globally. This global climatic goal aligns with the renewable energy sources increase which is going to boost the biomethane market in the coming years.

Additionally, the growing renewable energy demand for enhancing energy security, along with a reduction of reliance on imported fossil fuel for utilization in diverse sectors like energy and transportation, is also leading the shift towards renewable energy. As per the International Energy Agency (IEA), there was a rise of 50 percent renewable energy capacity in 2023 compared to 2022 globally.

Moreover, according to the Ministry of New and Renewable Energy data, the renewable energy installed capacity was 203.18 GW in October 2024, which was an increase from 178.98 GW in October 2023. The Indian government has set a renewable energy target of achieving 500 GW from renewable sources capacity by 2030, and this growth in renewable energy capacity is expected to increase the demand for biomethane as it offers the dispatchability and flexibility required for supporting the renewable energy system.

- Stringent Government Rules and Increased Demand for Eco-Friendly Fuel in Transportation- Government rules and evolution in the transportation fuel sector drive the demand for the biomethane market growth. The government regulations involve reducing carbon emissions by adopting alternative fuel choices other than diesel and gasoline. Biomethane is an alternative choice after fossil fuels and is in demand for vehicles like buses and trucks. This gas emits low greenhouse gases compared to other forms of fuel and is the forefront contender for sustainable transport solutions.

Further, the government are setting targets for reducing reliance of fossil fuel and promote the biomethane production, such as, the European Union launched a scale-up plan of biomethane, which is the REPowerEU Plan, in May 2022 intending to reach a target of 35 billion cubic meters (bcm) annually by 2030 through biomethane production, the estimated investment during this period is expected to amount to €37 billion.

The biomethane is derived from organic waste and has nature-friendly benefits. This positions biomethane gas as a powerful aspect due to stricter government rules regarding emissions, and biomethane will emerge as a clean fuel alternative in the future. For instance, according to the article published by the International Energy Agency in 2023, India intends to extend the use of natural gas in India's economy through investments in gas infrastructure, with a forecast prediction of the contribution of natural gas to the respective energy sector is 15% by 2030.

- Enhanced Environmental Concerns and Sustainability Targets: Biomethane is an emerging trend in the market against traditional fuel due to its decarbonization properties and sustainability targets. Compared to traditional fuels like diesel and gasoline, biomethane gas is capable of emitting low greenhouse gases, which is perfectly suitable for tackling climate change. This gas can be utilized in transportation and power generation. Furthermore, biomethane production reduces waste disposal to the environment. End products like food waste and animal waste are used to produce biomethane gas.

Waste from sources like agricultural waste and wastewater sludge can be converted into a suitable energy source for sustainable power generation in the future. This benefits economically and also helps to tackle excess waste, which becomes a raw material for producing electricity and transportation fuel globally. The environment and waste management can be coordinated for a sustainable future.

Challenges:

- Raw Material Inventory may curb the market growth: To run a business for a longer period of time in the market, one needs to maintain raw materials, which are waste feedstock. As this production facility needs a lot of waste materials as raw materials, it may be challenging to ensure the availability of waste at all times for biomethane gas production.

Biomethane Market Regional Analysis

- North America: The region is expected to account for a major market share, owing to the growing pollution and carbon emission has shifted the consumer preference for sustainable fuel in the regional countries like the United States. Hence, major industrial sectors, inclusive of transportation and energy & power, are emphasizing on adoption of an environment-friendly approach, which has positively impacted the demand for biomethane in the US market.

According to the “United States Energy Policy Review 2024” report issued by the International Energy Agency, the country harbors nearly 2,300 sites across all 50 states that produce biomethane & biogas. Moreover, the same source also states that nearly 59% of the US biomethane & biogas is used for heat & power generation, while the transportation sector accounts for 28%. Owing to its low-carbon intensity, the demand for biomethane is anticipated to pick up pace in the United States.

Biomethane Market Competitive Landscape

The market is fragmented, with many notable players, including EnviTec Biogas AG, AB HOLDING SPA, Future Biogas Limited, PlanET Biogas Group, ETW Energietechnik GmbH, Verbio SE, Veolia Group, Air Liquide, TotalEnergies, DMT International, Bright Renewables, and Malmberg, among others.

- Collaboration: In February 2025, Toyota Tsusho signed a development agreement with Sebigas Cótica Bioenergia LTDA, Ferrari Agroindústria S.A., and Toho Gas Co., Ltd, to study the biomethane production pilot plant in Brazil. The objective of this agreement is to develop a process to produce biomethane from sugarcane waste.

- Production Unit Launch: In February 2025, TotalEnergies announced the launch of its 2nd largest biomethane production unit in France, which is expected to produce 153 GWh of biomethane annually.

Biomethane Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Biomethane Market Size in 2025 | USD 4.916 billion |

| Biomethane Market Size in 2030 | USD 7.787 billion |

| Growth Rate | CAGR of 9.63% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Biomethane Market |

|

| Customization Scope | Free report customization with purchase |

Biomethane Market Segmentation:

By Feedstock

- Animal Manure

- Organic Household

- Energy Crops

- Sewage Sludge

- Others

By Production Process

- Anaerobic Digestion

- Pyrolysis

- Gasification

By Application

- Automotive

- Power Generation

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Our Best-Performing Industry Reports:

Navigation:

- Biomethane Market Size:

- Biomethane Market Highlights:

- Biomethane Market Overview & Scope

- Top Trends Shaping the Biomethane Market

- Biomethane Market Growth Drivers vs. Challenges

- Biomethane Market Regional Analysis

- Biomethane Market Competitive Landscape

- Biomethane Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 17, 2025