Report Overview

Global Potentiometric Titration Market Highlights

The Potentiometric Titration Market

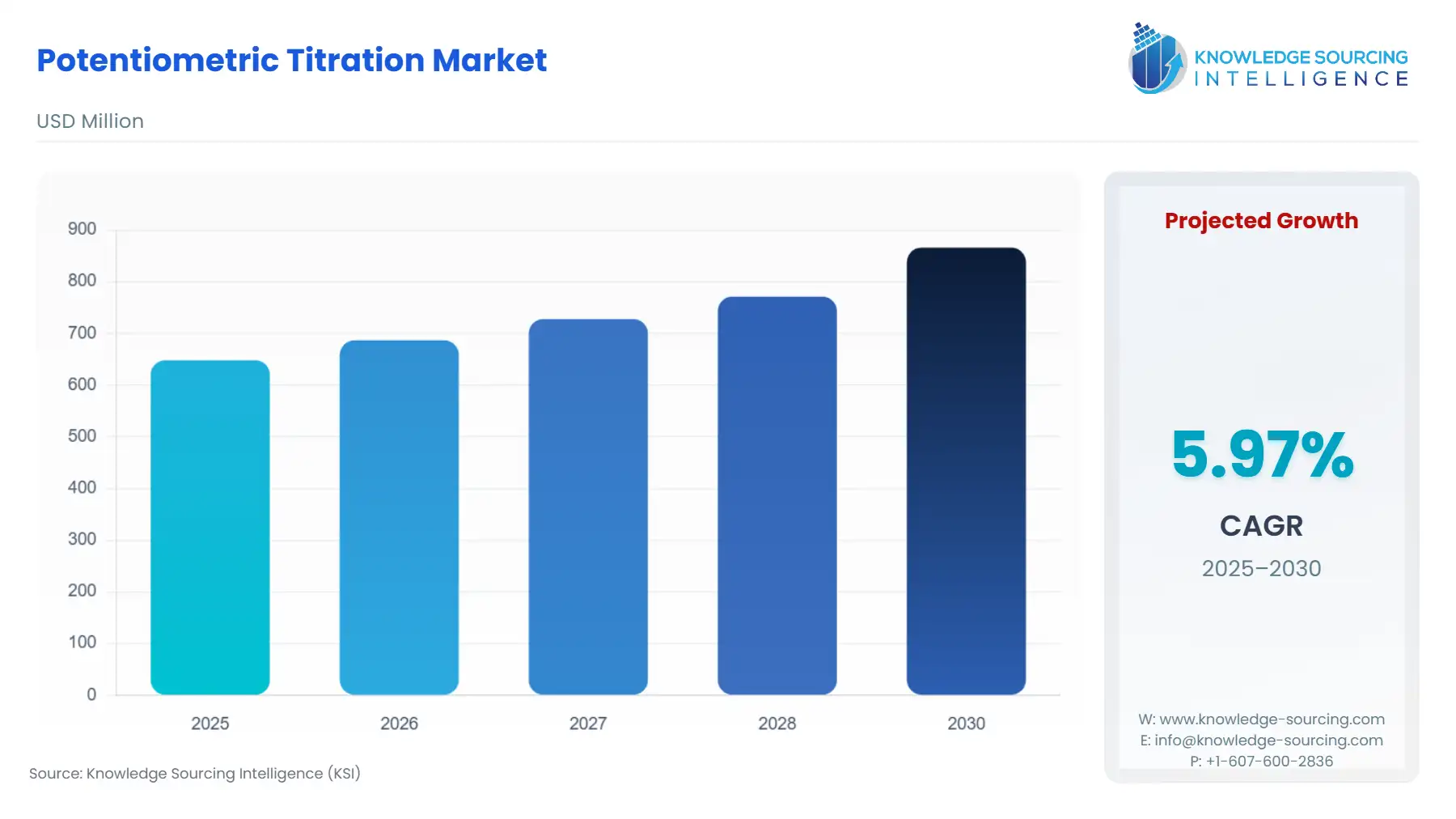

The Potentiometric Titration Market will reach US$866.180 million in 2030 from US$648.177 million in 2025 at a CAGR of 5.97% during the forecast period.

Potentiometric Titration Market Introduction

Potentiometric titration, a cornerstone of analytical chemistry, is a widely adopted technique for determining the concentration of a substance in a solution by measuring the potential difference between two electrodes during a titration process. This method is valued for its precision, versatility, and ability to analyze a broad range of chemical compounds, making it indispensable across industries such as pharmaceuticals, food and beverage, environmental monitoring, and chemical manufacturing. The potentiometric titration market encompasses the production, distribution, and application of titration equipment, electrodes, sensors, and associated software, which are critical for laboratories and industrial settings aiming to achieve accurate chemical analyses. As global industries increasingly prioritize quality control, regulatory compliance, and environmental sustainability, the demand for advanced potentiometric titration systems continues to grow, driven by technological advancements and evolving industry needs.

Potentiometric titration operates on the principle of measuring the voltage change in a solution as a titrant is added, typically using a reference electrode and an indicator electrode. This method is particularly effective for detecting the endpoint of a titration, where the reaction between the analyte and titrant is complete. Unlike traditional titration methods that rely on visual indicators, potentiometric titration offers greater accuracy by eliminating human error and enabling automation. Common applications include acid-base titrations, redox titrations, and complexometric titrations, which are essential for quality assurance in drug formulation, food safety testing, and wastewater analysis. The market for potentiometric titration equipment includes manual, semi-automated, and fully automated systems, with the latter gaining traction due to their efficiency and integration with digital platforms.

The potentiometric titration market is poised for steady growth, driven by its critical role in ensuring product quality and regulatory compliance across industries. The integration of artificial intelligence and machine learning into titration systems is an emerging trend, enabling predictive maintenance and real-time data analysis. A 2025 article in Lab Manager discussed how AI-driven titration systems can optimize endpoint detection, reducing errors and improving efficiency. Additionally, the growing emphasis on point-of-use testing in industries like pharmaceuticals and environmental monitoring is creating opportunities for portable and compact titration devices.

Emerging markets, particularly in Asia-Pacific and South America, present significant growth potential due to expanding industrial sectors and increasing investments in laboratory infrastructure. For instance, a 2024 initiative by the Indian government to bolster pharmaceutical manufacturing has spurred demand for advanced analytical equipment. Similarly, the rise of contract research organizations (CROs) in these regions is driving the need for reliable titration systems to support drug development and testing.

Potentiometric Titration Market Trends

The potentiometric titration market is evolving rapidly, driven by technological advancements and increasing demand for precision in chemical analysis across industries like pharmaceuticals, food and beverage, and environmental monitoring. A key trend is the rise of automated potentiometric titration systems, which enhance efficiency by automating titrant delivery, endpoint detection, and data logging. These systems, such as Metrohm’s Titrando series, integrate seamlessly with LIMS integration titration platforms, enabling real-time data management and compliance with regulatory standards.

Another significant trend is the growing adoption of Karl Fischer titration for precise moisture analysis, particularly in pharmaceuticals and petrochemicals. Innovations in ion-selective electrode (ISE) titrators are expanding applications, allowing selective ion analysis in complex matrices, as seen in recent advancements by Thermo Fisher Scientific. The demand for high-precision titration is also rising, driven by stringent quality control requirements, such as those mandated by the FDA. Additionally, AI-driven analytics and IoT connectivity are enhancing titration systems, enabling predictive maintenance and remote monitoring. These trends underscore the market’s shift toward automation, precision, and digital integration, positioning potentiometric titration as a cornerstone of modern analytical chemistry.

Potentiometric Titration Market Dynamics

Market Drivers

Technological Advancements in Analytical Equipment: Innovations in electrode design and automation have significantly enhanced the performance of potentiometric titration systems. The development of solid-state ion-selective electrodes (ISEs) has improved sensitivity and durability, enabling precise detection of specific ions in complex matrices, such as those found in pharmaceutical formulations or environmental samples. A 2024 study in Analytical Chemistry demonstrated that new solid-state ISEs reduce response times by up to 30% compared to traditional electrodes, lowering maintenance costs and increasing throughput in laboratories. Additionally, the integration of AI into titration systems allows for real-time data analysis and predictive maintenance, further enhancing efficiency. A 2025 article in Lab Manager highlighted how AI-driven titration systems optimize endpoint detection, reducing errors by up to 15% in high-throughput settings.

Stringent Regulatory Requirements: Regulatory bodies worldwide are imposing stricter guidelines on quality control, particularly in pharmaceuticals and environmental monitoring, driving demand for precise analytical techniques like potentiometric titration. In the pharmaceutical industry, the U.S. Food and Drug Administration (FDA) updated its Good Manufacturing Practices (GMP) guidelines in 2023, emphasizing validated analytical methods for drug production. Potentiometric titration is critical for ensuring the purity and concentration of active pharmaceutical ingredients (APIs). Similarly, environmental regulations, such as those enforced by the Environmental Protection Agency (EPA), require accurate monitoring of water quality parameters like pH and ion concentrations, which potentiometric titration effectively measures. These regulations compel industries to invest in advanced titration systems to maintain compliance.

Rising Demand for Quality Control in Food and Beverage: The food and beverage industry increasingly relies on potentiometric titration to meet stringent safety and quality standards. This technique is used to measure critical parameters such as acidity, salt content, and preservative levels in products like dairy, beverages, and processed foods. A 2025 report from the International Food Information Council noted a 20% increase in demand for analytical testing due to heightened consumer awareness of food safety and regulatory requirements set by bodies like the Codex Alimentarius. For example, titration is essential for determining the acidity of fruit juices to ensure compliance with international standards, driving the adoption of automated titration systems in large-scale food production facilities.

Sustainability and Green Chemistry Initiatives: The global push for sustainability has spurred innovations in titration systems that minimize reagent use and waste generation. Microscale titration techniques, which use smaller sample volumes and less titrant, align with green chemistry principles by reducing chemical consumption. A 2024 article in Green Chemistry Letters and Reviews reported that microscale titration systems can reduce reagent use by up to 50% while maintaining analytical accuracy, making them attractive for environmentally conscious industries. Additionally, the development of eco-friendly electrodes, such as those made from recyclable materials, further supports market growth by addressing sustainability concerns.

Market Restraints:

High Initial Costs: The acquisition of advanced potentiometric titration systems, particularly fully automated ones, requires significant capital investment, which can be a barrier for small and medium-sized enterprises (SMEs). High-end systems, equipped with advanced features like AI integration and multi-parameter analysis, can cost upwards of $50,000, as noted in a 2024 industry analysis in Chemical Engineering News. This high cost limits market penetration in regions with budget-constrained laboratories, such as parts of Southeast Asia and South America, where smaller labs may opt for less expensive manual systems or alternative analytical methods.

Need for Skilled Operators: Operating sophisticated titration equipment, especially automated systems with complex software interfaces, requires specialized training. A 2025 survey by the American Chemical Society (ACS) identified a shortage of skilled analytical chemists in emerging markets, with 60% of surveyed laboratories in Asia-Pacific reporting difficulties in recruiting qualified personnel. This skills gap can slow the adoption of advanced titration systems, as laboratories may struggle to fully utilize their capabilities without trained staff, particularly in regions with developing industrial sectors.

Competition from Alternative Technologies: Emerging analytical techniques, such as near-infrared (NIR) spectroscopy and high-performance liquid chromatography (HPLC), are gaining traction as alternatives to potentiometric titration in specific applications. These methods can offer faster results or require less sample preparation, making them appealing for certain industries. A 2024 review in the Journal of Analytical Methods in Chemistry highlighted that NIR spectroscopy can analyze certain food and pharmaceutical samples in seconds, compared to the minutes required for titration, posing a competitive threat. While titration remains superior for specific analyses, the growing availability of these alternatives could limit market growth in niche segments.

Economic and Regulatory Uncertainties: Global economic fluctuations and evolving regulatory landscapes can impact the potentiometric titration market. For instance, economic downturns may reduce laboratory budgets, delaying equipment upgrades or purchases. Additionally, frequent changes in regulatory standards can create uncertainty for manufacturers, as they must adapt systems to meet new requirements. A 2024 analysis in Analytical Chemistry noted that regulatory shifts in environmental testing protocols across Europe have led to temporary market slowdowns as companies recalibrate their equipment. These uncertainties can deter investment in new titration systems, particularly in cost-sensitive markets.

Potentiometric Titration Market Segmentation Analysis

By Product Type, Automatic Titrators are gaining greater market share

Automatic titrators lead the potentiometric titration market due to their high efficiency, precision, and suitability for high-throughput environments. These systems automate the entire titration process, from titrant delivery to endpoint detection, reducing operator error and enhancing reproducibility. Equipped with advanced features like digital interfaces, AI-driven endpoint detection, and compatibility with various electrode types, automatic titrators are preferred in industries requiring rapid and consistent results. A 2025 article in Lab Manager highlighted that AI-integrated automatic titrators can reduce analysis time by up to 20% and improve accuracy by 15% in pharmaceutical and environmental applications. The push for laboratory automation, particularly in pharmaceuticals and food safety testing, has accelerated its adoption. For example, innovations like Metrohm’s OMNIS platform enable faster, safer titrations with modular designs, enhancing laboratory productivity. The global market for automatic titrators is significant, driven by their integration with laboratory information management systems (LIMS) for streamlined data handling, as noted in a 2024 analytical chemistry review.By End-User Industry, the healthcare sector is experiencing rapid growth

The healthcare sector, particularly pharmaceuticals, is the primary end-user of potentiometric titration systems, driven by the need for precise quality control in drug development and manufacturing. Potentiometric titration is essential for determining the purity and concentration of active pharmaceutical ingredients (APIs), excipients, and final formulations, ensuring compliance with stringent regulations from bodies like the U.S. FDA and the EMA. The FDA’s 2023 updated GMP guidelines underscore the importance of validated analytical methods, increasing reliance on titration systems. The rise of biologics and personalized medicine has further boosted demand, as these require precise analysis of complex molecules. A 2024 study in Analytical Chemistry noted that new electrode designs have improved sensitivity for low-concentration APIs, making potentiometric titration indispensable for biologics. Additionally, the growth of contract research organizations (CROs) in markets like India, supported by government initiatives to expand pharmaceutical manufacturing, has increased demand for advanced titration systems. The healthcare sector’s reliance on automated systems further solidifies its position as the leading end-user.

Potentiometric Titration Market Geographical Outlook:

The North American market is growing significantly

North America, particularly the United States, is the dominant region in the potentiometric titration market, driven by its advanced industrial infrastructure, significant R&D investments, and rigorous regulatory framework. The U.S. leads due to its robust pharmaceutical and chemical industries, which rely on titration for quality control and compliance with regulations, such as those set by the EPA for environmental monitoring. In 2024, the U.S. market benefited from widespread adoption of automated titration systems in pharmaceuticals and food safety testing, as noted in a 2025 industry analysis. The EPA’s emphasis on water quality monitoring has also spurred demand for titration systems, particularly portable models for on-site testing, as highlighted in a 2024 study on green chemistry advancements. The presence of major manufacturers like Thermo Fisher Scientific and academic-industrial collaborations, such as those supported by the National Institutes of Health (NIH), further strengthens the U.S. market. North America’s leadership is underpinned by its focus on technological innovation and regulatory compliance.

List of key companies profiled:

Thermo Fisher Scientific Inc.

Xylem Analytics

Hanna Instruments, Inc.

Kyoto Electronics Manufacturing Co., Ltd

Potentiometric Titration Market Key Developments:

AT-710 Automatic Titrator by CSC Scientific: In 2025, CSC Scientific launched the AT-710 Automatic Titrator, designed for precise measurements of chlorides, acidity, mercaptan, H2S, and bromine in various industries, including chemicals and petrochemicals. This system features enhanced automation and user-friendly interfaces, making it suitable for laboratories requiring reliable and repeatable results.

Advancements in Solid-State Ion-Selective Electrodes: A significant development in potentiometric titration was the introduction of advanced solid-state ion-selective electrodes (ISEs) in 2024, which improved sensitivity and durability for precise ion detection in complex matrices.

Potentiometric Titration Market Segmentation:

The Potentiometric Titration Market is analyzed by product type, including:

By Product Type

Automatic Titrators

Manual Titrators

Portable Titrators

The market is evaluated by end-user industry, including:

By End-User Industry

Chemicals

Healthcare

Personal Care

Aquaculture

Textiles

Others

The study also analysed the Potentiometric Titration Market into the following regions, with country level forecasts and analysis as below:

By regions:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and the Rest of South America)

Europe (Germany, UK, France, Spain, and the Rest of Europe)

Middle East and Africa (Saudi Arabia, UAE, and the Rest of the Middle East and Africa)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)