Report Overview

Global Practice Management System Highlights

Practice Management System Market Size:

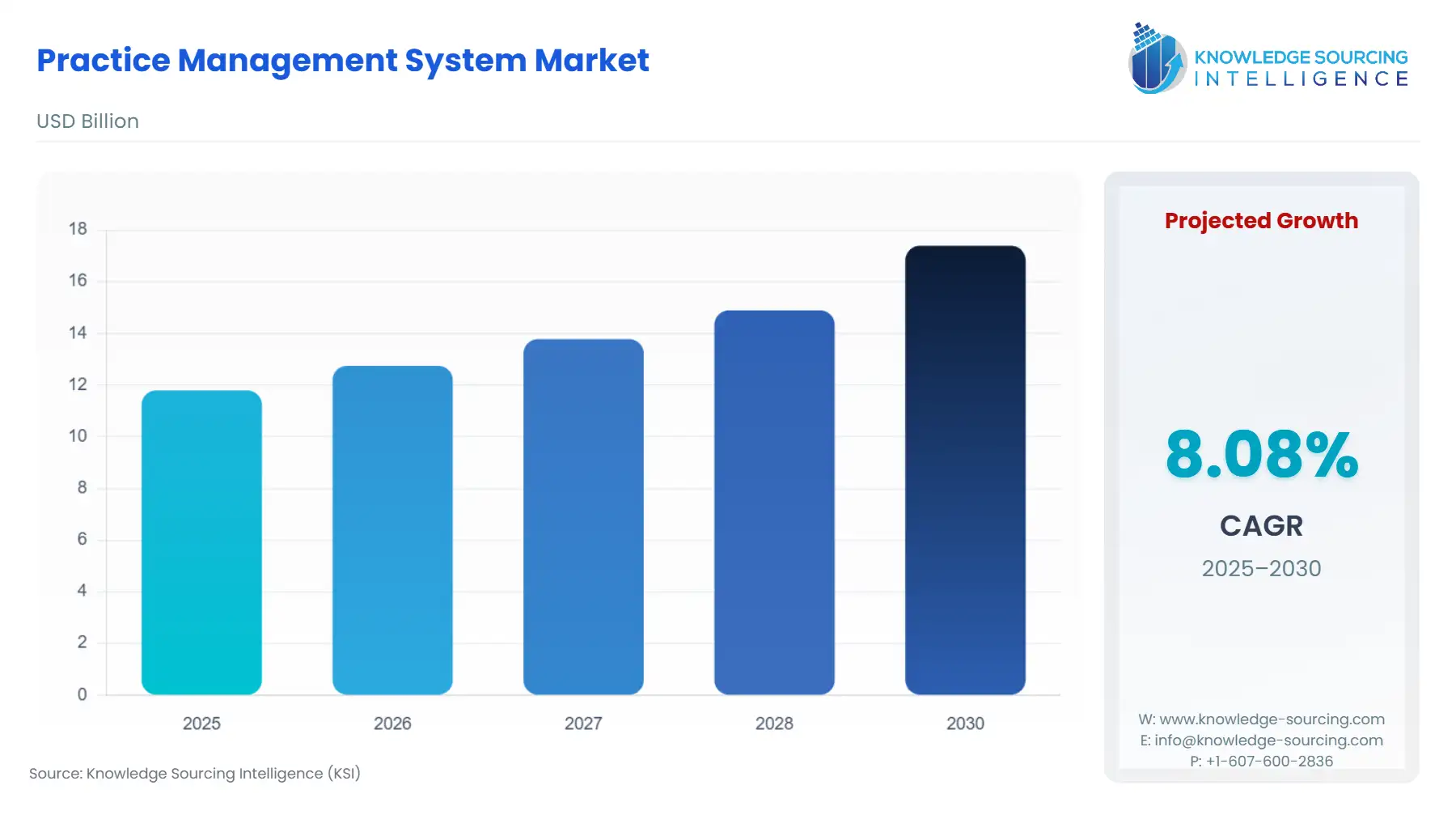

The Global Practice Management System Market is expected to grow from USD 11.798 billion in 2025 to USD 17.399 billion in 2030, at a CAGR of 8.08%.

The Practice Management System (PMS) market provides the essential digital infrastructure for the administrative and financial operations of medical practices. This includes critical functions such as patient scheduling, billing and claims management, and reporting.

The market's evolution is directly influenced by the broader healthcare industry's move toward digitalization, aiming to enhance efficiency, reduce costs, and improve patient outcomes. The global demand for these systems is propelled by the necessity for healthcare providers to navigate an increasingly complex regulatory environment and adapt to new models of care delivery, such as value-based care and telehealth. The report provides a detailed, fact-based perspective for industry professionals seeking to understand the intricate mechanics of market growth and evolution, with a strict focus on verifiable data from official, non-commercial sources.

Practice Management System Market Analysis:

- Growth Drivers

The primary driver influencing demand for Practice Management Systems is the global shift toward digitalization mandated by governmental and institutional bodies. In the United States, the Health Information Technology for Economic and Clinical Health (HITECH) Act created powerful incentives for healthcare providers to adopt certified EHRs and PMS. These regulations directly impacted demand by linking financial penalties to the failure to adopt and use compliant systems, compelling a broad swath of the market to transition from paper-based to digital records.

Beyond regulatory mandates, the business imperative to improve operational efficiency is a key driver. The high administrative burden and a lack of interoperability between disparate systems lead to physician burnout and increased operational costs. PMS solutions directly address these challenges by automating workflows, from patient registration to claims submission, which in turn reduces administrative overhead. The growing need for real-time analytics on patient demographics, billing cycles, and practice performance is also influencing demand, as it empowers providers to make data-driven business decisions and improve financial outcomes.

- Challenges and Opportunities

Despite strong growth drivers, the market faces significant restraints. A major challenge influencing adoption, particularly among smaller practices, is the high initial cost of implementation. This includes not only the software subscription or licensing fees but also the costs associated with hardware, staff training, and ongoing technical support. For many practices with limited capital, this financial barrier can be a deterrent to upgrading from legacy systems or paper-based methods.

The market is also rife with opportunities, particularly in the integration of new technologies. The emergence of AI and machine learning presents a significant opportunity to enhance the functionality of Practice Management Systems. AI can be used to automate a wide range of tasks, such as coding for claims, identifying billing errors, and predicting patient no-shows, which directly influences efficiency and revenue. The rapid growth of telemedicine also presents a major opportunity for vendors. The global demand for remote patient consultations and virtual care has grown exponentially, and this trend has created a need for PMS that can seamlessly integrate with telehealth platforms.

- Supply Chain Analysis

The value chain for Practice Management Systems starts with software development, which involves significant investment in R&D to create compliant, user-friendly, and secure platforms. The next stage is distribution, which can be done directly by the vendor or through a network of resellers and partners. Implementation and training are crucial steps, influencing the successful adoption of the system within a practice. The final and ongoing stage is maintenance and support, which involves regular software updates, security patches, and customer service. The value chain is fundamentally influenced by the need for continuous innovation and robust support, as a system’s long-term value is tied to its ability to adapt to changing regulatory and technological landscapes.

- Government Regulations

Government regulations are a major factor influencing the demand for and design of Practice Management Systems. The following table highlights key regulatory influences across major geographies.

|

Regulation/Policy |

Description |

Market Implication |

|

U.S. Health Insurance Portability and Accountability Act (HIPAA) |

HIPAA sets national standards for the security of Protected Health Information (PHI) and governs how patient data is handled, stored, and transmitted. |

This act directly influences demand by requiring all healthcare providers to use secure, compliant software. It compels vendors to embed robust security features, data encryption, and access controls into their systems, ensuring that non-compliant solutions are not viable in the US market. |

|

U.S. HITECH Act |

The Health Information Technology for Economic and Clinical Health Act provided federal funding and incentives to encourage the widespread adoption of EHRs and other health IT. |

This act created a powerful financial incentive for healthcare providers to transition from paper-based systems to digital ones. By linking Medicare and Medicaid payments to the "Meaningful Use" of certified technology, the HITECH Act directly fueled a surge in demand for compliant Practice Management Systems. |

|

UK NHS Digital Strategy |

The UK's National Health Service (NHS) has a long-term strategy to digitize all health and social care services, moving away from paper-based records toward a fully interoperable digital system. |

This policy is influencing demand by creating a clear mandate for healthcare providers to adopt digital solutions. The strategy’s focus on interoperability is particularly important, as it compels vendors to design systems that can seamlessly exchange patient data with other NHS platforms and services. |

|

EU General Data Protection Regulation (GDPR) |

GDPR establishes a robust data protection framework across the European Union, with strict rules for the collection, processing, and use of personal data, including sensitive health information. |

This regulation directly influences the design and security of Practice Management Systems sold in Europe. It requires vendors to incorporate features like "privacy by design," data portability, and robust data breach notification protocols, which are now essential for a system to be considered compliant and competitive. |

|

India National Digital Health Mission |

Launched by the Government of India, this mission aims to create a national health ID for every citizen and establish a comprehensive digital health ecosystem. |

This mission is influencing a fundamental change in demand by driving the development of interoperable, centralized health records. It is creating a need for Practice Management Systems that can link to the national digital health ecosystem, manage patient consent, and securely exchange data, thereby fueling demand for compliant solutions. |

Practice Management System Market Segment Analysis:

- By Delivery Mode

The market is segmented by delivery mode into On-premise, Web-based, and Cloud-based solutions. The demand for each delivery mode is heavily influenced by factors such as cost, security concerns, and the need for remote access. The demand for cloud-based solutions is being heavily influenced by its compelling advantages, including significantly lower upfront costs, automatic software updates, and scalability. The ability to access the system from any location with an internet connection is a key driver, enabling both remote work for administrative staff and the expansion of telemedicine services. Conversely, demand for on-premise solutions is influenced by a preference for absolute control over data and a high degree of customization, often favored by large hospital systems with dedicated IT departments.

- By End-User

The Practice Management System market serves a diverse range of end-users, each with unique operational needs and demands. This segmentation highlights how different healthcare providers utilize and require these systems. Physician practices, particularly those that are small and independent, represent a significant portion of the demand for PMS. Their demand is influenced by the need for solutions that can streamline patient scheduling, manage complex billing processes, and simplify the administrative burden that has become a major concern. The demand from pharmacists for PMS is a growing segment. The need for these systems is influenced by the increasing complexity of pharmacy operations, which now include not just dispensing medication but also managing patient records, tracking inventory, and submitting claims. Hospitals are a major end-user segment and a primary source of demand for large-scale, integrated systems. Their needs are complex, requiring systems that can manage a high volume of patients, integrate with multiple departments, and handle complex billing for a wide range of services.

Practice Management System Market Geographical Analysis:

- US Market Analysis

The U.S. market is the largest and most mature, with demand influenced by a robust and competitive landscape. The market is propelled by a continuous push toward interoperability and data-driven care. The need for systems that can handle complex billing, comply with rigorous data privacy laws, and integrate with a wide range of providers is a key factor influencing demand. The U.S. healthcare system's complexity and the significant role of private insurance drive a sustained demand for sophisticated revenue cycle management capabilities.

- UK Market Analysis

Demand in the UK is heavily influenced by the NHS's digital transformation strategy. The focus is on moving away from paper-based systems toward fully integrated, interoperable digital platforms. The demand is also influenced by the need to support telehealth and remote care models, which are central to the NHS’s long-term vision for modernizing healthcare delivery. This creates a market for systems that can conform to national standards and connect with the broader NHS IT infrastructure.

- China Market Analysis

Demand in China is influenced by a comprehensive digital health governance strategy. The government is promoting the use of big data and internet-based healthcare to optimize resource allocation and improve service delivery. This creates a strong need for Practice Management Systems that can integrate with national health information platforms, thereby influencing a fundamental shift from traditional paper records to digital systems. The sheer volume of the population and the rapid expansion of private healthcare facilities are also significant drivers of demand.

- India Market Analysis

The Indian market is experiencing a significant shift, with demand influenced by the National Digital Health Mission. This mission is creating a digital health ecosystem that requires solutions to manage patient data, issue health IDs, and facilitate telemedicine. This initiative is a major factor fueling demand for compliant, scalable systems, particularly as the country seeks to extend modern healthcare services to a broader population base.

- Brazil Market Analysis

The Brazilian market for Practice Management Systems is growing, with demand influenced by the modernization of its healthcare sector. The demand is focused on cost-effective and scalable solutions that can be adopted by a mix of public and private healthcare providers. The market is developing, with a growing need for systems to manage patient records and administrative tasks more efficiently to handle a large and geographically dispersed population.

Practice Management System Market Competitive Environment and Analysis:

The competitive landscape is defined by a mix of large corporations offering integrated platforms and specialized firms focusing on niche markets. The major players, like Henry Schein and Athenahealth, strategically position themselves as comprehensive solution providers, offering an entire ecosystem of products to secure customer loyalty. Their strategy revolves around vertical integration, acquisitions, and developing innovative features to retain their market-leading positions. For instance, they continually invest in cloud-based solutions to cater to the growing demand for flexibility and accessibility.

Competitive Dashboard

|

Company |

Core Offering |

Strategic Focus |

|

Henry Schein Medical Systems, Inc. |

A wide range of integrated practice management and EHR systems. |

Strategic acquisitions and development of cloud-based platforms to cater to both medical and dental markets, emphasizing a comprehensive product suite. |

|

Athenahealth, Inc. |

Cloud-based practice management, EHR, and revenue cycle management solutions. |

Focused on providing an all-in-one cloud platform and building an extensive partner network to offer a wide range of integrated services to independent practices. |

|

Epic Systems Corporation |

Integrated clinical and administrative software for large hospital systems. |

Specializes in developing highly complex, integrated platforms for large hospital and health systems, with a focus on interoperability and data exchange within its own ecosystem. |

Practice Management System Market Company Profiles:

Athenahealth, Inc.

Athenahealth is a leading provider of cloud-based Practice Management Systems and EHRs for physician practices. Its core strategy is based on offering an all-in-one, subscription-based service that handles administrative, clinical, and billing workflows. The company is particularly focused on independent and small to medium-sized practices, which value its user-friendly interface and comprehensive support.

GE Healthcare

GE Healthcare provides a range of healthcare IT solutions, with a focus on enterprise-level hospital systems and diagnostic imaging. While its portfolio includes practice management and billing solutions, its primary strength lies in providing integrated clinical and administrative platforms for large-scale operations.

McKesson Corporation

McKesson Corporation is a major healthcare technology and logistics company. It offers a portfolio of healthcare IT solutions, including Practice Management Systems, with a focus on serving the needs of hospitals and large clinics. Its strategy is to provide a wide range of solutions to its customers, from medical supplies to software.

eClinicalWorks LLC

eClinicalWorks is a provider of integrated cloud-based EHR and Practice Management Systems. The company’s strategy is to offer a single, comprehensive platform that caters to a wide range of specialties, with a strong focus on interoperability and patient engagement tools.

CareCloud Corporation

CareCloud provides cloud-based Practice Management Systems and revenue cycle management services. Its strategy is to offer a modular, scalable platform that allows practices to choose the specific features they need. The company focuses on a modern, user-friendly interface and a subscription-based model.

Oracle Corporation

Oracle's entry into the healthcare IT market, particularly with the acquisition of Cerner, has positioned it as a major player. Its strategy is to leverage its expertise in enterprise software to provide a comprehensive suite of healthcare solutions, including Practice Management and EHR systems, for large-scale hospital and health systems.

Epic Systems Corporation

Epic Systems is a dominant player in the healthcare IT market, specializing in integrated software for large hospital systems and academic medical centers. Its strategy is to provide a single, comprehensive system for an entire hospital network, which is a key factor influencing its demand from major health systems.

Practice Management System Market Recent Developments:

- August 2025: Oracle Corporation announced a collaboration with a leading research hospital to use cloud-based solutions for managing clinical trial data. This development is part of Oracle’s strategic push into the healthcare sector, leveraging its enterprise technology to influence demand for secure, scalable data management platforms in the clinical research domain.

- July 2025: Athenahealth announced a new partnership with a national telehealth provider, HarmonyCares. The collaboration is designed to provide seamless integration between Athenahealth’s practice management software and the telehealth platform, allowing physician practices to streamline scheduling and billing for virtual visits, a key factor influencing demand in the evolving market.

Practice Management System Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 11.798 billion |

| Total Market Size in 2031 | USD 17.399 billion |

| Growth Rate | 8.08% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Delivery Mode, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Practice Management System Market Segmentation:

- By Product Type

- Integrated Practice Management System

- Standalone Practice Management System

- By Delivery Mode

- On-premise

- Web-based

- Cloud-Based

- By End-User

- Physicians

- Pharmacists

- Diagnostic Labs

- Hospital

- Others

- By Geography

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific