Report Overview

Global Rectifiers Market - Highlights

Rectifiers Market Size:

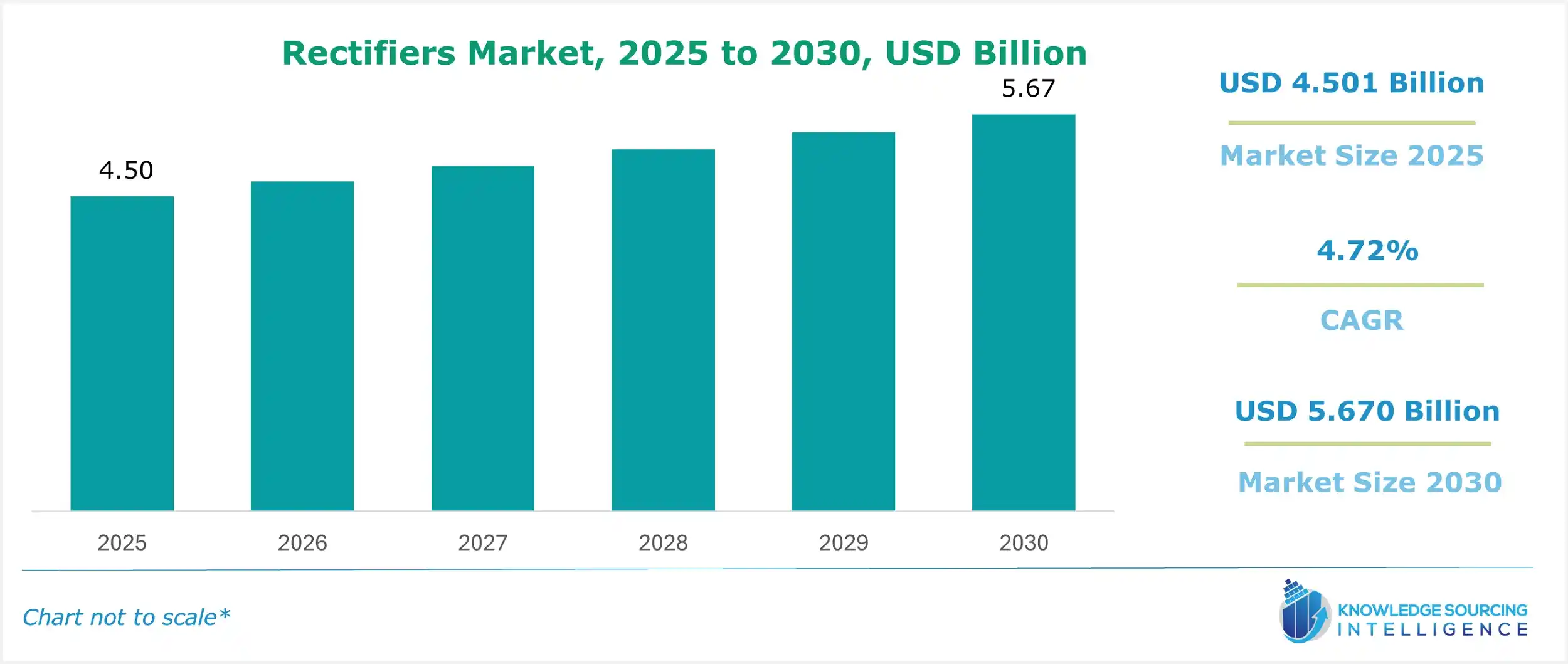

The Rectifiers Market is expected to grow from US$4.501 billion in 2025 to US$5.670 billion in 2030, at a CAGR of 4.72%.

Global Rectifiers Market Introduction:

A rectifier is a two-lead semiconductor that enables the current to flow in one direction only. These rectifiers are mainly used in electrical components for rectifying a voltage, isolating signals from the supply, controlling the size of the signal, and for voltage reference. Due to these properties, rectifiers are mainly used as guards in the circuits of the electronic components for avoiding the dangers of accidental reversal of supply voltage. Apart from this, rectifiers are used in the electronic components across all industry verticals. Industry automation, increasing demand for consumer electronics and smartphones, growing adoption of EVs, and electrification demand are driving the demand for rectifiers in onboard chargers and battery management systems. Renewable energy integration, expansion of 5G and data centers, industrial automation, growth of smart grids, and the surging consumer electronics market are key factors significantly driving market expansion.

The rectifier market is a critical segment of power conversion solutions, enabling efficient AC-to-DC conversion across industries. As electrification trends accelerate, rectifiers play a pivotal role in renewable energy integration, supporting solar, wind, and energy storage systems with reliable power management. The semiconductor market growth drives innovation in rectifier design, enhancing efficiency and thermal performance for applications in automotive, industrial, and telecommunications sectors. With rising demand for energy-efficient systems and clean energy infrastructure, rectifiers are essential for optimizing power delivery and stability, positioning the market as a cornerstone of modern electrification and sustainable energy advancements. The Asia Pacific region will have a significant market share due to an increase in demand and production for smartphones and consumer electronics on account of a rise in disposable income.

Global Rectifiers Market Overview:

The rectifiers are witnessing growing demand due to the rising need for power conversion systems of renewable energy sources such as solar and wind. Rectifiers are utilized in the conversion of AC to DC, which is used for grid integration and supporting renewable energy generation, promoting the overall market expansion. According to data from the International Energy Agency (IEA), the renewable electricity generation share is expected to grow from 34.5 percent in 2025 to 45.6 percent by 2030.

Additionally, rectifiers are increasingly utilized in the production of green hydrogen derivatives by powering hydrogen production and ensuring a stable and efficient power supply. Companies are aligning with the global push towards carbon-neutral fuels with new product launches, which will promote the expansion in the rectifier market during the forecasted period. For instance, in March 2024, Green Power launched a rectifier for a 3000Nm3/h hydrogen project, which is capable of producing up to 15MW, utilizing reliable 24-pulse thyristor rectification technology.

Moreover, in September 2023, ABB announced that PERIC, a Chinese hydrogen firm, selected it for the supply of rectifier systems to its Texas pilot plant. The UNIREC H2 water-cooled power rectifier offers an efficient solution for hydrogen production while ensuring low maintenance costs and a smart control feature. This technology supports the global hydrogen industry. ABB’s automation rectifier solution is utilized by PERIC to support the green hydrogen power facility for clean and renewable energy.

The rectifiers market is advancing with high-efficiency rectifiers driving energy savings in renewable energy and industrial applications. High power density and miniaturization enable compact designs for space-constrained systems like EVs and IoT devices. Smart rectifiers, integrated with digital power control, offer real-time monitoring and optimization. Power factor correction (PFC) enhances energy efficiency, aligning with regulatory standards. Low forward voltage drop improves performance, reducing heat generation. High-frequency switching supports faster, more efficient power conversion, catering to telecommunications and data centers. These trends reflect the market’s focus on compact, intelligent, and energy-efficient solutions for modern electrification demands.

Global Rectifiers Market Drivers:

- Growth in Electric Vehicles (EVs) and Automotive Applications

The increase in adoption of EVs and growing automotive applications will fuel the global rectifiers market. The growth in EV demand necessitates high-performance rectifiers for reliable and efficient charging infrastructures.

Further, in both EVs and internal combustion engine vehicles, rectifiers provide stable DC power to components such as infotainment systems, sensors, and ADAS. In traditional vehicles, rectifiers also convert the AC voltage produced by an alternator into DC voltage to charge the battery and supply the electrical systems.

According to the IEA data, the production of electric cars reached a total of 17.3 million cars globally in 2024, an increase of approximately one-quarter, i.e., 13.8 million electric cars from 2023. Additionally, the highest electric car-producing region was China at 12.4 million electric cars in 2024, with 70 percent of the global production, followed by Europe and the United States with 2.4 million and 1.1 million electric cars, respectively, produced in 2024.

Similarly, according to the data from the International Organization of Motor Vehicle Manufacturers (OICA), the total automotive production was 92.504 million units in 2024, with Asia-Oceania production at 54.907 million, followed by America at 19.187 million and Europe at 17.231 million.

Additionally, the automotive companies are integrating rectifiers for handling diverse voltage and current, contributing to market growth. For instance, in December 2024, Delta Electronics India announced signing an MOU with ThunderPlus, which is a leading EV charging solutions provider, to provide domestically produced advanced high-efficiency 4kW rectifiers for ThunderPlus' fast chargers for 2W and 3W EVs in the low voltage sector, produced at its Krishnagiri manufacturing site.

The global rectifiers market is highly fragmented with various small and regional players constituting 75% to 80% share, while some major key players such as Infineon technologies AB, Onsemi, STMicroelectronics, Vishay Intertechnology, Inc., Nexperia B.V., Diodes Incorporated, ABB, and some others are top global companies, making up a considerable market share.

The global rectifiers market is experiencing dynamic growth, driven by product development, acquisitions, and emerging trends. These trends are aligning with technological advancements as well as the demands of energy efficiency (launch of KTA1170 that offers 92% system efficiency and saves up to 1W in March 2025), and the global push for electrification and sustainability. The market is focusing on using advanced materials, miniaturized products (Diodes Incorporated’s launch of 2A Schottky Rectifiers occupying only 0.84 mm² board space in 2024), high-frequency and ultrafast rectifiers (Nexperia’s Ultrafast 650V Recovery Rectifiers for automotive and industrial applications), and eco-friendly designs.

Global Rectifiers Market Trends:

The rectifiers market is advancing with high-efficiency rectifiers driving energy savings in renewable energy and industrial applications. High power density and miniaturization enable compact designs for space-constrained systems like EVs and IoT devices. Smart rectifiers, integrated with digital power control, offer real-time monitoring and optimization. Power factor correction (PFC) enhances energy efficiency, aligning with regulatory standards. Low forward voltage drop improves performance, reducing heat generation. High-frequency switching supports faster, more efficient power conversion, catering to telecommunications and data centers. These trends reflect the market’s focus on compact, intelligent, and energy-efficient solutions for modern electrification demands.

Global Rectifiers Market Segmentation Analysis:

- The global rectifier market has been segmented based on type, application, industry vertical, and geography.

By type, the market is segmented into half-wave and full-wave. Half-wave rectifiers are simple and less expensive, making them suitable for low-cost and low-power applications like small electronics components. The segment is growing due to demand for cost-effectiveness, particularly in emerging markets with price-sensitive consumers. However, as it faces challenges due to its inefficiency, the demand for full-wave rectifiers is growing significantly. It constitutes a major market share due to its use in power supplies, electric vehicle (EV) charging systems, and industrial automation.

By industry vertical, the global rectifier market is segmented as consumer electronics, communication and technology, automotive, and manufacturing. Consumer electronics is a major segment that is growing robustly, fuelled by the proliferation of smartphones, laptops, TVs, and IoT devices. The communication and technology segment is also witnessing growth as 5G and data centers are expanding, driving demand for high-frequency rectifiers. Automotive is also a key segment, and the growth of EVs and HEVs is a major boost for use in battery charging systems, powertrain electronics, and advanced driver-assistance systems (ADAS).

By application, the market is segmented into renewable energy systems, medical equipment, lighting systems, Uninterruptible Power Supplies (UPS), and railway electrification. Rectifiers are used in renewable energy systems for converting variable AC from wind turbines or solar inverters into stable DC. The segment is experiencing growth due to a global push towards clean energy as well as rising demand for solar PV. Rectifiers are also used in medical equipment, lighting systems, UPS, and railway electrification, all growing considerably.

Geographically, the global rectifiers market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific regions. North America is a key player in the market, driven by its advanced industrial infrastructure and high demand for rectifiers in automotive, particularly EV, consumer electronics, and telecommunications, such as Data centres and 5G. It is a mature market, benefiting from its free trade policies, strong R&D, and presence of key players, though high labour and production costs negatively impact the market.

Europe, the Middle East, and Africa are also key regions. Europe is driven by EV growth, renewable energy growth, and industrial automation, while the Middle East and Africa are growing but face critical challenges in terms of political instability, limited local manufacturing, and reliance on imports.

The Asia-Pacific region is emerging as the fastest-growing market with a dominant share, as China, South Korea, Taiwan, and India are global leaders in consumer electronics, semiconductors, and automotive production, driving demand for single-phase and full-wave rectifiers. Additionally, growth in EVs and automotives, renewable energy, and smart manufacturing is driving market expansion. However, the US-China trade disputes and shortages in semiconductors disrupting the supply chain and overreliance on exports are key issues faced by the region.

Global Rectifiers Market Geographical Outlook:

- The US is anticipated to lead the market expansion

Industrial automation is booming in the United States, providing new growth prospects for modern approaches such as electric motors and robotics to be implemented, which will bolster overall productivity. Moreover, the growing emphasis on adopting capital-intensive techniques is driving machinery usage in the country, propelling the demand for rectifiers employed in such machines to ensure efficient power delivery.

According to the International Federation of Robotics, in 2024, major industries in the USA, such as automotive, witnessed an 11% growth in robotics installation, with 13,747 units being installed. Likewise, food & beverage also experienced a significant 22% growth with the installation of 2,277 units.

Owing to their ability in current management and power transmission, rectifiers have high industrial applicability in major sectors such as electronics, manufacturing, and IT & telecommunications. Ongoing investment in the United States to bolster network infrastructure, followed by emphasis on smart grids, has established a framework that outlines rectifiers.

Moreover, the rising adoption of sustainable fuel in the country has increased the electric vehicle transition, further driving market expansion. According to the International Energy Agency’s “Global EV Outlook 2025”, the total electric vehicle sales in the United States reached 1.5 million units, representing a 7% growth over the preceding year’s sales volume. Moreover, the same source also specified that battery electric vehicle sales experienced 9% growth in the same year.

Furthermore, the growing emphasis on improving renewable energy storage, coupled with new product development and launches are additional driving factor for market expansion. For instance, in March 2025, it launched its new high-voltage silicon rectifiers, expanding the company’s “HPD Series”, which offers rectifiers with power outputs ranging from 1600 to 2200V.

Global Rectifiers Market Key Developments:

- Launch of Ultra-Low Voltage Drop Bridge Rectifiers: Semiconductor companies have introduced bridge rectifiers with ultra-low forward voltage drops, designed for high-efficiency applications in AI servers, telecom, and gaming power supplies, offering improved energy efficiency and high surge current capabilities.

- Introduction of High-Voltage Rectifier Diodes: New high-voltage rectifier diodes, capable of handling up to 800V, have been launched to meet the demands of compact and powerful electronic systems, particularly in consumer electronics and industrial applications.

- Development of Compact Synchronous Rectifier Switches: Advanced synchronous rectifier switches with low resistance have been released for power adapters in devices like laptops and mobile phones, enhancing efficiency and reducing power losses in charging systems.

- Advancements in Silicon Carbide Rectifiers: Manufacturers have rolled out silicon carbide-based rectifiers, offering superior performance in high-power applications like electric vehicle charging and renewable energy systems, driven by their high efficiency and thermal resilience.

List of Top Rectifiers Companies:

- NEXPERIA B.V.

- ABB

- Microchip Technology Inc.

- Delta Electronics, Inc.

- KraftPowercon

Rectifiers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Rectifiers Market Size in 2025 | US$4.501 billion |

| Rectifiers Market Size in 2030 | US$5.670 billion |

| Growth Rate | CAGR of 4.73% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Rectifiers Market |

|

| Customization Scope | Free report customization with purchase |

Rectifiers Market is analyzed into the following segments:

- By Type

- Half-Wave

- Full-Wave

- By Application

- Renewable Energy Systems

- Medical Equipment

- Lighting Systems

- Uninterruptible Power Supplies (UPS)

- Railway Electrification

- By Industry Vertical

- Consumer Electronics

- Communication and Technology

- Automotive

- Manufacturing

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

- Wide Bandgap Semiconductor Market

- Electric Vehicle Power Electronics Market

- Renewable Energy Semiconductor Market

Navigation

- Rectifiers Market Size:

- Global Rectifiers Market Highlights:

- Global Rectifiers Market Introduction:

- Global Rectifiers Market Overview:

- Global Rectifiers Market Drivers:

- Global Rectifiers Market Trends:

- Global Rectifiers Market Segmentation Analysis:

- Global Rectifiers Market Geographical Outlook:

- Global Rectifiers Market Key Developments:

- List of Top Rectifiers Companies:

- Rectifiers Market Scope:

Page last updated on: September 25, 2025