Report Overview

Global Thermal Energy Storage Highlights

Thermal Energy Storage Market Size:

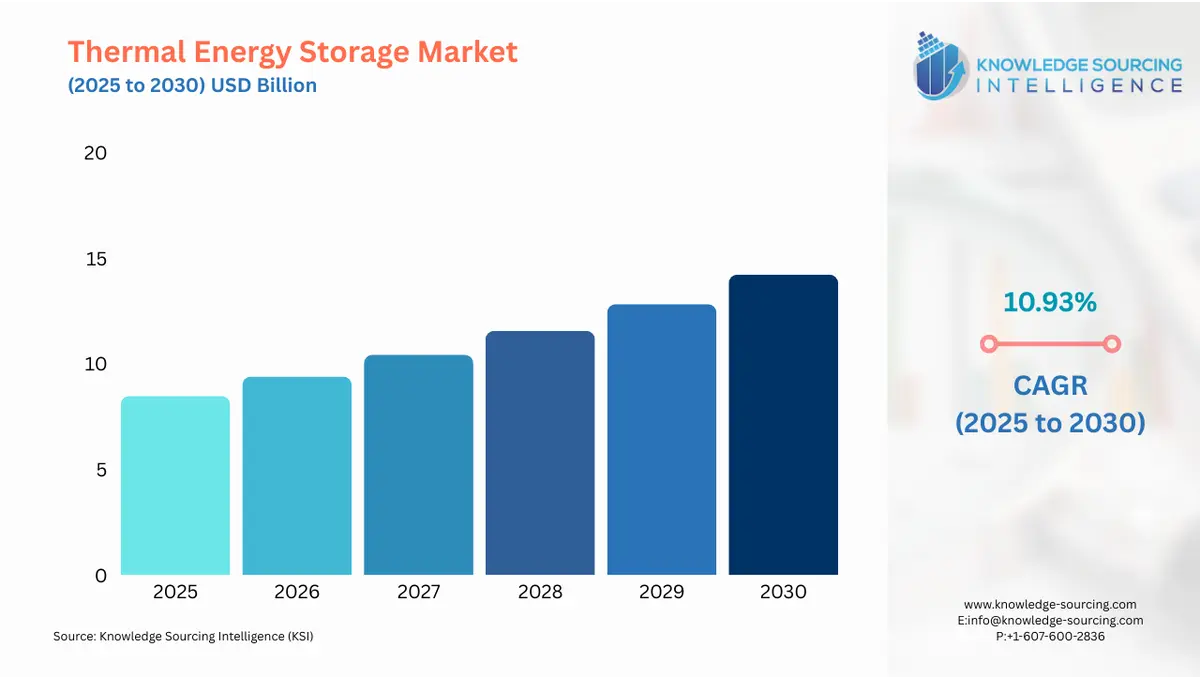

The global thermal energy storage market is expected to grow at a CAGR of 10.93%, reaching a market size of US$14.219 billion in 2030 from US$8.466 billion in 2025.

Thermal Energy Storage Market Trends:

The intermittent nature of renewable energy sources is reduced by thermal energy storage (TES) systems, which store excess energy during times of low demand and release it when required. Nonstop research on materials and storage techniques is enhancing the effectiveness and scale of thermal energy storage systems. Thermal energy storage systems help increase energy efficiency by reducing peak demand and energy costs and improving heating, ventilation, and air conditioning (HVAC) system performance.

Therefore, they started gaining popularity in commercial and industrial sectors for better energy utilization. There is also an increasing trend towards the application of TES systems due to efforts by the government to implement policies and financial incentives aimed at promoting energy efficiency as well as clean energy. Measures to encourage investment in renewable energy sources and reduce greenhouse gases are significantly upheld.

Thermal Energy Storage Market Growth Drivers:

- Increased demand for renewable energy is contributing to the global thermal energy storage market's growth

As the demand for thermal energy rises, TES solutions will inevitably be increasingly needed. Manufacturing, residential climate control, agriculture, transport, and even more so, renewable energy conversion – all of these activities are correlated with rising temperatures in industrialized processes and heat transfer, as global urbanization trends weigh in along with a cleaner energy transition. In addition, it is increasingly emphasized that thermal energy is utilized more efficiently since energy efficiency measures are being implemented. Therefore, looking at the whole picture, the increasing demand for thermal energy underlines the importance of thermal energy storage in enhancing resilience, sustainability, and energy security.

- Rising technological advancement is anticipated to propel the global thermal energy storage market growth.

The advancement of high-temperature content materials allows the function of TES systems at elevated temperatures, improving their performance in terms of efficiency and the quantity of energy stored. This makes renewable energy generation sources such as concentrated solar power (CSP) more effective by utilizing waste heat more efficiently, making them more viable and sustainable. Enhancing thermal storage techniques and the chemical storage of heat energy offers a solution to enabling long-term chemical energy storage for heat release whenever needed. Hybrid thermal energy storage systems make it possible to combine different storage systems to maximize their merits while improving energy density and cycling stability, and enhancing system adaptability.

Moreover, enhancements in the control strategies and the integration of the systems improve the performance of the TES systems in real-time by considering the weather, energy demand, and energy costs, hence improving the reliability and performance of the system. The smooth interaction between the traditional power plants and the renewable sources of energy in the TES system aids in fast-tracking the uptake of thermal energy options because the smart algorithms control the blending of those technologies harmoniously. Therefore, thermal energy storage systems are increasingly being adopted in these regions.

- Increasing the use of sensible heat technology will increase the market.

Using sensible heat technology, thermal energy storage stores thermal energy by altering a material's temperature without causing a phase shift. Sensible heat systems are easy to use, dependable, and unlikely to break down or require maintenance. They are simple to implement and run because they don't require complicated phase change materials or chemical reactions. They also provide high efficiency. Because of their adaptability, they can be used for various tasks, including industrial operations and home heating. Another benefit of sensible heat storage is its affordability. The materials are usually cheap and widely available, reducing the system's overall cost. These systems can also be easily integrated into traditional heating, cooling, and power generation systems because they are scalable and compatible with current infrastructure.

Major Restraints in the Thermal Energy Storage Market:

- High investment costs are anticipated to hamper the market growth

The initial investment cost for thermal energy storage includes costs associated with the purchase and assembly of storage tanks, heat exchangers, insulation, control systems, and other miscellaneous equipment. These costs are also subject to change depending on the costs of materials. Engineering and design costs incorporate feasibility studies, specialized designs, and meeting regulations. There are also costs for the installation and the provision of labor, as well as the costs of operation and maintenance of the system, which include monitoring, inspections, and repairs. Therefore, the expansion of the thermal energy storage market worldwide will be limited by the high costs of investments.

Thermal Energy Storage Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period.

Concentrated solar power plants are becoming more widely deployed, with molten salt TES systems playing an important role in the market's growth. Further, China and India, two nations with high levels of solar radiation, are at the forefront of CSP advancements.

The growing energy demand in Asia-Pacific nations is fueled by the use of TES systems to manage peak loads, increase grid stability, and boost overall energy efficiency. This increased demand is mostly caused by rapid industrialization and urbanization.

Thermal Energy Storage Market Key Launches:

- In April 2024, the innovative Finnish company Polar Night Energy took a major step toward revolutionizing energy storage, which recently raised €7.6 million in a funding round. The money will be carefully used to grow the company's research and sales teams and improve the technology that makes it easier to convert thermal energy stored into electrical power.

- In April 2024, through a successful private placement, MN8 Energy LLC, a US-based independent solar power producer, raised USD 325 million (EUR 303 million) to fund its expansion plans. The investment seeks to advance the company's growth trajectory and fortify its operations.

Thermal Energy Storage Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Thermal Energy Storage Market Size in 2025 | US$8.466 billion |

| Thermal Energy Storage Market Size in 2030 | US$14.219 billion |

| Growth Rate | CAGR of 10.93% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Thermal Energy Storage Market |

|

| Customization Scope | Free report customization with purchase |

The thermal energy storage market is segmented and analyzed as follows:

- By Material Type

- Molten salt

- Water

- Phase Change Materials (PCM)

- Others

- By Application

- By Technology

- By End-User

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Our Best-Performing Industry Reports:

- Distributed Energy Resource Management System Market

- Residential Energy Storage Market

- Wave Energy Market

Navigation:

- Thermal Energy Storage Market Size:

- Thermal Energy Storage Market Key Highlights:

- Thermal Energy Storage Market Trends:

- Thermal Energy Storage Market Growth Drivers:

- Major Restraints in the Thermal Energy Storage Market:

- Thermal Energy Storage Market Geographical Outlook:

- Thermal Energy Storage Market Key Launches:

- Thermal Energy Storage Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025