Report Overview

Distributed Energy Resource Management Highlights

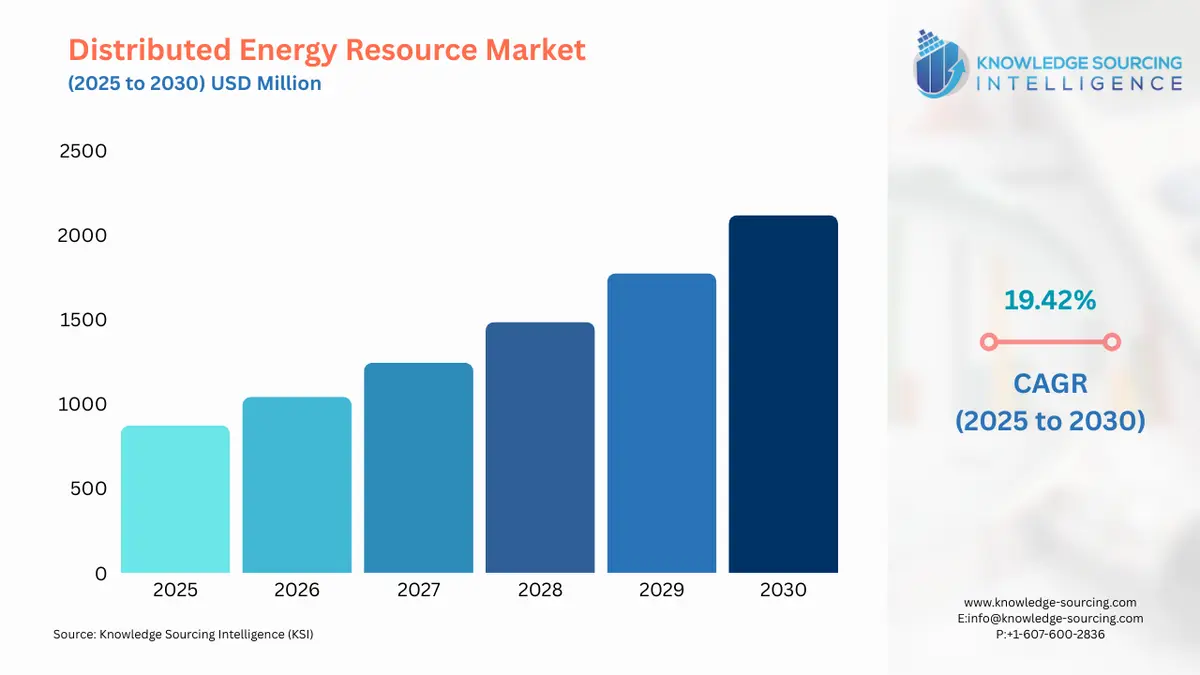

Distributed Energy Resource Management System Market Size:

The distributed energy resource management system market, at a 16.03% CAGR, is projected to increase from USD 556.636 million in 2025 to USD 1358.58 million in 2031.

A distributed energy resource management system (DERMS) is a software platform specifically designed to coordinate the functioning of aggregated distributed energy resources (DER) within a power grid. Most commonly, these systems find their application at the level of the distribution grid. The components of a DERMS can be categorized into both software and hardware elements. Distributed energy resource management systems industry is primarily driven by the surge in factors such as ongoing grid modernization initiatives and the growing adoption of renewable energy sources.

Distributed Energy Resource Management System Market Drivers:

Ongoing grid modernization bolsters the distributed energy resource management system market.

Grid modernization aims to enhance the adaptability, resilience, and efficiency of power networks. Distributed energy resource management system enables this modernization by coordinating and managing distributed energy resources such as solar, wind, and storage assets, ensuring optimal use and effective load balancing. The global push for sustainable energy, coupled with technological advances and regulatory support, is driving the growth of grid modernization. According to the N.C. Clean Energy Technology Center, In the third quarter of 2022, there were 441 instances of actions taken towards modernizing the grid in the United States of America. The states leading this charge, with the most actions during this period, were California, New York, Massachusetts, Michigan, Illinois, Connecticut, and Hawaii.

Increased adoption of renewable energy drives market expansion.

Distributed energy resource management systems are utilized in renewable energy generation to efficiently manage and integrate various decentralized energy sources. These systems are vital in optimizing energy production and consumption and facilitating energy savings. The rise in renewable energy adoption, driven by environmental concerns, and supportive government policies, contributes to an increased demand for such management systems. This, in turn, propels the growth of the distributed energy resource management systems market. According to the International Renewable Energy Agency, in 2022, the total capacity of global renewable energy generation reached 3372 Gigawatts (GW), marking an impressive growth of 295 GW. This represented an increase of 9.6% in the overall stock of renewable power.

Initiatives by major players drive the distributed energy resource management system market.

Distributed energy resource management system market is significantly fuelled by strategic collaborations and investments made by leading players in the sector. These companies are increasingly joining forces to combine their expertise and resources, fostering technological innovation and expanding their service offerings. therefore, driving the growth and progress of the distributed energy resource management system industry. For instance, in May 2022, at DistribuTECH, GE Digital unveiled Opus One DERMS as the inaugural outcome of its acquisition of Opus One Solutions. This cutting-edge solution serves as a comprehensive, modular distributed energy resource management system designed to support utilities in their transition towards distributed energy resources.

Distributed Energy Resource Management System Market Geographical Outlook:

Asia-Pacific is expected to dominate the market.

Asia-Pacific will hold a significant share of the distributed energy resource management system market due to significant governmental investments aimed at bolstering smart grid infrastructure and power distribution systems. Leading economies in the region, are actively promoting the integration of distributed energy resources to enhance energy security, improve grid reliability, and achieve sustainability goals. For instance, According to the International Energy Agency, in 2022, India initiated a scheme valued at approximately 3.03 trillion INR aimed at bolstering power distribution companies and enhancing distribution infrastructure. Also, in the period from 2021 to 2025, China strategized to upgrade and extend its power grids, earmarking an investment of 442 billion USD.

Distributed Energy Resource Management System Market Restraints:

High initial costs may restrain market growth.

The widespread adoption of distributed energy resource management systems and corresponding technologies often mandates considerable preliminary capital investments. Such significant upfront costs could serve as a deterrent for several utilities and companies. For example, the initial cost of implementing a DERMS for a large-scale PV system, with a capacity of 8.9-MVA, stands at an estimated $42k. The substantial financial commitment required in these cases can create a certain level of hesitation among prospective adopters, which in turn, could restrain the expansion of the distributed energy resource management systems market

Distributed Energy Resource Management System Market Key Developments:

February 2023: EnergyHub, a prominent player in distributed energy resources management, formed a strategic alliance with Siemens to collaborate on the development of next-generation DER management solutions. This partnership aims to expand its grid software business ecosystem. By combining their expertise, EnergyHub and Siemens are poised to deliver innovative and comprehensive DER management solutions that will drive the advancement of the energy industry and promote the widespread adoption of renewable energy and energy storage technologies.

May 2022: Schneider Electric, a global pioneer in digital energy management and automation, recently unveiled 'Grid to Prosumer', a holistic solution for Distributed Energy Resources (DER) management. This innovative approach aims to optimize the integration and value derived from renewable energy sources, energy storage systems, and electric vehicles. By fostering a seamless connection between these resources and the grid, Schneider Electric is furthering its commitment to maximizing the potential of renewable energy and enabling a sustainable energy future.

May 2022: Siemens unveiled a novel software solution aimed at enhancing the management of Distributed Energy Resources. This groundbreaking software from Siemens bolsters the capability of customers to execute grid protection simulations at a pace that is up to six times faster than the current rate. By accelerating the simulation process, the software assists utilities in more effective planning, operation, and maintenance of their power networks, hence contributing to the efficiency and reliability of power distribution.

May 2022: Schneider Electric acquired AutoGrid, a strategic move to harness the immense potential of distributed energy resources. This acquisition positions Schneider Electric to bridge the gap between utility grids and the diverse energy sources beyond the utility meter. AutoGrid's state-of-the-art virtual power plant technology platform will serve as a key enabler in this initiative, providing the tools and systems necessary for efficient integration and management of distributed energy resources, thereby amplifying Schneider Electric's capabilities in the rapidly evolving energy landscape.

List of Top Distributed Energy Resource Management System Companies:

Open Access Technology International, Inc.

General Electric

Oracle Corporation

Hitachi Energy Ltd. (Hitachi Group)

Itron Inc.

Distributed Energy Resource Management System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Distributed Energy Resource Management System Market Size in 2025 | USD 556.636 million |

Distributed Energy Resource Management System Market Size in 2030 | USD 1,196.079 million |

Growth Rate | CAGR of 16.53% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Distributed Energy Resource Management System Market |

|

Customization Scope | Free report customization with purchase |

Distributed Energy Resource Management System Market Segmentation

By Resource Type

Solar PV

Wind Turbine

Battery Storage

Others

By Distribution Type

Radial

Ring

Interconnected

By Component

Hardware

Software

By End-User

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Navigation

Distributed Energy Resource Management System Market Key Highlights:

Distributed Energy Resource Management System Market Drivers:

Distributed Energy Resource Management System Market Geographical Outlook:

Distributed Energy Resource Management System Market Restraints:

Distributed Energy Resource Management System Market Key Developments:

List of Top Distributed Energy Resource Management System Companies: