Report Overview

Global Thermally Conductive Plastic Highlights

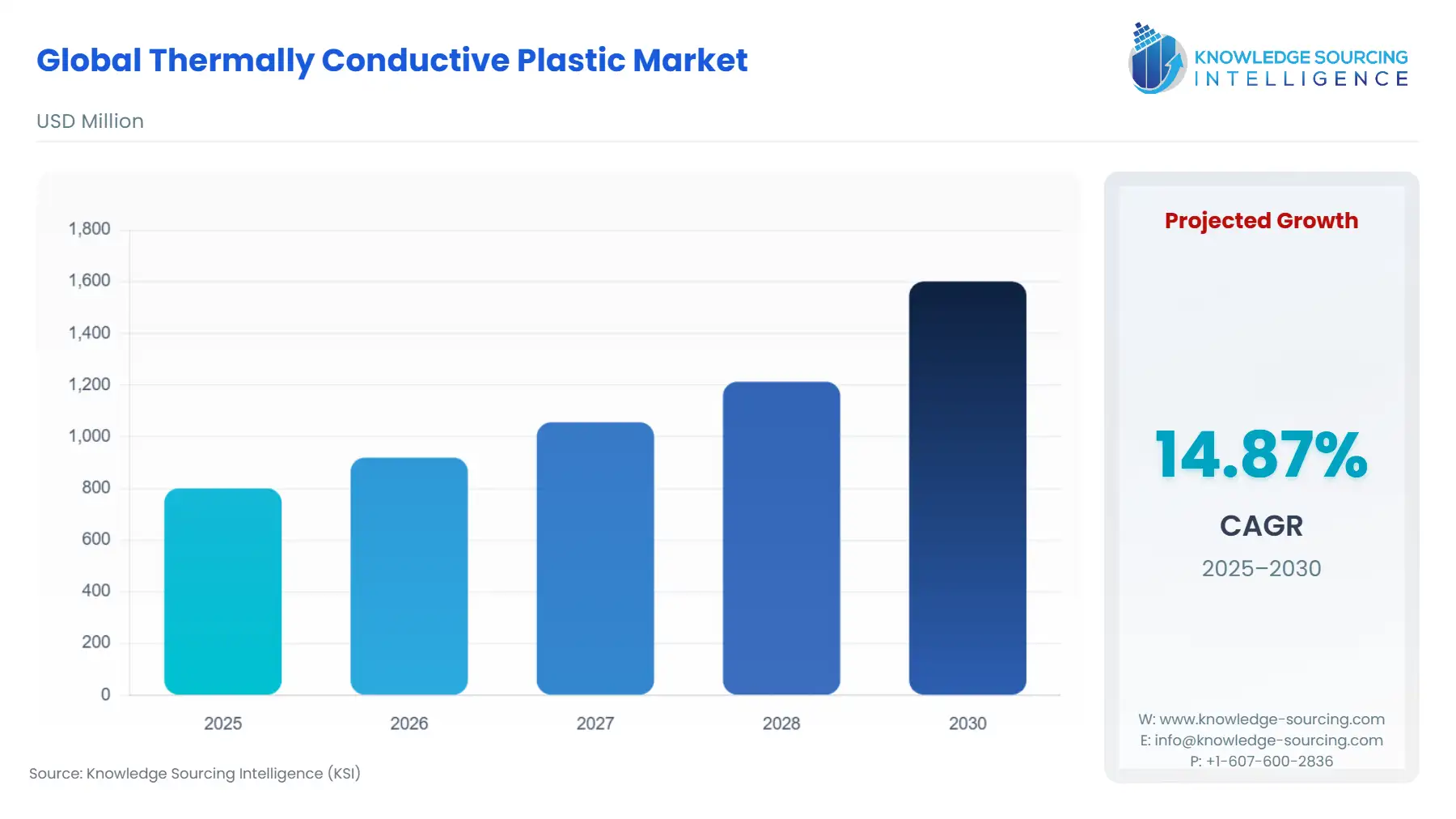

Global Thermally Conductive Plastic Market Size:

The Global Thermally Conductive Plastic Market is expected to grow from USD 800.550 million in 2025 to USD 1,601.111 million in 2030, at a CAGR of 14.87%.

The global thermally conductive plastic market is at a pivotal point, driven by the imperative for efficient thermal management across an expanding range of high-tech applications. These specialized polymers, engineered to conduct heat away from sensitive electronic components, are transforming how industries address thermal challenges. Unlike traditional plastics, which are typically thermal insulators, these materials are compounded with thermally conductive fillers to achieve a balance of heat dissipation and other desirable properties like lightweighting and electrical insulation. The market's growth is a direct consequence of the increasing density and power of modern electronic devices and the push for higher efficiency in automotive and aerospace systems.

Global Thermally Conductive Plastic Market Analysis

- Growth Drivers

The thermally conductive plastics market is directly linked to the need for effective thermal management in high-power-density environments. The proliferation of electronic devices, from consumer electronics to complex industrial systems, is a primary driver. As processors, LEDs, and power components become smaller and more powerful, they generate more heat in a confined space. This necessitates a material solution that can efficiently dissipate heat to prevent performance degradation or component failure. Thermally conductive plastics offer an ideal solution by enabling the design of lightweight heat sinks and enclosures that can be injection-molded into complex geometries, something that is often difficult or costly with metals. This ability to combine thermal performance with design freedom and reduced weight directly propels demand.

Another significant driver is the rapid electrification of the automotive industry. The shift from internal combustion engines to electric powertrains introduces new and complex thermal management challenges, particularly for battery packs, power inverters, and on-board chargers. Battery performance and longevity are highly dependent on maintaining a stable operating temperature. Thermally conductive plastics are increasingly used in battery modules, cell spacers, and housings to dissipate heat generated during charging and discharging, which directly impacts the performance and safety of the vehicle. The imperative to reduce vehicle weight to extend battery range further amplifies the demand for these lightweight plastic materials over heavier metal counterparts. The transition to advanced driver assistance systems (ADAS) and autonomous driving also fuels demand, as the complex electronics in these systems require robust thermal management to ensure reliability.

- Challenges and Opportunities

A primary challenge facing the thermally conductive plastic market is the inherent trade-off between thermal conductivity and mechanical properties. Achieving high thermal conductivity often requires a high loading of filler materials, which can negatively impact the polymer's processability, ductility, and overall mechanical strength. This makes it difficult to produce materials that can meet the stringent performance requirements of arduous applications like automotive components or aerospace systems. Additionally, the cost of high-performance fillers such as boron nitride and carbon fibers can make these specialized compounds more expensive than traditional metal solutions, which can be a competitive constraint in cost-sensitive markets.

However, these challenges create significant opportunities for innovation. The market presents an opportunity for companies to develop new filler technologies and polymer formulations that can achieve a higher thermal conductivity without compromising mechanical performance. This involves researching and integrating novel additives or designing polymer matrices that are more compatible with existing fillers. There is also a substantial opportunity in the recycling and re-use of these specialized plastics, which aligns with broader sustainability goals. As the volume of thermally conductive plastics in electronic and automotive applications grows, a circular economy for these materials will become a critical differentiator. The ability to recover, reprocess, and reintroduce these materials into the value chain presents a lucrative opportunity to capture new demand while addressing the industry's environmental footprint.

- Raw Material and Pricing Analysis

The raw materials for thermally conductive plastics consist of two main components: the base polymer resin and the thermally conductive filler. The base polymer can be a variety of thermoplastics, such as polyamide, PBT, or PPS, and its cost is influenced by the volatility of petrochemical feedstock prices. The conductive fillers, however, are a more specialized and critical component of the final product. These fillers can range from more common materials like aluminum oxide and graphite to high-performance, more expensive materials like boron nitride, expanded graphite, and aluminum nitride. The pricing of these filler materials is subject to their own supply chain dynamics, including sourcing, processing, and purity requirements. The final price of the thermally conductive plastic is therefore a direct function of the base polymer cost, the type and loading of the filler material, and the proprietary compounding processes. High-performance grades with expensive fillers will command a significant price premium, which can limit their application to high-value-add sectors like aerospace and advanced electronics.

- Supply Chain Analysis

The global supply chain for thermally conductive plastics is a two-tiered system. The first tier involves the production of base polymer resins, which are manufactured in large-scale petrochemical facilities located in regions with access to feedstock, such as North America, the Middle East, and Asia. The second tier, and the more complex one, is the compounding process. This involves blending the base polymer with the specialized thermally conductive fillers and other additives to create the final, performance-grade plastic pellets. The supply of these high-performance fillers is concentrated among a smaller number of specialized producers, which can create dependencies and supply chain vulnerabilities. The pellets are then distributed globally to original equipment manufacturers (OEMs) and molders. Logistical complexities include ensuring the purity and quality of the materials during transport and storage, as well as managing the specialized handling of certain fillers. The supply chain's efficiency is critical for meeting the just-in-time manufacturing demands of the electronics and automotive industries.

Thermally Conductive Plastic Market Government Regulations

Government regulations, while not directly mandating the use of thermally conductive plastics, significantly influence their demand by imposing stringent requirements on energy efficiency and product safety. These regulations create a market imperative for solutions that can enable compliance.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | The European Green Deal and its directives on vehicle emissions and energy efficiency | The EU's ambitious climate goals and CO2 emission standards for vehicles directly incentivize the automotive industry to reduce vehicle weight to improve fuel efficiency. This creates a strong demand for lightweight, high-performance materials like thermally conductive plastics as a direct substitute for heavier metal components in applications such as battery enclosures and power electronics. |

| United States | Environmental Protection Agency (EPA) regulations and Corporate Average Fuel Economy (CAFE) standards | CAFE standards compel automakers to improve the fuel economy of their vehicle fleets. This market pressure, combined with the growing consumer demand for electric vehicles, drives the adoption of lightweight materials. Thermally conductive plastics offer a solution for both weight reduction and the critical thermal management of EV batteries, which is a key factor in vehicle range and safety. |

| China | National standards for electric vehicle performance and safety | As the largest market for electric vehicles, China has a comprehensive set of national standards (e.g., GB/T series) that govern the performance, safety, and battery thermal management of EVs. These regulations create a clear and robust demand signal for high-performance materials that can meet these specifications, providing a significant market for thermally conductive plastics in the EV sector. |

Thermally Conductive Plastic Market Segment Analysis

- By End User: Electrical & Electronics

The electrical & electronics sector is the largest and most dynamic consumer of thermally conductive plastics. This market is driven by the industry’s relentless pursuit of miniaturization, increased power density, and enhanced performance. Components such as LEDs, CPUs, power supplies, and various integrated circuits generate a substantial amount of heat that must be effectively managed to ensure operational stability and product longevity. Traditional thermal management solutions, such as metal heat sinks, are often heavy, expensive to manufacture, and can pose challenges for design integration. Thermally conductive plastics directly address these pain points. For example, in LED lighting, these plastics enable the production of lightweight, complex-shaped heat sinks that are not only more cost-effective to produce but also allow for greater design freedom in luminaire aesthetics. The shift towards more powerful, compact consumer devices, such as smartphones, laptops, and wearables, further amplifies demand. In these applications, thermally conductive polymers are used for component enclosures and internal frames to dissipate heat and prevent localized hot spots, thereby improving device performance and reliability. The necessity is particularly pronounced for electrically insulating, thermally conductive plastics, as they enable the consolidation of functions—providing both thermal management and electrical isolation in a single component.

- By Type: Polyamide (PA)

Polyamide (PA) is a foundational polymer type in the thermally conductive plastics market, valued for its excellent balance of mechanical properties, chemical resistance, and ease of processing. The need for thermally conductive PA is driven by its broad applicability across the automotive and electrical & electronics sectors. In the automotive industry, thermally conductive PA is used for under-the-hood components, such as engine covers, air ducts, and sensors, where a combination of high thermal resistance, mechanical strength, and chemical stability is required. Its ability to be molded into complex parts reduces the need for multiple assembly steps and can consolidate several metal components into a single, lightweight plastic part. In the electrical and electronics sector, thermally conductive PA finds a strong demand in connectors, circuit breaker housings, and coils. The material's inherent electrical insulation, when combined with high thermal conductivity, allows it to be used in applications where heat must be dissipated from a component without the risk of electrical shorting. This dual functionality directly creates a robust demand for PA-based thermally conductive solutions, particularly for high-voltage and high-power applications in both electric vehicles and industrial electronics.

Thermally Conductive Plastic Market Geographical Analysis

- US Market Analysis

The US market for thermally conductive plastics is characterized by a high demand from the automotive and electrical & electronics industries, particularly in the production of electric vehicles and advanced consumer electronics. The country's robust research and development ecosystem, along with a focus on high-performance materials, drives innovation and adoption. The market is also influenced by federal and state-level regulations, such as CAFE standards, which incentivize lightweighting in the automotive sector. This creates a strong market for thermally conductive plastics as a viable replacement for metal components. The presence of major automotive OEMs and a strong consumer electronics manufacturing base ensures a consistent and growing demand for these specialized materials.

- Brazil Market Analysis

Brazil's thermally conductive plastics market is in a nascent stage of growth, with demand primarily driven by the country's developing electrical and electronics manufacturing sector and its growing automotive industry. The market is smaller and more price-sensitive than those in mature economies. This places a greater emphasis on cost-effective solutions, such as materials with lower-cost fillers, rather than high-performance grades. The market is centered on applications like LED lighting components, consumer electronics housings, and some automotive parts, where basic thermal management is required. The lack of a comprehensive regulatory framework for energy efficiency and vehicle lightweighting, similar to those in Europe and North America, means that demand is currently more a function of cost-benefit analysis by manufacturers than a regulatory imperative.

- Germany Market Analysis

Germany is a European leader in the thermally conductive plastics market, propelled by its world-class automotive and industrial manufacturing sectors. The country's automotive industry, with its focus on premium and high-performance vehicles, is a key driver for the adoption of high-end thermally conductive materials for battery management systems and power electronics in electric vehicles. The German government's commitment to the European Green Deal and its ambitious climate goals further accelerate this trend. In the industrial sector, the demand is strong for materials used in automation, robotics, and industrial electronics, where robust and reliable thermal management is an essential requirement. German manufacturers often seek materials with a high degree of technical precision and verifiable performance, creating a strong market for a wide range of specialty polymer grades.

- Saudi Arabia Market Analysis

The Saudi Arabian market for thermally conductive plastics is emerging, driven by the government's economic diversification plan, Vision 2030, and its focus on developing new industrial sectors. While the country is a major producer of commodity plastics, its domestic market for specialized, high-performance materials is still developing. The market expansion is being generated by new industrial projects, particularly in the electrical and construction sectors. The local market for plastics is heavily influenced by the availability of low-cost feedstocks, which places a premium on cost-effective solutions. The market for high-end thermally conductive plastics is currently driven by a few select, high-tech projects rather than a broad industrial base. The future growth of this market will depend on the successful expansion of high-value-added manufacturing capabilities within the country.

- China Market Analysis

China is the largest and fastest-growing market for thermally conductive plastics, fueled by its dominant position in the global electronics and electric vehicle manufacturing industries. The country's consumer electronics sector, which produces a vast volume of smartphones, laptops, and other devices, is a massive consumer of these materials. The Chinese government's strong support for the EV industry, through subsidies and regulatory targets, has created a boom in demand for materials used in battery packs, power inverters, and charging infrastructure. Chinese manufacturers are investing heavily in R&D to develop domestic expertise and reduce their reliance on imported materials. The sheer scale of production and the rapid pace of technological innovation in China's end-user markets create an unparalleled demand for a wide range of thermally conductive plastic solutions, from commodity grades to highly specialized polymers.

Thermally Conductive Plastic Market Competitive Environment and Analysis

The competitive landscape of the global thermally conductive plastics market is defined by a small number of global chemical companies and a larger number of specialized compounders. Competition is centered on material science expertise, intellectual property related to filler technologies, and the ability to provide integrated application development support to customers.

- SABIC: A major player in the market, leveraging its extensive portfolio of engineering thermoplastics and a strong focus on advanced materials. SABIC's strategic positioning is built on its ability to offer a wide range of thermally conductive compounds, such as the LNP™ KONDUIT™ and LNP™ THERMOCOMP™ families of products. The company's recent product launches have been specifically targeted at the high-growth electric vehicle market. For example, in August 2025, SABIC launched a new non-brominated/non-chlorinated flame retardant PBT compound to enhance the safety and functionality of critical EV components, such as electric vehicle control units (EVCUs). The compound's laser-weldable properties and lightweighting benefits directly increase its demand as a metal replacement.

- BASF SE: A global chemical company that offers a broad portfolio of performance materials, including engineering plastics. BASF’s strategy in this market is to provide high-performance solutions for arduous applications in the automotive and electrical & electronics industries. The company's Ultramid® portfolio of polyamides is a key offering, with specialized grades developed to meet specific customer requirements for thermal management. BASF's commitment to innovation and customer collaboration allows it to develop tailored material solutions that address complex challenges in new energy vehicles and industrial applications.

- Celanese Corporation: Celanese is a significant provider of engineered materials, with a strategic focus on high-performance polymers for the automotive, electronics, and medical industries. The company’s competitive edge is derived from its broad portfolio and its ability to provide tailored material solutions that address specific application needs. Celanese is actively collaborating with automotive OEMs to develop materials that meet the challenges of electric vehicles, including thermal management and lightweighting. The company’s focus on high-impact projects (HIPs) that emphasize specialty product offerings indicates a strategic alignment with the high-value segments of the thermally conductive plastics market.

Thermally Conductive Plastic Market Developments

- August 2025: SABIC launched LNP™ THERMOCOMP™ WFC061I compound, a new non-brominated/non-chlorinated flame retardant polybutylene terephthalate (PBT) designed for critical electric vehicle control units (EVCUs). The material can replace metal in EVCU covers, offering significant weight reduction and enhanced design freedom, directly addressing the demand for lightweight, high-performance materials in the EV sector.

- April 2025: Celanese Corporation and Li Auto collaborated to advance innovation in new energy vehicles. This partnership signifies a strategic focus on developing material solutions to meet the evolving demands of the electric vehicle market, including the need for advanced plastics that enable lightweighting, improved safety, and thermal management.

Thermally Conductive Plastic Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 800.550 million |

| Total Market Size in 2031 | USD 1,601.111 million |

| Growth Rate | 14.87% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Global Thermally Conductive Plastic Market Segmentation:

- By Type

- Polyamide

- Polybutylene terephthalate (PBT)

- Polycarbonate

- Polyphenylene Sulfide (PPS)

- Polyetherimide

- Other (PEEK, PEKK)

- By End User

- Electrical & Electronics

- Automotive

- Healthcare

- Aerospace

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

- North America