Report Overview

Vertical Cavity Surface Emitting Highlights

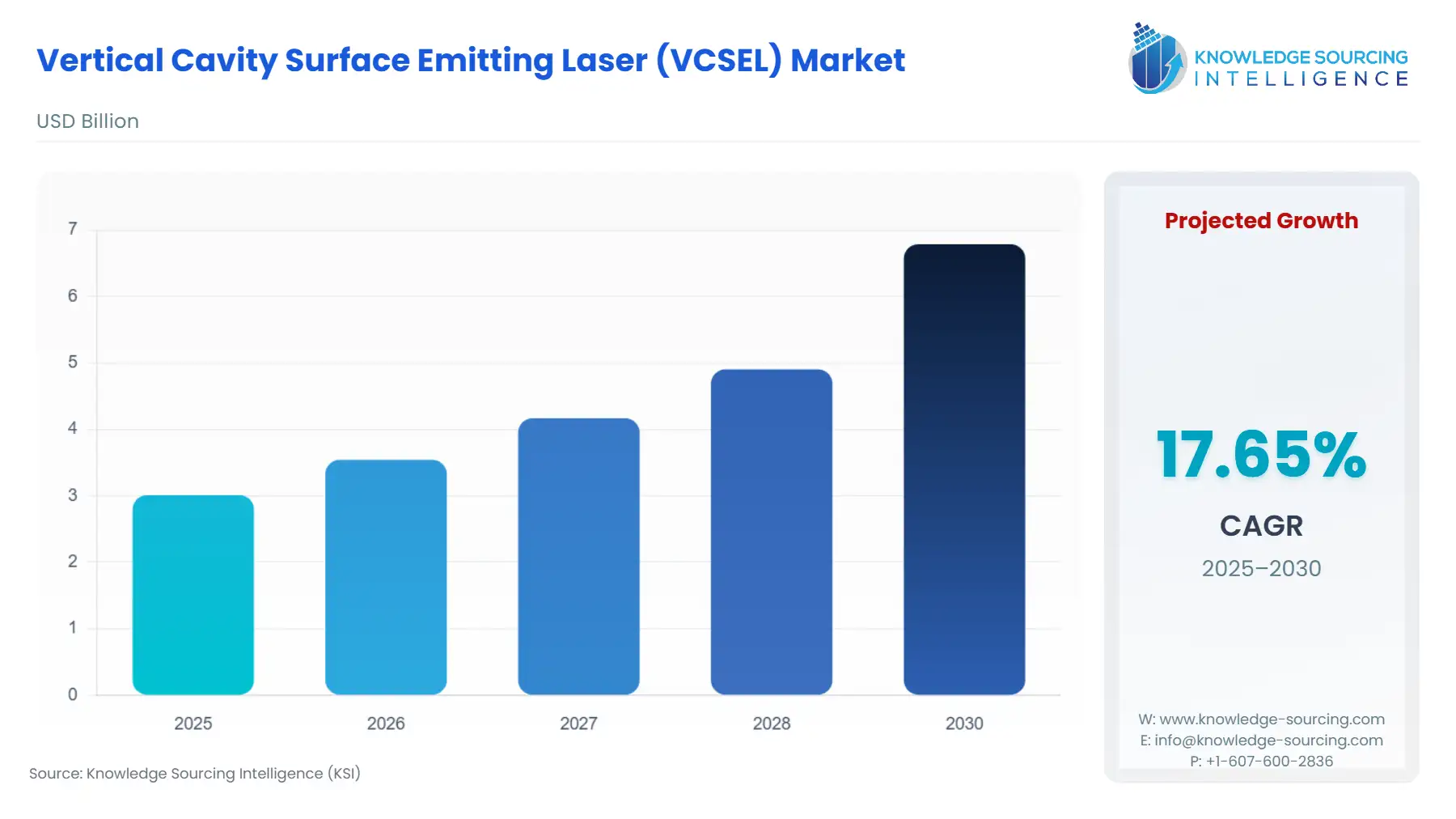

Vertical Cavity Surface Emitting Laser Market Size:

The Vertical Cavity Surface Emitting Laser Market is set to soar from USD 3.012 billion in 2025 to USD 6.789 billion by 2030, at a CAGR of 17.65%.

The Global Vertical Cavity Surface Emitting Laser (VCSEL) Market is defined by its core utility in transforming electrical signals into high-speed, low-divergence optical beams. VCSELs distinguish themselves from traditional edge-emitting lasers due to their circular output beam, low threshold current, and superior manufacturability via high-volume wafer-level testing, making them ideal for integration into complex array configurations. Initially recognized for their role in fiber-optic data communications, the market experienced a significant paradigm shift with their ubiquitous adoption in consumer electronics for sophisticated 3D sensing applications. This dual-market dependency, high-volume, lower-margin consumer products versus lower-volume, higher-margin infrastructure components, necessitates continuous investment in both material science to improve efficiency and manufacturing scale to reduce unit costs.

Global Vertical Cavity Surface Emitting Laser (VCSEL) Market Analysis

- Growth Drivers

The relentless push for higher data transmission speeds across Telecommunications & Datacenters constitutes a foundational demand driver. VCSELs' low power consumption and suitability for array integration directly address the need for 400G and 800G short-reach optical transceivers, increasing demand for Multi-Mode VCSELs. Simultaneously, the mass-market adoption of 3D sensing in consumer electronics, including proximity sensing, depth sensing, and facial recognition, compels the integration of VCSEL arrays into every premium smartphone and increasingly into augmented reality devices. This high-volume mobile application is the primary catalyst for manufacturing scale-up, directly spiking demand for high-performance, compact VCSEL components suitable for sensing applications.

- Challenges and Opportunities

A principal challenge is the persistent issue of thermal management in high-power, dense VCSEL arrays, particularly in LiDAR and high-speed data applications. Excessive heat compromises performance and lifespan, which limits VCSEL power output and consequently constrains demand in high-power industrial and automotive applications where reliability is paramount. The primary opportunity lies in the burgeoning Automotive sector, specifically in LiDAR for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. The requirement for robust, solid-state, and cost-effective laser sources for long-range, high-resolution sensing presents a major new market, potentially driving explosive demand for specialized, high-reliability 905nm and 1550nm VCSEL arrays.

- Raw Material and Pricing Analysis

VCSELs are physical devices fabricated on highly pure Gallium Arsenide (GaAs) or Indium Phosphide (InP) wafers, making this section mandatory. GaAs forms the critical substrate for most 850nm and 940nm VCSELs utilized in sensing and data comms, while InP is essential for longer-wavelength devices. Pricing dynamics are heavily influenced by the upstream supply chain of these compound semiconductor wafers, which face capacity constraints and high purification costs. The wafer price volatility directly translates into uncertainty for VCSEL manufacturers. Cost reduction efforts focus on increasing the yield and size of the epitaxially grown wafers, as the cost of the raw material substrate remains a substantial portion of the overall VCSEL die cost.

- Supply Chain Analysis

The global VCSEL supply chain is compartmentalized, starting with a few specialized substrate manufacturers (GaAs/InP wafers), followed by epitaxial growth specialists that use Metal-Organic Chemical Vapor Deposition (MOCVD) reactors to deposit the Bragg reflectors and quantum wells. Production hubs are concentrated in technologically mature regions like North America and parts of East Asia. The primary logistical complexity arises from the dependence on highly sophisticated MOCVD equipment, which represents a significant capital expenditure and a bottleneck in capacity expansion. The final stage involves VCSEL fabrication, assembly, and packaging, which has largely shifted to Asian Contract Manufacturing hubs, creating a geographical concentration risk and dependency on seamless cross-border logistics.

Vertical Cavity Surface Emitting Laser Market Government Regulations

Regulatory mandates primarily focus on laser safety and international trade compliance, which shape the design and commercial viability of VCSEL products.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Global |

IEC 60825-1 (International Standard) |

Mandates strict safety classifications for all laser products, including VCSELs. This compels manufacturers to integrate power-limiting features and necessitates extensive design validation, directly impacting the VCSEL's complexity and driving demand for integrated safety circuitry. |

|

United States |

FDA (21 CFR 1040.10 & 1040.11) |

Governs laser light products in the U.S. market. Compliance is mandatory for consumer electronics and medical devices, driving manufacturers to design eye-safe VCSELs (Class 1) and demanding rigorous pre-market compliance testing, increasing product development costs. |

|

United States / Global |

US Tariffs on Goods from China (Trade Act of 1974) |

Imposition of tariffs on VCSEL components and modules (often assembled in China) increases the final cost of goods for companies serving the US market. This creates commercial friction, forcing companies to restructure supply chains and diversify assembly operations to mitigate tariff costs, indirectly affecting the global price structure and demand velocity. |

Vertical Cavity Surface Emitting Laser Market Segment Analysis

- Sensing (By Application)

The Sensing application segment represents the highest volume driver for the VCSEL market, primarily due to the ubiquitous adoption of 3D depth sensing across the premium consumer electronics sector. This unprecedented demand is directly tied to the integration of functionalities such as facial recognition for secure authentication and high-fidelity augmented reality (AR) experiences in mobile devices. VCSELs are the preferred light source for structured light and Time-of-Flight (ToF) sensing because their small, high-power, multi-emitter arrays offer a uniform light pattern and rapid modulation essential for accurate depth mapping in confined spaces. The market demand is highly cyclical, tied to consumer product release schedules, necessitating manufacturers maintain flexible but massive production capabilities to support the annual surge in unit volume. The continual effort by consumer electronics OEMs to enhance biometric security and AR capabilities dictates a sustained, high-specification demand for increasingly efficient and higher-power VCSEL arrays.

- Consumer Electronics (By End-User Industry)

The Consumer Electronics end-user segment is the single largest consumer of VCSEL units, fundamentally driven by the product design strategies of major smartphone and tablet manufacturers. Demand is explicitly generated by the inclusion of front-facing VCSELs for facial identification (e.g., Apple's Face ID) and rear-facing VCSELs for world-facing depth sensing. The VCSEL's small form factor, ease of integration with standard CMOS image sensors, and high reliability make it an indispensable component for secure, gesture-based, and ambient light sensing. The market's insatiable requirement for thinner, lighter, and more powerful devices forces VCSEL suppliers to continuously invest in lithographic refinement and thermal optimization. This direct, high-volume relationship ensures that technological advances in consumer electronics, rather than infrastructure upgrades, dictate the immediate manufacturing scale and pricing trajectory for the majority of Multi-Mode VCSELs.

Vertical Cavity Surface Emitting Laser Market Geographical Analysis

- US Market Analysis

The US market is characterized by high-value R&D and a concentration of major technology companies, particularly those in hyperscale datacenters and high-end consumer electronics design. The demand for VCSELs is driven by the early adoption of new technology standards, such as 400G/800G optical transceivers, and the specification of VCSEL-based 3D sensing modules for globally marketed devices. Local market conditions are heavily influenced by ITAR regulations for defense applications and the complex impacts of US tariffs on components assembled offshore, which can compel US-based companies to seek domestic or allied-nation manufacturing partners, thereby stimulating local investment in assembly and packaging capabilities.

- Brazil Market Analysis

Demand for VCSELs in Brazil is primarily an indirect consumer-driven demand, tied to the importation and sales volume of smartphones that feature VCSEL-enabled 3D sensing. The Telecommunications sector is a steady, though slower, adopter of VCSEL technology, focused mainly on short-reach fiber optic links within large corporate and local data centers. Pricing is a critical local factor, as currency fluctuations and import duties often inflate the final cost of VCSEL-containing modules, which can decelerate the adoption of VCSELs in lower-cost, locally manufactured products.

- Germany Market Analysis

Germany maintains strong demand, primarily fueled by its dominant Automotive sector and sophisticated Industrial manufacturing base. VCSEL demand here is focused on two key areas: the development of Automotive LiDAR systems and high-power Industrial Heating and Printing applications where VCSEL arrays provide precise, localized heat sources. Regulatory scrutiny under TÜV standards for industrial safety and the European Union's Machinery Directive drives demand for highly reliable, certified VCSEL components, favoring established European or aligned manufacturers over low-cost options.

- South Africa Market Analysis

The VCSEL market in South Africa is nascent, with demand driven largely by the rollout of fiber optic infrastructure within key economic centers and the high rate of smartphone penetration. Demand is almost exclusively for Multi-Mode VCSELs used in 10G/25G short-haul data communication links. Local factors, including the slower pace of 5G deployment compared to other regions, mean that high-end VCSEL applications like high-resolution ToF sensing have a smaller addressable market, focusing demand on cost-effective, proven VCSEL technologies rather than leading-edge innovation.

- China Market Analysis

China is both a massive end-user market and the global manufacturing hub for VCSEL-enabled consumer electronics. Demand is astronomical, dictated by the enormous volume of mobile devices and the accelerated deployment of hyperscale data centers driven by national cloud infrastructure policies. While tariffs create cost pressure for goods exported to the US, the immense domestic demand and the presence of local VCSEL manufacturers ensure sustained, high-volume production. The NMPA's regulatory framework for advanced sensing devices also influences the rapid iteration of VCSEL design, pushing manufacturers towards domestic solutions.

Vertical Cavity Surface Emitting Laser Market Competitive Environment and Analysis

The competitive landscape is bifurcated: a small number of integrated device manufacturers (IDMs) dominate the high-volume consumer and data comms segments, while a greater number of specialized firms cater to the lower-volume, high-specification automotive and industrial sectors. Success is predicated on achieving high manufacturing yield on large wafer sizes (up to 6-inch GaAs), securing long-term supply agreements with major consumer electronics OEMs, and continually improving thermal efficiency and bandwidth. The entry barrier is exceptionally high, due to the proprietary nature of MOCVD epitaxial growth recipes and the immense capital required for cleanroom facilities.

- ams-OSRAM AG

ams-OSRAM AG maintains a powerful competitive edge by focusing primarily on the Sensing market, particularly in 3D sensing for consumer and automotive applications. Their strategic positioning centers on providing complete VCSEL illumination solutions, rather than just the chip. The company's focus on optical packaging and system integration has secured its position as a primary supplier to major smartphone original equipment manufacturers (OEMs).

- Lumentum Holdings Inc.

Lumentum plays a crucial role in the VCSEL ecosystem, positioned as a key supplier for both high-end Data Communication and 3D Sensing markets. Their unique strength lies in their high-volume, vertically integrated manufacturing process, allowing them to scale production rapidly. The company’s ability to meet stringent quality and high-volume demands from major OEMs is their core competitive differentiator.

Global Vertical Cavity Surface Emitting Laser (VCSEL) Market Segmentation:

- By Type

- Single-Mode VCSEL

- Multi-Mode VCSEL

- By Material

- Gallium Arsenide

- Indium Phosphide

- Others

- By Application

- Data Communication

- Sensing

- LiDAR

- Industrial Heating & Printing

- Others

- By End-User Industry

- Consumer Electronics

- Automotive

- Telecommunications & Datacenters

- Industrial

- Healthcare

- Defense & Aerospace

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America