Report Overview

Laser Technology Market Report, Highlights

Laser Technology Market Size:

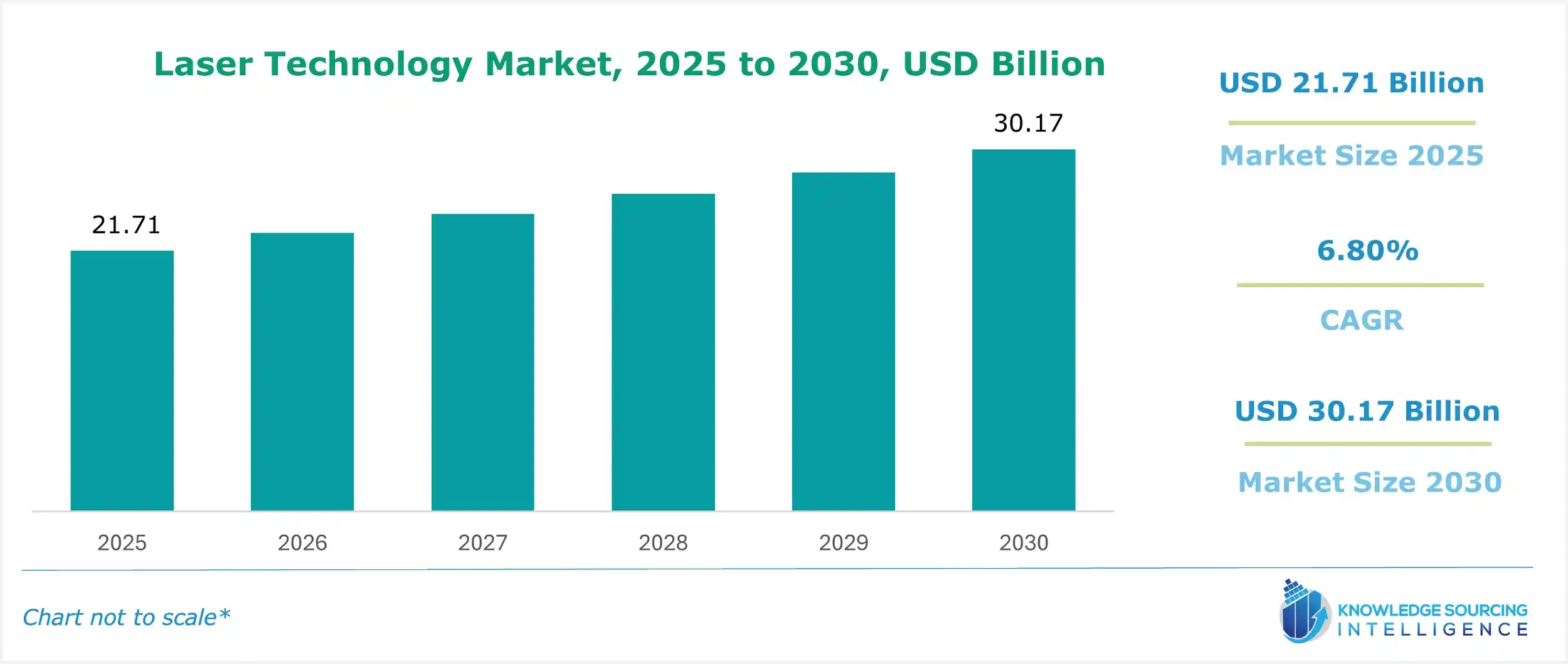

The Laser Technology Market will grow at a CAGR of 6.80% to be valued at US$30.17 billion in 2030 from US$21.71 billion in 2025.

Laser technology offers high accuracy with the minimum environmental effect, which is a major factor contributing to the growing popularity of lasers. The recent shift towards the production of nano and microdevices is anticipated to be instrumental in driving the laser technology market growth during the forecast period. The use of advanced equipment in industries like healthcare, food and beverage, metallurgy, and others is increasing the adoption of different types of lasers for various applications by key industry players. The adoption of lasers in the healthcare industry is expanding rapidly because they offer significant improvements in treating diseases over conventional methods.

The outbreak of the novel coronavirus disease had a negative impact on the laser technology market. The manufacturing facilities were shut down in many parts of the world to curb the spread of coronavirus, which led to a decline in market growth. The travel restrictions also led to supply chain disruptions, which harmed the market. Moreover, even after the re-opening of the manufacturing facilities, a dearth of laborers was reported in many places, further diminishing the laser technology market size during the pandemic.

Laser Technology Market Drivers:

- Rising use of lasers in healthcare.

With advancements in healthcare, the use of lasers in the medical sector is becoming increasingly prominent, propelling the global laser technology market growth during the forecast period. Lasers are being used in cosmetic surgery (to remove tattoos, scars, stretch marks, sunspots, wrinkles, birthmarks, spider veins, or hair), refractive eye surgery (to reshape the cornea to correct or improve vision as in LASIK, or PRK), dental procedures (such as endodontic/periodontic procedures, tooth whitening, and oral surgery), general surgery (such as tumor removal, cataract removal, breast surgery, plastic surgery, and most other surgical procedures), among many other procedures.

With continuous research and developments, advancements are being made in laser technology, further boosting the adoption of laser technology in healthcare and, consequently, augmenting its market expansion. UCI Health urologists reported in the Journal of Endourology in May 2021 that they have tested a new laser technology named super-pulsed thulium fiber laser. This can destroy even big kidney stones to dust that can be suctioned or flushed from the body. It is stated that the new laser technology targets the water in the stones, enabling the breakdown of the stone the size of a human thumb into dust particles of 100 microns or less.

- Advantages over traditional material processing.

One of the major factors anticipated to drive the growth of the global laser technology market during the forecast period is the advantages of laser material processing over traditional methods. With the rise in the demand for miniaturization of microelectronics, laser cutting is increasingly being used. These cutters have extremely high accuracy and precision, which is required where tolerances are extremely tight. It operates at high speed and produces products without the need for retooling.

Furthermore, laser welding provides higher strength as it is narrow and has an excellent depth-to-width ratio. The heat-affected zone is limited, and the surrounding material is not annealed due to rapid cooling. Moreover, lasers allow the drilling of several materials, from rubber and wood to very hard metals such as diamonds and ceramics. A large depth-diameter ratio can be obtained by laser drilling. Many such advantages provided by the use of laser in material processing, coupled with the miniaturization of microelectronics prompting an increased need for precision, are projected to surge the global laser technology market’s growth.

Laser Technology Market Geographical Analysis:

- Asia Pacific is predicted to hold a significant market share.

Geographically, the Asia Pacific region is anticipated to hold a significant market share. It is projected to witness the fastest growth owing to the use of laser processing in manufacturing, largely in China. The increasing investments by various market players and rising expenditure for research and development for developing novel products are further expected to propel market growth. Furthermore, the growth of end-use industries such as electronics, healthcare, and construction is also boosting the regional market expansion.

Laser Technology Market Key Development:

- In January 2025, Fonon Technologies, a global leader in advanced laser technology, launched a cutting-edge laser tech designed for material processing and defense infrastructure. The company stated that the latest technology features overheat protection of the system and a compact scanning head.

Laser Technology Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Laser Technology Market Size in 2025 | US$21.71 billion |

| Laser Technology Market Size in 2030 | US$30.17 billion |

| Growth Rate | CAGR of 6.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East, and Africa, Asia Pacific |

| List of Major Companies in Laser Technology Market |

|

| Customization Scope | Free report customization with purchase |

Laser Technology Market Segmentation:

By Type

- Gas Laser

- Liquid Laser

- Solid Laser

- Others

By Application

- Laser Processing

- Optical Communications

- Others

By End-user Industry

- Telecommunications

- Industrial

- Semiconductor & Electronics

- Aerospace & Defense

- Automotive

- Medical

- Research

- Others

By Geography

- Americas

- USA

- Europe, Middle East, and Africa

- Germany

- Netherlands

- Others

- Asia Pacific

- China

- Japan

- Taiwan

- South Korea

- Others