Report Overview

Healthcare 3PL (Third-Party Logistics) Highlights

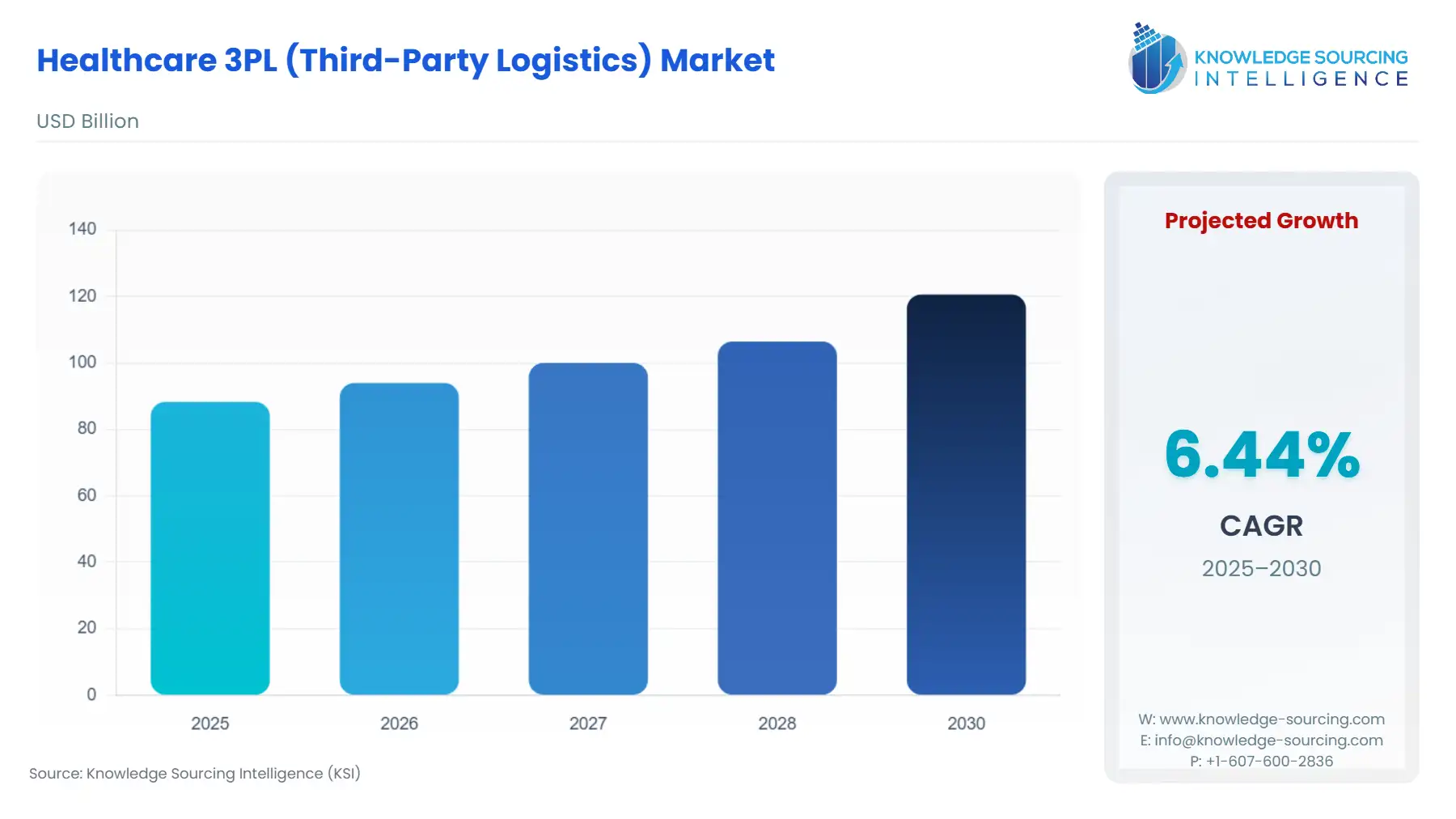

Healthcare 3PL (Third-Party Logistics) Market Size:

The Healthcare 3PL (Third-Party Logistics) Market is expected to grow at a CAGR of 6.44%, reaching a market size of US$120.631 billion in 2030 from US$88.293 billion in 2025.

The healthcare supply chain management landscape has undergone a profound transformation in recent years, driven by the increasing complexity of global pharmaceutical and biopharmaceutical distribution networks. The Healthcare Third-Party Logistics (3PL) market has emerged as a critical component of this ecosystem, enabling pharmaceutical companies, medical device manufacturers, and biotech firms to navigate stringent regulatory requirements, ensure product integrity, and meet the growing demand for specialized logistics solutions. By outsourcing logistics to specialized 3PL providers, healthcare companies can focus on their core competencies—such as research, development, and commercialization—while leveraging the expertise of logistics partners to manage intricate supply chains.

The Healthcare 3PL market encompasses a range of services, including transportation, warehousing, inventory management, and distribution of pharmaceuticals, biologics, vaccines, medical devices, and advanced therapies such as cell and gene therapy logistics. Unlike traditional logistics, healthcare 3PL demands precision, compliance with global regulations, and advanced technology to ensure product safety and efficacy. The rise of biologics transport and cell and gene therapy logistics has further elevated the need for specialized solutions, as these products require stringent temperature control, real-time monitoring, and rapid delivery to maintain their therapeutic value. Additionally, drug serialization—the process of assigning unique identifiers to track and trace pharmaceutical products—has become a cornerstone of regulatory compliance, driven by mandates like the U.S. Drug Supply Chain Security Act (DSCSA) and the EU Falsified Medicines Directive (FMD).

Several factors are propelling the growth of the Healthcare 3PL market. First, the global expansion of pharmaceutical and biotech industries has increased the complexity of supply chains, necessitating outsourcing logistics to manage cross-border distribution and comply with diverse regulatory frameworks. The surge in demand for biologics transport, particularly for temperature-sensitive monoclonal antibodies, vaccines, and gene therapies, has driven investments in cold chain infrastructure. For instance, UPS Healthcare expanded its cryogenic storage capabilities in the U.S. and Germany to support cell and gene therapy logistics, reflecting the growing need for ultra-low temperature solutions.

Second, stringent regulatory requirements, such as GDP-compliant (Good Distribution Practice) and GMP-certified (Good Manufacturing Practice) standards, are pushing healthcare companies to partner with 3PL providers that possess expertise in compliance. These regulations ensure that products are stored, handled, and transported under controlled conditions to prevent spoilage or contamination. The increasing adoption of drug serialization technologies to combat counterfeiting and ensure traceability further underscores the need for 3PL providers with advanced IT systems and regulatory knowledge.

Third, the rise of patient-centric models, such as direct-to-patient (DTP) delivery and decentralized clinical trials, is reshaping logistics strategies. These models require last-mile delivery solutions that are both compliant and efficient, further boosting demand for specialized 3PL services. For example, in October 2024, McKesson launched InspiroGene, a business unit dedicated to supporting cell and gene therapy logistics, highlighting the industry’s shift toward tailored solutions for personalized medicine.

Despite its growth, the Healthcare 3PL market faces several challenges. High operational costs associated with maintaining GDP-compliant facilities, temperature-controlled fleets, and validated IT systems pose significant barriers, particularly for smaller providers. Compliance with evolving regulations, such as the DSCSA, requires substantial capital investment, which can strain resources. Additionally, the complexity of managing global supply chains, with varying regional regulations and customs requirements, can lead to delays and increased costs. Finally, concerns about loss of control when outsourcing logistics may deter some companies, particularly those handling high-value or sensitive products like biologics transport or cell and gene therapy logistics.

Choosing the Best Healthcare 3PL Provider:

Selecting the right Healthcare 3PL provider is a strategic decision that requires careful evaluation of several factors to ensure alignment with business objectives and regulatory requirements. Industry experts should consider the following criteria:

Regulatory Compliance and Certifications: Ensure the provider is GDP compliant and GMP certified, with a proven track record of adhering to global standards. Verify their compliance with drug serialization mandates, such as DSCSA or FMD, and their ability to provide validated documentation. For example, DHL’s acquisition of CryoPDP in March 2025 enhanced its GDP-compliant capabilities for temperature-sensitive pharmaceuticals, making it a strong contender in the market.

Specialized Capabilities: Assess the provider’s expertise in biologics transport and cell and gene therapy logistics, particularly their cold chain infrastructure and real-time monitoring systems. Providers with cryogenic storage and ultra-low temperature capabilities are essential for advanced therapies. For instance, FedEx’s partnership with pharmaceutical manufacturers expanded its cold-chain services for biologics and mRNA vaccines.

Technology and Transparency: Look for providers with advanced IT systems for drug serialization, track-and-trace capabilities, and real-time visibility. AI-driven analytics and IoT integration can optimize routes and enhance supply chain efficiency. DHL’s Life Sciences Innovation Hub integrates AI-based temperature monitoring, setting a benchmark for technological innovation.

Global Reach and Scalability: Choose a provider with a robust global network to handle cross-border logistics, especially for regions with stringent regulations. Providers like UPS Healthcare and Kuehne+Nagel, which expanded their GDP-compliant facilities in Asia, offer scalability for growing companies.

Customized and Patient-Centric Solutions: Prioritize providers offering tailored services, such as last-mile delivery for DTP models or clinical trial logistics. Their ability to adapt to specific product requirements, such as biologics transport, is critical.

Proven Track Record and Partnerships: Evaluate the provider’s experience with similar clients and their industry reputation. Strategic partnerships, such as Cryoport’s collaboration with BioTherapies in October 2023 for cell and gene therapy logistics, indicate reliability and innovation.

By aligning these criteria with organizational needs, companies can select a Healthcare 3PL provider that ensures compliance, efficiency, and product integrity while supporting strategic goals in healthcare supply chain management.

Healthcare 3PL (Third-Party Logistics) Market Trends:

The Healthcare 3PL market is evolving rapidly, driven by technological advancements and the need for efficient supply chain visibility. IoT in healthcare is transforming logistics by enabling real-time tracking of temperature-sensitive pharmaceuticals and biologics. For instance, DHL’s Life Sciences Innovation Hub integrates IoT sensors to monitor conditions during transit, ensuring product integrity.

AI for logistics is another key trend, optimizing route planning and demand forecasting. In January 2025, FedEx introduced AI-driven tools to enhance delivery efficiency for vaccines and advanced therapies, reducing delays. Similarly, predictive analytics is being leveraged to anticipate supply chain disruptions, with UPS Healthcare using it to streamline cold chain operations.

Blockchain supply chain solutions are gaining traction for secure, transparent, real-time tracking. Kuehne+Nagel implemented blockchain to ensure compliance with drug serialization mandates, enhancing traceability.

Finally, automated warehouse systems are improving efficiency. McKesson’s InspiroGene unit, launched in October 2024, uses robotics for precise inventory management of cell and gene therapies. These trends underscore the industry’s shift toward technology-driven, patient-centric logistics solutions.

Healthcare 3PL (Third-Party Logistics) Market Drivers:

Rising Biologics Demand: The rising biologics demand is a significant driver of the Healthcare 3PL market, as biologics like monoclonal antibodies, vaccines, and cell and gene therapies require specialized logistics solutions. These products are highly sensitive to temperature and environmental conditions, necessitating advanced cold chain infrastructure and supply chain resilience. The complexity of biologics transport demands 3PL providers with expertise in cryogenic storage and real-time monitoring to ensure product efficacy. For instance, UPS Healthcare expanded its ultra-low temperature storage facilities in the U.S. and Germany to support the growing need for biologics and advanced therapies, reflecting the industry’s response to this demand. Additionally, the shift toward personalized medicine, such as cell and gene therapies, further amplifies the need for tailored logistics, pushing companies to partner with 3PL providers capable of ensuring compliance and precision in global distribution networks.

Growth of E-commerce Pharma: The expansion of e-commerce pharma is reshaping the Healthcare 3PL market by driving demand for direct-to-patient (DTP) delivery and last-mile logistics. Online pharmacies and telehealth platforms are increasing access to medications, requiring 3PL providers to offer efficient, patient-centric solutions while maintaining supply chain resilience. This trend is fueled by consumer demand for convenience and the rise of decentralized clinical trials, which rely on 3PLs for the timely delivery of trial materials to patients’ homes. In October 2024, McKesson launched InspiroGene, a dedicated unit for DTP logistics supporting cell and gene therapies, highlighting the growing importance of e-commerce pharma. Moreover, stringent regulations like the U.S. Drug Supply Chain Security Act mandate secure tracking, pushing 3PLs to adopt advanced technologies like blockchain to ensure compliance and transparency in e-commerce-driven pharmaceutical distribution.

Stringent Regulatory Requirements: Stringent regulations, such as Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP), are propelling the Healthcare 3PL market by necessitating specialized expertise in compliance. Regulatory bodies worldwide enforce strict guidelines to ensure pharmaceutical products remain safe and effective throughout the supply chain. This includes mandates for drug serialization to combat counterfeiting and ensure traceability, as seen in the EU Falsified Medicines Directive. 3PL providers with validated systems and supply chain resilience are critical to meeting these standards. DHL’s Life Sciences Innovation Hub introduced AI-driven compliance monitoring to align with global regulations, underscoring the industry’s focus on regulatory adherence. As regulations evolve, healthcare companies increasingly rely on 3PLs to navigate complex compliance landscapes, particularly for cross-border logistics involving rising biologics demand.

Healthcare 3PL (Third-Party Logistics) Market Restraints:

High Operational Costs: The Healthcare 3PL market faces significant challenges due to high operational costs, which stem from the need for specialized infrastructure and compliance with stringent regulations. Maintaining GDP-compliant facilities, temperature-controlled fleets, and validated IT systems for drug serialization requires substantial capital investment. For instance, cold chain logistics for biologics and cell therapies demand advanced cryogenic storage and real-time monitoring, escalating expenses. Smaller 3PL providers often struggle to compete with larger firms like UPS or DHL, which have the resources to invest in such infrastructure. In 2024, Kuehne+Nagel highlighted the rising costs of expanding its GDP-compliant facilities in Asia to meet regulatory demands, illustrating this challenge. These costs can limit scalability and deter new entrants, ultimately constraining market growth and innovation in specialized logistics services.

Complexity of Global Supply Chains: The complexity of global supply chains poses a significant restraint for the Healthcare 3PL market, as varying regional regulations, customs requirements, and logistical challenges create inefficiencies. Stringent regulations like the DSCSA and EU FMD differ across jurisdictions, complicating cross-border logistics for pharmaceuticals and biologics. Additionally, geopolitical disruptions and trade barriers can delay shipments, impacting supply chain resilience. For example, in 2025, it was noted that challenges in navigating diverse regulatory frameworks for biologics transport across Asia and Europe required significant coordination. This complexity increases operational risks and costs, particularly for high-value products like cell and gene therapies, where delays can compromise product integrity. Healthcare companies may hesitate to outsource critical logistics functions, fearing loss of control in such intricate global networks, thus limiting the adoption of 3PL services.

Healthcare 3PL (Third-Party Logistics) Market Segmentation Analysis:

Pharmaceuticals are expected to grow significantly: The Pharmaceuticals segment is the largest in the Healthcare 3PL market due to the high volume and complexity of pharmaceutical logistics, encompassing prescription drugs, biologics, and advanced therapies like cell and gene therapies. This segment requires stringent temperature control, regulatory compliance (e.g., Good Distribution Practice), and drug serialization to ensure product safety and traceability. The rise in biologics and personalized medicine has intensified demand for specialized cold chain solutions and real-time monitoring. For instance, UPS Healthcare expanded its cryogenic storage capabilities in the U.S. and Germany to support pharmaceutical logistics, particularly for biologics and vaccines, highlighting the segment’s dominance. Additionally, the global expansion of pharmaceutical supply chains, driven by increasing demand in emerging markets, further fuels the need for 3PL providers with expertise in cross-border compliance and efficient distribution, solidifying Pharmaceuticals as the leading product type in the market.

By Service Type, the Transportation Management segment is gaining traction: Transportation Management is the most critical service type in the Healthcare 3PL market, as it ensures the safe and timely delivery of temperature-sensitive and high-value healthcare products. This segment includes managing cold chain logistics, route optimization, and compliance with regulations like the U.S. Drug Supply Chain Security Act. Advanced technologies, such as IoT for real-time tracking and AI for predictive analytics, are increasingly integral to this service. FedEx introduced AI-driven tools to enhance transportation efficiency for pharmaceuticals and vaccines, reducing delays and ensuring compliance. The segment’s prominence is driven by the need for specialized transport solutions for biologics, vaccines, and cell therapies, which require precise temperature control and rapid delivery to maintain efficacy, making Transportation Management a cornerstone of healthcare logistics.

By Delivery Speed, the Express Delivery segment is anticipated to rise rapidly: Express Delivery dominates the Healthcare 3PL market’s delivery speed segment due to the time-sensitive nature of many healthcare products, particularly vaccines, biologics, and cell and gene therapies. This segment prioritizes rapid, often same-day or next-day, delivery to ensure product integrity and meet patient needs, especially in direct-to-patient models and decentralized clinical trials. The demand for Express Delivery has surged with the rise of e-commerce pharma and personalized medicine. For example, in October 2024, McKesson’s InspiroGene unit launched specialized express delivery services for cell and gene therapies, emphasizing speed and compliance. Providers like DHL and UPS leverage advanced tracking and cold chain capabilities to support this segment, ensuring products reach their destination without compromising quality, making Express Delivery critical for urgent healthcare logistics.

Healthcare 3PL (Third-Party Logistics) Market Key Developments:

In April 2025, UPS announced plans to acquire Canada-based AHG, a specialized supply chain management company for the healthcare sector. This acquisition significantly strengthens UPS Healthcare's cold chain and complex logistics capabilities, especially for high-value biopharma products and temperature-sensitive solutions in North America. The move reinforces UPS's global strategy to become a premier provider for complex healthcare logistics, integrating AHG's network, temperature-controlled facilities, and specialized cold chain transport into its existing offerings.

In October 2024, McKesson Corporation introduced Inspirogene, a specialized business unit and platform focused on facilitating the commercialization and logistics of complex cell and gene therapies. This is more than a standard service; it is a dedicated, integrated supply chain solution encompassing logistics, specialty distribution, and patient services. The launch is a focused effort to address the unique logistical challenges—including chain of identity and chain of custody—of these ultra-personalized medicines, providing manufacturers with a streamlined path to market.

Healthcare 3PL (Third-Party Logistics) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 88.293 billion |

| Total Market Size in 2030 | USD 120.631 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Service Type, Delivery Speed, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Healthcare 3PL (Third-Party Logistics) Market Segmentations:

By Product Type

Pharmaceuticals

Medical Devices & Equipment

Vaccines

Personal Healthcare Products

By Service Type

Transportation Management

Warehousing & Distribution

Freight Forwarding

Value-Added Services

By Delivery Speed

Express Delivery

Regular Delivery

By End-User

Pharmaceutical companies

Medical Device Manufacturers

Hospitals and Clinics

Pharmacies and Retail

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

South Korea

Australia

India

Indonesia

Thailand

Others