Report Overview

Healthcare Cybersecurity Market Size, Highlights

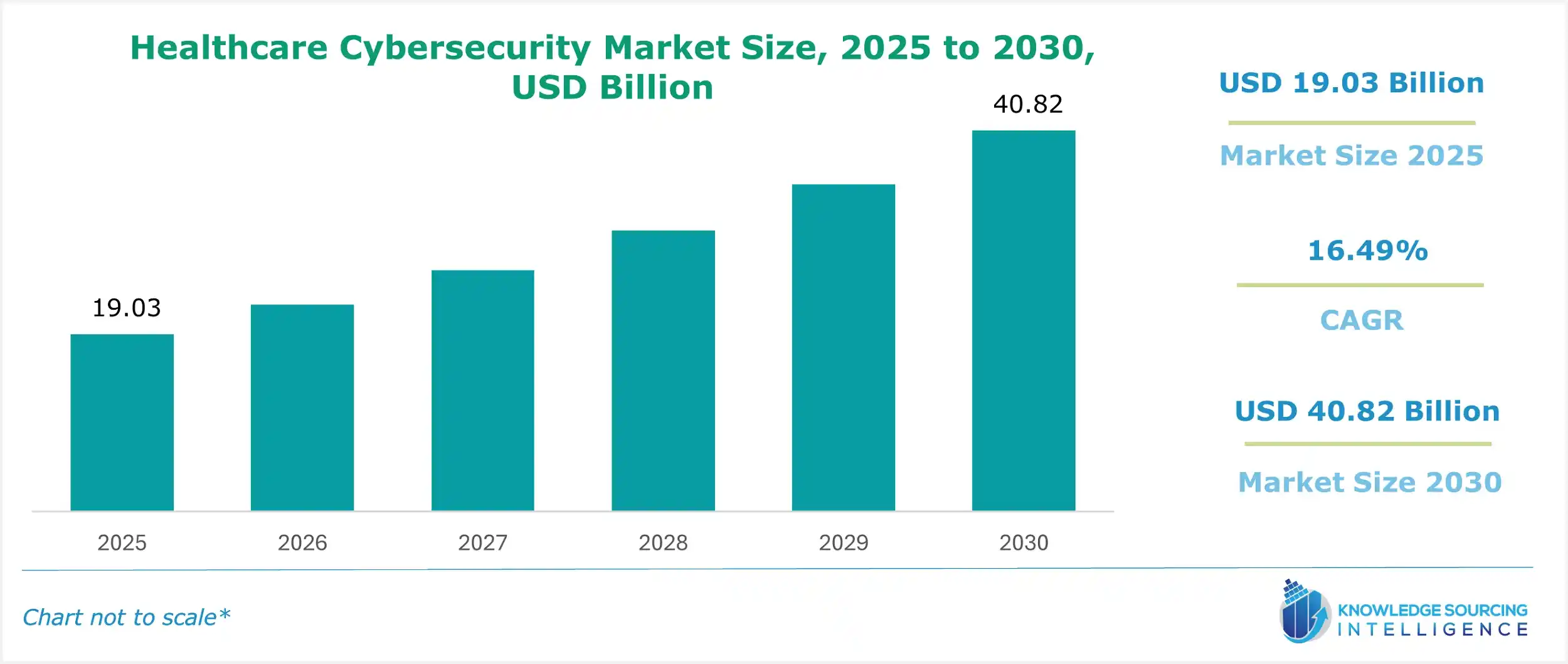

Healthcare Cybersecurity Market Size:

The healthcare cybersecurity market is projected to grow at a CAGR of 16.49% to be worth US$40.82 billion in 2030 from US$19.03 billion in 2025.

Demand for electronic medical records and virtual information systems expanding with growing focus on digitalization in healthcare. As medical records contain a lot of information that can be used for identity theft and fraud, personal health information possesses a high value on the black market. The proliferation of cyber threats is thus a serious concern, driving the healthcare cybersecurity market growth. Other growth factors are the availability of a specialized skilled workforce, robust R&D demanding big data, and digital technology penetration in emerging nations.

Healthcare Cybersecurity Market Growth Drivers:

- Increasing frequency and complexity of cyberattacks to drive market growth.

The healthcare sector is becoming increasingly reliant on internet-connected technologies —from clinical data to radiology devices for providing better care delivery by facilitating data integration, patient involvement, and medical assistance. However, these systems are frequently susceptible to cyberattacks that steal medical data, hijack equipment, or shut down facilities for ransom. According to the U.S. Department of Health and Human Services’ Office for Civil Rights (OCR), 677 major breaches affected over 182.4 million individuals in 2024 alone, with the Change Healthcare ransomware attack in February 2024 compromising 100 million Americans’ data. This attack disrupted insurance verification and payment systems nationwide, highlighting the healthcare sector’s vulnerability. The increasing frequency and complexity of cyberattacks are the key drivers of the healthcare cybersecurity market growth.

- Technological advancement being incorporated in cybersecurity systems to offer opportunities.

The growing demand for cloud-based security systems in the healthcare industry, the expanding usage of smartphones and connected devices, and the surging utilization of 5G technology are assisting the market growth during the forecast period. In June 2024, Palo Alto Networks and Accenture expanded their collaboration, offering AI-driven threat detection and Zero Trust architecture to counter ransomware and IoT vulnerabilities in healthcare.

- Increasing regulatory focus on cybersecurity to facilitate market growth.

The increasing regulatory focus on cybersecurity in the healthcare sector is also expected to provide opportunities for the market players. For e.g., the December 2024 Health Care Cybersecurity and Resiliency Act modernizes HIPAA, mandating incident response plans post-Change Healthcare breach. The U.S. introduced the Health Care Cybersecurity and Resiliency Act, a bipartisan bill to modernize HIPAA and mandate cybersecurity incident response plans, reflecting heightened regulatory focus post-Change Healthcare breach.

Healthcare Cybersecurity Market Geographical Outlook:

Geographically, North America is expected to dominate the global healthcare cybersecurity market over the projected period owing to the expanding number of cybercrimes, the presence of major market players, and regulatory support in the region. For instance, in February 2024, the cyberattack on Change Healthcare’s underscored North America’s dominance as a target, driving demand for cybersecurity solutions in the region. The Asia-Pacific healthcare cybersecurity market is expected to experience high growth.

The global Healthcare Cybersecurity Market report provides a comprehensive analysis of the industry landscape, delivering strategic and executive-level insights supported by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It explores demand across various cybersecurity technologies and systems, such as identity and access management, antivirus solutions, DDoS mitigation, and risk management tools, while also examining applications and key end-user segments like pharmaceutical enterprises, health insurance sectors, hospitals, and laboratories. Additionally, the report evaluates technological advancements, critical government policies, regulatory frameworks, and macroeconomic factors, offering a holistic perspective of the market

Healthcare Cybersecurity Market Segmentations:

Healthcare Cybersecurity Market Segmentation by type of threat:

The market is analyzed by type of threat into the following:

Healthcare Cybersecurity Market Segmentation by solution:

The report analyzes the market by solution as below:

- Identity and Access Management

- Risk and Compliance Management

- Antivirus and Antimalware

- DDoS Mitigation

- Others

Healthcare Cybersecurity Market Segmentation by end-user:

The market is analyzed by end-user into the following:

- Pharmaceutical Enterprises

- Health Insurance Sector

- Hospitals

- Laboratories

Healthcare Cybersecurity Market Segmentation by regions:

The study also analyzed the Healthcare Cybersecurity Market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain and Others

- Middle East and Africa (Saudi Arabia, UAE and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Healthcare Cybersecurity Market Competitive Landscape:

The global Healthcare Cybersecurity Market features key players such as Broadcom (Symantec), Trend Micro Incorporated, Cisco, IBM, Kaspersky Lab, Fireeye Inc., Intel Corporation, GE Healthcare CrowdStrike, Imperva, CyberArk, Trellix among others.

Healthcare Cybersecurity Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different types of threats, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by solution, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-user segment, with historical revenue data and analysis across various segments.

- Healthcare Cybersecurity Market is also analyzed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario, and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players, and recent major developments undertaken by the companies to gain a competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure the most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for the purchase?

- The report provides a strategic outlook of the Healthcare Cybersecurity Market to the decision-makers, analysts, and other stakeholders in an easy-to-read format for making informed decisions.

- The charts, tables, and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and emails for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports to help cater to additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Healthcare Cybersecurity Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Healthcare Cybersecurity Market Size in 2025 | US$19.03 billion |

| Healthcare Cybersecurity Market Size in 2030 | US$40.82 billion |

| Growth Rate | CAGR of 16.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Healthcare Cybersecurity Market |

|

| Customization Scope | Free report customization with purchase |