Report Overview

Hydrogen Compressor Market Size, Highlights

Hydrogen Compressor Market Size

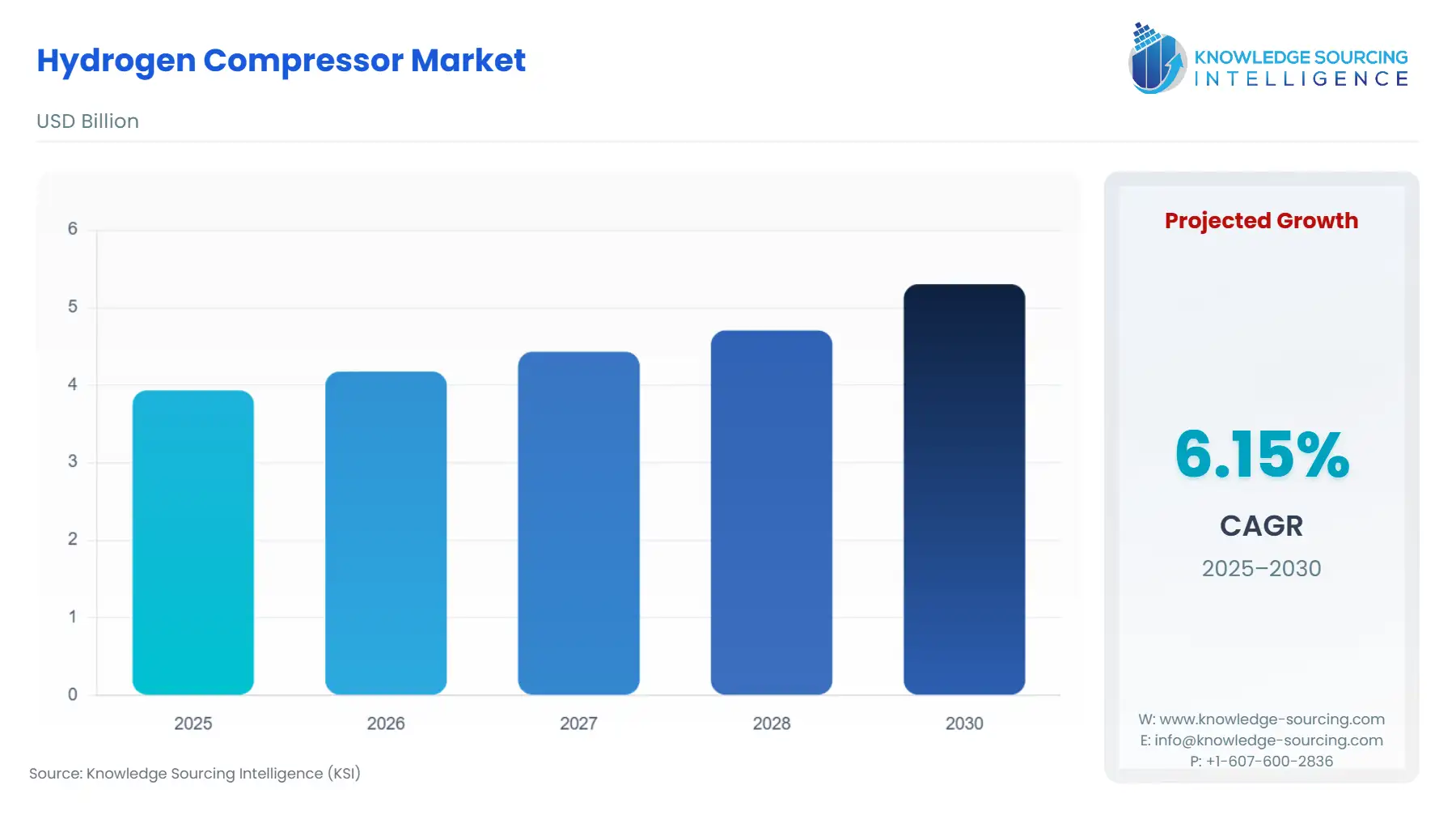

The hydrogen compressor market is expected to grow at a CAGR of 6.15%, reaching a market size of US$5.303 billion in 2030 from US$3.934 billion in 2025.

Hydrogen compressors play an important role in the storage, transportation, and distribution of hydrogen gas. The compressors help increase hydrogen pressure, enabling it to be kept in containers or transported within pipelines. These machines are essential for industries like energy, refueling stations, chemical plants, etc., for tapping into clean energy sources. Increasing demand for sustainable energy makes hydrogen compressors an imperative tool for the future in building hydrogen infrastructure and supporting a hydrogen economy.

This market is growing steadily and fast due to the increasing use of hydrogen for clean energy and industrial applications. Hydrogen will soon be one of the main fuels that people will depend on in the future. With this, additional opportunities for efficient compression technologies will arise, as these are used in almost all cases where hydrogen-fired burners generate the heat required for processing the reformer feed gases. Manufacturing firms are developing highly efficient systems by making the exhaust waste heat recoverable to perform better at reduced costs.

Hydrogen Compressor Market Growth Drivers:

- The growing demand for clean energy is stimulating market growth.

The global transition to clean energy will require reducing emissions from fossil fuels to establish hydrogen as a major sustainable fuel. In both industry and state emissions reduction efforts, hydrogen is important as an eligible alternative, particularly for transportation, power plants, and industrial manufacturing. However, the full potential of hydrogen can only be achieved when compression works efficiently.

Indeed, the gas is compressed primarily to store, carry, and use in various applications, such as fuel cells and industrial processes. Hydrogen refueling stations and the large-scale storage systems for energy play a vital role in those locations as they fuel cell vehicles with high-pressure hydrogen and store it for the long term. Energy-efficient and reliable hydrogen compressors are necessary for developing more hydrogen economies and growing green energy initiatives that increase this demand.

- Increasing adoption of fuel cell electric vehicles (FCEVs) is accelerating the market expansion.

The growing popularity of Fuel Cell Electric Vehicles (FCEVs) requires reliable hydrogen refueling infrastructure. Thus, efficient power requires hydrogen storage at a pressure of about 700 bar. To greatly help store the hydrogen, it must be compressed using a hydrogen compressor until it's time to be dispensed into an FCEV refueling station.

The increasing number of FCEVs is creating a demand for high-pressure hydrogen fueling that hydrogen filling stations must accommodate. These compressors are beneficial because they provide for the safe storage and dispensing of hydrogen under the correct pressure for quicker and more effective refueling of vehicles. According to the California Air Resources Board, California's FCEV registrations have grown steadily, reaching 14,429 as of April 2024. However, growth has slowed, with only 1,436 new registrations from April 2023 to April 2024, compared to 1,859 in the previous year.

With the growing transition to cleaner transportation systems, hydrogen-powered vehicles will be the next best alternative as demand for FCEVs rises. This entails an inclination towards bolstering hydrogen infrastructure.

Hydrogen Compressor Market Restraints:

- Infrastructure & technological limitations can hamper the market growth.

The hydrogen compressor market is facing two major challenges: the absence of infrastructural links and technological limitations. A comprehensive hydrogen infrastructure is challenging to establish because it requires cooperation among governments, industries, and the private sector, making the process time-consuming and difficult. Without a strong network, hydrogen is unlikely to achieve significant energy utilization.

Second, enhancing technology to develop suitable hydrogen compressor systems for various applications is another major challenge. The technology currently in use makes it difficult for practical industrial usage. Hence, significant investment in research and development is required to find more efficient solutions that are better suited to large-scale industrial use.

Integrating hydrogen compressors with existing systems also involves those technical and time-consuming processes. The advancement of hydrogen as an energy source requires overcoming multiple challenges through technological innovation and infrastructure development.

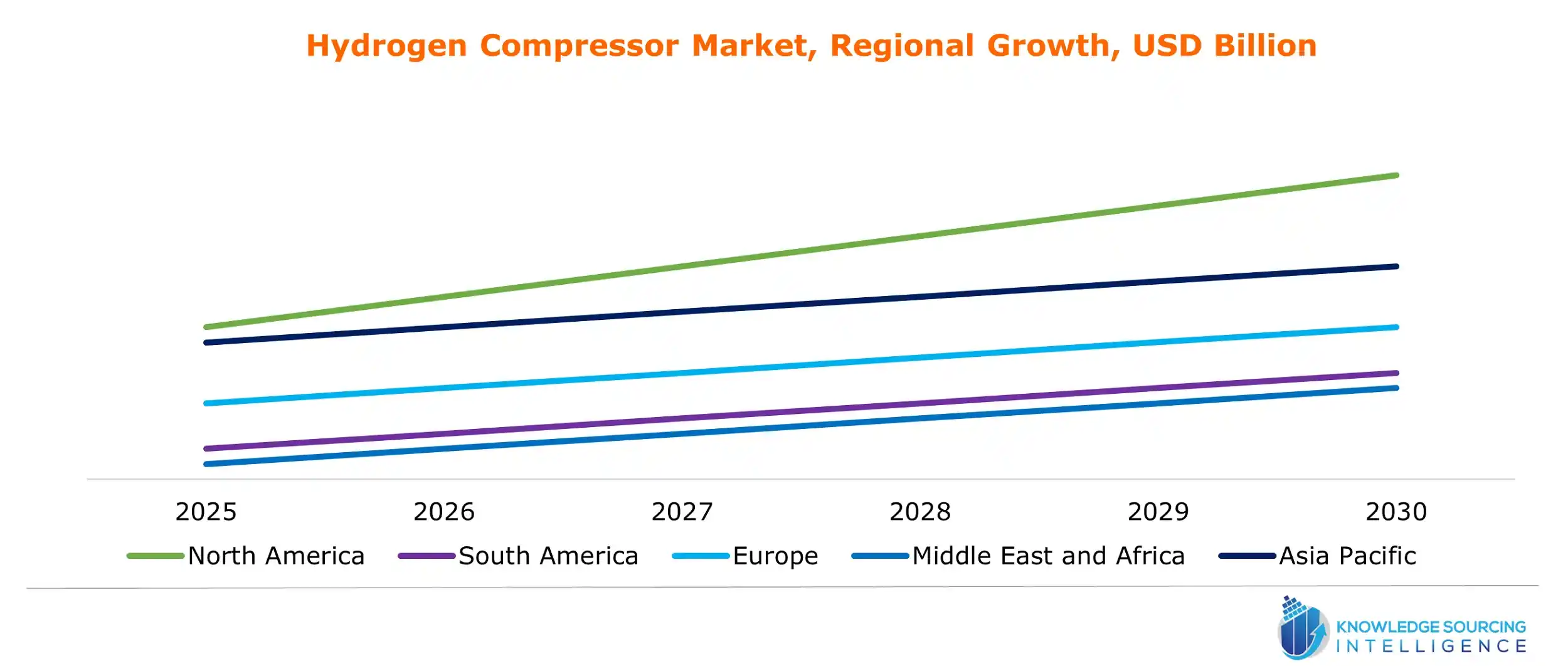

Hydrogen Compressor Market Geographical Outlook:

- North America will be the fastest-growing region during the forecast period

North America is poised for a positive expansion, which will position it as an important player in the global market for hydrogen compressors. Major regional countries are pouring considerable investment into the production, storage, and distribution of hydrogen to keep pace with the intensifying energy demands and growing carbon emissions. The development of FCEVs is worth noting, as it is rapidly increasing the need for an expanding network of hydrogen refueling stations, one that is tied in a big way to the efficiency of hydrogen compression technology.

The Hydrogen Shot program aims to lower the cost of clean hydrogen to just $1 per kilogram by 2031. This would trigger a fivefold increase in hydrogen use to 50 million metric tons by 2050 in alignment with the National Clean Hydrogen Strategy and Roadmap under the Bipartisan Infrastructure Law. Although the goal would imply an extension of the existing hydrogen markets, new markets would also open up, supporting economic growth and job creation. With DOE and private capital, the business will create around 100,000 jobs across the sectors by 2030, accelerating the clean energy transition.

Given the emerging strategic position of hydrogen in North America's clean energy portfolio, the need for advanced, reliable hydrogen compressors is positioned to grow, hence boosting its shift toward sustainable energy solutions.

Hydrogen Compressor Market Recent Developments:

- In April 2024, MITSUI E&S Co., Ltd. unveiled a high hydrogen flow compression system intended to be utilized for hydrogen station facilities and synthesis and production systems. This gas compressor can compress hydrogen up to 50 MPa and a 95 kg/h flow rate, thereby providing a more efficient solution for hydrogen infrastructure.

- In January 2024, Linde started its operation to supply clean hydrogen and captured CO2 to Celanese, one of the world's leading specialty materials and chemical companies.

List of Top Hydrogen Compressor Companies:

- Linde plc

- Air Products and Chemicals, Inc.

- Haskel International

- PDC Machines

- Andreas Hofer Hochdrucktechnik GmbH

Hydrogen Compressor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Hydrogen Compressor Market Size in 2025 | US$5.303 billion |

| Hydrogen Compressor Market Size in 2030 | US$3.934 billion |

| Growth Rate | CAGR of 6.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Hydrogen Compressor Market |

|

| Customization Scope | Free report customization with purchase |

The Hydrogen Compressor Market is analyzed into the following segments:

- By Technology

- Single-stage

- Multi-stage

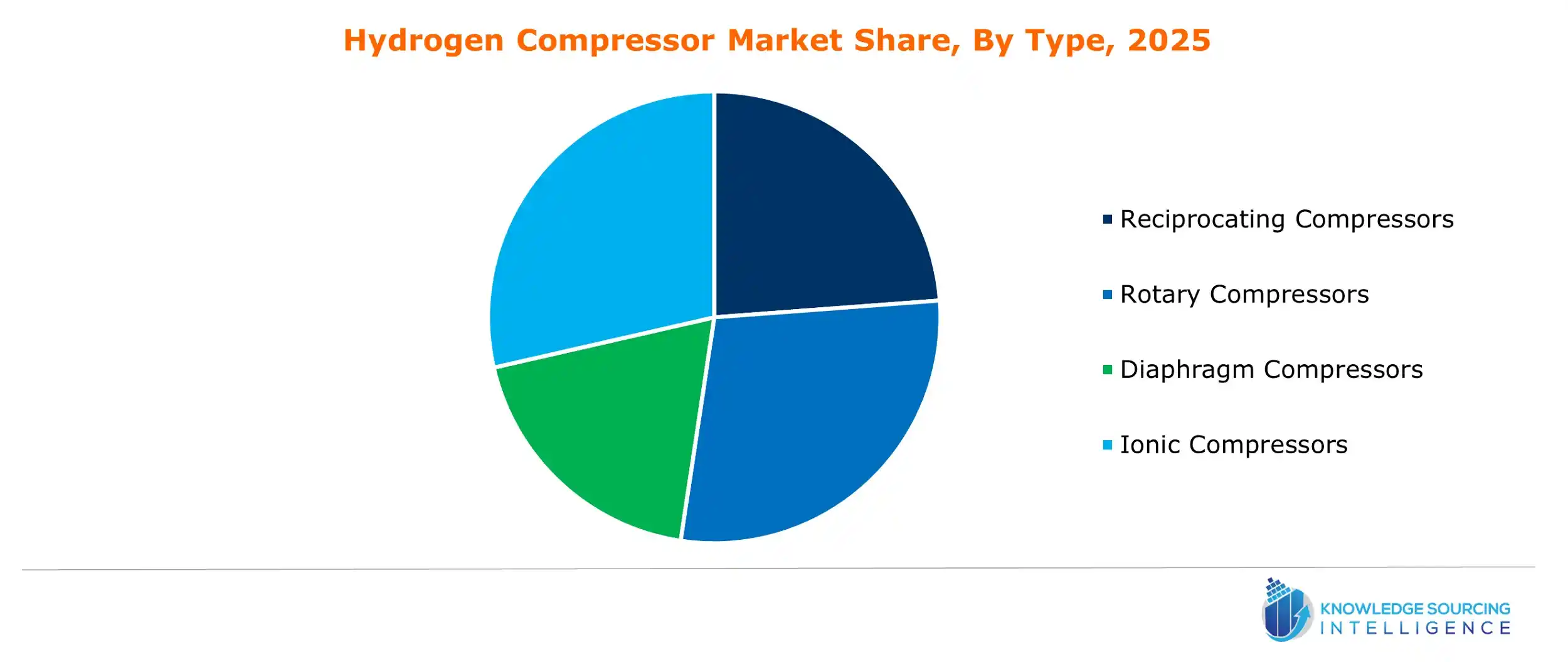

- By Type

- Reciprocating Compressors

- Rotary Compressors

- Diaphragm Compressors

- Ionic Compressors

- By Application

- Oil & Gas

- Energy & Power

- Chemical

- Industrial

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America

Navigation

- Hydrogen Compressor Market Size

- Hydrogen Compressor Market Key Highlights:

- Hydrogen Compressor Market Growth Drivers:

- Hydrogen Compressor Market Restraints:

- Hydrogen Compressor Market Geographical Outlook:

- Hydrogen Compressor Market Recent Developments:

- List of Top Hydrogen Compressor Companies:

- Hydrogen Compressor Market Scope: