Report Overview

Image Recognition Market Report Highlights

Image Recognition Market Size:

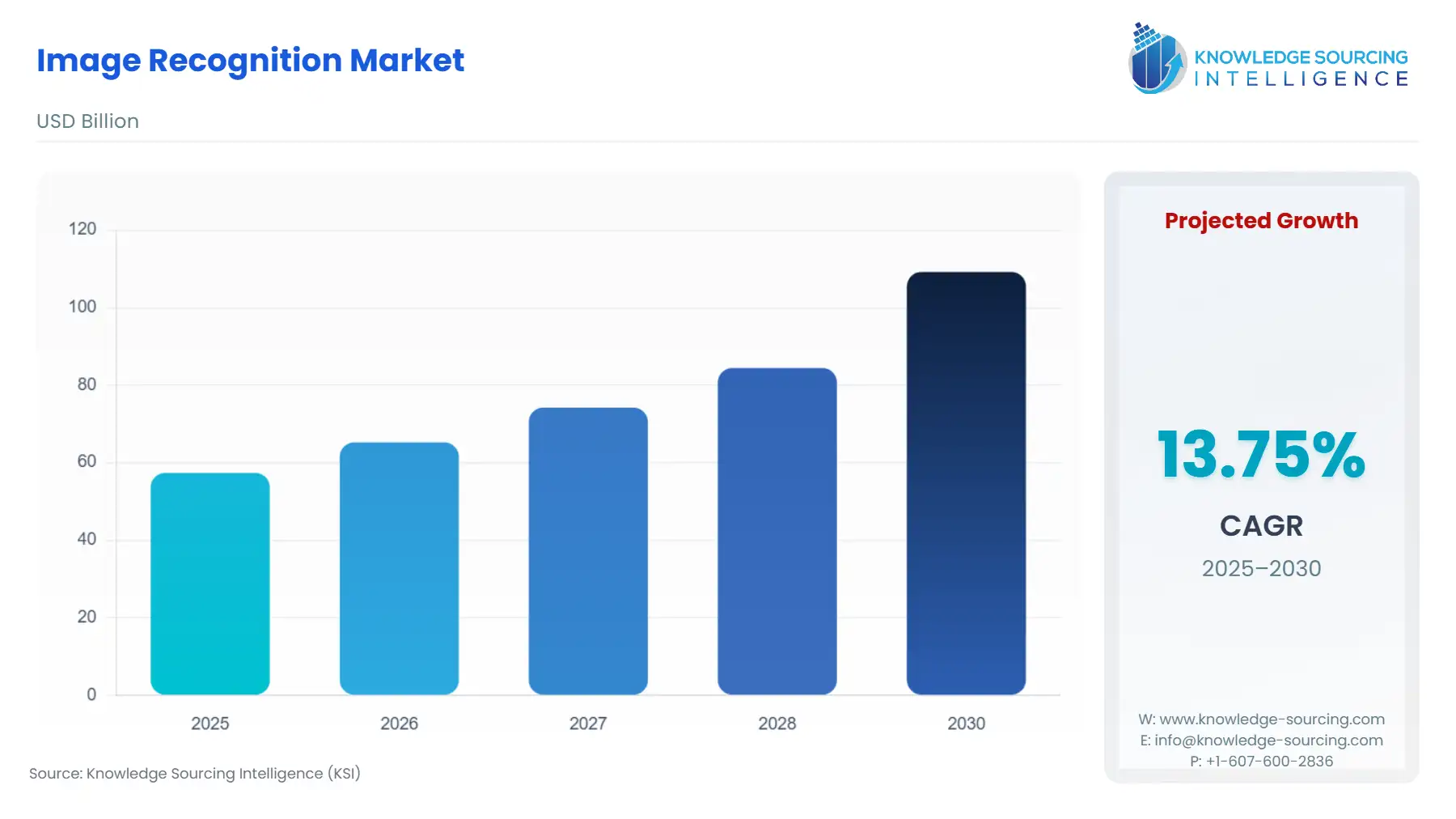

The Image Recognition Market will soar from USD 57.360 billion in 2025 to USD 109.236 billion by 2030, fueled by a 13.75% compound annual growth rate (CAGR).

Introduction to the Image Recognition Market:

Image recognition, a subset of artificial intelligence (AI) and computer vision, enables systems to identify, interpret, and analyze visual data from images or videos. By leveraging advanced algorithms, neural networks, and machine learning, image recognition technology processes visual inputs to detect objects, faces, patterns, or scenes with increasing accuracy. This technology has become integral to industries ranging from healthcare and automotive to retail and security, transforming operational efficiencies and enabling innovative applications. As businesses and governments increasingly rely on data-driven decision-making, the image recognition market is experiencing rapid growth, driven by technological advancements and widespread adoption across sectors.

Image recognition technology relies on deep learning models, particularly convolutional neural networks (CNNs), to process and classify visual data. These systems are trained on vast datasets to recognize patterns and features, enabling applications such as facial recognition, object detection, and automated image tagging. The technology’s versatility has led to its integration into diverse sectors. In healthcare, image recognition aids in medical imaging analysis, such as detecting tumors in radiology scans. In automotive, it powers autonomous driving systems by identifying road signs, pedestrians, and obstacles. Retail leverages image recognition for inventory management and personalized customer experiences, while security applications include surveillance and biometric authentication.

The global demand for image recognition is fueled by the proliferation of AI-driven solutions and the increasing availability of visual data from smartphones, cameras, and IoT devices. According to a 2025 report from the International Data Corporation (IDC), global spending on AI, including image recognition technologies, is projected to surpass $110 billion by 2026, reflecting the growing investment in vision-based AI solutions. This growth is underpinned by the technology’s ability to enhance automation, improve decision-making, and unlock new business models.

Image Recognition Market Drivers:

- Advancements in AI and Deep Learning

Continuous improvements in artificial intelligence (AI), particularly deep learning, are a primary driver of the image recognition market. Convolutional neural networks (CNNs) and transformer-based models have significantly enhanced the accuracy and efficiency of image recognition systems. For example, Google’s Vision Transformer (ViT), introduced in 2021 and refined in subsequent years, has set new standards for image classification by leveraging attention mechanisms to process visual data more effectively. Similarly, Meta AI’s DINOv2 model, released in 2024, advances self-supervised learning, enabling models to learn from unlabelled data, reducing training costs, and improving scalability. These advancements enable real-time applications, such as autonomous driving and live video analysis, making image recognition viable for mission-critical systems. Additionally, the integration of generative AI with image recognition, as seen in OpenAI’s CLIP model updates, enhances multimodal capabilities, allowing systems to understand both images and text for more complex tasks. The rapid pace of innovation in AI architectures ensures that image recognition systems are becoming faster, more accurate, and accessible to a broader range of industries.

- Proliferation of Visual Data

The exponential growth of visual data from smartphones, social media platforms, and Internet of Things (IoT) devices is a significant catalyst for the image recognition market. According to Cisco’s 2025 Annual Internet Report, video content is expected to account for 82% of global internet traffic by 2026, driven by streaming services, video conferencing, and user-generated content. This surge in visual data necessitates advanced tools to process, analyze, and extract insights from images and videos. For instance, social media platforms like Instagram and TikTok rely on image recognition to moderate content, recommend posts, and enable features like augmented reality filters. In the IoT ecosystem, smart cameras in retail and manufacturing use image recognition to monitor inventory and detect defects, respectively. The availability of high-resolution cameras in consumer devices and the rise of 5G networks, which enable faster data transmission, further amplify the demand for image recognition solutions capable of handling large-scale visual datasets in real time.

- Industry-Specific Applications

The adoption of image recognition across diverse sectors is a major growth driver. In healthcare, image recognition enhances diagnostic accuracy by analyzing medical images such as X-rays, MRIs, and CT scans. Google Health’s AI tool for diabetic retinopathy screening, for example, has demonstrated high accuracy in detecting eye conditions, improving access to early diagnosis in underserved regions. In the automotive industry, image recognition is critical for autonomous driving systems. Companies like Tesla and Waymo use it to identify road signs, pedestrians, and obstacles, with Tesla’s Full Self-Driving (FSD) system processing millions of images daily to refine its algorithms. In retail, image recognition powers visual search, inventory management, and personalized customer experiences, as seen in Amazon’s Just Walk Out technology, which uses cameras to track purchases in cashier-less stores. These industry-specific applications demonstrate the technology’s versatility and its ability to address unique operational challenges, driving widespread adoption.

- Government and Security Initiatives

Governments worldwide are investing heavily in image recognition for public safety, security, and smart city initiatives. The European Union’s AI Act, finalized in 2024, provides a regulatory framework for deploying AI in high-risk applications like surveillance, encouraging the development of compliant image recognition systems. In China, smart cities leverage facial recognition for traffic management and public security, with systems processing real-time data from millions of cameras. Additionally, border control agencies in the United States and elsewhere use biometric systems powered by image recognition for identity verification, as evidenced by the U.S. Customs and Border Protection’s facial recognition program at airports. These initiatives highlight the growing role of image recognition in enhancing security and operational efficiency, supported by government funding and policy frameworks.

Image Recognition Market Restraints:

- Data Privacy and Ethical Concerns

The use of image recognition, particularly in facial recognition, raises significant privacy and ethical challenges. Public and regulatory scrutiny has intensified following controversies like the 2024 backlash against Clearview AI, which faced criticism for scraping billions of images from the internet to build its facial recognition database. Regulations such as the European Union’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on data collection, storage, and processing, limiting the scope of image recognition applications. For instance, the GDPR mandates explicit consent for processing biometric data, which complicates the deployment of facial recognition systems. Ethical concerns about surveillance and potential misuse, particularly in authoritarian regimes, further restrain market growth. Companies must invest in transparent data practices and ethical AI frameworks to address these concerns, which can increase costs and delay deployments.

- High Computational Costs

Developing and deploying image recognition models requires significant computational resources, including high-performance GPUs, TPUs, and cloud infrastructure. Training deep learning models on large datasets can cost millions of dollars, making it a barrier for smaller organizations. A 2025 McKinsey report highlights that AI infrastructure costs remain a challenge for mid-sized enterprises, which may lack the budget for advanced hardware or cloud services. Additionally, real-time image recognition applications, such as those in autonomous vehicles, require low-latency processing, necessitating expensive edge computing solutions like NVIDIA’s Jetson Orin platform. These costs can limit market access for smaller players and slow adoption in cost-sensitive industries.

- Bias and Accuracy Challenges

Image recognition systems are prone to biases in training data, which can lead to inaccurate or discriminatory outcomes. A 2023 study by the National Institute of Standards and Technology (NIST) found that some facial recognition algorithms exhibited higher error rates for individuals with darker skin tones or specific demographic characteristics, raising concerns about fairness and reliability. Addressing these biases requires diverse and representative datasets, which are difficult to curate and maintain. Furthermore, achieving high accuracy in complex environments, such as low-light conditions or crowded scenes, remains a technical challenge. Companies must invest in continuous model refinement and testing, which increases development time and costs, potentially hindering market expansion.

Image Recognition Market Segmentation Analysis:

- By Component, the software segment is witnessing considerable growth

Among the components—hardware, software, and services—software dominates the image recognition market due to its critical role in enabling image recognition capabilities. Image recognition software encompasses algorithms, machine learning models, and deep learning frameworks, such as CNNs and vision transformers, that process and analyze visual data. The dominance of software is driven by advancements in AI, particularly open-source frameworks like Meta AI’s DINOv2, which enhances self-supervised learning for image recognition tasks. These software solutions are highly scalable, supporting applications from facial recognition to object detection across industries. For instance, Google’s Vision AI platform provides cloud-based software tools for image classification and object detection, enabling businesses to integrate image recognition into their workflows. The rise of software-as-a-service (SaaS) models has further accelerated adoption, as companies can access pre-trained models without significant upfront investment. Additionally, software updates, such as OpenAI’s CLIP model enhancements in 2024, have improved multimodal capabilities, allowing systems to process both images and text for advanced applications like visual search. The flexibility, scalability, and continuous innovation in image recognition software make it the leading component, as it addresses diverse industry needs while reducing dependency on specialized hardware.

- By Deployment Model, cloud solutions are experiencing notable growth

In terms of deployment models, cloud-based solutions are the dominant segment in the image recognition market, driven by their scalability, cost-effectiveness, and ease of integration. Cloud deployment allows organizations to leverage powerful computing resources, such as GPUs and TPUs, without investing in on-premise infrastructure. Major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offer image recognition APIs, such as AWS Rekognition and Azure Computer Vision, which enable businesses to process large volumes of visual data in real time. The cloud model supports rapid deployment and scalability, making it ideal for industries like retail and healthcare, where real-time image analysis is critical. For example, AWS Rekognition is used in retail for inventory management and in security for facial recognition, processing millions of images daily. The rise of 5G networks, as noted in Cisco’s 2025 report, enhances cloud-based image recognition by enabling faster data transmission, supporting applications like autonomous driving and live surveillance. Furthermore, cloud solutions reduce maintenance costs and provide access to regular software updates, ensuring businesses stay at the forefront of AI advancements. The flexibility and accessibility of cloud deployment make it the preferred choice for organizations of all sizes.

- By End-User, the Communication and Technology sector is expanding rapidly

The Communication and Technology sector is the leading end-user segment in the image recognition market, driven by its extensive use of visual data processing for applications like content moderation, augmented reality (AR), and cybersecurity. Tech giants like Meta, Google, and ByteDance rely on image recognition to enhance user experiences on platforms such as Instagram, YouTube, and TikTok. For instance, Meta uses image recognition to power AR filters and moderate content, analyzing billions of images daily to detect inappropriate material. In telecommunications, image recognition supports network optimization by analyzing visual data from infrastructure inspections, as seen in Nokia’s AI-driven solutions for 5G networks. The sector also leverages image recognition for cybersecurity, with companies like Palo Alto Networks integrating it into threat detection systems to identify malicious content in visual data. The communication and technology sector’s dominance is further fueled by its access to vast datasets and computational resources, enabling rapid development and deployment of advanced image recognition models. The sector’s innovation-driven nature ensures it remains at the forefront of market growth.

Image Recognition Market Geographical Outlook:

- The North American market is growing substantially

North America, particularly the United States, Canada, and Mexico, is the leading region in the image recognition market, driven by its advanced technological infrastructure, high AI adoption rates, and significant investments in research and development. The U.S. hosts major players like Google, Amazon, and Microsoft, which drive innovation through platforms like Google Cloud Vision and AWS Rekognition. The region’s dominance is supported by substantial venture capital funding, with PitchBook reporting that AI startups in North America raised over $20 billion in 2024, a significant portion of which targeted computer vision and image recognition. In healthcare, North American institutions like the Mayo Clinic use image recognition for medical imaging analysis, improving diagnostic accuracy. The region’s robust regulatory environment, including frameworks like the U.S. AI Bill of Rights, fosters trust and adoption by addressing privacy and ethical concerns. Additionally, Canada’s AI research hubs, such as the Vector Institute, and Mexico’s growing tech ecosystem contribute to the region’s leadership. North America’s combination of technological innovation, investment, and supportive policies solidifies its position as the market leader.

Image Recognition Market Key Development:

- Klarna’s Shopping Lens: In October 2023, Swedish fintech company Klarna launched the Shopping Lens, an image recognition tool integrated into its app. This feature allows users to photograph products and find similar items on Klarna’s platform, enhancing visual search capabilities in the retail sector. Powered by advanced AI, Shopping Lens improves consumer experiences by streamlining product discovery and has driven the adoption of image recognition in e-commerce.

- AWS HealthLake Imaging: In November 2022, AWS launched Amazon HealthLake Imaging, a cloud-based service designed for healthcare imaging. This platform integrates image recognition to analyze medical images such as X-rays and MRIs, enabling faster and more accurate diagnoses.

Segmentation

- By Component

- Hardware

- Software

- Services

- By Deployment

- On-Premise

- Cloud

- By Enterprise Size

- Small

- Medium

- Large

- By Application

- Facial Recognition

- Object Recognition

- Optical Character Recognition (OCR)

- Others

- By End-User

- IT & Telecommunication

- BFSI

- Retail

- Government

- Media & Entertainment

- Healthcare

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Image Recognition Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Image Recognition Market Size in 2025 | US$53.550 billion |

| Image Recognition Market Size in 2030 | US$98.183 billion |

| Growth Rate | CAGR of 12.89% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Image Recognition Market |

|

| Customization Scope | Free report customization with purchase |

Our Best-Performing Industry Reports:

Navigation:

- Image Recognition Market Size:

- Image Recognition Market Highlights:

- Introduction to the Image Recognition Market:

- Image Recognition Market Drivers:

- Image Recognition Market Restraints:

- Image Recognition Market Segmentation Analysis:

- Image Recognition Market Geographical Outlook:

- Image Recognition Market Key Development:

- Image Recognition Market Segmentations:

- Image Recognition Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 10, 2025