Report Overview

India Additive Manufacturing Market Highlights

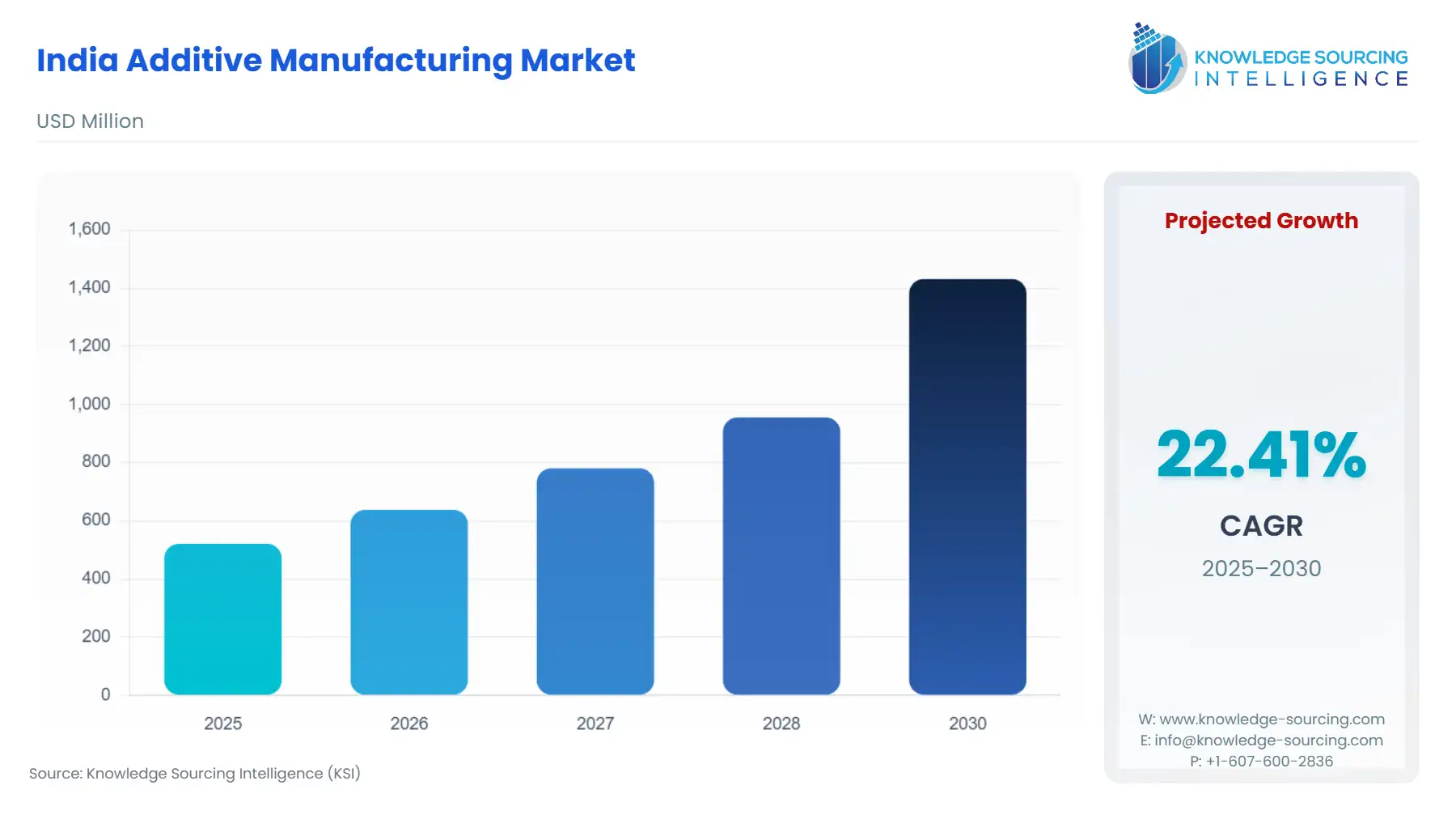

India Additive Manufacturing Market Size:

The India Additive Manufacturing Market is forecast to grow at a CAGR of 22.41%, climbing to USD 1.432 billion in 2030 from USD 0.521 billion in 2025.

The Indian Additive Manufacturing (AM) market is transitioning from a prototyping utility to a strategic industrial production tool, deeply aligning with the nation's Atmanirbhar Bharat (self-reliant India) and Industry 4.0 ambitions. The market is defined by a dichotomy: significant government impetus and a large addressable manufacturing base, counterbalanced by persistent challenges in localized material supply and workforce proficiency. Sectoral expansion is no longer confined to low-volume, high-complexity components but is broadening into tooling, medical devices, and even consumer goods, accelerating the need for industrial-scale, reliable AM systems and a robust service ecosystem.

India Additive Manufacturing Market Analysis:

- Growth Drivers

The formal release of the National Strategy on Additive Manufacturing (NSAM) propels demand across the ecosystem by setting tangible, high-level targets. The policy creates a direct need for specialized hardware and software by mandating the development of 50 India-specific technologies for material, machine, and software. This government-backed vision incentivizes academic-industry collaboration, driving demand for AM solutions in R&D and educational institutions for skilling the targeted 1 lakh new workers. Furthermore, the Make in India initiative strongly encourages domestic manufacturing, stimulating companies, particularly in aerospace and defense, to adopt AM for creating complex, indigenous parts, thereby directly increasing the necessity for high-end industrial systems. The rapidly growing healthcare sector, with its surging requirement for patient-specific implants and prosthetics, is a dedicated growth generator for the AM services segment, where customization is a core value proposition.

- Challenges and Opportunities

The primary challenge constraining market adoption is the high initial capital expenditure required for industrial AM machinery, which limits entry for many Indian SMEs. This high investment cost negatively impacts demand, shifting business towards service bureaus rather than proprietary machine ownership. Another constraint is the lack of standardized qualifications and certification norms for AM-produced components, which creates hesitancy in highly regulated sectors like aerospace, thus dampening demand for functional, end-use parts. Conversely, the opportunity lies in the leveraging of India's established IT and software ecosystem, which creates immediate high-growth demand for local software development in design for AM (DfAM), simulation, and printing process management. Additionally, the mandate to develop 100 new AM start-ups through the NSAM promises to democratize the technology, creating a long-term surge in demand for affordable desktop and entry-level industrial printers.

- Raw Material and Pricing Analysis

Additive Manufacturing is an intrinsically physical product market spanning hardware, materials, and finished parts. The raw material supply chain for advanced AM, particularly metal powders (e.g., Titanium, Aluminum, Nickel alloys), is characterized by significant import dependency. This reliance subjects the pricing of end-use parts to global commodity fluctuations, import duties, and complex logistics, resulting in a higher cost structure compared to traditional manufacturing inputs. Domestic metallurgy firms are increasingly working to produce AM-grade powders from existing steel and aluminum expertise, a trend that is starting to exert downward pressure on entry-level material costs and creating a nascent local supply chain. The high cost of specialized polymer and metal powders directly limits the mass-market requirement for AM in price-sensitive sectors like consumer goods, pushing their adoption towards high-value, low-volume applications.

- Supply Chain Analysis

The global AM supply chain is concentrated in key production hubs in North America and Europe for core hardware (industrial printers) and specialized software. India currently functions primarily as a consumer and service hub, creating a logistical dependency on international Original Equipment Manufacturers (OEMs) for machine spare parts and dedicated material streams. This dependency results in long lead times for machine maintenance and material replenishment, which negatively affects the need for AM as a reliable, high-throughput production method. However, AM's core benefit, local, on-demand production, acts as a powerful counter-force, offering resilience against global supply chain disruptions by shifting production closer to the point of consumption, a value proposition that is gaining traction in defense and MRO (Maintenance, Repair, and Overhaul) applications.

Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

India (Central) |

National Strategy on Additive Manufacturing (NSAM) / MeitY |

Directly boosts demand for domestic R&D, skills, and technology adoption by setting ambitious quantitative goals for technology development and global market share capture. |

|

India (Central) |

Defence Acquisition Procedure (DAP) / Ministry of Defence |

Indirectly increases demand for domestic, high-performance AM parts (especially metal) by mandating a preference for indigenous defense equipment, requiring rapid prototyping and complex geometry solutions. |

|

India (Central) |

SAMARTH Udyog Bharat 4.0 / Ministry of Heavy Industries |

Creates demand for AM awareness and adoption by funding experiential and demonstration centers across premier institutions, promoting Industry 4.0 technologies, and encouraging skills development. |

India Additive Manufacturing Market Segment Analysis:

- By Technology: Selective Laser Sintering (SLS)

Selective Laser Sintering (SLS) is a powder bed fusion technology that creates robust, functional plastic components without the need for support structures, making it highly efficient for complex geometries and nesting multiple parts in a single build. The primary growth driver for SLS in India is the transition from simple prototyping to small-batch production and end-use part manufacturing in the automotive and consumer electronics sectors. The material freedom of SLS (e.g., Nylon 12) to produce durable, isotropic parts meets the structural requirements for complex jigs, fixtures, and customized dashboard components in the automotive supply chain. This necessity is further amplified by the rapid design iteration cycle in Electric Vehicle (EV) development, where SLS offers a quick, cost-effective way to validate new battery enclosures and interior structures before committing to expensive injection molding tooling.

- By End-User Industry: Aerospace & Defense

The Aerospace & Defense (A&D) sector is the anchor for high-value AM demand, particularly for metal technologies like Powder Bed Fusion (PBF). The core growth driver is the compelling need for lightweighting, part consolidation, and supply chain agility in mission-critical applications. Indigenous defense programs, including the development of advanced aero-engines and fighter components, directly generate demand for AM to produce complex, high-strength parts in titanium and nickel alloys, often in low volumes. For instance, the adoption of Direct Metal Laser Sintering (DMLS) by entities like Hindustan Aeronautics Limited (HAL) for developing engine components signals a clear shift toward end-use AM parts. The technology's ability to create on-demand parts for MRO reduces long lead times associated with procuring obsolete or spare components from foreign OEMs, thereby ensuring high operational readiness.

India Additive Manufacturing Market Competitive Analysis:

The Indian Additive Manufacturing market features a hybrid competitive landscape with established global OEMs and aggressive domestic players. Competition is primarily focused on application-specific material development, technology localization, and the expansion of service bureau networks.

- Stratasys India: As a major global player, Stratasys maintains a dominant strategic positioning by focusing on a broad portfolio of Polymer AM technologies, including Fused Deposition Modeling (FDM) and PolyJet. Their key products target both the industrial and professional segments. In India, their strategy centers on collaborating with educational institutions and maintaining a strong network of resellers to capture the prototyping and educational market.

- Wipro 3D: This domestic entity is strategically positioned as an end-to-end additive manufacturing solutions provider, focusing on high-end industrial and metal AM services. Their key offerings are not limited to printing but extend into consulting, design for AM (DfAM), and post-processing, making them a crucial partner for companies in the aerospace and defense sectors that require rigorous quality assurance and certification. They leverage their existing large-scale IT and engineering services background to provide a holistic solution.

India Additive Manufacturing Market Developments:

- September 2025: UltiMaker, a leading global desktop 3D printing company, introduced its Secure Line portfolio to the Indian market, targeting high-security environments like defense, aerospace, and government sectors. This offering provides a certified, defense-grade 3D printing solution that ensures end-to-end data security and traceability across the entire workflow, from design file to final printed part. The launch emphasizes the company's commitment to supporting the "Make in India" initiative by enabling local, secure production of prototypes, tooling, and functional components where intellectual property protection is paramount. This move addresses a critical need in India's growing defense and strategic manufacturing segments.

- August 2025: Indian space tech startup Agnikul Cosmos achieved a landmark feat by successfully creating and launching a rocket featuring the world's largest single-piece 3D printed rocket engine. This technological breakthrough, integral to their Agnibaan rocket, underscores the maturity of indigenous metal additive manufacturing for mission-critical aerospace applications. The ability to print an entire engine, including the combustion chamber and nozzle, as one piece significantly reduces part count, assembly time, and potential failure points, positioning India as a global leader in utilizing AM for space propulsion systems.

India Additive Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.521 billion |

| Total Market Size in 2031 | USD 1.432 billion |

| Growth Rate | 22.41% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, End-User |

| Companies |

|

India Additive Manufacturing Market Segmentation:

- BY COMPONENT

- Hardware

- Software

- Services

- Material

- BY TECHNOLOGY

- Selective Laser Sintering (SLS)

- Laser Sintering (LS)

- Electron Beam Melting (EBM)

- Fused Disposition Modeling

- Stereolithography (SLA)

- BY END-USER INDUSTRY

- Aerospace & Defense

- Healthcare

- Automotive

- Construction

- Consumer

- Others