Report Overview

Industrial Tank Trucks Market Highlights

Industrial Tank Trucks Market Size:

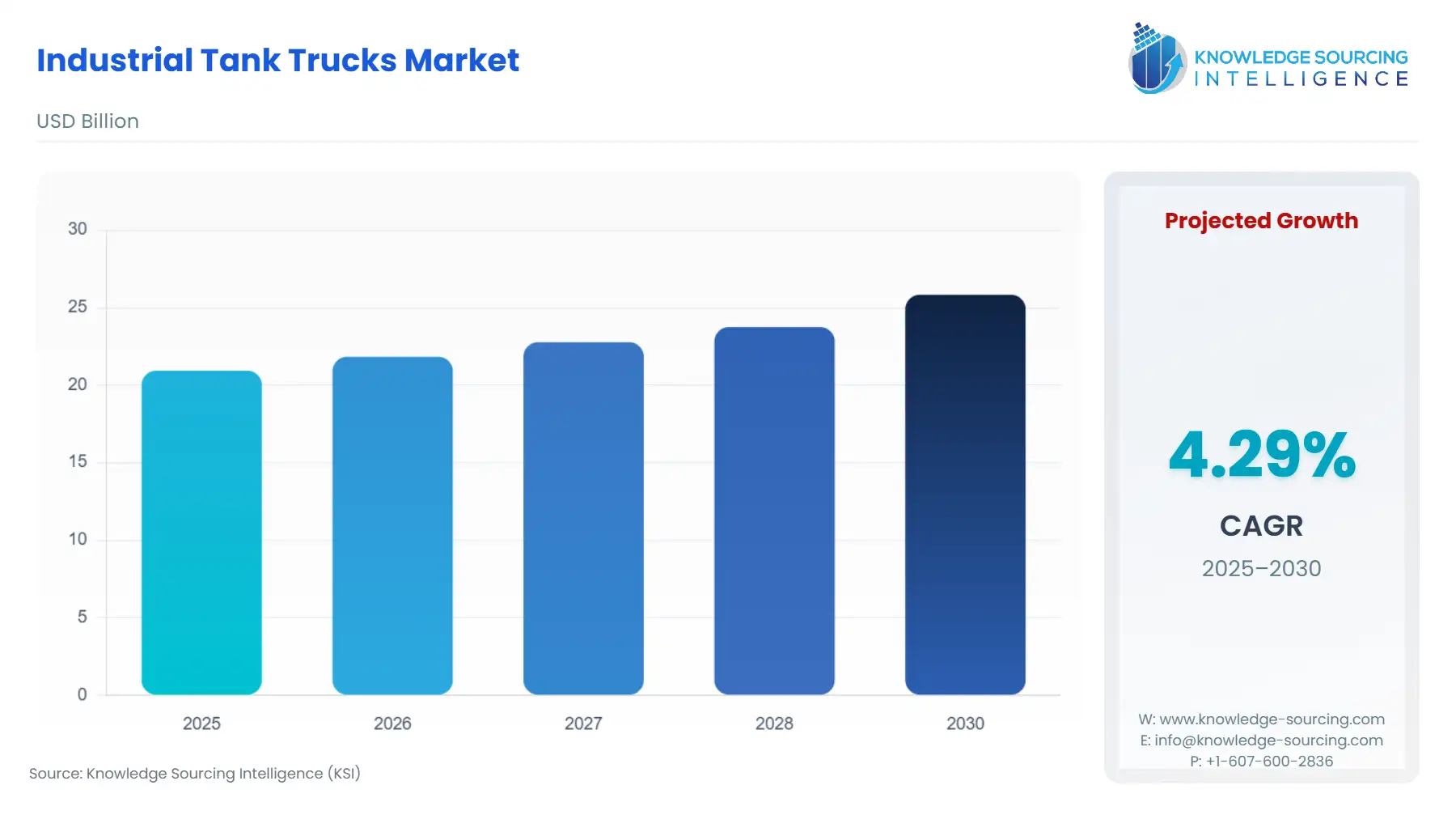

The Industrial Tank Trucks Market is expected to grow from USD 20.936 billion in 2025 to USD 25.834 billion in 2030, at a CAGR of 4.29%.

Industrial Tank Trucks Market Trends:

A tank truck is also known as a tanker truck and is used for the transport of oil, fuels and gases, dairy products, and chemicals for various industries. These trucks are basically characterized as large and small pickups. Both the large and small trucks cater to a variety of different applications. For the transport of gasoline and fuel to filling stations and materials such as liquid goods like molasses and milk large trucks are used. The construction of tank trucks depends on the products being hauled. The truck can carry multiple products at the same time if the tank is divided into sections from the inside into more compartments. This is used to carry different grades of gasoline. Small trucks are used for the delivery of liquefied petroleum gases to houses, commercial stores, and industries. Small trucks can carry approximately 1000 gallons under pressure conditions. The material used for their construction is lightweight steel so that more gallons are easily carried.

The demand from various industries like oil and gas, dairy, industrial chemicals industry, and other industries for vehicles such as tank trucks, which can transport bulk liquid materials of different types of liquid material at one time from one place to another in a short span of time to reduce costs and increase efficiency, is rising. This will boost the demand for these trucks and act as a driving factor for the tank truck market over the forecast period. Moreover, there are stringent government regulations regarding the transport of hazardous liquids and materials such as chemicals, and fuels that cause the release of dangerous pollutants like hydrocarbons into the air. This, coupled with the guidelines regarding the proper transport of liquid consumption of dairy products, is encouraging companies to employ these solutions and use these trucks for their operations, which will boost the demand for these trucks further, contributing to the growth of the market. Furthermore, the market players are involved in the market through investments and advancements to facilitate the growth of the tank truck market.

Industrial Tank Trucks Market Segment Analysis:

- Heavy Duty (more than 4000 gallons) to remain a key market segment during the forecast period

Based on capacity, heavy-duty is expected to hold a significant amount of market share in the market owing to the fact that most industries prefer this type of tank truck as it can carry a lot of liquid material from one place to another in a short span of time. This helps these companies cut down on costs and increase efficiency.

- Oil and Gas, and chemicals to hold a significant share

Based on end-user, oil and gas are expected to hold a significant market share owing to the increasing number of oil and gas operations coupled with the burgeoning demand for petroleum products. The chemical industry is also expected to hold a considerable market share aided by the demand for industrial chemicals from different industries.

- North America and the Asia Pacific are the key regional markets

Based on geography, North America is expected to hold a decent market share, which is attributable to the fact that the US is one of the largest oil consumers. The Asia Pacific region follows the North American region and holds good potential due to the increasing consumption of oil in major countries such as China, and India.

Industrial Tank Trucks Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 20.936 billion |

| Total Market Size in 2031 | USD 25.834 billion |

| Growth Rate | 4.29% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Capacity, Propulsion, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Industrial Tank Trucks Market Segmentations:

- By Capacity

- Small Duty (less than 1000 gallons)

- Medium Duty (1000 gallons-4000 gallons)

- Heavy Duty (more than 4000 gallons)

- By Propulsion

- Diesel

- Electric

- Others

- By End-User

- Oil and Gas

- Chemical

- Food and Beverages

- Water and Waste

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Taiwan

- Thailand

- Indonesia

- Others

- North America