Report Overview

IoT Node And Gateway Highlights

IoT Node And Gateway Market Size:

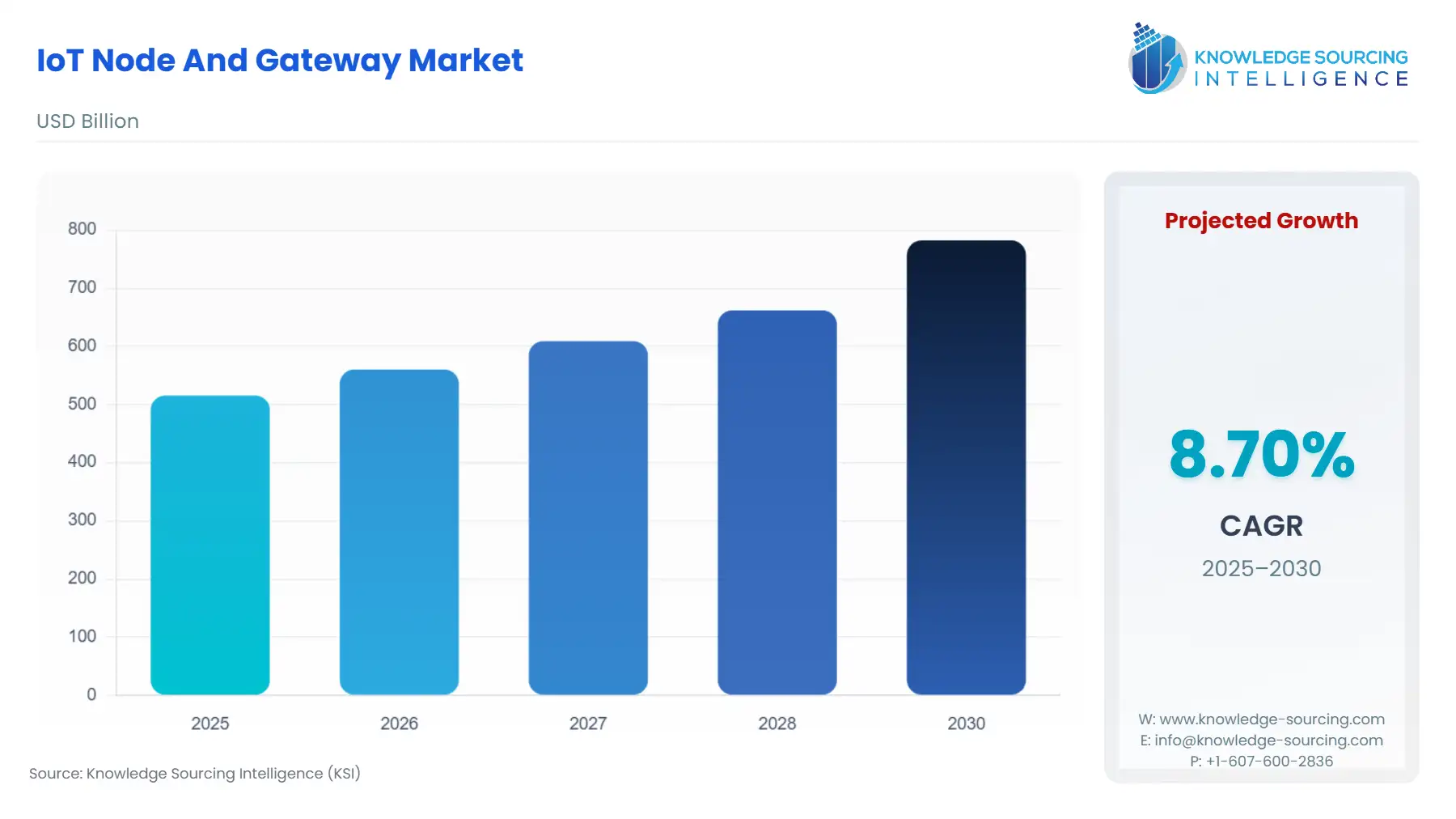

IoT Node And Gateway Market, with a 8.44% CAGR, is projected to increase from USD 515.460 billion in 2025 to USD 838.123 billion in 2031.

IoT Node And Gateway Market Trends:

An IoT gateway is a software program that connects IoT devices to the cloud and streamlines their communications and management. It acts as a central hub, routing data between devices and the cloud, handling both inbound and outbound traffic, and preprocessing data locally at the edge. Some IoT gateways can also deduplicate, summarize, or aggregate data to reduce the volume of data that must be forwarded to the cloud, which can improve response times and reduce network transmission costs. IoT gateways can be a typical hardware device or software program, and they have various characteristics such as processor, RAM, supported wireless connections, security modules, and operating system. They can also provide additional device security, perform data aggregation, pre-process and filter data, provide local storage as a cache/buffer, and compute data at the edge level.

The Internet of Things (IoT) node and gateway market is currently experiencing a rapid expansion that shows no signs of slowing down in the foreseeable future. This burgeoning market owes its growth to a multifaceted set of factors, each contributing to its upward trajectory. One of the primary catalysts behind this growth is the advent and widespread adoption of 5G technology. The ultra-fast and low-latency capabilities of 5G networks have paved the way for more efficient and connected IoT devices and systems, fueling their proliferation. Furthermore, the market is being propelled by the increasing prevalence of wireless smart sensors and networks. These technologies enable seamless communication and data exchange among various IoT devices, enhancing their functionality and overall utility. Moreover, the escalating adoption of cloud platforms has created a heightened demand for data centers, which are essential for storing and processing the vast amounts of data generated by IoT devices. This necessity has further driven the growth of the IoT node and gateway market. In addition to these factors, substantial advancements in telecommunication networks have played a pivotal role in shaping the landscape of the IoT node and gateway market. These advancements have not only improved connectivity but have also facilitated the deployment and management of IoT devices on a larger scale. Additionally, sectors such as healthcare and building automation have emerged as significant players in this market. These industries recognize the potential of IoT technology to enhance patient care, optimize energy consumption, and streamline operations, thereby contributing significantly to the market's overall share. In conclusion, the IoT node and gateway market are on an upward trajectory driven by a confluence of factors, including 5G technology, wireless smart sensors, data center demand, telecommunication network advancements, and the growing influence of healthcare and building automation. As technology continues to evolve and industries continue to embrace IoT solutions, this market is poised for sustained growth in the coming years.

IoT Node And Gateway Market Growth Drivers:

5G technology: The emergence of 5G technology has accelerated the growth of the IoT node and gateway market.This revolutionary leap in connectivity technology has become a pivotal force driving the expansion of the Internet of Things (IoT) ecosystem. With its lightning-fast speeds and remarkably reliable connectivity, 5G has ushered in an era where IoT devices can operate with unparalleled efficiency and effectiveness. These advanced networks offer not only faster data transmission but also substantially lower latency, making real-time communication and data processing a reality for countless IoT applications. As a result, the adoption of 5G technology has unlocked a world of possibilities for IoT deployments, from smart cities and autonomous vehicles to industrial automation and healthcare, further propelling the growth and innovation within the IoT node and gateway market.

Adoption of wireless smart sensors and networks: The increasing adoption of wireless smart sensors and networks represents a pivotal catalyst for the IoT node and gateway market's rapid growth and evolution. These wireless sensors and networks play a pivotal role in facilitating seamless communication among IoT devices, as well as connecting them to the expansive cloud infrastructure, a fundamental component in the entire IoT ecosystem. This connectivity enables the efficient collection of vast volumes of data, which can subsequently undergo sophisticated analysis processes, ultimately driving innovation, automation, and optimization across numerous industries and applications. By leveraging wireless technology, these sensors and networks empower IoT devices to transcend physical boundaries, providing real-time data insights and enhancing the overall efficiency and functionality of interconnected systems. The transformative potential of IoT is driving its continued expansion and integration into diverse domains, including smart homes, industrial automation, healthcare, and agriculture, with profound implications for our lives and work.

Growing market for connected devices: The rapidly growing market for connected devices, is a major driver of growth for both IoT nodes and gateway technologies. As society becomes increasingly reliant on interconnected devices, the demand for IoT gateways is surging in tandem. These gateways serve as critical intermediaries between the vast network of IoT devices and the central data processing infrastructure. They undertake the vital tasks of collecting, aggregating, and transmitting data generated by these connected devices, ensuring that the information flows seamlessly and efficiently. In essence, IoT gateways are the linchpin that enables the effective management and processing of the substantial influx of data originating from the ever-expanding ecosystem of connected devices. Consequently, they have become indispensable components within the broader IoT landscape, facilitating not only data management but also enhancing security, scalability, and overall functionality.

The growing adoption of cloud platforms is driving the need for more data centers: The surging demand for data centers is a direct consequence of the growing prevalence of cloud-based platforms, and this phenomenon serves as a pivotal catalyst for the expansion of the IoT node and gateway market. In this context, IoT gateways play a pivotal role by serving as crucial intermediaries in the intricate ecosystem of IoT infrastructure. These gateways are indispensable for efficiently handling and processing the vast influx of data generated by a myriad of IoT devices. Their significance becomes even more pronounced as a greater number of enterprises and organizations worldwide are embracing cloud-based solutions. This is because IoT gateways serve as the primary means of ensuring that data from IoT devices is collected, organized, and optimized before being transmitted to cloud environments.

Advancements in telecommunication networks: The continuous evolution and enhancement of telecommunication networks play a pivotal role in propelling the IoT node and gateway market forward. These networks serve as the backbone of the IoT ecosystem, and their ongoing improvements translate into substantial benefits for IoT devices and gateways. With the relentless progress in telecommunication networks, the connectivity and reliability of IoT devices and gateways are poised to reach unprecedented heights. This heightened connectivity and reliability are paramount for fostering the sustained expansion of the IoT market, as they ensure seamless data transmission, reduced downtime, and enhanced overall performance. As a result, businesses and individuals can increasingly rely on IoT solutions to optimize their operations, enhance productivity, and unlock new opportunities across various industries and domains. The synergy between telecommunications and IoT is poised to shape a future where smart, interconnected devices revolutionize the way we live and work.

List of Top IoT Node And Gateway Companies:

Sierra Wireless offers a variety of software and cloud solutions to support its IoT node and gateway products. These solutions make it easy to deploy, manage, and secure IoT devices, and to collect and analyze data from these devices.

Huawei AR502H is a next-generation IoT gateway device that offers powerful edge computing capabilities, open software and hardware resources, and Software Development Kits (SDKs) for flexibly invoking compute, storage, and network resources. It is suitable for a wide range of IoT applications, including smart Integrated Energy Services (IES), smart pole sites, smart power distribution rooms, smart campuses, and smart water conservation.

IoT Node And Gateway Market Segmentation Analysis:

Prominent growth in the sensors segment within the IoT node and gateway market:

The sensors segment stands out as a focal point of substantial growth within the dynamic landscape of the IoT node and gateway market. First and foremost, the ever-increasing utilization of sensors in the realm of IoT applications serves as a primary catalyst. This surge in adoption is underpinned by a tandem of cost reduction and miniaturization, alongside continuous technological enhancements. These innovations have made sensors more accessible and versatile, driving their integration into a multitude of IoT devices. Sensors, being the bedrock of data collection in the IoT ecosystem, assume a pivotal role in facilitating seamless communication between devices and the cloud, thus underlining their indispensable nature. Furthermore, the relentless march of progress in sensor technology plays a pivotal role in propelling the growth of this segment. This relentless pursuit of innovation has yielded a new generation of sensors characterized by heightened accuracy, enhanced reliability, and cost-effectiveness. These advancements have significantly lowered barriers to entry, empowering companies across industries to readily embrace IoT solutions. A burgeoning desire for smart homes and buildings forms another substantial impetus for the sensor segment's expansion. Sensors have emerged as linchpins for monitoring and managing various systems within smart residences and commercial structures, encompassing lighting, heating, and security, thereby enhancing energy efficiency and security measures. In summation, the sensors segment within the IoT node and gateway market is undergoing a robust expansion, propelled by the rising demand for sensors across diverse IoT applications, advancements in sensor technology, the emergence of smart homes and buildings, the proliferation of wearable devices, and the burgeoning market for connected vehicles.

IoT Node And Gateway Market Geographical Outlook:

The Asia Pacific region is expected to hold a significant share of the IoT node and gateway market:

The Asia Pacific region is poised to exert a substantial influence on the IoT node and gateway market, driven by a confluence of factors that underscore its pivotal role in this burgeoning industry. One of the key catalysts behind this prominence is the region's remarkable economic growth trajectory. In recent years, the Asia Pacific region has witnessed a remarkable surge in economic prosperity, creating a fertile ground for the widespread acceptance of IoT solutions across diverse sectors and industries. Furthermore, the technological landscape in the Asia Pacific region has undergone a remarkable transformation. A surge in innovation and cutting-edge advancements has paved the way for the development and seamless integration of IoT solutions into the fabric of daily life. This technological prowess has not only spurred the evolution of IoT but has also accelerated its adoption in various applications and use cases. Another compelling driver of IoT adoption in the Asia Pacific region is the escalating demand for connected devices. As societies across this vast expanse increasingly embrace the benefits of connectivity, the appetite for IoT-enabled gadgets and equipment continues to surge. This heightened demand directly fuels the expansion of the IoT node and gateway market, as these devices become indispensable in managing and processing the voluminous data generated by the ever-growing array of interconnected devices.

IoT Node And Gateway Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

IoT Node And Gateway Market Size in 2025 | USD 515.460 billion |

IoT Node And Gateway Market Size in 2030 | USD 782.304 billion |

Growth Rate | CAGR of 8.70% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the IoT Node And Gateway Market |

|

Customization Scope | Free report customization with purchase |

IoT Node and Gateway Market Segmentation

By Component

Sensors

Processors

Connectivity IC

Others

By Connectivity

Wi-Fi

Bluetooth

Cellular

Zigbee

Others

By Enterprise Size

Small & Medium Enterprise

Large Enterprise

By End-User

BFSI

Consumer Electronics

Manufacturing

Automotive

Retail & E-Commerce

Healthcare

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Thailand

Others