Report Overview

Italy Advanced Battery Market Highlights

Italy Advanced Battery Market Size:

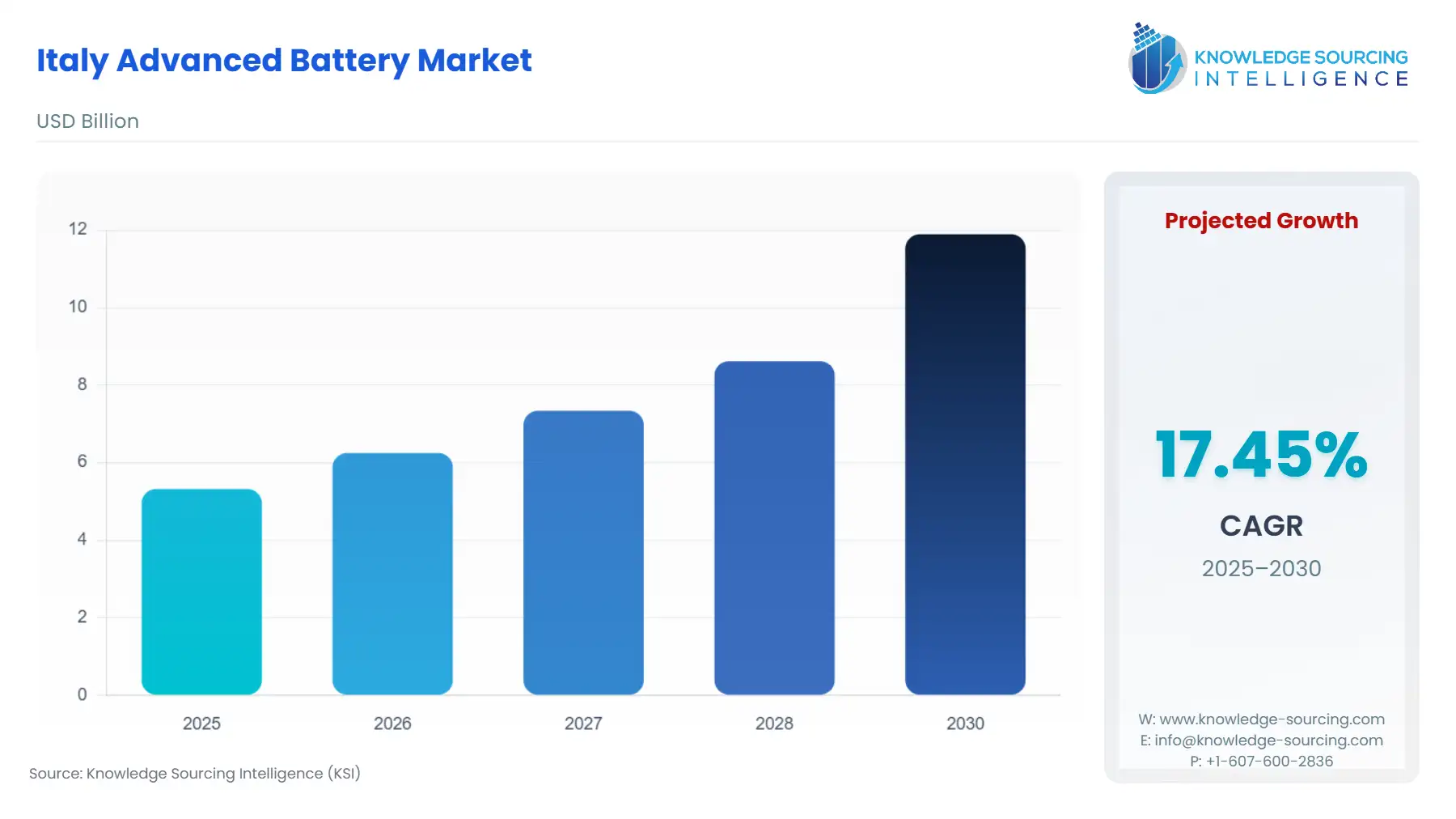

The Italy Advanced Battery Market is expected to grow at a CAGR of 17.45%, attaining USD 11.8945 billion in 2030 from USD 5.321 billion in 2025.

________________________________________

The Italian advanced battery market has seen significant growth, particularly in electric vehicles (EVs) and energy storage systems (ESS). As the country strives for a greener future, advancements in battery technology are essential for supporting a sustainable energy landscape.

________________________________________

Italy Advanced Battery Market Analysis:

Growth Drivers:

- Electric Vehicle (EV) Adoption: The Italian government's ambitious plans to reduce carbon emissions and encourage the adoption of electric vehicles have been pivotal in driving demand for advanced batteries. The push for electric mobility, driven by both regulatory frameworks and consumer awareness of environmental issues, has propelled growth in the demand for lithium-ion batteries, which are widely used in EVs. The Italian government has aligned its policies with the EU’s Green Deal and Fit for 55 package, which mandates reductions in greenhouse gas emissions, directly influencing the need for electric vehicles and, consequently, the batteries that power them.

- Renewable Energy Integration: Italy is a leading adopter of renewable energy sources, such as wind and solar. The integration of renewable energy into the national grid has created a growing need for energy storage systems (ESS) to stabilize the grid. Batteries, especially lithium-ion and emerging technologies like solid-state batteries, play a critical role in ensuring that renewable energy is stored effectively for use when demand peaks. The necessity for ESS is expected to increase significantly as Italy continues its energy transition and seeks to optimize the utilization of its renewable energy capacity.

- Technological Innovations in Battery Chemistry: The advancement of new battery chemistries, such as solid-state and sodium-ion batteries, is providing Italy with more diverse and efficient options for energy storage. Solid-state batteries, for instance, offer higher energy densities and improved safety over traditional lithium-ion solutions, which is fueling interest among automakers and energy companies. These technological improvements promise to reduce costs, increase efficiency, and enhance battery life, driving further demand across various sectors, including automotive and energy storage.

- Government Regulations and Supportive Policies: Italy’s commitment to supporting the transition to a low-carbon economy has catalyzed the advanced battery market. Government incentives such as subsidies for EV purchases, investment in charging infrastructure, and grants for renewable energy projects have significantly boosted demand for advanced battery solutions. Additionally, the EU's stringent regulations regarding vehicle emissions and energy efficiency standards have further incentivized battery manufacturers to scale production and innovate in line with the demand for sustainable technologies.

Challenges and Opportunities:

- Raw Material Supply Chain Constraints: A major challenge faced by the Italian advanced battery market is the volatility in the supply of critical raw materials, particularly lithium, cobalt, and nickel. These materials are essential for the production of high-performance batteries, and disruptions in supply chains—due to geopolitical tensions, mining inefficiencies, or rising global demand—could lead to increased costs and supply shortages. This constraint has created an opportunity for companies to invest in alternative materials and recycling technologies to mitigate dependency on these materials.

- Competitive Pressure and Technological Advancements: While there is significant opportunity in the advanced battery market, fierce competition from both established players and emerging startups is increasing. Companies in Italy and across Europe are racing to develop next-generation battery technologies. This intense competition presents an opportunity for firms to capitalize on new technological advancements, such as the development of solid-state batteries or energy-dense sodium-ion alternatives. However, staying ahead in such an innovative and rapidly evolving market will require substantial investment in R&D and partnerships with academic and industrial institutions.

Supply Chain Analysis:

The global supply chain for advanced batteries is complex and heavily reliant on raw material extraction and processing. In the case of Italy, the production of advanced batteries is influenced by the European Union's reliance on imported raw materials, primarily from regions like South America, Africa, and Australia. Logistics challenges, regulatory complexities, and geopolitical risks complicate the production and distribution of critical components. This has created opportunities for Italy to develop local supply chains and reduce dependency on external sources by establishing local mining and material processing facilities.

Italy Advanced Battery Market Government Regulations:

|

Jurisdiction |

|

Key Regulation / Agency |

Market Impact Analysis |

|

Italy (EU) |

|

European Green Deal, Fit for 55 |

Regulations mandate a significant reduction in carbon emissions, accelerating the adoption of electric vehicles and energy storage systems. This drives increased demand for advanced batteries. |

|

Italy |

|

Incentives for Electric Vehicles (EV) |

Italian subsidies for EVs and charging infrastructure have incentivized both consumer purchases and manufacturer investment in EVs, thereby directly increasing demand for lithium-ion batteries. |

|

Italy (EU) |

|

Renewable Energy Directive (RED II) |

Focus on integrating renewable energy into the grid, requiring robust energy storage solutions that are heavily reliant on advanced batteries, especially in commercial and residential ESS. |

|

EU (Italy) |

|

European Battery Alliance |

This initiative focuses on establishing a competitive battery industry in Europe, promoting investment in battery manufacturing and R&D, creating a long-term demand for advanced batteries in Italy. |

Italy Advanced Battery Market Segment Analysis:

- Automotive: Electric Vehicles (EVs)

The EV sector in Italy has grown substantially, fueled by both governmental support and changing consumer preferences. Italy, being home to major automotive manufacturers such as Fiat and Ferrari, has witnessed a surge in EV adoption, particularly in urban areas where the demand for cleaner and more efficient vehicles is high. The strong regulatory push toward decarbonization, including Italy's alignment with the EU's Green Deal, directly influences the need for advanced batteries. These vehicles rely on high-capacity lithium-ion batteries, and as Italy transitions to net-zero emissions by 2050, the market for EV batteries will continue to expand.

- Energy Storage Systems (ESS): Residential and Commercial

The rise of renewable energy sources in Italy has directly impacted the demand for energy storage systems. With the country's goal to become a net-zero emitter of greenhouse gases, the integration of solar and wind energy into the national grid requires efficient energy storage solutions. ESS in residential and commercial sectors allow consumers and businesses to store excess energy generated during off-peak hours for later use, reducing dependency on traditional energy sources. This shift toward green energy solutions has propelled demand for advanced battery technologies capable of storing large amounts of energy.

________________________________________

Italy Advanced Battery Market Competitive Analysis:

Key players in Italy’s advanced battery market include global companies such as Saft (a subsidiary of TotalEnergies) and FIAMM Energy. These companies have significantly contributed to the development of battery technologies in Italy. Saft, for example, has a long history in the development of lithium-ion batteries, with a focus on renewable energy storage and electric mobility solutions. Their ongoing efforts to increase production capacities in Europe will likely strengthen their market position in the Italian advanced battery sector.

Companies like Enel X and FAAM are making strategic investments in battery production and integration, focusing on electric vehicles and renewable energy storage.

- Enel X: As a leader in energy solutions, Enel X focuses on providing smart energy storage and charging infrastructure for electric vehicles. Their strategic investments in both hardware and software solutions make them a key player in Italy's advanced battery market.

- FAAM: Specializing in lead-acid and lithium-ion batteries, FAAM has established itself as a key supplier for the automotive and industrial sectors. Its focus on sustainable energy storage solutions positions it well for long-term growth.

________________________________________

Italy Advanced Battery Market Developments:

- October 2025 - Italy's grid operator Terna awarded all 10 GWh of capacity in its inaugural battery storage auction, with Enel securing half. The average price fell well below the regulatory cap, boosting investor confidence in grid-scale energy storage. This milestone supports Italy's renewable integration goals, attracting major players like Greenvolt Group, which won 499 MWh for a 15-year tariff. The event highlights Europe's accelerating BESS market amid rising solar and wind deployment.

- September 2025 - Eni and Seri Industrial launched operations for a lithium iron phosphate (LFP) battery factory in southern Italy, targeting over 10% of Europe's stationary storage market. The integrated hub in Brindisi and Teverola focuses on sustainable manufacturing, reducing petrochemical reliance. Backed by €2 billion in Eni investments, the project advances energy transition, producing high-density batteries for grid stability and renewables. Permitting began, with full production eyed for 2026.

________________________________________

Italy Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.321 billion |

| Total Market Size in 2031 | USD 11.8945 billion |

| Growth Rate | 17.45% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

Italy Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket