Report Overview

Land Mobile Radio Market Highlights

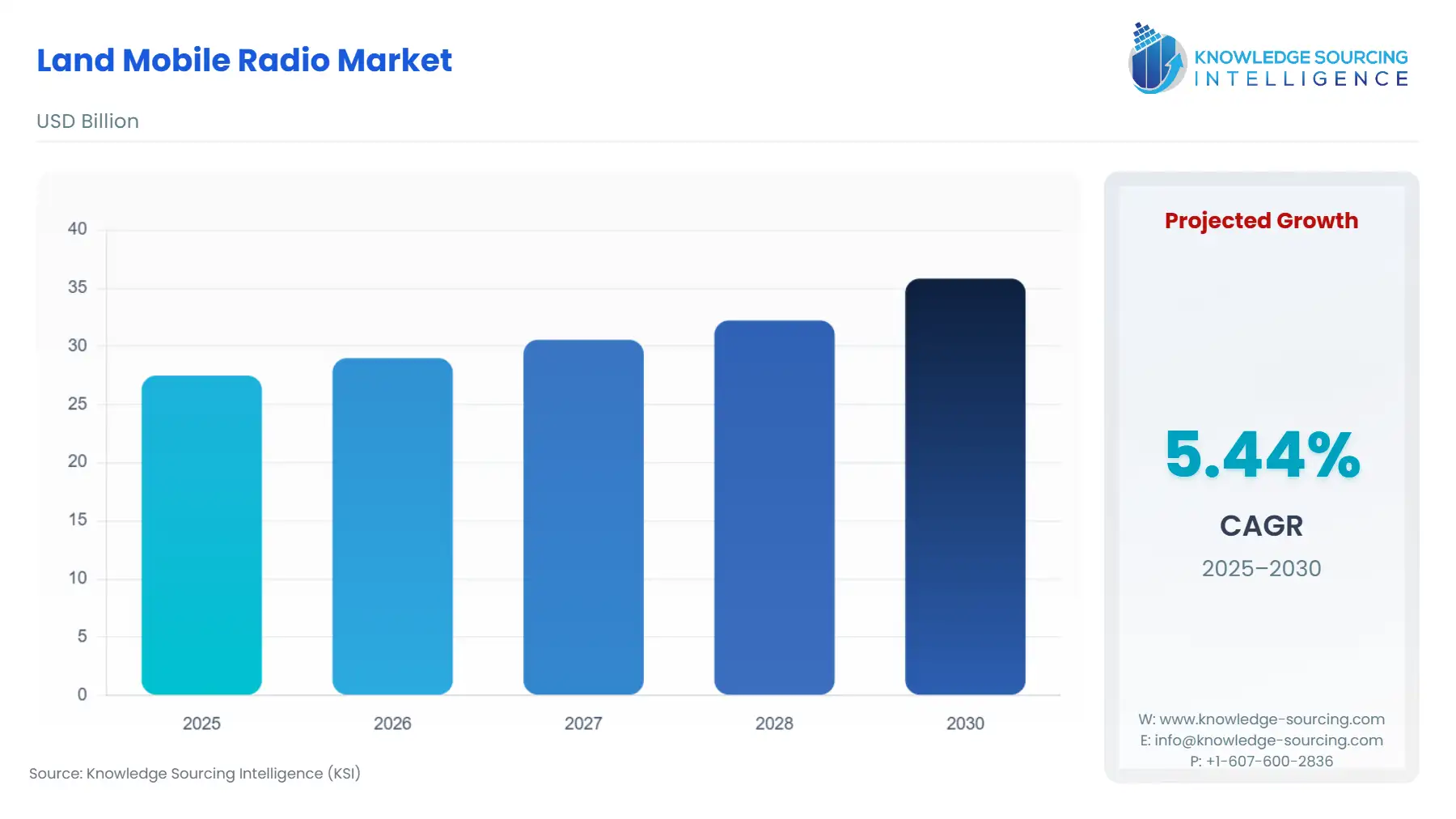

Land Mobile Radio Market Size:

The Land Mobile Radio Market is expected to grow from USD 27.495 billion in 2025 to USD 35.833 billion in 2030, at a CAGR of 5.44%.

The Land Mobile Radio (LMR) market encompasses highly reliable, private two-way radio communication systems essential for coordinating mission-critical and business-critical operations across diverse industrial and governmental sectors. Historically characterized by proprietary Analog systems, the market has undergone a fundamental, regulation-driven migration to open-standard Digital technologies like DMR (Digital Mobile Radio) and TETRA (Terrestrial Trunked Radio) to enhance spectrum efficiency and augment voice communications with basic data services. The enduring demand for LMR products, ranging from handheld Transceivers to vast Trunking Systems, is directly tied to the need for secure, instantaneous group communication where commercial cellular infrastructure is either unreliable, unavailable, or lacks the necessary resilience for emergency response.

Land Mobile Radio Market Analysis

- Growth Drivers

Regulatory mandates are the primary, non-cyclical driver, notably the long-term, global push for spectrum efficiency, which compelled end-users to transition from 25kHz Analog LMR to 12.5kHz Digital LMR systems to comply with technical standards. This technical necessity drives a multi-year cycle of equipment replacement across Public Safety and Industrial sectors. Concurrently, the increasing complexity of field operations in sectors like Mining and Aviation necessitates the upgrade to Digital trunked systems that can manage greater user capacity, integrate low-rate data applications (e.g., GPS tracking), and offer advanced features like encryption, all of which fuel the procurement of new-generation Digital LMR hardware.

- Challenges and Opportunities

The primary headwind for LMR systems is the increasing technological and budgetary competition from Push-to-Talk over Cellular (PoC) and dedicated public safety LTE broadband networks, which offer superior multimedia data capabilities. This competitive constraint decreases the market share for non-critical, pure voice Analog systems. This challenge, however, generates a critical opportunity for LMR vendors in hybrid solutions: developing and selling dual-mode LMR/LTE Transceivers and integrated broadband-LMR platforms that allow users to leverage the reliability of LMR for voice while accessing the data-rich applications of LTE networks, thereby strengthening overall demand for sophisticated Digital LMR infrastructure.

- Raw Material and Pricing Analysis

Pricing dynamics for LMR devices are governed by the cost of electronic components and the complexity of the digital processing chipsets. Key material inputs include high-frequency quartz crystals for stable radio frequency (RF) control, specialized printed circuit boards, and robust, often polymer-based, chassis for ruggedization (e.g., meeting MIL-STD-810G). The global supply chain volatility for semiconductor chipsets, particularly those used in Digital modulation and encryption modules, imposes cost pressure on manufacturers, which is often mitigated by long-term strategic component agreements. The high cost of specialized LMR systems is justified by non-price factors, primarily the certified reliability and mission-critical functionality they provide, maintaining market demand inelasticity.

- Supply Chain Analysis

The LMR supply chain is vertically integrated for core technology and relies heavily on Asian manufacturing hubs for high-volume production. Key production occurs in countries like China, where major players such as Hytera Communications manage large fabrication facilities, and Japan, home to integrated manufacturers like JVC Kenwood Corporation. Logistical complexity involves the distribution of highly specialized, often government-regulated, radio equipment requiring specific frequency programming and certification before deployment. The market exhibits a heavy dependency on the global semiconductor industry for digital processing components and microcontrollers, making the end-user delivery schedule susceptible to geopolitical and component sourcing constraints.

Land Mobile Radio Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FCC Narrowbanding Mandate (VHF/UHF) / Federal Communications Commission (FCC) |

Drives Equipment Replacement: The FCC mandated the migration of all private LMR systems operating in the 150-174 MHz and 421-512 MHz bands from 25kHz to 12.5kHz channels. This regulatory deadline forced the mass obsolescence of older Analog equipment, compelling Public Safety and Industrial/Business licensees to procure new Digital LMR devices and infrastructure for compliance, directly fueling sales. |

|

Europe |

ETSI Standards (DMR, TETRA) / European Telecommunications Standards Institute (ETSI) |

Standardizes Digital Demand: European demand is heavily shaped by the ETSI standards for DMR and TETRA, which define spectral efficiency and interoperability. National governments' preference for the TETRA standard for public safety accelerates the procurement of sophisticated Digital LMR trunking infrastructure and devices that must adhere to these unified technical specifications. |

|

South Africa |

ICASA Radio Frequency Migration Plan / Independent Communications Authority of South Africa (ICASA) |

Mandates Frequency Re-Farming: ICASA's ongoing frequency migration plans require the systematic reallocation of spectrum and, in some cases, the re-channeling or replacement of LMR equipment to accommodate new spectrum allocations. This regulatory action creates demand for technical services, updated licenses, and new-generation, frequency-agile LMR radios. |

Land Mobile Radio Market Segment Analysis

- By Type: Digital

The Digital LMR segment is the core growth engine, driven by the demand for improved spectrum efficiency and integrated data capabilities beyond basic voice communications. End-users in Public Safety and Industrial sectors are procuring Digital systems because they offer features such as enhanced audio quality, superior battery life, and data services like text messaging, GPS location tracking, and telemetry, which are critical for operational efficiency. The inherent Time Division Multiple Access (TDMA) architecture in some Digital standards (e.g., DMR Tier II/III) effectively doubles the capacity of a single 12.5 kHz channel, directly increasing demand for these systems by organizations that need to accommodate a growing number of field personnel without acquiring additional, costly spectrum licenses. This transition represents a mandatory technological upgrade, sustaining high demand for new digital Transceivers and infrastructure.

- By Industry: Military and Defense

The Military and Defense segment generates consistent and high-value demand for LMR systems based on non-negotiable requirements for security, ruggedness, and reliable operation in austere environments. The necessity for tactical, mission-critical communications that cannot be compromised by external threats or rely on vulnerable commercial infrastructure drives this demand. This segment requires LMR solutions, often utilizing specialized standards and dedicated frequency bands, that provide Type 1-grade encryption and anti-jamming capabilities. The increasing adoption of Network-Centric Warfare doctrines necessitates the integration of LMR systems with other tactical data networks, compelling defense organizations to procure advanced, feature-rich Digital LMR products from vendors like Thales and Harris Corporation that are certified to meet stringent security and interoperability standards (e.g., P25).

Land Mobile Radio Market Geographical Analysis

- US Market Analysis

The US LMR market is dominated by the replacement cycle initiated by the FCC's narrowbanding mandate and sustained by the continual need for interoperable public safety communications. Growth is heavily concentrated in the P25 Digital standard for Public Safety (Police, Fire, EMS) and the adoption of advanced LMR-LTE hybrid platforms. Federal, state, and local agencies continue to procure multi-year trunking system upgrades to enhance situational awareness, driving high demand for Digital LMR infrastructure and advanced Transceivers capable of PTT, secure voice, and integrated data functions, often leveraging federal funding mechanisms like the FirstNet initiative for complementary broadband access.

- Brazil Market Analysis

The LMR market in Brazil is characterized by strong procurement from the Industrial sector, notably Mining, Oil & Gas, and large infrastructure projects, which require robust, private communications in geographically challenging areas where cellular service is intermittent. Demand is primarily for economical and reliable Digital Mobile Radio (DMR) Tier II systems, which offer trunking capabilities and improved spectral efficiency over legacy Analog systems. Government-led infrastructure investments and the need for public safety agencies in major urban centers to manage complex security situations also drive a steady, albeit sensitive to capital expenditure, demand for Digital LMR solutions.

- Germany Market Analysis

Germany’s LMR market is mature and highly standardized, centered on the TETRA digital standard, which has been widely adopted by federal and state Public Safety agencies (BOS-Net). The market growth is stable, driven by the regular maintenance, replacement, and expansion of the existing nationwide TETRA network infrastructure. Furthermore, a secondary market for Digital LMR exists within the manufacturing and utility sectors, which demand customized, high-reliability Digital trunking systems that conform to the highly stringent technical and security requirements of European regulatory bodies (ETSI, BNetzA).

- Saudi Arabia Market Analysis

The LMR market in Saudi Arabia is driven by substantial government investment in critical national infrastructure, including oil and gas facilities (Aramco), major industrial zones, and ambitious urban development projects (e.g., NEOM). This creates high-value demand for resilient, high-capacity, and secure Digital LMR solutions, particularly TETRA and advanced DMR Tier III trunking systems. The Military and Defense sector is also a massive end-user, prioritizing high-security digital communications equipment, leading to demand for specialized, encrypted LMR systems, often sourced through government-to-government agreements.

- China Market Analysis

China represents a vast and technologically evolving LMR market, driven by mass-scale commercial and government applications. The growth is characterized by rapid procurement of both Digital standards, including indigenous solutions and international standards like DMR, across Transportation, Utilities, and Commercial sectors. Major domestic manufacturers, such as Hytera Communications, benefit from strong local demand for cost-effective Digital LMR solutions that provide feature-rich voice and data for massive commercial user bases, fueling high-volume production of both handheld and system-level products.

Land Mobile Radio Market Competitive Environment and Analysis

The LMR competitive environment is defined by a global rivalry between established North American and European players, which dominate high-security Public Safety standards (e.g., P25, TETRA), and rapidly ascending Asian manufacturers, which compete aggressively in the high-volume commercial and industrial DMR segment. Product differentiation is achieved through interoperability certifications, robustness against electronic countermeasures, and the seamless integration of LMR with complementary broadband solutions.

- Motorola

Motorola Solutions maintains its strategic leadership through dominance in the proprietary Digital P25 standard, which is the preferred choice for US and North American Public Safety agencies. The company's strategy pivots on transforming from a pure LMR hardware provider to an integrated software and services powerhouse, exemplified by the acquisition of Noggin in July 2024. This acquisition added critical event management and operational resilience software to their portfolio, directly addressing the demand from first responders for unified command and control platforms that leverage LMR voice with broader data and analytics capabilities.

- JVC Kenwood Corporation

JVC Kenwood Corporation competes globally by offering a comprehensive range of interoperable Digital LMR solutions, primarily focused on the DMR and P25 standards for diverse professional markets. Their strategic positioning emphasizes developing reliable, multi-protocol Transceivers that support migration paths for legacy Analog users in both Public Safety and Commercial sectors. In 2025, the company demonstrated its capacity in the European market by securing a major contract to supply professional digital radio systems to the Fire Department in Italy, underscoring its ability to meet stringent European service requirements.

- Hytera Communications

Hytera Communications is a prominent, high-volume supplier, strategically positioned by offering full-stack LMR products based on open standards like DMR and TETRA. Its competitive advantage stems from a wide product portfolio and aggressive development in the hybrid LMR-broadband space. The company consistently launches new products, such as the PNC660 Dual-mode Rugged Radio in February 2025, demonstrating a commitment to meeting the demand for devices that seamlessly bridge the gap between secure LMR voice and data-rich Push-to-Talk over Cellular (PoC) or private LTE networks for enterprise and public safety users.

Land Mobile Radio Market Developments

- November 2025: Hytera Communications launched the P50E and P60 smart Push-to-Talk over Cellular (PoC) radios at PMRExpo. This product launch expands the company's portfolio of rugged, dual-mode devices, serving the increasing demand for LMR interoperability with broadband data applications in transportation and security.

- August 2025: Motorola Solutions completed the acquisition of Silvus Technologies for USD 4.4 billion. This strategic merger enhances Motorola’s capacity in Mesh Networking and advanced data/video transmission capabilities for mission-critical operations, strengthening its integrated LMR and broadband portfolio.

- July 2024: Motorola Solutions acquired Noggin, a global provider of cloud-based critical event management software. This product line capacity addition supports the demand for unified command and control solutions by integrating LMR communication with operational resilience and business continuity planning software.

Land Mobile Radio Market Segmentation:

- By Type

- Digital

- Analog

- By Industry

- Military and Defense

- Aviation

- Mining

- Marine

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America