Report Overview

Software Defined Radio Communications Highlights

Software Defined Radio Communications Market Size:

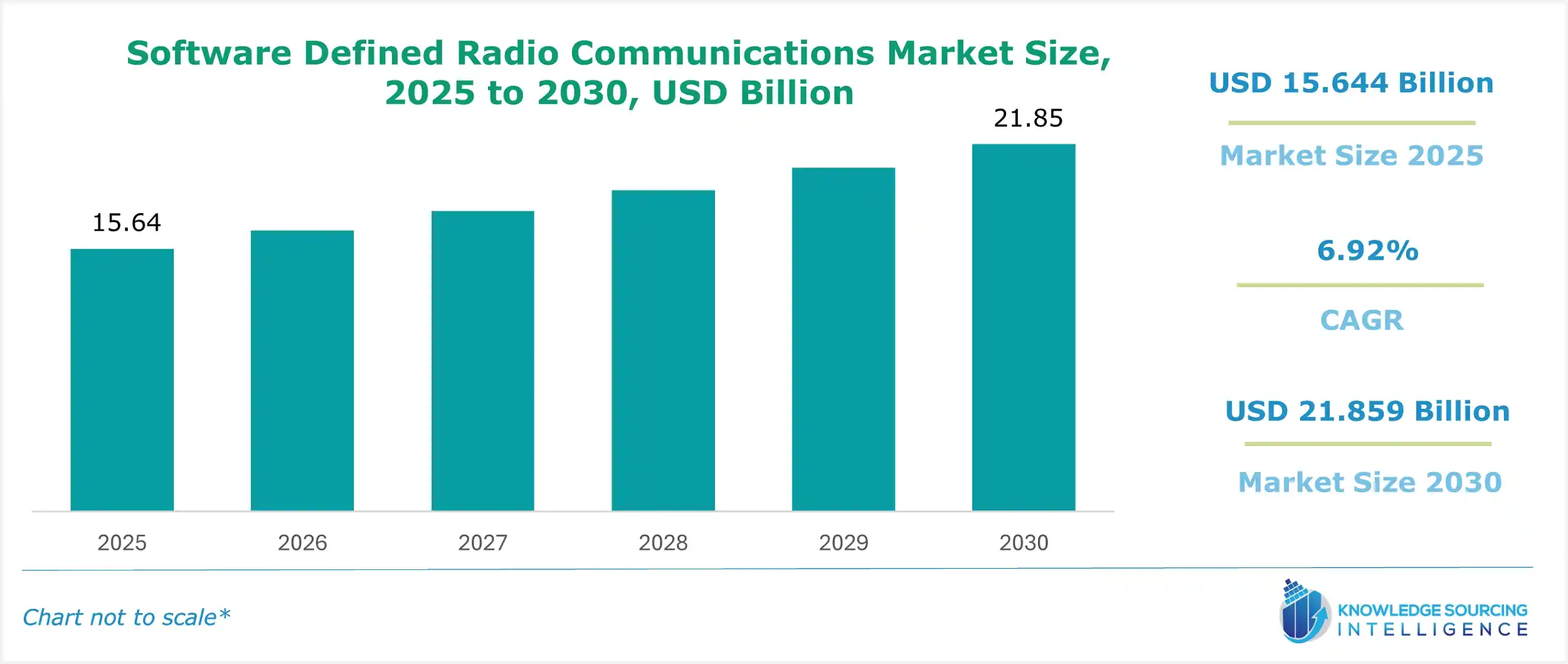

The Software Defined Radio Communications Market is expected to grow from USD 15.644 billion in 2025 to USD 21.859 billion in 2030, at a CAGR of 6.92%.

Software-Defined Radio Communication Market Trends:

The software-defined radio (SDR) communication market is a dynamic and rapidly evolving sector within the telecommunications and electronics industries, characterized by its ability to adapt radio functionality through software rather than hardware. SDR systems differ from traditional radios in that they use software to adjust radio parameters, rather than relying on fixed hardware components for specific frequency bands and modulation schemes. This flexibility offers greater interoperability and efficiency. As a transformative technology, SDR has become essential in modern communication systems, finding applications in military, aerospace, public safety, commercial telecommunications, and amateur radio communities. As global demand for advanced, adaptable, and secure communication systems grows, the SDR market is poised for significant expansion, driven by technological advancements and increasing connectivity needs.

SDR is fundamentally a radio communication system in which components that are typically implemented in hardware, such as mixers, filters, amplifiers, and modulators, are instead defined and managed through software. This approach enables a single hardware platform to support various communication protocols, frequency bands, and modulation types by updating or reconfiguring the software. The concept of SDR emerged in the 1990s, initially adopted by the military for secure and flexible communications. However, it has since expanded into commercial and civilian applications due to advancements in digital signal processing (DSP), field-programmable gate arrays (FPGAs), and software development tools.

The versatility of SDR enables it to support a wide range of applications, from 5G network infrastructure to satellite communications and Internet of Things (IoT) connectivity. For instance, SDR platforms can dynamically switch between standards like LTE, Wi-Fi, or Bluetooth, making them ideal for environments requiring multi-protocol support. Additionally, SDR’s ability to perform over-the-air updates ensures that systems remain future-proof, adapting to new standards or security requirements without hardware replacement. This adaptability is particularly valuable in industries where rapid technological evolution and spectrum scarcity are persistent challenges.

The SDR communication market is critical in addressing the growing complexity of modern communication networks. In the military sector, SDR enables secure, encrypted communications across diverse platforms, such as tactical radios, unmanned aerial vehicles (UAVs), and naval systems. For example, the U.S. Department of Defense’s Joint Tactical Networking Center (JTNC) has been actively promoting SDR standards to enhance interoperability among allied forces. In commercial telecommunications, SDR is integral to the deployment of 5G networks, where base stations use software-defined architectures to manage dynamic spectrum allocation and support massive device connectivity. Companies like Nokia and Ericsson have integrated SDR into their 5G solutions, enabling operators to optimize network performance in real time.

Public safety and disaster response greatly benefit from SDR. Emergency communication systems that utilize SDR can switch between frequency bands, ensuring connectivity during crises such as natural disasters when traditional infrastructure may fail. For instance, recent deployments of SDR-based systems in wildfire response operations in California demonstrated their ability to maintain reliable communication across fragmented networks. In the amateur radio community, platforms such as the HackRF One and the USRP series have made advanced radio experimentation more accessible, promoting innovation and education.

Recent advancements underscore the market’s growth trajectory. In 2024, the Open Radio Access Network (O-RAN) Alliance announced new SDR-based solutions to enhance 5G network flexibility, with trials conducted by major operators like Verizon. Additionally, the development of open-source SDR platforms, such as GNU Radio, has lowered barriers to entry, fostering innovation among developers and startups. In the aerospace sector, companies like SpaceX have explored SDR for satellite communications, enabling low-latency, high-bandwidth links for Starlink.

Software-Defined Radio Communication Market Drivers:

- Demand for Flexible and Scalable Communication Systems

The increasing number of IoT devices and the rollout of 5G networks demand communication systems capable of managing various protocols and adapting to changing spectrum requirements. SDR offers reconfigurability that allows operators to adjust to new standards without incurring costly hardware upgrades. This flexibility makes SDR a preferred option for telecom providers. For example, Qualcomm’s Snapdragon X75 modem, announced in 2024, integrates SDR capabilities to enable seamless transitions between 5G and emerging 6G protocols, supporting the global rollout of next-generation networks. The International Telecommunication Union (ITU) projects that global IoT connections will exceed 24 billion by 2030, further driving demand for SDR in managing complex, multi-protocol environments.

- Advancements in Digital Signal Processing and AI

Improvements in DSP and AI have significantly enhanced SDR performance, enabling real-time spectrum analysis, adaptive modulation, and cognitive radio capabilities. AI-driven SDR systems can optimize frequency usage in crowded spectrum environments, a critical need as global data traffic is projected to grow by 20-30% annually through 2030. These advancements are enabling SDR to support mission-critical applications, such as autonomous vehicle communications and smart city infrastructure, where low latency and high reliability are paramount.

- Military Modernization and Interoperability Needs:

Defense agencies worldwide are investing heavily in SDR to ensure secure, interoperable, and resilient communications across joint operations. The ability of SDRs to support multiple waveforms and encryption standards on a single platform is essential for modern military networks. For instance, NATO's Coalition Interoperable Radio Network, initiated in 2023, utilizes SDR technology to facilitate seamless communication among allied forces. This capability addresses the challenges of operating in contested environments. The U.S. Army's Integrated Tactical Network, which uses SDR-based radios, has been deployed in field exercises to improve battlefield connectivity, with plans for further expansion by 2026.

- Spectrum Efficiency and Regulatory Support

Spectrum scarcity is a growing challenge as demand for wireless connectivity surges. Regulatory bodies, such as the Federal Communications Commission (FCC) and the European Telecommunications Standards Institute (ETSI), are promoting dynamic spectrum access (DSA) to optimize frequency usage. SDR’s ability to dynamically allocate and reallocate frequencies aligns with these policies, enabling more efficient use of limited spectrum resources. In 2024, the FCC expanded its support for DSA through new policies encouraging SDR adoption in commercial and public safety networks, particularly for 5G and beyond. Additionally, the ITU’s World Radiocommunication Conference in 2023 emphasized SDR’s role in addressing spectrum congestion, further driving its adoption.

Software-Defined Radio Communication Market Restraints:

- High Initial Development Costs

Developing SDR systems requires substantial investment in advanced hardware, such as high-performance FPGAs and analog-to-digital converters, as well as sophisticated software development for signal processing and protocol management. These costs can be prohibitive for smaller companies or organizations in emerging markets, limiting market entry and scalability. For instance, a 2024 report from the IEEE highlighted that the development of SDR platforms for 5G applications can require upfront investments exceeding $10 million for mid-sized firms, posing a significant barrier to entry. Additionally, the need for specialized expertise in both hardware design and software optimization further escalates costs, particularly for custom applications in defense or aerospace.

- Complexity in Integration

Integrating SDR into existing communication infrastructure is a complex process that demands expertise in both hardware and software domains. Legacy systems, often designed for specific frequency bands or protocols, may require significant retrofitting to accommodate SDR’s flexible architecture. This complexity can lead to extended deployment timelines and increased operational costs. For example, a 2023 case study by the European Space Agency noted that integrating SDR into satellite communication systems required 18 months of additional testing to ensure compatibility with existing ground stations, delaying project timelines. Furthermore, the lack of standardized SDR frameworks can complicate interoperability with non-SDR systems, particularly in heterogeneous networks.

- Security Concerns

The software-based nature of SDR, while offering flexibility, introduces significant cybersecurity risks. SDR systems are susceptible to threats such as unauthorized reconfiguration, signal jamming, or malicious software updates, which could compromise critical communications. For instance, a 2024 security analysis by DARPA identified vulnerabilities in SDR-based military radios, where attackers could exploit software interfaces to disrupt tactical communications. These risks necessitate robust cybersecurity measures, such as secure boot mechanisms and real-time intrusion detection, which add to development and maintenance costs. In commercial applications, the open-source nature of some SDR platforms, like GNU Radio, can exacerbate vulnerabilities if not properly secured, as highlighted in a 2024 cybersecurity report by ETSI.

Software-Defined Radio Communication Market Segmentation Analysis:

- By Technology, Cognitive Radio holds a significant market share

Among the technological segments, adaptive radio, cognitive radio, and intelligent radio, cognitive radio stands out as the most significant due to its advanced capabilities in spectrum management and autonomous operation. Cognitive radio, a branch of SDR, incorporates intelligent decision-making to adapt dynamically to changing environmental conditions, such as spectrum availability and interference levels. Unlike adaptive radios, which modify their parameters based on predefined rules, and intelligent radios, which use basic automation, cognitive radios utilize real-time spectrum sensing and machine learning to optimize frequency usage and select the most efficient waveforms. This capability is critical in addressing spectrum scarcity, a pressing challenge as global wireless traffic continues to surge.

In 2024, cognitive radio gained prominence in military applications, where it enables autonomous frequency selection in contested environments. For example, the U.S. Department of Defense’s DARPA Spectrum Collaboration Challenge demonstrated cognitive radio systems that improved spectrum efficiency by 40% in dense RF environments, enhancing tactical communications. In commercial applications, cognitive radio is pivotal for 5G and beyond, supporting dynamic spectrum access (DSA) to accommodate massive IoT deployments. The O-RAN Alliance reported in 2024 that cognitive radio solutions decreased spectrum interference by 25% in 5G trials conducted by Verizon, underscoring its significance in next-generation networks. Additionally, a 2023 study by the National Institute of Standards and Technology (NIST) highlighted cognitive radio’s capability to reduce interference in congested urban areas, forecasting a 30% increase in spectrum utilization efficiency by 2027. These advancements position cognitive radio as a cornerstone of SDR innovation, driving its adoption across defense, telecommunications, and public safety sectors.

- By Component, the software segment is experiencing robust growth

Among the components of SDR systems, software is the most critical, as it defines the functionality and flexibility of SDR platforms. The software layer encompasses signal processing algorithms, protocol stacks, and user interfaces that enable SDR to support multiple communication standards and adapt to changing requirements. Unlike hardware components, which provide the physical foundation, software enables quick reconfiguration, supports over-the-air updates, and facilitates integration with emerging technologies such as AI and cloud computing. Open-source software frameworks, such as GNU Radio, have democratized SDR development, enabling developers to create custom applications and foster innovation.

In 2024, advancements in SDR software have accelerated market growth. For instance, GNU Radio’s latest release introduced enhanced support for 5G NR waveforms, enabling developers to prototype next-generation networks on low-cost SDR platforms. In the aerospace sector, SpaceX has leveraged custom SDR software to optimize satellite communications for Starlink, achieving low-latency, high-bandwidth links across its constellation. In 2024, the ETSI launched an initiative that emphasized the importance of SDR in facilitating secure, real-time updates for public safety networks, while also reducing deployment costs by 20% compared to hardware-based systems. The software segment plays a crucial role in enabling cognitive radio capabilities, including spectrum sensing and adaptive modulation. These features rely on advanced algorithms to optimize performance. The flexibility and scalability of SDR software make it the foundation of modern SDR systems, fostering innovation across various applications.

Software Defined Radio Communications Market Geographical Outlook:

- The United States will hold a substantial market share

The United States holds a significant market share for SDR due to its robust technological infrastructure, substantial defense spending, and leadership in 5G deployment. The U.S. hosts major SDR innovators, including companies like Qualcomm, Analog Devices, and National Instruments, which drive advancements in SDR hardware and software. The country’s defense sector, supported by initiatives like the JTNC, heavily invests in SDR for secure, interoperable communications. In 2024, the U.S. Department of Defense allocated $1.2 billion to SDR-based tactical radio programs, emphasizing their role in modernizing battlefield networks

In the commercial sector, the U.S. leads in 5G adoption, with operators like Verizon and AT&T deploying SDR-based base stations to support dynamic spectrum allocation. A 2024 report by the FCC noted that SDR adoption in U.S. 5G networks improved spectrum efficiency by 15%, supporting the country’s goal of nationwide 5G coverage by 2026. The United States is a center for SDR research, with prestigious institutions like MIT and Stanford leading advancements in cognitive radio and AI-driven SDR solutions. For example, a study conducted at MIT in 2024 showcased an SDR system that reduced latency in communications for autonomous vehicles by 25%, paving the way for the development of smart transportation networks. The U.S. leads in regulatory frameworks, such as the FCC’s dynamic spectrum access policies, which further accelerate SDR adoption and position the country as the epicenter of the global SDR market.

Software-Defined Radio Communication Market Key Developments:

- November 2025: L3Harris demonstrated a fully interoperable end-to-end software-defined communications network uniting tactical radios, imaging, and mobile C2 systems across U.S. government agencies.

- November 2025: L3Harris launched NETCASTER™, a next-generation software-defined tactical network and sovereign router developed in Australia to enhance deployable communications resilience.

- October 2025: The U.S. Army selected L3Harris Technologies’ AN/PRC-158C NGC2 Gateway Manpack software-defined data devices under a $24 million award to support Next Generation Command and Control transport requirements.

- October 2025: Industry sources report Indian SDR standard IRSA 1.0 was launched in October 2025 to improve interoperability for SDR platforms and future military communication capabilities.

- September 2025: Thales secured its first international export deal for HF XL TRC 3900 high-frequency radio systems with Malaysia, offering resilient, high-data-rate SDR communications.

List of Top Software-Defined Radio Communications Companies:

- Northrop Grumman Corporation

- L3Harris Technologies, Inc

- Viasat, Inc.

- BAE Systems

- Analog Devices Inc.

Software Defined Radio Communications Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Software Defined Radio Communications Market Size in 2025 | USD 15.644 billion |

| Software Defined Radio Communications Market Size in 2030 | USD 21.859 billion |

| Growth Rate | CAGR of 6.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Software Defined Radio Communications Market |

|

| Customization Scope | Free report customization with purchase |

Software Defined Radio Communications Market Segmentation:

By Technology

- Adaptive Radio

- Cognitive/ Intelligent Radio

- Joint Tactical Radio System

By Component

- Hardware

- RF Receiver/Transmitter

- Amplifier

- Others

- Software

- Services

By Application

- Military Applications

- Telecommunications

- Space Communication

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others