Report Overview

Life Science Instrumentation Market Highlights

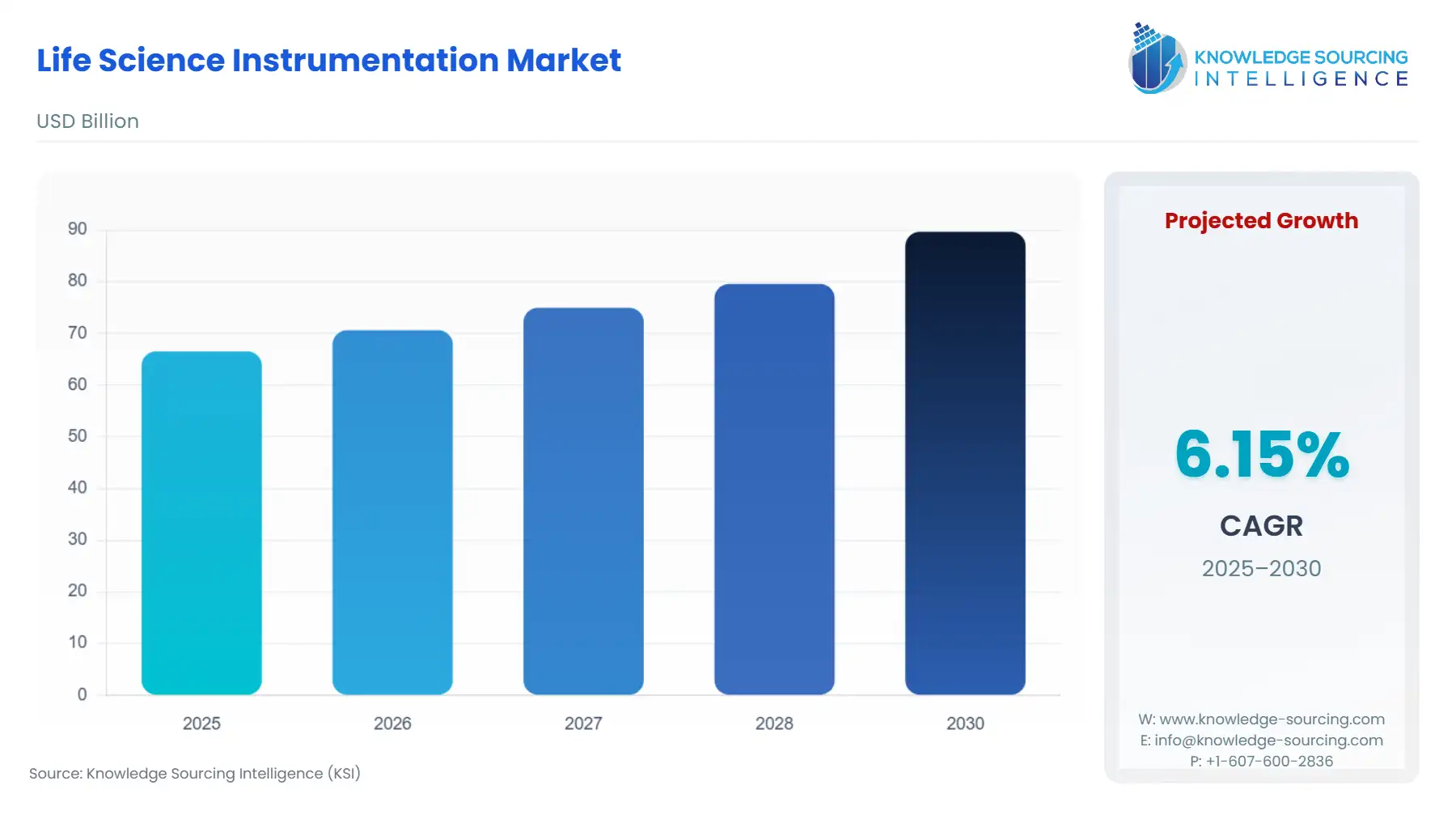

Life Science Instrumentation Market Size:

The Life Science Instrumentation Market is projected to surge from USD 66.541 billion in 2025 to USD 89.679 billion by 2030, at a CAGR of 6.15%.

The Life Science Instrumentation (LSI) market constitutes the critical capital equipment and recurring consumables platform supporting the global biomedical, pharmaceutical, and diagnostic sectors. LSI encompasses a spectrum of sophisticated analytical Technologies, including Spectroscopy, Chromatography, and Flow Cytometry, which are essential for research, drug discovery, clinical diagnostics, and quality control. The market’s trajectory is inextricably linked to global investments in public health and biotechnology innovation, where instruments serve as the non-substitutable tools that enable molecular-level discovery and high-volume diagnostic throughput. Consequently, the purchasing decisions of Pharmaceutical & Biotechnology Companies and Diagnostic Laboratories are the primary barometers of market expansion.

Life Science Instrumentation Market Analysis

- Growth Drivers

Increased global R&D expenditure by Pharmaceutical & Biotechnology Companies serves as the primary driver, as the development of novel molecular entities requires enhanced analytical capabilities, generating direct demand for high-resolution Spectroscopy and separation-based Chromatography systems. Concurrently, the proliferation of personalized and precision medicine compels Diagnostic Laboratories to acquire more sophisticated, multi-parameter instruments, like advanced Flow Cytometers, that can rapidly and accurately perform complex biomolecular assays on minute clinical samples. This technological imperative elevates the adoption rate for the latest generation of instrumentation offering superior sensitivity and automation.

- Challenges and Opportunities

The primary constraint is the significant capital outlay associated with purchasing advanced Flow Cytometry and Mass Spectrometry equipment, which restricts immediate adoption by smaller Research Institutes and many Hospitals. Furthermore, the complexity of these instruments necessitates a constant supply of highly skilled technical personnel. This challenge creates the greatest opportunity: the strategic integration of Artificial Intelligence and Machine Learning into instrument software, as demonstrated by leading vendors. This development increases user accessibility, automates complex data processing (reducing operator error), and improves the efficiency of high-throughput workflows, directly lowering the total cost of ownership (TCO) and expanding the potential end-user base.

- Raw Material and Pricing Analysis

Pricing for complex LSI hardware is intrinsically linked to the supply chain for high-purity components, including precision optics (lenses, lasers) for Flow Cytometry systems and high-grade specialty metals (e.g., titanium, stainless steel) required for the intricate vacuum chambers and fluidic pathways in Spectroscopy and Chromatography instruments. High-purity quartz and borosilicate glass are crucial for consumables like vials and chromatography columns, maintaining demand stability in these input markets. The pricing structure is "Razor-and-Blade," where the instrument is the high-cost capital item, but recurrent demand and sustained revenue are derived from proprietary, consumable reagents, columns, and sample preparation kits essential for its operation.

- Supply Chain Analysis

The LSI supply chain is bifurcated: a concentrated network for highly-engineered hardware and a globalized, diversified network for consumables. High-value components, such as high-powered lasers and specialized detectors, are manufactured by a limited number of specialized electronic and optics companies, primarily located in the US, Germany, and Japan, which introduces geopolitical sensitivity. Conversely, high-volume consumables (media, reagents, buffers) are produced in ISO-certified, redundant manufacturing facilities globally (e.g., in the US and Europe) by major players to ensure supply continuity for large Pharmaceutical & Biotechnology Companies and Diagnostic Laboratories, mitigating logistics risks associated with temperature-sensitive materials.

Life Science Instrumentation Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Federal Food, Drug, and Cosmetic Act (FFDCA) / FDA Medical Device Classification (I, II, III) |

Increases demand for documentation and high-quality instruments: Classification dictates the level of regulatory control (GMP, PMA). For Class II and III Clinical Analysis instruments, this necessitates rigorous pre-market and post-market surveillance data, directly increasing the demand for traceable, validated, and high-accuracy Spectroscopy and Flow Cytometry systems. |

|

India |

Medical Device Rules (MDR) 2017/2022/2023 / Central Drugs Standard Control Organisation (CDSCO) |

Mandates instrument registration: MDR 2018/2022/2023 requires all medical devices, including Clinical Analysis instruments (IVDs), to be formally registered and acquire ISO 13485 certification. This mandate forces Hospitals and Diagnostic Laboratories to exclusively procure standardized, high-quality instrumentation, raising the procurement threshold and increasing demand for certified systems. |

|

Europe |

In Vitro Diagnostic Regulation (IVDR) 2017/746 / European Medicines Agency (EMA) |

Raises performance standards for IVDs: The IVDR imposes stricter requirements for clinical evidence and conformity assessment for in vitro diagnostic devices used in Clinical Analysis, including many Flow Cytometry and molecular Spectroscopy instruments. This regulation forces manufacturers to produce higher-quality, better-documented instruments, increasing demand for premium, compliant systems over general-purpose lab equipment. |

Life Science Instrumentation Market Segment Analysis

- By Technology: Spectroscopy

The Spectroscopy segment, particularly Mass Spectrometry (MS) and its hyphenated techniques (LC-MS, GC-MS), experiences high growth driven by the analytical requirements of proteomics, metabolomics, and small-molecule drug testing. The central growth factor is the need for unparalleled resolution, accurate mass measurement, and high-speed quantification in complex matrices. The transition of MS from a high-end research tool to a routine quantitative Analytical Chemistry and Clinical Analysis instrument is a major catalyst. For example, the launch of new triple quadrupole (LCMS-TQ RX Series) and high-resolution MS systems directly addresses the market's need for enhanced sensitivity and stability in high-throughput applications like newborn mass screening and targeted contaminant (e.g., PFAS) analysis. This technological advancement allows Research Institutes and Diagnostic Laboratories to identify and quantify hundreds of analytes from a single, small sample, fueling instrument upgrade cycles.

- By End-User: Diagnostic Laboratories

Diagnostic Laboratories represent a pivotal and rapidly growing end-user segment, with demand for LSI fueled by two core drivers: the increasing global prevalence of chronic diseases and the necessity for early and complex molecular diagnostics. The need to process a growing volume of patient samples accurately and efficiently mandates investment in fully automated, high-throughput systems, such as clinical Flow Cytometers and automated Chromatography analyzers. Furthermore, regulatory frameworks (e.g., FDA/CDSCO device classification) prioritize the use of validated, high-quality equipment for Clinical Analysis. This regulatory scrutiny prevents the use of unreliable systems, creating a stable and non-cyclical demand for reliable, service-supported instruments and their associated high-margin consumables from established vendors. The adoption of instruments that integrate LIS/EHR systems and offer robust cybersecurity features is also a rapidly accelerating demand vector.

Life Science Instrumentation Market Geographical Analysis

- US Market Analysis

The US market is characterized by substantial governmental and private investment, driven by NIH/NSF funding for Research Institutes and massive R&D budgets from major Pharmaceutical & Biotechnology Companies. The market focuses intensely on leading-edge Technology (e.g., High-Resolution MS, Spectral Flow Cytometry) for gene therapy, synthetic biology, and translational research. Furthermore, the US FDA's stringent clinical trial requirements create a perpetual demand for cGMP-compliant LSI for biopharma quality control. This requirement is high-value, concentrated on systems that offer the highest possible performance and integration capabilities.

- Brazil Market Analysis

The Brazilian market is primarily steered by public healthcare spending and the expansion of private Diagnostic Laboratories. The demand focus is typically on cost-effectiveness and robustness, favoring mid-range, automated Clinical Analysis instruments and established Spectroscopy models over the newest, highest-cost platforms. Increased regulatory focus on food safety standards (ANVISA) drives localized demand for Chromatography and basic Spectroscopy instruments for Food and Beverage Analysis and environmental monitoring, creating distinct, regionally-specific pockets of procurement.

- Germany Market Analysis

Germany maintains a high-quality, high-demand market, largely driven by its powerful export-oriented chemical and pharmaceutical industries and world-class academic institutions. The growth is robust for both core R&D tools and certified, compliant instruments required by the IVDR for Clinical Analysis. The German market prioritizes quality assurance and automation, translating into high procurement rates for specialized Chromatography systems for complex substance separation and advanced Spectroscopy for industrial quality control, supporting both the End-Users and the local instrument manufacturing base.

- Saudi Arabia Market Analysis

The Saudi Arabian market is almost entirely dependent on large-scale government investment initiatives (Vision 2030) aimed at diversifying the economy and building a domestic R&D and healthcare infrastructure. Procurement is characterized by strategic, high-capital purchases to equip newly constructed biomedical Research Institutes and specialized Hospitals. This often results in substantial, single-vendor contracts for comprehensive laboratory fit-outs, generating demand across all technology segments, particularly in translational research for chronic disease, but with low, localized recurring consumables demand initially.

- South Korea Market Analysis

South Korea represents a hyper-competitive, high-throughput market, dominated by its major IDMs and Pharmaceutical & Biotechnology Companies. This requirement is critically tied to the rapid development and manufacturing of biosimilars and cell therapies, necessitating vast installed bases of high-throughput Flow Cytometry and analytical Chromatography systems for quality control. The competitive landscape mandates instruments capable of extreme uptime and automation. Government-backed investment in public health and genomics research further accelerates demand for cutting-edge sequencing and advanced Spectroscopy platforms.

Life Science Instrumentation Market Competitive Environment and Analysis

The Life Science Instrumentation market exhibits a concentrated competitive structure, dominated by a few global conglomerates that derive resilience from their extensive installed base and diversified portfolio across instruments, reagents, and services. Competition centers on technology integration, global service networks, and the ability to offer complete, validated workflow solutions.

- Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. maintains its leadership position by offering the broadest portfolio, encompassing high-end Spectroscopy (Mass Spectrometry), Chromatography, and Flow Cytometry systems, complemented by an enormous recurring revenue stream from consumables and reagents. The company’s strategic imperative is to offer end-to-end workflow solutions, ensuring its instrumentation is continuously fed by its proprietary consumables. Its scale and global service network provide a critical competitive advantage, especially for multinational Pharmaceutical & Biotechnology Companies and large Diagnostic Laboratories that require global technical support and supply chain redundancy.

- Danaher Corporation

Danaher Corporation strategically operates through focused, decentralized operating companies (e.g., Beckman Coulter Life Sciences, SCIEX, Cytiva) to cover critical, high-growth segments like Flow Cytometry and Spectroscopy. Its competitive positioning is defined by the Danaher Business System (DBS), focusing on operational excellence and strategic acquisitions to fill technology gaps. The acquisition of informatics companies, such as GeneData, demonstrates a strategic pivot to integrate software/AI capabilities deeply into its analytical tools, directly increasing demand for its hardware by offering superior, automated data interpretation for Research Institutes.

- Shimadzu Corporation

Shimadzu Corporation commands a robust competitive stance, particularly in the Chromatography and Spectroscopy segments, prioritizing high-performance, durable, and cost-effective analytical solutions. Its strategy focuses on penetrating routine and regulated markets, as evidenced by the launch of the LCMS-TQ RX Series and its new North American R&D center established in April 2024. This investment aims to increase its proximity to major Pharmaceutical & Biotechnology Companies and expand its market share in routine, high-throughput Analytical Chemistry and regulatory testing applications globally, specifically targeting improved sensitivity and reduced operating costs.

Life Science Instrumentation Market Developments

- August 2024: Danaher Corporation announced the acquisition of GeneData, an informatics company specializing in computational biology software for life sciences. This strategic acquisition bolsters Danaher’s software portfolio, accelerating the integration of AI/ML into its Spectroscopy and Flow Cytometry platforms.

- May 2024: Shimadzu Corporation launched the LCMS-TQ RX Series of high-performance liquid chromatograph mass spectrometers. This product launch enhances data sensitivity and stability, directly increasing demand among Diagnostic Laboratories for routine, high-accuracy analysis required in clinical and food safety testing.

- April 2024: Shimadzu Corporation established a new research and development center near Boston, San Francisco, and in Maryland. This capacity addition aims to strengthen application development and customer collaboration, supporting business growth in the critical North American Pharmaceutical & Biotechnology Companies segment.

Life Science Instrumentation Market Segmentation:

- By Technology

- Spectroscopy

- Chromatography

- Flow Cytometry

- Others

- By Application

- Analytical Chemistry

- Clinical Analysis

- Environmental Testing

- Food and Beverage Analysis

- Others

- By End-Users

- Hospitals

- Research Institutes

- Diagnostic Laboratories

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America