Report Overview

Lighting as a Service Highlights

Lighting as a Service Market Size:

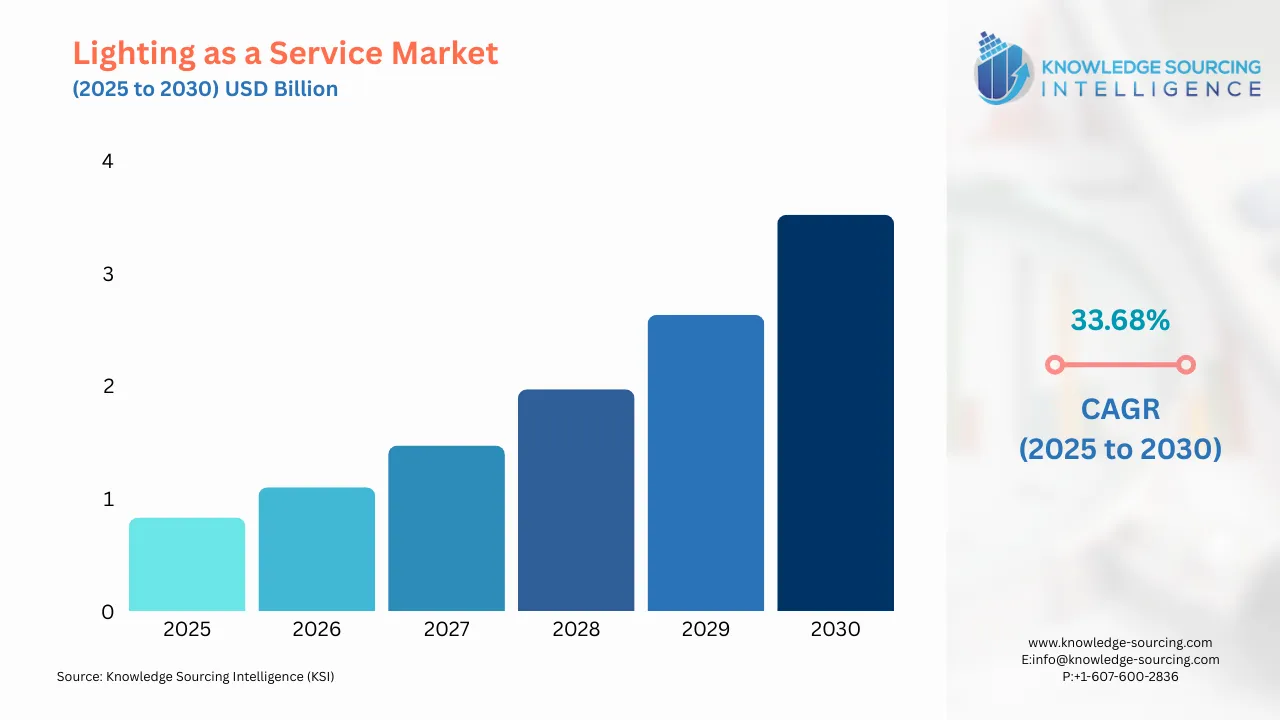

The Lighting as a Service (LaaS) Market is projected to grow at a CAGR of 33.68% to reach US$3.522 billion in 2030 from US$0.825 billion in 2025.

The LaaS industry is growing rapidly as companies from various fields, including commercial, industrial, and public sectors, are willing to invest in energy-efficient and digitally enabled lighting without the need for considerable upfront capital expenditure. The service-based model, which combines hardware, installation, maintenance, monitoring, and periodic upgrades into a predictable subscription, has proven to be a corporate strategy for addressing energy price increases, stringent energy efficiency regulations, and sustainability initiatives of companies.

Governments worldwide are implementing stricter requirements regarding energy consumption while simultaneously eliminating inefficient lighting technologies. This situation is generating a strong regulatory push for LED implementation and positioning LaaS as a beautiful means of compliance. At the same time, the shift to circular-economy business models is resulting in an increasing need for lighting systems that guarantee ongoing system updation, less waste in the product lifecycle, and better performance-based results.

Lighting as a Service Market Overview:

The Lighting as a Service (LaaS) market is gradually growing in volume with the transition of enterprises, municipalities, industrial facilities, and commercial real estate developers to service-based lighting models that reduce capital expenditure while improving energy efficiency and operational performance. LaaS is a change from a traditional one-time lighting installation to a subscription-based contract that includes LED fixtures, smart controls, maintenance, monitoring, and periodic upgrades in a single recurring service.

The model is gaining increasing popularity due to rising energy prices, strict energy-efficiency regulations, and the emphasis on carbon-emission reduction by global operations. Germany (€0.3835 per kWh), Belgium (€0.3571 per kWh), Denmark (€0.3485 per kWh), and Italy (€0.3291 per kWh) had the highest electricity prices for household consumers in the first half of 2025.

The Lighting as a Service market is a direct result of various energy-efficiency and sustainability regulations that promote the use of LED and smart-lighting systems. Important policies that lead to the implementation of LaaS are the EU Energy Efficiency Directive (EED), which requires energy consumption to be reduced step by step in the member states; the European Ecodesign Regulation, which eliminates inefficient lighting products gradually; and the U.S. Energy Policy and Conservation Act (EPCA) standards, which define the minimum efficiency levels for lighting equipment. Moreover, local green-building programs like LEED and BREEAM are also helping LaaS become more popular by demonstrating the installation of energy-efficient lighting and smart-control systems. All these regulatory drivers are hastening the transition to service-based lighting models as efficient, upgradeable, and well-maintained lighting systems are becoming a compliance requirement rather than just an optional upgrade.

Building green is the trend certified by various green building certifications, which is also fueling the demand for outcome-based contracting models, a way of aligning costs with measurable environmental and economic results. LaaS, as a result, is emerging as a strategic instrument for reducing operating costs and achieving sustainability goals, particularly amid accelerating smart city investments and the modernization of commercial infrastructures. This positions LaaS as a cornerstone of future facility management strategies.

Innovators in LED technologies, IoT-enabled lighting controls, and performance-based service models have been the main strategies of key players that include Signify, Zumtobel Group, Eaton, Energy Focus, Cree Lighting, Ameresco, Legrand S.A., Hubbell Incorporated, Digital Lumens, and Osram GmbH for the last quarter to outpace rivals and shape the competitive landscape in the LaaS market. These organizations are providing integrated subscription solutions that effortlessly combine cutting-edge hardware, cloud analytics, and lifecycle management to address the ever-growing need for efficient, connected, and economically attractive lighting systems in commercial, industrial, and municipal sectors.

Lighting as a Service Market Trends:

The LaaS market is experiencing a transformative phase, driven by the global push for energy efficiency, sustainability, and smart technology integration. LaaS, a subscription-based model where third-party providers manage lighting solutions, including design, installation, maintenance, and upgrades, has emerged as a compelling alternative to traditional lighting ownership. This model allows businesses, municipalities, and institutions to reduce upfront costs, enhance energy savings, and adopt advanced lighting technologies without the burden of capital investment. As organizations prioritize sustainability and operational efficiency, LaaS is gaining traction across commercial, industrial, and public sectors.

Integration of IoT and Smart Lighting Solutions: The integration of Internet of Things (IoT) technologies into LaaS offerings is a dominant trend, enabling intelligent, data-driven lighting systems that optimize energy use and enhance functionality.

Focus on Sustainability and Carbon Neutrality: Sustainability is a cornerstone of the LaaS market, with organizations leveraging the model to meet stringent environmental regulations and carbon neutrality goals.

Expansion of LaaS in Emerging Markets: The LaaS market is expanding rapidly in emerging economies, particularly in Asia-Pacific and the Middle East, driven by urbanization and infrastructure development.

Adoption of Human-Centric Lighting: Human-centric lighting (HCL), which adjusts light intensity and color temperature to enhance well-being and productivity, is gaining prominence in LaaS offerings.

Lighting as a Service Market Growth Drivers:

Demand for Energy Efficiency and Cost Savings: The global push for energy efficiency, driven by rising electricity costs and stringent environmental regulations, is a primary driver of the LaaS market.

Rapid Urbanization and Smart City Initiatives: The lighting as a service market is witnessing significant growth, primarily driven by the growing urbanisation interlinked with the expansion of smart city initiatives. This model works by transitioning capital expenditure lighting solutions to operational and subscription models, which corresponds to the rising demand for energy-efficient, scalable, and IoT-integrated urban infrastructures.

According to the World Bank data, about 58 per cent of the total population in 2024 lived in urban areas, an increase from 56 per cent in 2020. Similarly, as per the United Nations, about 68 per cent of the global population is expected to live in urban regions by 2050.

Additionally, governments globally are investing heavily in the development of smart cities' infrastructure with a focus on reduced emissions, energy efficiency, and sustainability, while providing the public with enhanced safety. This is expected to promote demand for smart lighting systems for providing a remote monitoring system that is adaptive to brightness based on occupancy and traffic. Furthermore, the smart poles and street lights are expected to promote the need for lighting as a service product integrated with data analysis, sensors, public wi-fi, and traffic monitoring services.

For instance, according to the data from the Indian Government Press Information Bureau (PIB) of June 2025, there are a total of 8,067 smart cities projects under the Smart Cities Mission in the country. Of this, about 7,555 projects, i.e., 94% of the projects, are completed with a total investment in the mission accounting for ?1.64 lakh crore. This involved the improvement of infrastructures and services in cities, followed by an area-based and pan-city approach. Additionally, 6 per cent, i.e., 512 projects, are ongoing as of May 2025 with ?13,043 crore funding.

Moreover, with the rapid rise in urban areas, especially in the Asia Pacific, cities are expected to promote the need for efficient, energy-saving commercial and public lighting solutions, which in turn propel the market size. This is also driven by the lighting as a service market, providing decreased upfront cost for businesses and also boosting sustainability goals.

Adoption of IoT and Smart Lighting Technologies: The integration of IoT technologies into lighting systems is a significant driver, enabling LaaS providers to offer intelligent, data-driven solutions that enhance functionality and energy efficiency.

Lighting as a Service Market Segmentation Analysis by Component:

Hardware: Includes luminaires and controls critical for energy-efficient lighting systems.

Software: Encompasses IoT platforms and analytics for smart lighting management.

Services: Covers design, installation, maintenance, and upgrades, ensuring system reliability and efficiency.

Lighting as a Service Market Segmentation Analysis by Installation:

Indoor Installation: Dominates due to demand for energy-efficient and smart lighting in commercial and institutional settings.

Outdoor Installation: Growing in urban areas for smart street lighting and public infrastructure.

Lighting as a Service Market Segmentation Analysis by End-User:

Commercial: Leads due to demand for cost-effective, sustainable lighting in offices, retail, and hospitality.

Industrial: Utilizes LaaS for energy-efficient lighting in manufacturing and warehousing.

Others: Includes public sector applications like municipal and educational facilities.

Lighting as a Service Market Geographical Segmentation:

The Lighting as a Service market report analyzes growth factors across the following regions:

North America: Leads due to commercial demand for energy-efficient lighting and sustainability goals.

Europe: Fastest-growing region, driven by commercial and industrial demand and stringent environmental regulations.

Asia Pacific: Rapid growth fueled by urbanization and smart city initiatives in countries like China and India.

Lighting as a Service Market Competitive Landscape:

Signify N.V.: Leader in IoT-enabled LaaS solutions with its Interact platform for smart lighting.

Zumtobel Group AG: Focuses on sustainable LaaS programs with recyclable LED luminaires.

Acuity Brands, Inc.: Pioneers human-centric lighting solutions for healthcare and commercial sectors.

These companies drive innovation through advanced lighting technologies and strategic partnerships, enhancing market competitiveness.

Lighting as a Service Market Segmentation Analysis

By End-user: Commercial

Based on the end user, the Lighting as a Service Market is segmented into commercial, industrial, and others. The commercial market has been the most successful sector for lighting-as-a-service, as businesses prefer to preserve capital rather than invest in hardware and instead seek a reliable, cost-effective solution for to upgrading their lighting system. Businesses of every type – office, retail, hotel, and large campus – are using this model to replace old fixtures, reduce energy costs, minimise downtime and transfer maintenance responsibility to an external provider. However, the critical factor is that commercial buildings typically have long operating hours, and even marginal energy efficiencies can represent significant value. Hence, when their lighting is contracted as a service, it also includes monitoring, continuous performance optimisation, and rapid-response replacement, which is a clear and competitive benefit to the business. In addition, organisations require the flexibility to add or reconfigure lighting as their space changes, which is both easier and more affordable under a service model than under traditional ownership.

Essentially, LaaS is well-suited for internal corporate sustainability goals, facility-management budgets, and operational plans, making the commercial segment the most active adopter and clearest driver of long-term demand in the lighting-as-a-service market.

Signify has a good share in the lighting-as-a-service sector, and its revenue distribution indicates that the future is geared towards commercial upgrades. In its most recent fiscal year, Signify generated sales of €3,933 million in the professional lighting segment compared to €1,297 million in the consumer segment. The difference between professional and consumer sales indicates where the greater demand is coming from, as the professional side of the business generally involves larger installations, connected controls, and long-term agreements, which align exactly with the lighting-as-a-service model. The scale of the professional environment allows Signify to innovate in areas such as automation, sensors, and management tools to make the LaaS model attractive in office spaces, retail properties, campuses, and industrial environments. Ultimately, Signify's position within the professional segment bolsters the commercial refurbishment cycles, aiding both itself and the market as a whole.

North America: the US

The growing energy demand in the United States, followed by constant population growth and industrial productivity, has accelerated the need for energy optimization, thereby reducing overall consumption costs. Hence, lighting as a service has provided a modern approach that integrates urban infrastructures with optimum energy usage, thereby making it an ideal choice in commercial establishments.

Public construction spending has shown progression over the years, fuelled by growing demand for modern and sustainable spaces. For instance, according to the U.S Census Bureau, in August 2025, the total public construction spending in non-residential spaces, inclusive of office, healthcare units, educational facilities and other commercial buildings, reached at a seasonally adjusted rate of USD 504.932 billion, which experienced a 2.39% growth over the spending recorded in 2024 for the same month.

Similarly, environmental regulations implemented by the US government, such as “Better Building Initiative” and “LEED Certification,” have established a framework for the adoption of energy-saving technologies via public-private collaboration. According to the U.S Department of Energy’s “2024 Better Building Initiative Progress Report”, nearly USD 22 billion has been saved in energy savings under the Better Building Initiative ever since its implementation.

Furthermore, the ongoing development in LEDs, followed by strategic collaboration to expand smart lighting solutions, is also an additional driving factor for market expansion. For instance, in September 2025, Itron. Inc. formed an agreement with Current Lighting Solutions for the development of end-to-end smart lighting solutions for cities and utilities. Well-established presence of major market players such as Signify, whose LaaS extend beyond installation, has provided a new market outlook.

Lighting as a Service Market Latest Developments:

2025: Eaton released Brightlayer 8.0, enhancing user experience with faster navigation and intuitive controls for LaaS deployments.

October 2024: Acuity Brands launched a LaaS solution under its Nightingale brand, focused on human-centric lighting for healthcare facilities.

November 2024: Zumtobel Group’s lighting brands, Thorn and Zumtobel, collaborated with Sunderland Association Football Club (AFC) to execute a LaaS-based illumination upgrade for the Stadium of Light.

Lighting as a Service Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 0.825 billion |

| Total Market Size in 2030 | USD 3.522 billion |

| Forecast Unit | Billion |

| Growth Rate | 33.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component, Installation, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Lighting as a Service Market Segmentation:

By Component

Hardware

Software

Services

By Installation

Indoor Installation

Outdoor Installation

By End-User

Commercial

Industrial

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others