Report Overview

Liquid Cooled Generator Market Size:

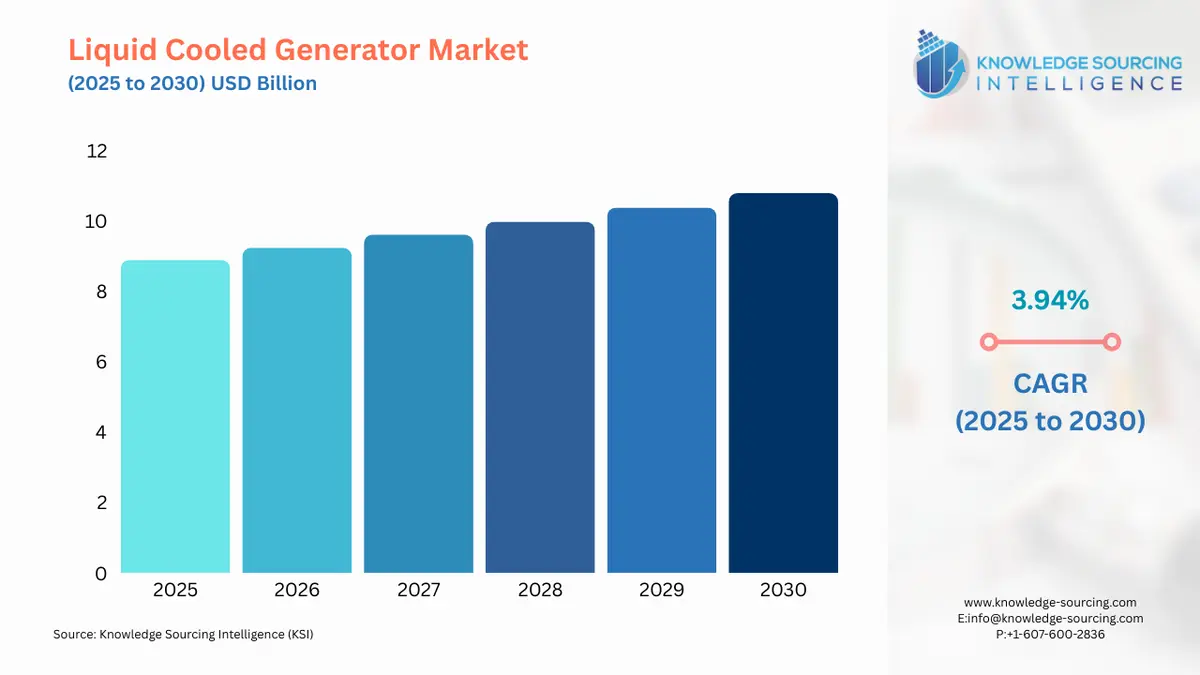

Liquid Cooled Generator Market, with a 3.94% CAGR, is expected to grow to USD 10.785 billion in 2030 from USD 8.891 billion in 2025.

A liquid-cooled generator is a type of electrical generator that uses a liquid coolant to regulate its temperature and dissipate heat during operation. The liquid coolant is circulated through the generator's internal components, including the stator and rotor windings, to maintain optimal operating temperatures and prevent overheating. One advantage of liquid-cooled generators is their ability to operate at higher temperatures without overheating, which can improve their overall efficiency and lifespan. Liquid-cooled generators are commonly used in residential and industrial applications, which include healthcare, data centers, telecommunications, and manufacturing. The liquid-cooled generators market is being driven by the increasing demand for reliable and efficient power sources across various industries.

Liquid Cooled Generator Market Growth Drivers:

- The increasing use of reliable power sources in various industries is augmenting the demand for liquid-cooled generators.

The reliability of liquid-cooled generators is a key factor in their adoption by industries. These generators can provide a continuous and stable power supply over long periods, reducing the risk of downtime and associated costs for businesses. Reliable power sources are crucial for the smooth and uninterrupted operation of various industries, such as healthcare, data centers, telecommunications, and manufacturing, and the use of liquid-cooled generators as a power source helps to ensure that these industries can continue to operate even in the event of a power outage or disruption. The increasing demand for reliable power sources is expected to drive the growth of the liquid-cooled generator market. Also, the increased electricity demand due to economic recovery and the continued adoption of electric vehicles and other electrification initiatives are expected to act as additional driving factors. The International Energy Agency (IEA) reported in 2021 that the electricity demand was expected to increase by 5% in 2021 and 4% in 2022. According to the World Bank, the global manufacturing sector grew by 3.9% in 2021, up from a contraction of 1.9% in 2020, and the industries, such as healthcare, education, and telecommunications, grew by 5.2% in 2021. The growing trend of using renewable energy sources, such as wind and solar power, is also expected to boost the growth of the liquid-cooled generator market as it is a backup power source. According to the International Energy Agency (IEA), renewable energy capacity grew by 45% in 2020, with renewable energy accounting for 90% of new electricity generation capacity worldwide. This demonstrates that liquid-cooled generators are expected to have a positive market demand.

Liquid Cooled Generator Market Geographical Outlook:

- The Asia Pacific region is expected to constitute a significant share of the market throughout the forecast period.

The increasing demand for reliable power sources in countries such as China, India, and Japan is driving the demand for liquid-cooled generators in the region, and the growing industrial sector in the Asia Pacific is also expected to boost the market as more companies are investing in backup power solutions to ensure uninterrupted operations. In 2020, the government of China announced a plan to invest over $350 billion in renewable energy by 2025. This plan was expected to increase the use of renewable energy sources and drive the demand for backup power solutions like liquid-cooled generators. In 2020, the Japanese government announced a new energy policy that promotes renewable energy and aims to phase out inefficient coal-fired power plants. This policy is expected to increase the demand for liquid-cooled generators that can support the intermittent power generation of renewable energy sources. The Indian government has also set a target of achieving 175 GW of renewable energy capacity by 2022, including 100 GW of solar power capacity. This ambitious target is expected to boost the renewable energy sector and create demand for supporting infrastructure like liquid-cooled generators. These factors add to the liquid-cooled generator market growth in the Asia Pacific.

Market Segmentation:

- LIQUID COOLED GENERATOR MARKET BY FUEL TYPE

- Diesel

- Gasoline

- Others

- LIQUID COOLED GENERATOR MARKET BY COOLANT TYPE

- Water-Based

- Oil-Based

- LIQUID COOLED GENERATOR MARKET BY PHASE TYPE

- Single Phase

- Three-Phase

- LIQUID COOLED GENERATOR MARKET BY POWER OUTPUT

- Up to 30 kW

- 30 to 50 kW

- Greater than 50 kW

- LIQUID COOLED GENERATOR MARKET BY END-USER

- Residential

- Commercial & Industrial

- LIQUID COOLED GENERATOR MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America