Report Overview

Air Cooled Generator Market Highlights

Air Cooled Generator Market Size:

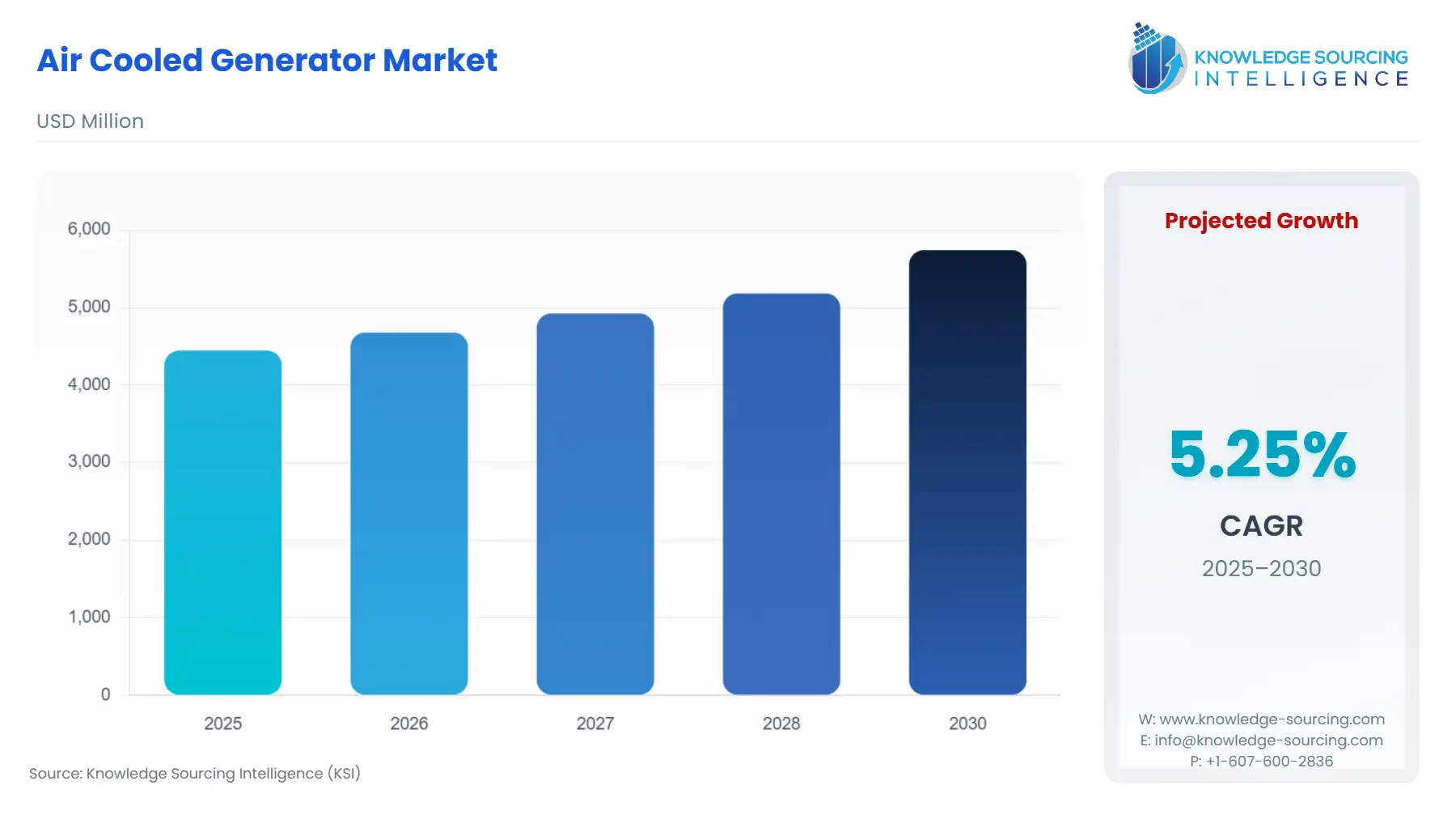

Air Cooled Generator Market is forecasted to rise at a 5.25% CAGR, reaching USD 5.742 billion by 2030 from USD 4.446 billion in 2025.

The air-cooled generator market is defined by its pivotal role in bridging the gap between aging centralized power infrastructure and the growing need for distributed, resilient power. These generators, which rely on ambient air for cooling the engine and alternator, primarily occupy the lower power-output segment (typically below 50 kW), serving critical backup power needs for the residential, light commercial, and small industrial sectors. Current market dynamics are characterized by a pronounced demand pull driven by macro-environmental and regulatory instability, compelling end-users to invest in autonomous power security. This shift positions air-cooled generators as an essential component of a robust, decentralized energy landscape, distinct from the higher-capacity, liquid-cooled segment focused on large-scale industrial or utility applications.

Air Cooled Generator Market Analysis

-

Growth Drivers

Increasing instability in centralized power grids, primarily due to aging infrastructure and the rising severity of natural hazards, acts as a powerful catalyst, directly propelling residential and small commercial demand. Customers, particularly in North America, seek immediate, non-utility power assurance to mitigate risks associated with multi-day outages. Concurrently, the global trend toward digitalization and the proliferation of mission-critical small data centers and telecommunication relays amplify demand for reliable, small-footprint backup power. Air-cooled units are well-suited for these applications due to their compact design and lower acquisition cost, making them the preferred solution for safeguarding critical operations against momentary or sustained grid interruptions.

-

Challenges and Opportunities

The primary challenge is the fluctuating cost and availability of critical raw materials, notably copper and specialty steel, which introduces significant cost variability into the Bill of Materials (BOM) and pressure on final product pricing. However, this challenge generates an opportunity: product redesign toward higher efficiency and alternative materials to secure margins and market share. Another opportunity lies in product innovation related to fuel flexibility. The growing push for lower emissions creates a strong demand for generators capable of running on non-diesel/gasoline fuels, such as Liquefied Natural Gas (LNG) or propane, thereby opening new high-value segments in environmentally sensitive jurisdictions.

-

Raw Material and Pricing Analysis

The Air Cooled Generator Market, as a physical product market, is significantly affected by the supply chain and pricing of non-ferrous metals. Copper is a paramount raw material, integral to the construction of the generator's windings and internal wiring harnesses. The annual average COMEX copper price, a key industry benchmark, was projected to be $4.20 per pound in 2024, reflecting an estimated 9% increase from the prior year’s average. This pricing surge, driven by global supply constraints and optimistic sentiment regarding world demand, translates directly into higher manufacturing costs. Producers must strategically manage material hedging and adopt lean manufacturing practices to absorb or pass on these elevated costs to maintain pricing competitiveness in a highly elastic consumer market.

-

Supply Chain Analysis

The global air-cooled generator supply chain is geographically diversified, with key production hubs located across North America, China, and India. Manufacturing is characterized by a reliance on highly specialized global suppliers for critical components, including magnet wire, engine control units (ECUs), and spark-ignited internal combustion engines. A significant logistical complexity is the single-source reliance for high-quality, rare-earth magnets, which, while more common in larger wind turbine generators, still feature in advanced air-cooled alternators and can stress the supply chain when demand spikes. The need for timely delivery, driven by high-urgency disaster recovery or power outage scenarios, further complicates logistics, pushing manufacturers to prioritize regional final assembly over purely offshore sourcing to mitigate transit risk.

Air Cooled Generator Market Government Regulations

Key governmental regulations primarily focus on emissions and sound mitigation, directly impacting generator design and market access.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Environmental Protection Agency (EPA) - Nonroad Compression-Ignition (CI) and Spark-Ignition (SI) Emissions Standards |

Mandates advanced engine technologies (e.g., electronic fuel injection) to meet strict emission limits, increasing the unit's complexity and manufacturing cost, thereby raising the final price and slightly curbing demand elasticity. |

|

European Union (EU) |

Noise Emission Directive (2000/14/EC) and its updates |

Sets maximum permissible sound power levels, which drives demand toward "Silent Generator" (enclosed/canopy) type, which adds cost but also creates a premium market segment focused on residential and urban use. |

|

India |

Central Pollution Control Board (CPCB) - Noise and Emission Standards for Gensets |

Enforces stringent requirements for both noise and air pollution, compelling all industrial and commercial users to procure certified sets, effectively consolidating demand towards compliant, higher-quality (often enclosed) products. |

Air Cooled Generator Market Segment Analysis

-

By Power Output: Up to 30 kW

The Up to 30 kW segment represents the largest volume driver in the air-cooled generator market, defined by intense demand from the residential and light commercial sectors. The core growth driver is the "Prosumer Resilience Mandate"—the fundamental need for homeowners and small businesses to maintain basic functionality during utility power failures. This necessity is directly influenced by the increasing duration and frequency of grid outages observed across key markets. For example, severe weather events (e.g., hurricanes, ice storms) have increased in magnitude, causing multi-day outages and forcing investment in non-utility-dependent power. The necessity is disproportionately high for gasoline and propane-fueled air-cooled units in this category due to their lower installation cost compared to their liquid-cooled counterparts and the prevalence of natural gas lines that support "set-it-and-forget-it" standby functionality. This segment’s growth is fundamentally inelastic to minor price increases as the value proposition shifts from convenience to non-negotiable power security.

-

By End-User: Residential

Residential demand acts as a critical anchor for the air-cooled generator market, specifically targeting the need for automatic, whole-house or essential-circuit backup power. The primary driver is the "Work-From-Home (WFH) Economy and Home Automation Imperative." The modern home is highly dependent on continuous power for professional work (internet, computers), climate control (HVAC), and security systems. A grid outage directly compromises professional livelihoods and the operability of expensive home infrastructure. This imperative has significantly increased the demand for permanent, air-cooled standby generators over portable units. Homeowners prefer air-cooled models for their compact size, suitability for smaller urban lots, and relative cost-efficiency, which is an accessible entry point to a non-interruptible power lifestyle. This segment experiences demand peaks immediately following major regional natural disasters as the perceived risk of future outages dramatically increases.

Air Cooled Generator Market Geographical Analysis

-

US Market Analysis (North America)

The US market for air-cooled generators is uniquely driven by a confluence of regulatory stability and environmental volatility. The growth is primarily centered in the residential and light commercial standby sectors, fueled by an escalating number of grid-threatening weather events and a relatively stable, yet aging, national transmission network. In key hurricane and ice-storm-prone states, the purchase of a standby air-cooled generator has transitioned from a discretionary luxury to a necessity for business continuity and personal safety. The market also sees strong demand for propane-fueled units, capitalizing on the established natural gas pipeline infrastructure that simplifies refueling and long-term operation for homeowners.

-

Brazil Market Analysis (South America)

Brazil's market dynamics are fundamentally driven by the need to support an expanding, decentralized industrial base and to manage power quality issues across the national grid. Industrial and commercial enterprises, particularly those operating in regions with inconsistent power supply or frequent voltage fluctuations, demand air-cooled generators for reliable primary or supplemental power. The requirement here is less focused on emergency backup for affluent residential users and more on power stabilization and cost mitigation against highly unreliable utility services, with diesel being the dominant fuel type due to its established supply chain for commercial use.

-

Germany Market Analysis (Europe)

The German market is heavily constrained by stringent noise and environmental regulations, leading to a strong, exclusive preference for enclosed, "Silent Generator" air-cooled units. The necessity is driven by small commercial users (e.g., data centers, small-scale manufacturing) requiring highly reliable, short-duration backup power that meets tight urban environmental standards. Unlike the US, residential adoption is lower but centers on highly efficient, often gasoline-fueled, units for utility power quality conditioning and niche applications, with a strong emphasis on compliance with the EU's Noise Emission Directive.

-

Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market is significantly influenced by extreme climate conditions. Air-cooled generators are deployed extensively for off-grid or remote primary power solutions in construction, oil & gas auxiliary operations, and desert-based telecommunication sites where traditional utility infrastructure is absent or highly constrained. The intense heat of the region acts as a physical constraint, necessitating robust, over-engineered cooling fins and materials, which slightly increases unit cost. The primary demand is for heavy-duty, diesel-fueled units, as fuel availability and logistics favor diesel in large-scale commercial deployments.

-

China Market Analysis (Asia-Pacific)

China's market is characterized by mass-volume manufacturing and a dual-tier demand structure. High-end, certified air-cooled generators are utilized in export-oriented manufacturing and data centers that require non-negotiable power quality. However, the bulk of demand stems from small, decentralized commercial operations and auxiliary construction sites that require inexpensive, temporary power. This environment drives intense price competition, promoting the widespread adoption of lower-cost, gasoline-fueled, open-framed air-cooled generators where local environmental regulations are less strictly enforced than CPCB regulations in other APAC markets.

Air Cooled Generator Market Competitive Environment and Analysis

The air-cooled generator market operates under an established competitive framework, dominated by a few global power generation conglomerates and a robust layer of regional specialists. Competition is based not only on price but critically on brand trust, service network coverage, and the ability to meet localized emission and noise standards. Major companies leverage their global distribution systems and deep expertise in engine and alternator design to maintain a competitive advantage.

-

Generac Power Systems, Inc.

Generac Power Systems is strategically positioned as a market leader, particularly in the North American residential standby generator segment. The company's strategy is heavily focused on innovation in the home-backup market, offering a full suite of Wi-Fi-enabled, remote-monitoring air-cooled units. Their key product range, predominantly in the up-to-22 kW air-cooled space, is designed for automatic home standby applications using natural gas or propane. This intense focus allows Generac to capture the rapidly growing residential requirement driven by the grid resilience imperative, creating a self-reinforcing brand presence among homeowners seeking set-it-and-forget-it reliability.

-

Cummins Inc.

Cummins Inc. commands a significant market position through its comprehensive portfolio that spans from light-duty air-cooled generators to heavy-duty liquid-cooled power systems, targeting the commercial and industrial sectors. Cummins leverages its reputation as a global power leader and its extensive, high-quality distribution and service network to position its air-cooled products for critical, high-reliability applications, such as telecommunication infrastructure and small healthcare facilities. The company’s strategic emphasis is on fuel flexibility and lower-emission technology, using its core engine technology expertise to ensure compliance with a broad range of global emissions standards. This strategy underpins their ability to service diverse geographical markets with a unified product platform.

Air Cooled Generator Market Recent Market Developments

-

February 2024: Cummins Inc. announced the commencement of an exchange offer to fully split off its remaining interest in Atmus Filtration Technologies Inc., which was formerly part of its Components segment. This strategic divestiture is an explicit move to streamline the Cummins portfolio, allowing the core Power Systems segment, which includes generators, to intensify focus and innovate on core technologies, reducing the complexity of its overall supply chain.

Air Cooled Generator Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 4.446 billion |

| Total Market Size in 2030 | USD 5.742 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Fuel Type, Type, Power Output, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Air Cooled Generator Market Segmentation:

BY FUEL TYPE

-

Diesel

-

Gasoline

-

Others

BY TYPE

-

Open-Framed Generators

-

Silent Generator

BY POWER OUTPUT

-

Up to 30 kW

-

30 to 50 kW

-

Greater than 50 kW

BY END-USER

-

Residential

-

Industrial & Commercial

BY GEOGRAPHY

-

North America

-

USA

-

Canada

-

Mexico

-

-

South America

-

Brazil

-

Argentina

-

Others

-

-

Europe

-

Germany

-

France

-

United Kingdom

-

Spain

-

Others

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Others

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

Others

-