Report Overview

Machine Learning for Carbon Highlights

Machine Learning for Carbon Footprint Management Market Size:

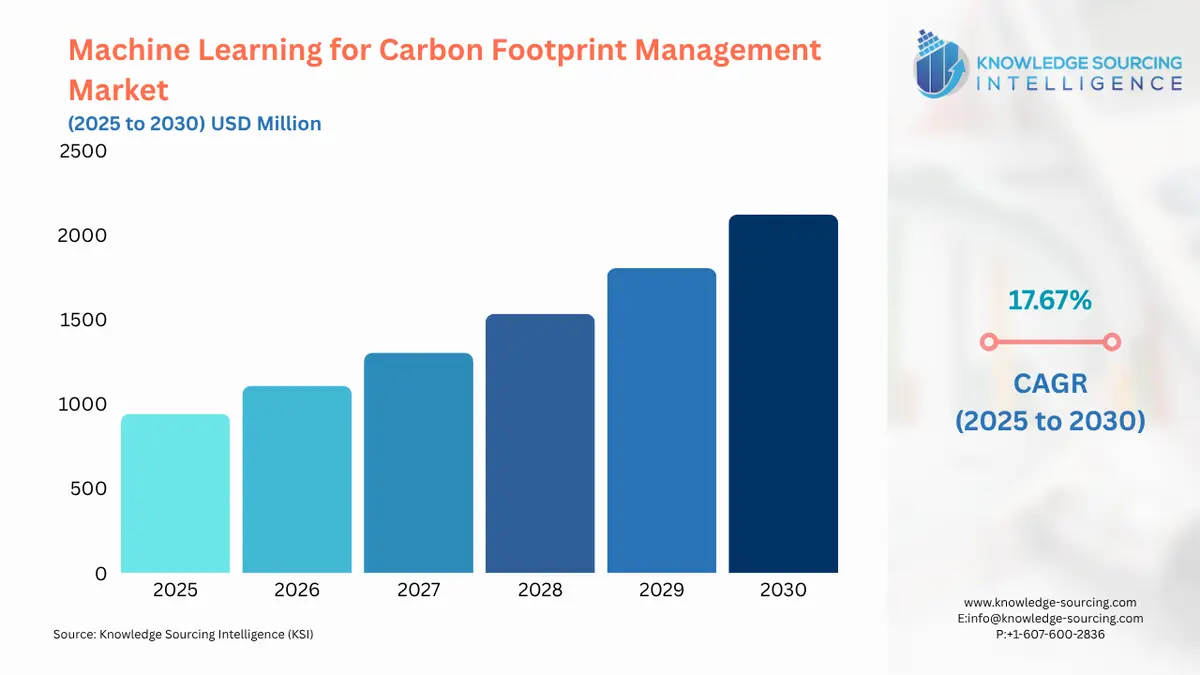

The Machine Learning for Carbon Footprint Management Market is set to expand at a CAGR of 17.67%, increasing to USD 2,122.355 million in 2030 from USD 940.723 million in 2025.

Machine learning is playing a significant role in carbon footprint management. It is helping in identifying patterns and trends in energy usage, optimizing energy systems, and predicting and preventing energy waste by analysing vast amounts of data. AI could reduce global greenhouse gas emissions by up to 4% by 2030, which is equivalent to nearly 2.4 gigatons of carbon dioxide (IEA), by significantly reducing carbon emissions in various sectors such as energy, transportation, manufacturing industries and others, significantly driving the ML in carbon footprint management.

The growing, stringent regulatory pressures, such as the EU’s CSRD, USA’s SEC Climate Disclosure rules and systems like carbon tax and carbon pricing, are driving the adoption of ML. Growing corporate ESG goals and increasing investor pressure, along with growing use of AI technologies, are becoming a key booster for market growth.

Machine Learning for Carbon Footprint Management Market Overview & Scope:

The Machine Learning for Carbon Footprint Management Market is segmented by:

- Components: The machine learning for carbon footprint management market is segmented by component into software and services. The software segment is further categorized into carbon accounting and reporting platforms, supply chain emissions management tools, predictive analytics and optimization, and real-time monitoring and IoT-integrated tools. Software segment holds the dominant share, while the service segment, which comprises consulting, implementation and training, is growing at a faster rate, driven by complexity in management, regulatory compliance mapping and the need for tailored adoption support.

- Deployment Mode: By deployment mode, the market is segmented into cloud-based and on-premise. Cloud-based platforms dominate the market as they offer scalability and easy integration with ML analytics. On-premise will be growing in highly regulated sectors.

- Enterprise Size: The market is segmented by enterprise size into large enterprises and small and medium-sized enterprises. Large enterprises represent the dominant share, while SMEs are the fastest-growing segment.

- End-User: By end-user, the market is segmented into energy & utilities, manufacturing & heavy industry, agriculture & food processing, transportation & logistics, construction & real estate, technology & telecom, and public sector & government bodies. Manufacturing and heavy industry have a significant share, while other verticals are also growing steadily. Transportation and logistics are growing at the fastest rate.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. North America holds a key share in the market, driven by stringent regulations, corporate ESG commitments, investment for a sustainable future, and strong IT infrastructure. Asia-Pacific is the fastest-growing market, driven by rapid industrialization and carbon-neutral targets by countries like China and India. The ESG mandates in various countries and emerging carbon trading schemes are driving the region’s growth.

Top Trends Shaping the Machine Learning for Carbon Footprint Management Market:

- Increasing Integration With Other Technologies

There is an increasing trend that ML is being integrated with other technologies such as IoT, ERP systems, blockchain, digital twins, and cloud platforms.

For instance, Siemens’s MindSphere uses IoT with advanced analytics and AI to quickly build and integrate personalized IoT applications to address specific use cases. - Emergence of ML-Powered Scope 3 Emissions Estimation Tools

There is an emergence of ML-Powered tools that analyse historical supplier data, IoT and logistics data, procurement and shipping records for tracking Scope 3 emission estimates.

To leverage the trend, many companies such as Watershed, Persefoni , Climateq and Normative are integrating ML for Scope 3 emissions estimation tools.

Machine Learning for Carbon Footprint Management Market Growth Drivers vs. Challenges:

Opportunities:

- Stringent Carbon Disclosures: Governments across the globe are increasingly mandating carbon emissions tracking and disclosures such as CSRD replaces and builds on the NFRD by introducing more detailed reporting requirements and expanding the number of companies that have to comply with the European Commission. Other regulations are SFRD by the EU, SECR by the UK, The SEC proposal by the U.S., and CSDDD applying globally. With increasing focus on climate and sustainability, and growing national aims for reducing carbon emissions are leading governments to push companies to adopt effective carbon tracking and disclosures, leading companies to adopt machine learning tools to automate emission tracking and reporting, providing a significant boost to the market.

- Corporate Net Zero and ESG Commitments: Large global companies are increasingly committing themselves to adopt net-zero goals and demonstrate real climate action. Governments' ESG regulations are pushing them to adopt sustainability efforts, including carbon footprint management. As part of their corporate responsibilities, major companies are prioritizing clean energy use and transparent carbon disclosures in procurement and investment decisions. As machine learning helps in offering efficiency, the market is increasingly growing. As per reports, the number of Fortune 500 companies with net zero commitments has increased by 6%, making half of Fortune 500 companies have established net zero goals. 8% of Fortune 500 companies have achieved carbon neutrality, while 9% plan to do so by 2030, and 17% by 2050.

- Stakeholder Preference for Clean Companies: Industry stakeholders such as shareholders, B2B buyers, and financial institutions are preferring those companies for investments that are prioritizing clean energy and transparent carbon disclosures. This is also pushing companies to adopt carbon footprint management to gain investment, driving the ML in carbon footprint management. A survey by Morningstar shows that 77% of companies are using digital and AI tech to reach sustainability targets.

Challenges:

- Lack of Standardization in Carbon Data across Industries: The availability of data and standardisation of data is one of the key challenges that are limiting the market growth. Carbon data are frequently unavailable or of low quality, making it challenging for ML systems to identify inefficiencies and offer improvement suggestions. Varying units of measurements, fragmented supply chain data and different system boundaries disrupt ML algorithms, making ML less efficient.

Machine Learning for Carbon Footprint Management Market Regional Analysis:

- North America: North America holds the largest share in the market. The dominance is driven by growing government policies for ESG compliance, investment in green energy, growing corporate social responsibility and high adoption rate of technology across industries. The key drivers are early technology adoption, and the market is investor-driven and corporate net-zero goals.

- USA: USA accounts for a huge share in the North America region as well as globally. The SEC’s climate disclosure mandates require public companies to disclose scope 1 and 2 emissions, climate-related risks, and large institutional investors’ ESG pressure is significantly driving the market. The high adoption of AI technology and presence of key tech companies drives the market. The country’s various federal and state-level climate action is driving the market.

- Europe: Europe holds a significant share in the market. The market is driven by Europe’s stringent regulations for carbon tracking and management, mandated in key laws such as CSRD, CBAM, EU Green Deal, SFDR and various countries' specific ones. The growing mandates for emission trading and taxes, such as on Carbon tax on EU border, drive the market. The region is led by manufacturing, construction and logistics industries.

Machine Learning for Carbon Footprint Management Market Competitive Landscape:

The market is moderately fragmented with a mix of large technology firms such as Microsoft, IBM, SAP, and specialized startups such as Emitwise, Persefoni, CarbonChain and others. The market is also growing towards consolidation. Many niche players are partnering with IoT, ERP and cloud vendors, while big tech is acquiring niche ML-driven firms. Some of the key developments in the market are:

- Product Innovation: In May 2025, Schneider Electric launched an AI-Native Initiative that focuses on Agentic AI for helping companies to track energy consumption, measure carbon emissions and identify opportunities to improve efficiency.

- Partnership:In April 2023, CarbonChain, with Quor’s Fintrade platform, announced a new API integration. It enabled the commodity traders to embed carbon intelligence into the management of their trading activities by automatically syncing trade portfolio information for comprehensive emissions calculations with breakdowns by trade, product or trade finance provider.

Machine Learning for Carbon Footprint Management Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 940.723 million |

| Total Market Size in 2031 | USD 2,122.355 million |

| Growth Rate | 17.67% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Deployment Mode, Enterprise Size, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Machine Learning for Carbon Footprint Management Market Segmentation:

- By Component

- Software

- Carbon Accounting and Reporting Platforms

- Supply Chain Emissions Management Tools

- Predictive Analytics and Optimization

- Real-Time Monitoring and IoT-Integrated Tools

- Services

- Software

- By Deployment Mode

- Cloud-Based

- On-Premise

- By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises

- By End-User

- Energy & Utilities

- Manufacturing & Heavy Industry

- Agriculture & Food Processing

- Transportation & Logistics

- Construction & Real Estate

- Technology & Telecom

- Public Sector & Government Bodies

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- North America