Report Overview

Medical Tourism Market Size, Highlights

Medical Tourism Market Size:

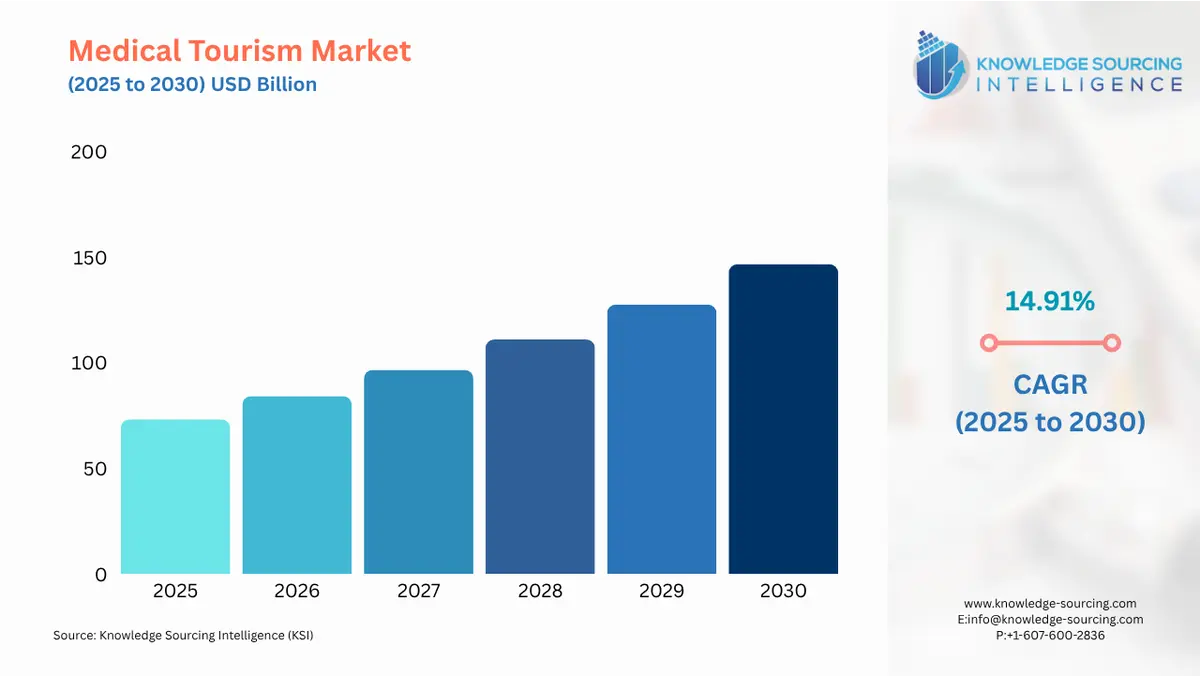

The Medical Tourism Market is expected to grow from USD 73.174 billion in 2025 to USD 146.604 billion in 2030, at a CAGR of 14.91%.

The global medical tourism market represents a critical intersection of healthcare services, international travel, and economic policy. It involves the intentional movement of patients across national borders to receive medical care, often driven by the pursuit of better value, a combination of lower cost, quicker access, and perceived higher quality of specialized treatments. This market is fundamentally demand-driven, propelled by "push" factors in source countries, such as escalating healthcare costs and lengthy public system wait times, and "pull" factors in destination countries, including advanced medical infrastructure, international accreditation, and government support. The market is highly segmented, ranging from cosmetic and dental procedures to complex cardiovascular and orthopedic surgeries. The strategic actions of large, internationally-accredited hospital groups, combined with the promotional efforts of destination governments, have professionalized this sector, transforming what was once informal cross-border care into a multi-billion dollar industry that directly impacts global healthcare equity and economics.

Medical Tourism Market Analysis:

- Growth Drivers

The most potent driver propelling the medical tourism market’s growth is the cost differential for medical procedures across national economies. Patients from high-income countries, particularly the United States, face high out-of-pocket costs due to rising deductibles, copayments, and limited insurance coverage for certain non-essential procedures. This economic pressure creates a strong "push" factor, as verifiable cost savings, often ranging from 40% to 80% for common procedures like knee replacement or cardiac bypass, immediately translate into increased patient demand for international options. The financial incentive is a quantifiable, primary catalyst for market growth.

Another critical driver is the issue of access and wait times in nationalized or publicly funded healthcare systems, such as those in Canada and the United Kingdom. Patients requiring elective or semi-urgent procedures, like hip replacements or specific diagnostic scans, often face protracted delays that can significantly impact their quality of life. This "adjournment" of care creates a direct and immediate demand for medical tourism services, where patients actively seek destinations that can offer timely appointments and immediate surgery scheduling. The ability of international providers to offer instant access bypasses a fundamental structural failure in many high-income healthcare systems, thereby directly stimulating outbound medical tourism demand.

The final major driver is the proliferation of international quality assurance via accreditation bodies, most notably the Joint Commission International (JCI). The attainment of JCI accreditation by hospitals in destination countries like India, Thailand, and Malaysia directly addresses the primary psychological barrier for patients: perceived risk and lower quality of care abroad. JCI certification validates that the facility meets rigorous international standards for patient safety and quality of care, effectively neutralizing the quality concern and allowing the lower price and faster access drivers to take precedence. This quality validation is a powerful "pull" factor that increases patient confidence and, consequently, demand for accredited international services.

- Challenges and Opportunities

The primary challenge facing the medical tourism market centers on post-procedural care and legal recourse. International patients often struggle with managing follow-up care upon returning to their home country. Local physicians may be reluctant to assume liability or responsibility for a procedure performed elsewhere, leading to fragmentation of care. Furthermore, in the event of medical complications or malpractice, the patient faces significant logistical, legal, and financial hurdles in seeking resolution in a foreign jurisdiction. These uncertainties raise the perceived risk profile of medical tourism and act as a headwind against more widespread adoption, particularly for complex surgeries.

This challenge concurrently generates a significant opportunity in the market: the development of integrated, end-to-end service platforms. There is a need for medical tourism facilitators and providers that offer comprehensive and seamless packages. These packages must include coordinated pre-trip consultations via telemedicine, detailed care-plan transfers, and established partnerships with local post-operative care networks in the patient's home country. Companies capable of guaranteeing this care continuum, along with offering malpractice insurance that covers international treatment, will capture substantial market share by directly mitigating the primary risks that currently deter potential patients. The opportunity lies in transforming the fragmented service into a standardized, insured product.

- Supply Chain Analysis

The medical tourism supply chain is a service-based network rather than a conventional physical supply chain. It is characterized by three distinct, interdependent tiers: Source Nodes, Facilitation Intermediaries, and Destination Hubs. Destination Hubs, which are the primary production centers, consist of internationally-accredited hospitals and specialized clinics, predominantly located in the Asia-Pacific (Thailand, India, Malaysia) and Latin America (Mexico, Brazil). These hubs concentrate the required resources: highly specialized medical professionals, advanced diagnostic equipment, and competitive pricing structures.

The Source Nodes are the high-cost economies (US, Canada, UK) that generate the patient demand. The connection between source and destination is bridged by Facilitation Intermediaries, which include medical tourism agencies, digital platforms, and dedicated international patient departments within the hospitals themselves. These intermediaries manage the logistical complexities, which are substantial: visa requirements (e.g., e-medical visas in India), travel arrangements, language translation, coordination of medical records transfer (often across incompatible Electronic Health Record systems), and accommodation. The entire chain is critically dependent on the integrity of patient data transfer and the verifiable quality assurance offered by the destination hub, with any failure in certification or logistics directly impacting demand flow.

Government Regulations:

Government policies in both source and destination countries exert a powerful influence on the flow and volume of the medical tourism market.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Destination Countries (e.g., India, Thailand, Malaysia) |

Medical Visa & Tourism Promotion Policies |

Governments actively issue specialized medical visas (e.g., India's e-Medical Visa) and launch national campaigns ('Heal in India,' 'Thailand Medical Hub'). This directly streamlines the patient entry process, removing a major logistical barrier. The active promotion of the country's medical capabilities, often coupled with tax incentives for hospitals, increases the supply of certified services and acts as a strong "pull" factor, significantly increasing demand from international patients. |

|

International |

Joint Commission International (JCI) Accreditation |

JCI, while a non-governmental entity, acts as a de facto international quality standard. Hospitals that attain JCI accreditation signal adherence to stringent US-level quality and safety protocols. This credential addresses the primary risk perception of the patient base, validating the quality of care and directly increasing the demand for services from those specific accredited facilities, making accreditation a non-negotiable competitive entry point. |

|

Source Countries (e.g., US, Canada) |

Health Insurance & Liability Laws |

Fragmented US private insurance and the high cost of the national healthcare system act as the core "push" factors, driving out-of-pocket payers abroad. Furthermore, the high costs associated with medical malpractice insurance and litigation in the US increase the overall price of US healthcare, widening the cost-differential gap and therefore sustaining the demand for lower-cost international alternatives. |

Medical Tourism Market Segment Analysis:

- By Treatment Type: Orthopedic

The Orthopedic treatment segment, encompassing procedures such as knee and hip replacements, spinal fusions, and arthroscopy, is a critical component of medical tourism demand. The need for outbound orthopedic procedures is primarily driven by two key factors: long wait times in publicly funded systems and the high cost of implants and surgery in private markets. In countries like Canada and the United Kingdom, patients can face wait times extending from six months to over a year for non-emergency joint replacement surgeries. This prolonged wait can lead to significant pain, reduced mobility, and inability to work, compelling patients to seek immediate relief elsewhere. The ability of international hospitals in destinations like India and Thailand to schedule surgery within weeks is a powerful motivator, directly converting latent, frustrated demand into active medical tourism trips. Furthermore, the price of an elective, uninsured knee replacement in the US can easily exceed USD $40,000, while the same procedure, using equivalent international-standard implants, can be secured for less than USD $15,000 in major medical hubs. This direct, substantial cost savings makes the orthopedic segment highly sensitive to the medical tourism value proposition, driving a consistent flow of both insured and self-pay patients. Destination hospitals actively market their orthopedic centers, highlighting JCI accreditation and the use of US/European-approved devices to validate quality, thereby ensuring sustained demand.

- By End-User: Hospitals

Hospitals form the core end-user segment of the medical tourism market, acting as the primary point of service delivery and the key infrastructure providers. The demand on hospitals from medical tourism is distinct from domestic requirements; it is characterized by the need for specialized international patient services and verifiable quality credentials. The influx of medical tourists compels leading hospital groups, such as Apollo in India or Bumrungrad in Thailand, to invest heavily in specialized International Patient Departments (IPDs). These departments are dedicated cost centers that handle the logistical and administrative complexities of foreign patients, including travel coordination, visa facilitation, language interpretation, and financial counseling. This specialized demand requires hospitals to allocate capital for non-clinical services that domestic patients do not require, driving investment in dedicated concierge and liaison staff. Furthermore, to capture international demand, hospitals must invest significantly in obtaining and maintaining international accreditations, primarily JCI, which involves costly compliance upgrades, training, and recurrent fees. The demand from medical tourism requires hospitals to transform into integrated service platforms that combine high-quality medical care with exceptional hospitality. This transformation ultimately enhances the hospital's overall capacity, technology acquisition, and service portfolio.

Medical Tourism Market Geographical Analysis:

- United States Market Analysis (North America)

The United States represents the largest source market for outbound medical tourism, driven fundamentally by the structure of its healthcare financing. The fragmented nature of private health insurance, coupled with soaring costs for elective procedures and high-deductible plans, shifts a significant financial burden onto the individual patient. This financial incentive, the ability to save thousands of dollars on procedures like bariatric surgery, cosmetic surgery, or even complex dental work, is the dominant local factor fueling outbound demand. Additionally, while the US has high-quality care, certain patient groups seek procedures not approved or readily available domestically, further contributing to cross-border travel. The proximity of destinations like Mexico for dental and cosmetic procedures, and the cultural acceptance of international travel, serve as significant demand enablers for the US patient population.

- Brazil Market Analysis (South America)

Brazil's strength in the medical tourism market is anchored in its world-renowned expertise in cosmetic and aesthetic surgery. Local factors, particularly the high density of internationally trained plastic surgeons and a cultural acceptance of aesthetic procedures, have established Brazil as a global hub for this specialty. According to data from the International Society of Aesthetic Plastic Surgery (ISAPS), Brazil consistently performs the second largest number of aesthetic surgeries globally, behind only the United States. This reputation of excellence, combined with lower procedure costs compared to North America and Europe, acts as a primary pull factor for international patients. Furthermore, major Brazilian medical centers, particularly in São Paulo, have attained JCI accreditation, validating quality and directly attracting patients seeking a combination of world-class specialization and competitive pricing.

- Germany Market Analysis (Europe)

Germany is a prominent destination for medical tourism, attracting patients primarily from Eastern Europe, the Middle East, and North America, with its demand centered on complex, technologically advanced treatments and specialized oncology. The local factor driving this demand is Germany’s reputation for highly advanced medical technology, rigorous regulatory standards, and renowned university hospitals, such as Charité - Universitätsmedizin Berlin. Unlike cost-driven destinations, Germany competes on quality, precision, and access to state-of-the-art equipment and specialized clinical trials. Its extensive network of JCI-accredited hospitals reinforces its reputation as a trusted provider of complex care. The necessity is specifically for non-elective, life-saving procedures where superior technology and clinical expertise outweigh marginal cost savings.

- United Arab Emirates (UAE) Market Analysis (Middle East & Africa)

The UAE, particularly Dubai, is strategically establishing itself as a medical tourism destination through aggressive government investment and policy. The local factor driving growth is a focused government strategy to diversify the economy and attract high-net-worth medical tourists from the wider Middle East, North Africa, and South Asia. The Dubai Health Authority (DHA) actively promotes the emirate as a comprehensive medical and wellness hub, focusing on orthopedic and cosmetic surgeries. This requirement is sustained by a combination of high-quality, newly built, JCI-accredited infrastructure and the ease of travel and cultural familiarity for patients from neighbouring Arab nations. The government's initiatives to facilitate medical visas and launch promotional campaigns directly generate inbound demand by improving logistical access and marketing the UAE's sophisticated service portfolio.

- India Market Analysis (Asia Pacific)

India is a dominant force in the medical tourism market, primarily fueled by its extreme cost competitiveness across nearly all medical specialties and the large number of English-speaking, Western-trained physicians. The 'Heal in India' initiative, actively promoted by the Ministry of Tourism, has institutionalized the government's commitment to the sector. This official support and the extension of the e-medical visa facility to nationals of 171 countries directly remove logistical barriers, thereby increasing inbound patient flow. With major hospital groups like Apollo holding extensive international accreditations, India attracts approximately 2 million patients annually, mainly from South Asia, the Middle East, and Africa, for high-end surgeries like cardiac and cancer treatment at costs that are a fraction of those in the West.

Medical Tourism Market Competitive Analysis:

The competitive environment in the medical tourism market is defined by a dynamic interplay between large, established hospital chains and specialized facilitators, with competition centered on accreditation, specialization, and integrated service delivery.

- Bumrungrad International Hospital (Thailand): Bumrungrad is a pioneer in the market, strategically positioning itself as a high-volume, high-quality, one-stop medical destination. The hospital was the first in Asia to be accredited by JCI in 2002, a non-negotiable credential that validated its quality early in the market's development. Its service portfolio is vast, spanning over 47 outpatient specialty centers, including a Heart Institute and a Robotic Surgery Center utilizing the da Vinci Xi system for complex procedures. The hospital's competitive advantage lies in its comprehensive support for international patients, including a dedicated international patient services team, on-site travel agencies, and translation services, making it a frictionless choice for medical tourists from over 190 countries.

- Apollo Hospitals (India): Apollo Hospitals operates as Asia's foremost integrated healthcare services provider, positioning itself as the leader in high-volume, cost-effective, complex care. Its strategy is built on a dual commitment to clinical excellence—evidenced by performing over 370,000 orthopedic surgeries and over 200,000 heart surgeries—and affordability. Apollo leverages its extensive network across India and its strong focus on technological innovation, including robotic surgeries and telemedicine, to attract international patients seeking specialized treatments at dramatically reduced costs. The 'ASK Apollo' online consultation platform and the organization's focus on clinical differentiation sustain its competitive advantage as a highly trusted, accessible, and affordable destination for major medical procedures.

- KPJ Healthcare Berhad (Malaysia): KPJ Healthcare positions itself as Malaysia’s largest private healthcare provider with a resilient network model. The company's competitive strategy is focused on leveraging its extensive regional footprint, with hospitals in Malaysia and operations in Indonesia and Bangladesh. KPJ actively promotes its health tourism segment, emphasizing its Integrated Management System (IMS) certifications and the provision of high-quality, culturally sensitive care, particularly catering to patients from the Middle East and neighboring Asian countries. The Group utilizes its extensive reach and investment in integrated technology, such as the KPJ Clinical Information System (KCIS), to ensure a seamless patient experience, addressing the demand for quality and convenience in the ASEAN region.

Medical Tourism Market Developments:

- September 2025: The Ministry of Economy & Tourism and the Dubai Health Authority (DHA) signed a memorandum of understanding (MoU) to promote medical tourism flows to the UAE. This partnership aims to strengthen the country's position as a favored medical and wellness tourism destination by facilitating expertise exchange and enhancing the attractiveness of the national medical tourism sector.

- August 2025: The Ministry of Tourism, India, reported that the total number of Foreign Tourist Arrivals for medical purposes in India during 2025 (up to April) was 131,856, representing a significant volume of inbound medical travel supported by government initiatives like the e-medical visa facility extended to 171 countries.

Medical Tourism Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 73.174 billion |

| Total Market Size in 2031 | USD 146.604 billion |

| Growth Rate | 14.91% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Treatment Type, Service Provider, Age Group, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Medical Tourism Market Segmentation:

By Treatment Type

- Cardiovascular Treatment

- Cancer Treatment

- Orthopedic Treatment

- Cosmetic Surgery/Treatment

- Bariatric Surgery/Treatment

- Dental Treatment

- Ophthalmology Treatment

- Infertility Treatment

- Neurological Treatment

- ENT Treatment

- Other Specialized Treatments

By Service Provider

- Public healthcare providers

- Private healthcare providers

By Age Group

- Children (0–12)

- Adolescents (13–17)

- Adult (18-59)

- Seniors (60+)

By Service Type

- Pre-Departure Services

- Post Admission Services

- Post Discharge Services

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others