Report Overview

Global Metallic Gasket Market Highlights

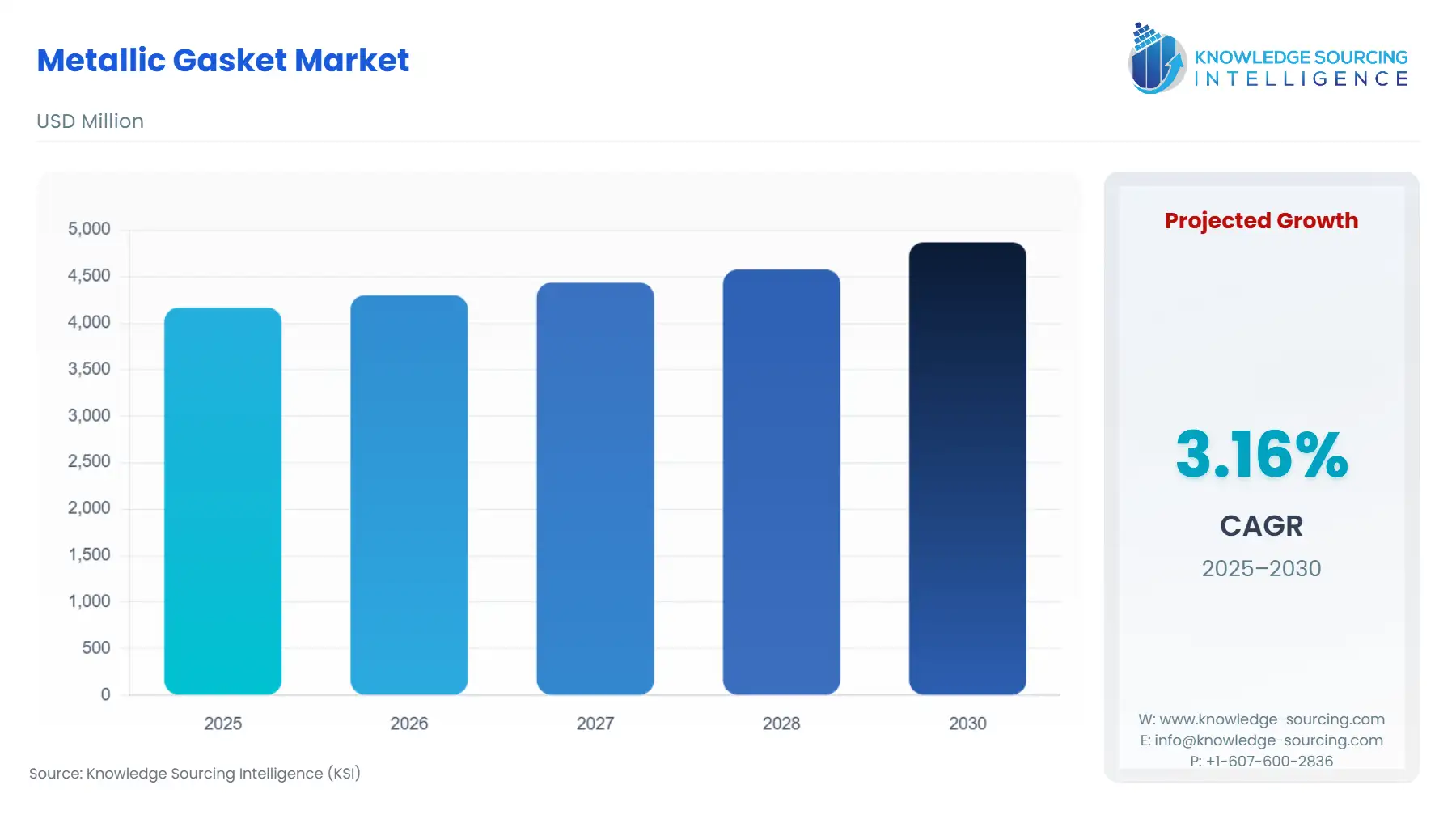

Metallic Gasket Market Size:

Global Metallic Gasket Market is expected to grow at a 3.17% CAGR, achieving USD 4.870 billion by 2030 from USD 4.168 billion in 2025.

The Metallic Gasket Market serves as a critical enabler of industrial infrastructure worldwide, providing indispensable static sealing solutions for flanged joints, heat exchangers, and pressure vessels. These gaskets are engineered to prevent the escape of process media, often hazardous, corrosive, or high-temperature fluids and gases, ensuring both operational safety and compliance with rigorous environmental protocols. Unlike non-metallic or semi-metallic alternatives, metallic gaskets offer superior mechanical strength, creep resistance, and thermal stability, making them mandatory in severe service conditions across core industries. The necessity for zero-leakage performance in critical applications establishes a non-cyclical, high-value demand profile for the most advanced metallic gasket types, pushing industry focus towards material science innovations and low-emission certifications.

Metallic Gasket Market Analysis

- Growth Drivers

The relentless global focus on process safety and environmental compliance, particularly concerning fugitive emissions from industrial facilities, acts as a primary catalyst for the Metallic Gasket Market. Tighter regulatory enforcement, such as the increased adoption of the ISO 15848 standard across the chemical and oil & gas sectors, directly increases demand for verifiable, high-integrity metallic sealing solutions over general-purpose gaskets. Simultaneously, the large-scale investment in upgrading aging infrastructure across North America and Europe, coupled with new capital expenditure in high-pressure facilities in Asia-Pacific, compels MRO buyers to seek metallic gaskets with enhanced durability and proven long service life, sustaining demand volumes.

- Challenges and Opportunities

A key challenge for the market is the significant volatility and long lead times associated with procuring specialty metal alloys, such as Nickel and high-grade Stainless Steel, which can disrupt production schedules and compress manufacturer margins. This price instability presents a major constraint on predictable profitability. However, this challenge simultaneously creates an opportunity through the rapidly accelerating energy transition, particularly the development of Carbon Capture and Storage (CCS) and Hydrogen infrastructure. These emerging high-pressure, specialty-media applications demand highly customized, corrosion-resistant metallic gaskets, creating a new, high-margin niche that fuels demand for advanced Ring-Type Joints and Corrugated gasket designs.

- Raw Material and Pricing Analysis

Metallic gaskets are physical components whose cost structure is heavily influenced by the spot and contract pricing of core metal alloys. The pricing of Nickel and high-chromium stainless steel (e.g., 316L, 321), essential for corrosion and heat resistance in Oil & Gas and Power applications, drives market price fluctuations. Global commodity market dynamics, including mining output and refining capacity, directly transmit volatility to gasket manufacturers. Procurement strategies must manage risk associated with these metallic components, as they constitute the structural element of spiral wound and ring-type gaskets. Fluctuations compel manufacturers to hedge costs or transfer risk via escalator clauses to end-users, directly impacting procurement decisions and demand stability.

- Supply Chain Analysis

The global metallic gasket supply chain is structured around core metal suppliers (primary steel/nickel producers), specialized metal component fabricators, and final assembly/distribution hubs. Key production hubs are concentrated in Asia (for high-volume, standardized production) and North America/Europe (for specialized, high-performance, and custom solutions). Logistical complexity arises from the necessity of Just-In-Time (JIT) delivery for MRO demand, which clashes with the long lead times required for specialty alloy sourcing. The primary dependency is on the reliability of the metal processing tier to deliver custom-stamped or machined components (such as Ring-Type Joint profile rings) under tight regulatory specifications, as failure here bottlenecks final product delivery to critical end-user applications.

Metallic Gasket Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Global Industry |

ISO 15848-1 (Fugitive Emissions) |

Increases Demand for Certified Products: This international standard specifies testing procedures for classifying the performance of metallic and non-metallic gaskets concerning external leakage. Adherence to tighter leakage classes (e.g., Class A, B) mandates the use of precision-engineered metallic gaskets (especially enhanced Spiral Wound and Kammprofile designs), directly increasing demand for certified, high-performance seals in the Oil & Gas and Chemical sectors. |

|

United States |

EPA Greenhouse Gas Reporting Program (GHGRP) |

Mandates Leakage Reduction: The EPA requires large facilities to monitor and report greenhouse gas emissions, including methane. This regulation compels operators in the Oil & Gas and Power & Energy segments to invest in sealing technologies that minimize fugitive emissions, reinforcing the non-negotiable demand for high-integrity metallic gaskets capable of achieving ultra-low leak rates. |

|

European Union |

Pressure Equipment Directive (PED) 2014/68/EU |

Establishes Safety-Critical Demand: The PED mandates essential safety requirements for pressure equipment, including flanges and their sealing elements, requiring metallic gaskets to meet explicit design, manufacturing, and material standards. This directive formalizes the use of highly reliable metallic gaskets in European process industries, acting as a non-cyclical, fundamental driver for quality-assured products. |

Metallic Gasket Market Segment Analysis

- By Type: Spiral Wound

The Spiral Wound gasket segment dominates the Metallic Gasket Market due to its superior resilience and ability to self-adjust to thermal cycling and pressure surges, which are routine in high-temperature, high-pressure environments. The need for this type is predominantly driven by the MRO (Maintenance, Repair, and Overhaul) cycle across established Oil & Gas refineries and chemical processing plants. Spiral wound gaskets, composed of a metallic winding and soft filler material, offer a cost-effective, reusable flange sealing solution that meets most ASME B16.20 standards. The critical growth driver is their proven reliability in preventing catastrophic failure while complying with industry standards for low fugitive emissions, positioning them as the standard workhorse for mission-critical flange applications globally.

- By End-User: Oil & Gas

The Oil & Gas sector is the largest and most technically demanding end-user of metallic gaskets. The necessity here is driven by two main factors: the sheer volume of high-pressure piping and equipment (flanges, valves, heat exchangers) and the extreme conditions of operation. Upstream exploration and production require metallic gaskets (notably Ring-Type Joints) capable of withstanding ultra-high pressures in corrosive well environments, while downstream refining operations demand high-temperature resistant Spiral Wound gaskets. Demand is intensified by the necessity to adhere to stringent safety and environmental regulations (API, ISO, EPA), where gasket failure results in immediate shutdown, massive fines, and safety hazards, making premium-quality metallic seals a non-discretionary capital expenditure.

Metallic Gasket Market Geographical Analysis

- US Market Analysis

The US market is characterized by high demand for metallic gaskets driven by the expansive Oil & Gas sector (Permian Basin, Gulf Coast refining) and the robust Aerospace manufacturing base. A critical local factor is the stringent enforcement of fugitive emissions regulations by the EPA, compelling end-users to adopt premium, low-leakage metallic gaskets and specialized Ring-Type Joints in critical service applications. The growth is heavily skewed towards high-specification and custom-engineered products, reflecting the industry’s preference for validated performance and documented compliance over lower initial cost. The substantial installed base of power generation assets also ensures stable MRO demand.

- Brazil Market Analysis

Brazil's need for metallic gaskets is largely centered on its vast Offshore Oil & Gas (Pre-salt fields) and Power & Energy sectors, particularly hydroelectric and thermal generation. The local factor is the dominance of state-controlled entities like Petrobras in the energy sector, whose investment cycles dictate large procurement volumes. This environment creates episodic, project-driven demand for metallic gaskets, notably large-diameter Spiral Wound and corrosion-resistant Ring-Type Joints for subsea applications. The market is highly price-sensitive but mandates certification to international (API/ASME) standards for safety and compatibility with imported equipment.

- Germany Market Analysis

The German market exhibits strong, steady demand, primarily driven by the Chemical and Advanced Manufacturing (Automotive) sectors, which prioritize precision, quality, and long service life. The local factor influencing demand is adherence to strict EU directives, such as the Pressure Equipment Directive (PED), which embeds safety and quality mandates into product design. German end-users demand metallic gaskets made from high-grade alloys with complete material traceability and documented performance characteristics, reinforcing a market focus on specialized products like Kammprofile (Corrugated) gaskets and high-end Spiral Wound products.

- Saudi Arabia Market Analysis

Saudi Arabia represents a massive, capital-intensive market dominated by the Oil & Gas industry. This growth is fundamentally driven by mega-projects in upstream, midstream, and downstream expansion, alongside continuous MRO for its immense installed base of refining and petrochemical assets. The local factor is the requirement for extreme heat and corrosion resistance due to the operating environment, which creates a specific, high-volume demand for specialty metallic gaskets, especially Ring-Type Joints (RTJ) made from high-nickel alloys and certified to the highest API standards. Project timelines and massive expenditure budgets ensure predictable, large-scale procurement.

- South Korea Market Analysis

The South Korean market is driven by its world-leading Marine (Shipbuilding) and Automotive Original Equipment Manufacturer (OEM) sectors, coupled with its large Petrochemical and Power generation base. The local factor is the intense competition in the shipbuilding sector, which demands gaskets that balance high performance with competitive pricing and tight integration into just-in-time supply chains. The market exhibits high demand for Spiral Wound and Corrugated metallic gaskets for vessel engine systems and high-pressure chemical processing, with a growing focus on meeting environmental regulations for marine emissions.

Metallic Gasket Market Competitive Environment and Analysis

The Metallic Gasket Market competition is fragmented but led by a few global firms that compete on product specialization, material science expertise, and certified compliance. Market distinction is achieved through offering proprietary low-emission designs, wide product portfolios, and global distribution networks capable of supporting MRO demand with localized service.

- Garlock

Garlock positions itself as a global leader in high-performance fluid sealing products, maintaining a competitive edge through material innovation and stringent quality control. The company's key product strategy involves offering proprietary metallic gasket designs, such as their FLEXSEAL® RWI Spiral Wound Gaskets, which utilize 304/304L stainless steel and flexible graphite. Garlock emphasizes product reliability for severe service applications in the Chemical and Power sectors, ensuring compliance with standards like ASME B16.20 and providing documented fire-safe performance, which is a non-negotiable requirement for critical infrastructure.

- EagleBurgmann (Freudenberg & Co. KG)

EagleBurgmann, a subsidiary of Freudenberg & Co. KG, strategically focuses on complete sealing solutions, integrating its metallic gaskets with mechanical seals and expansion joints. Its positioning targets high-end, complex engineering requirements, particularly in the Oil & Gas and Refining industries. The company leverages its global service network to provide MRO support and application-specific product selection. Key offerings include its range of Corrugated and Ring-Type Joints designed for extreme pressure and temperature services, capitalizing on its reputation for engineering prowess and customized application delivery.

- KLINGER Holding

KLINGER Holding focuses on a broad range of sealing, fluid control, and monitoring solutions, with its metallic gaskets serving as a core component of its sealing portfolio. KLINGER’s strategy is built on extensive global distribution and localized manufacturing presence, catering efficiently to both OEM and MRO demand across Europe and Asia. The firm is known for its high-quality Spiral Wound and Kammprofile gaskets, emphasizing compliance with international quality and safety standards (e.g., PED and TA-Luft). Their recent inorganic growth strategy, including strategic acquisitions, bolsters their regional footprint and product breadth.

Metallic Gasket Market Developments

- June 2025: John Crane (A Smiths Group plc business) announced the launch of the Type 93AX Coaxial Separation Seal, a next-generation dry gas sealing solution. This product launch addresses industry imperatives to reduce emissions and improve equipment reliability, indicating a technological drive toward advanced metallic component designs.

- February 2025: John Crane (A Smiths Group plc business) partnered with Franco Tosi Meccanica to supply dry gas seals and a gas seal system for a supercritical CO2 pilot plant. This capacity expansion signals the shift toward sealing solutions, including specialized metallic gaskets, for emerging Carbon Capture and Storage (CCS) applications.

- September 2024: KLINGER Spain completed the acquisition of Spanish sealing providers Productos Salinas and Juntas Besma. This merger significantly bolstered KLINGER's footprint in the Iberian market, broadening its product portfolio to meet local demand for industrial gaskets and specialized sealing solutions.

Segmentation:

- GLOBAL METALLIC GASKET MARKET BY TYPE

- Spiral Wound

- Corrugated

- Ring-Type Joints

- GLOBAL METALLIC GASKET MARKET BY METAL TYPE

- Aluminum

- Copper

- Steel

- Nickel

- GLOBAL METALLIC GASKET MARKET BY END-USER

- Automotive

- Aerospace

- Marine

- Oil & Gas

- Power & Energy

- Construction

- Others

- GLOBAL METALLIC GASKET MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America