Report Overview

Micro And Nano PLC Highlights

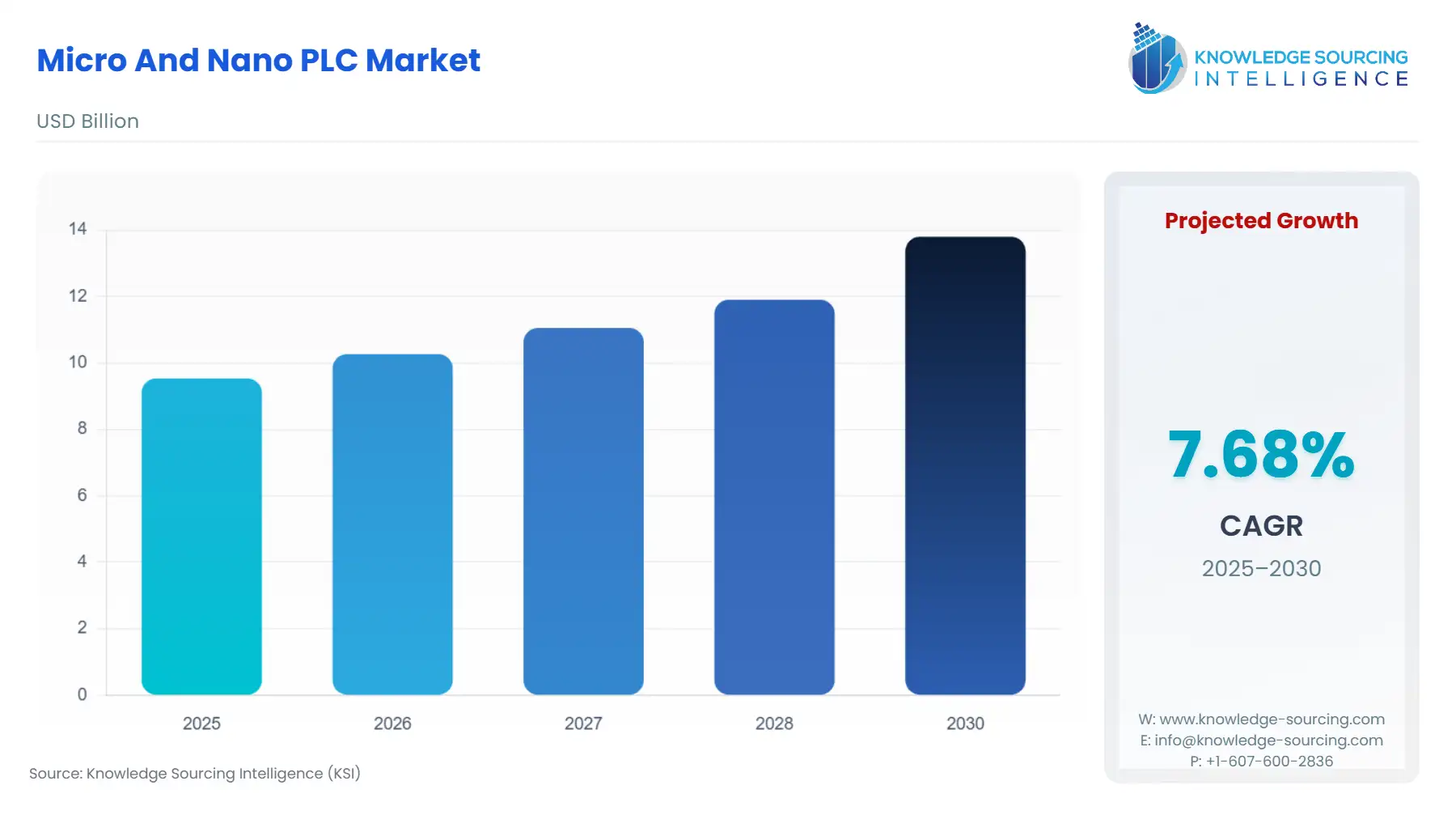

Micro And Nano PLC Market Size:

The Micro And Nano PLC Market is projected to climb from USD 9.536 billion in 2025 to USD 13.805 billion by 2030, with a 7.68% CAGR.

The Micro and Nano Programmable Logic Controller (PLC) market forms the intelligent edge of the industrial automation pyramid, governing discrete and small-scale sequential control applications. These controllers, typically defined by their lower I/O counts and compact physical dimensions, are pivotal to achieving flexibility, efficiency, and data acquisition goals in the global manufacturing sector. Market dynamics are currently characterized by a critical transition, moving beyond simple logic replacement to integrating controllers into complex, data-rich Industrial IoT (IIoT) ecosystems. This integration is vital for industries seeking to implement Industry 4.0 paradigms. The competitive environment is intensely focused on reducing hardware costs while simultaneously enhancing software capability, connectivity protocols, and lifecycle support, directly influencing the adoption rate across both mature and emerging industrial geographies.

________________________________________

Micro and Nano PLC Market Analysis

- Growth Drivers

The pervasive trend of Industrial Internet of Things (IIoT) deployment serves as the paramount driver, fundamentally transforming isolated machinery into connected assets. This imperative directly increases demand for Micro and Nano PLCs, as they serve as the necessary edge controllers to acquire, preprocess, and transmit machine-level data to centralized MES or cloud platforms. Concurrently, the sustained global focus on energy efficiency and predictive maintenance compels manufacturers, especially in the Chemical and Energy & Power sectors, to replace older, non-communicative controllers. Modern PLCs with integrated diagnostic functions and open communication stacks (e.g., OPC UA) stimulate replacement demand by offering tangible operational savings and reducing unplanned downtime, positioning them as essential enablers of operational expenditure reduction.

- Challenges and Opportunities

The primary constraint facing the market is persistent semiconductor supply volatility, which elongates lead times and inflates the pricing of the core electronic Hardware, thereby restricting rapid supply growth and delaying capital projects for end-users. Additionally, the shortage of skilled industrial programmers capable of managing complex, integrated control and IIoT architectures poses a significant adoption bottleneck. Conversely, a profound opportunity lies in the burgeoning market for automation upgrades in legacy manufacturing facilities. The simple, non-modular architecture of Fixed PLC units provides a low-cost, high-reliability solution for modernizing older, relay-based control systems in Tier 2 and Tier 3 manufacturing, especially across Asia-Pacific. This segment represents a vast, untapped potential market for simple, discrete automation solutions, creating substantial latent demand.

- Raw Material and Pricing Analysis

Micro and Nano PLCs are electronic devices, making their pricing intrinsically linked to the supply chain of semiconductors, particularly specialized microcontrollers (MCUs) and FPGAs used for high-speed logic execution and communication protocol handling. The high concentration of these core components in East Asia creates a substantial geopolitical and logistical risk. Recent global supply disruptions have seen component lead times extend significantly, which directly increases the risk premium and input costs for Hardware manufacturers. This inflationary pressure on components is often passed to the end-user, thereby compressing the demand elasticity for price-sensitive Nano PLC models, forcing system integrators to strategically choose between premium, high-availability controllers and cheaper, potentially volatile alternatives.

- Supply Chain Analysis

The global supply chain is structured as a multi-tiered system, commencing with specialized Asian foundries for semiconductor fabrication, followed by electronics manufacturing service (EMS) providers for PCB assembly, and culminating in the final assembly and distribution centers managed by global OEMs (e.g., Siemens, ABB). The key dependency is the procurement of highly customized Application-Specific Integrated Circuits (ASICs) required for proprietary backplane communication in Modular PLC systems. Logistical friction in maritime shipping and a heavy reliance on just-in-time inventory strategies for standardized components creates vulnerability. Furthermore, the proliferation of global trade policy friction, including US tariffs on Chinese-made electronic assemblies, necessitates vendor-led supply chain reshoring and diversification efforts, particularly into Southeast Asia and Mexico, to mitigate tariff-induced price increases and ensure product availability in North America.

Micro And Nano PLC Market Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | Cyber Resilience Act (CRA) | Mandates security-by-design for connected industrial products (Products with Digital Elements). This regulation directly increases demand for Micro/Nano PLCs that integrate verified, robust cybersecurity Software features (e.g., secure boot, mandatory lifecycle updates), raising the barrier to entry for non-compliant Hardware vendors and favoring premium-security solutions. |

| United States | Tariffs on Chinese Imports (Section 301) | The imposition of duties on imported Chinese electronic components and automation hardware directly inflates the cost of Micro and Nano PLCs sold in the US market. This action decreases demand elasticity and incentivizes US manufacturers to seek Supply Chain diversification or reshoring strategies, while indirectly increasing demand for non-tariff-impacted manufacturers. |

| China | "Made in China 2025" / National Automation Subsidies | National strategic plans and local government subsidies actively encourage domestic industrial digitalization and automation adoption across all sectors. These incentives directly stimulate and lower the cost of demand for all PLC types, especially high-volume, cost-effective Nano PLC units, driving massive market expansion within the Asia-Pacific region. |

________________________________________

Micro And Nano PLC Market Segment Analysis

- By Component: Software

The Software component segment is rapidly evolving from a necessary utility to the primary value differentiator, significantly driving demand for modern Micro and Nano PLCs. The shift is catalyzed by the Industry 4.0 mandate to extract actionable insights from shop-floor data. Demand is no longer merely for the sequential control program, but for integrated Software tools that facilitate: 1) seamless IIoT connectivity via standardized protocols (e.g., MQTT, OPC UA); 2) advanced diagnostics and data visualization; and 3) integrated cybersecurity and remote access management. Premium software offerings, such as those enabling low-code/no-code programming or embedded AI execution (Industrial Edge), directly increase demand for the companion high-performance Hardware, effectively creating a profitable, recurring revenue stream and locking users into a vendor's digital ecosystem.

- By Industry Vertical: Energy & Power

The Energy & Power vertical, encompassing generation, transmission, and distribution assets, represents a high-reliability, long-lifecycle demand source. Micro and Nano PLCs are deployed extensively in substation automation, renewable energy site controllers (solar/wind farms), and critical balance-of-plant applications. The specific demand drivers here are the regulatory mandates for grid stabilization and operational security, which necessitate controllers with exceptional durability and integrated functional safety features. The distributed nature of renewable assets (e.g., solar inverters, battery storage) requires compact, often Fixed PLC units for localized control. Furthermore, the imperative for remote monitoring and predictive maintenance in geographically dispersed assets increases demand for controllers with robust telecommunication capabilities and stringent Cybersecurity certification, ensuring reliability against both physical and digital threats.

________________________________________

Micro And Nano PLC Market Geographical Analysis

- US Market Analysis (North America)

The US market is a mature landscape characterized by high labor costs and a strong imperative for technological innovation, which drives demand for productivity-enhancing Micro PLC solutions. Market dynamics are heavily influenced by the Department of Commerce's trade policies; specifically, US tariffs on Chinese industrial components have demonstrably increased the final cost of automation projects, compelling domestic system integrators to seek supply chain solutions closer to home (near-shoring to Mexico) or switch to non-tariff-impacted suppliers to maintain competitive pricing. Demand is strong for Modular PLC systems integrated with high-level Software solutions, emphasizing cybersecurity compliance and cloud-to-edge data analytics for high-value industries like Automotive and specialized machinery.

- Brazil Market Analysis (South America)

Brazil's demand structure is dominated by the need for cost-effective modernization in its substantial Food & Beverage and Automotive industries. The market exhibits a clear preference for the economical Nano PLC and Fixed PLC segments for localized machine control upgrades and new small-scale factory deployments. Economic volatility and currency fluctuation act as a constant headwind, causing end-users to prioritize low capital expenditure (CapEx) and proven product reliability over cutting-edge innovation. Local factors, such as the need for simplified regulatory compliance and robust local Service networks, significantly influence procurement decisions, favoring global vendors who demonstrate strong local manufacturing and support presence.

- Germany Market Analysis (Europe)

Germany is a global leader in automation, with market demand primarily driven by the Industry 4.0 strategic national initiative. The procurement criteria prioritize functional safety, integrated security, and open standards compliance, such as the IEC 61499 standard championed by vendors like Schneider Electric. The strict requirements of the EU Cyber Resilience Act (CRA) profoundly increases demand for PLCs with verifiable security credentials and guaranteed, long-term Software update roadmaps. Consequently, the German market commands a premium for highly sophisticated Modular PLC architectures that allow for granular, complex control and seamless integration with high-level MES and ERP systems.

- United Arab Emirates Market Analysis (Middle East & Africa)

The UAE market demand is principally generated by massive, state-backed infrastructure projects in Oil & Gas and the expansion of advanced logistics and data center capacity. This demand is non-price sensitive but rigorously focused on system reliability, long-term vendor stability, and environmental hardening. Projects often specify Modular PLC systems designed to operate reliably in high-temperature, dusty environments, and there is a high requirement for certified Service and support to minimize downtime in critical national infrastructure. Geopolitical security concerns mandate that all automation Software and Hardware meet strict, government-level cybersecurity protocols, directly increasing demand for controllers with superior security certifications.

- China Market Analysis (Asia-Pacific)

China represents the highest-volume market, driven by its national imperative to upgrade its vast manufacturing base, supported by government incentives. Demand is bifurcated: high-end foreign brands dominate the sophisticated Automotive and advanced Healthcare sectors, while indigenous manufacturers aggressively compete in the massive low-end segment using cost-effective Nano PLC and Fixed PLC solutions for general manufacturing. The enormous scale of factory construction and renovation actively generates a continuous, high-volume demand. The market is highly dynamic, with domestic vendors rapidly closing the technology gap, which creates intense price competition that continually compresses margins for all participants in the low-to-mid-range controller segment.

________________________________________

Micro And Nano PLC Market Competitive Environment and Analysis

The competitive landscape is a power struggle among established multinationals, primarily differentiated by their commitment to ecosystem integration and IIoT platform capability.

- Siemens AG

Siemens AG utilizes a strategy focused on complete digital integration, positioning its SIMATIC S7-1200 (Micro PLC) and LOGO! (Nano PLC) as critical endpoints within its overarching Siemens Xcelerator platform. The company's competitive edge is its aggressive integration of Industrial AI, exemplified by the launch of the Siemens Industrial Copilot for Operations in January 2025. This Software initiative directly increases demand for their high-performance Hardware by offering manufacturers the capability to generate code using natural language and enabling real-time diagnostics at the edge, solidifying the company's premium position in sectors like Automotive and advanced machine building.

- Schneider Electric SE

Schneider Electric competes through a robust focus on open automation and its global footprint in energy management. The Modicon M221 (Micro PLC) is a central offering in its EcoStruxure architecture. Schneider's strategic position is reinforced by its strong commitment to high-growth emerging markets. A key action was the agreement on July 30, 2025, to acquire the remaining 35% stake in its India Joint Venture (JV) from Temasek. This M&A move directly enhances the company's manufacturing and R&D capacity in India, a critical hub, allowing it to better capitalize on the huge Nano PLC and Micro PLC demand across Asia-Pacific and emerging markets.

- Rockwell Automation, Inc.

Rockwell Automation secures a dominant position in the North American market through its tightly integrated Allen-Bradley brand and the Logix control architecture, specifically targeting the Modular PLC segment with products like the Micro800 controllers. Its strategy prioritizes a unified control and information platform, emphasizing high security and reliability, which drives demand among Fortune 500 manufacturers in the Chemical and Food & Beverage sectors. Rockwell's competitive differentiation is built upon a superior, unified Software suite that minimizes complexity for system integrators, reinforcing customer lock-in through deep integration with their high-value enterprise asset management systems.

________________________________________

Micro And Nano PLC Market Developments

July 2025: Schneider Electric Reinforces India Hub Strategy with Acquisition of Remaining JV Stake

- Schneider Electric signed an agreement to acquire the remaining 35% stake in Schneider Electric India Private Limited (SEIPL) from Temasek for an all-cash consideration of €5.5 billion. This transaction, which brings Schneider to full ownership, strategically expands their control over local manufacturing and R&D capabilities in India. The consolidation directly supports the company's multi-hub strategy, which is crucial for meeting the double-digit growth demand for Hardware and Software solutions across the fast-growing Asia-Pacific and emerging markets.

January 2025: Siemens Unveils Industrial AI Innovations at CES

- Siemens introduced the Siemens Industrial Copilot for Operations at CES 2025, enabling AI tasks, such as diagnostics and troubleshooting, to run directly on the shop floor via the Industrial Edge ecosystem. This breakthrough elevates technological demand across the market for next-generation Micro PLC and Modular PLC Hardware that possesses the necessary processing power and integrated Edge computing capability to support real-time, AI-driven Software functions.

Micro and Nano PLC Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 9.536 billion |

| Total Market Size in 2031 | USD 13.805 billion |

| Growth Rate | 7.68% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Component, Architecture, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Micro and Nano PLC Market Segmentation:

- By Type

- Micro PLC

- Nano PLC

- By Component

- Hardware

- Software

- Service

- By Architecture

- Modular PLC

- Fixed PLC

- By Industry Vertical

- Automotive

- Healthcare

- Chemical

- Metallurgy

- Energy & Power

- Oil & Gas

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

- North America