Report Overview

Solar Inverter Market - Highlights

Solar Inverter Market Size:

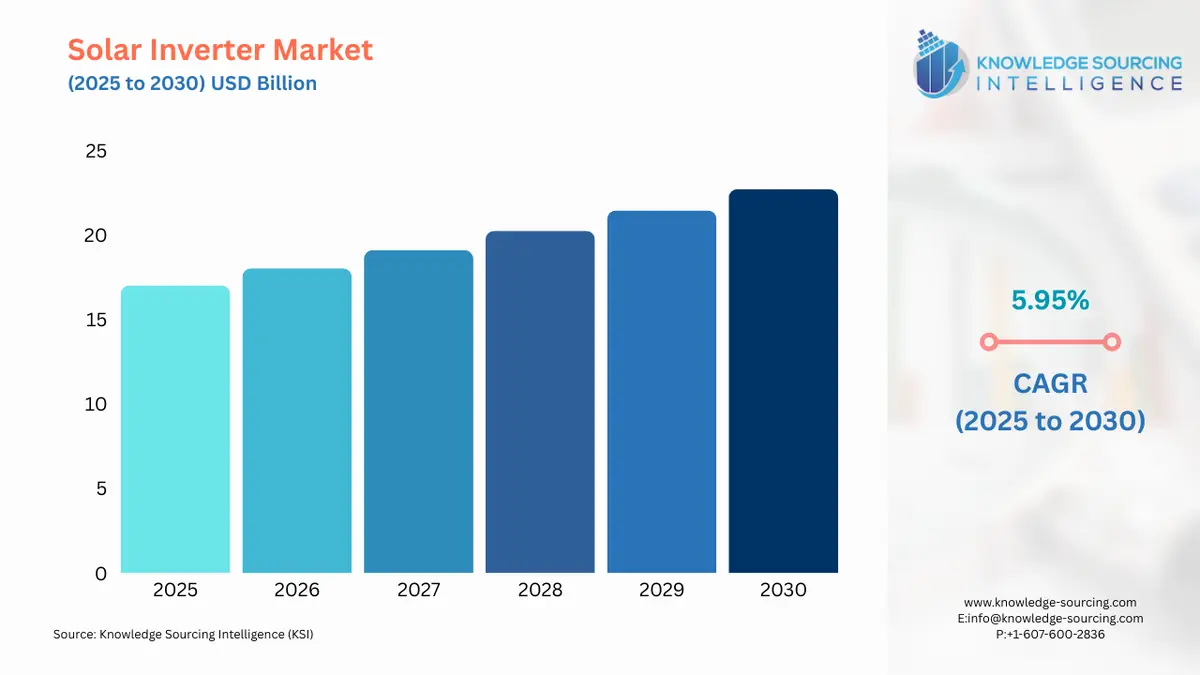

The solar inverter market, with a 5.77% CAGR, is expected to grow to USD 23.831 billion in 2031 from USD 17.019 billion in 2025.

Solar Inverter Market Trends:

A solar inverter, also known as a photovoltaic inverter, is an electrical device that transforms the fluctuating direct current produced by a solar panel into a consistent alternating current. This converted electricity is seamlessly integrated into the existing electrical grid or utilized within a self-sustained local network that operates independently from the main power grid. High demand from residential and commercial, coupled with grid infrastructure development, is increasing the solar inverter market size.

Solar Inverter Market Drivers:

High-end user demand is propelling the solar inverter market growth.

Households and businesses embrace solar energy for powering their day-to-day applications, owing to which solar energy adoption has surged among these end-users. This increasing adoption of solar power systems has propelled the solar inverters market demand. According to the International Energy Agency, in 2021, solar photovoltaic (PV) generation experienced a surge of 179 TWh, registering a remarkable growth rate of 22%. This achievement placed solar PV as the second-fastest-growing renewable energy technology. Moreover, solar PV is emerging as the most cost-effective choice for new electricity generation in the majority of the world.

Government initiatives to develop grid infrastructure drive the solar inverter market.

Government initiatives focusing on the development of grid infrastructure can significantly boost the growth of the solar inverter market as improving and modernizing the grid infrastructure allows for better integration of renewable energy sources, including solar power, into the existing grid system. Enhanced grid infrastructure enables the seamless integration of solar PV systems, creating a favorable environment for the growth of the solar inverters industry. According to the Ministry of New and Renewable Energy, in December 2022, the Government of India started a scheme called "Development of Solar Parks and Ultra Mega Solar Power Projects." The currently ongoing initiative is focused on simplifying the setup of extensive solar power projects connected to the grid. The target is to achieve a capacity of 40 GW by March 2024 through this initiative.

Solar Inverter Market Geographical Outlook:

Asia-Pacific region is anticipated to dominate the lifting station market.

The Asia Pacific region has witnessed a remarkable surge in solar power installations, with countries like China, India, Japan, and Australia leading the way. This widespread adoption of solar panels has created a thriving market for solar inverters. = Additionally, according to the Ministry of New and Renewable Energy, as of November 2022, in India, the installed capacity of solar power had reached approximately 61.97 GW.

Alternative source availability restrains the lifting station market growth.

The solar inverter industry encounters competition from various renewable energy technologies, including wind power and hydropower, which can present cost-competitive alternatives. The preference for these alternative sources over solar energy depends on the specific region and its energy resource availability. Factors such as wind resources, hydrological conditions, and geographical features play a role in determining the suitability and economic viability of different renewable energy options. In regions with abundant wind or hydro resources, stakeholders may prioritize these technologies due to their cost-effectiveness or established infrastructure.

Solar Inverter Market Key Developments:

November 2025: Waaree Energies launched the 350KW MANAV inverter series with 6 MPPT trackers, designed for utility-scale, commercial & industrial, and KUSUM Yojana solar projects, offering enhanced efficiency, durability, and scalability to support India's renewable energy goals.

November 2025: Sungrow unveiled innovative solar and energy storage solutions at REI Expo 2025 in India, including the PowerStack 255CS BESS for C&I applications, MG5/6RL residential inverters with MGL060 batteries, and the high-efficiency 2.5 kW S2500S-L microinverter to boost local energy stability and sustainability.

October 2025: Saatvik Green Energy unveiled the UDAY on-grid solar inverter series, featuring single-phase models (1.1 kW–6 kW) for residential and small commercial rooftops, and three-phase models (6 kW–50 kW) for larger projects, with up to 20 A PV input current and an IP66 rating for enhanced performance.

September 2025: Growatt concluded RE+ 2025 by showcasing U.S.-tailored innovations, including the MIN 3.8–11.4KTL-XH2-US single-phase hybrid inverter, THOR EV chargers, ALP LV US, and AXE modular batteries, and portable systems like Helios 3600 and INFINITY 2000 Pro, emphasizing grid support and energy resilience.

Solar Inverter Market Company Products:

UNO-2.0/2.5-I: ABB’s UNO-2.0, is a highly advanced inverter featuring a high-speed and precise Maximum Power Point Tracking (MPPT) algorithm. This innovative technology enables real-time power tracking, resulting in enhanced energy harvesting and improved overall efficiency of up to 96.3%.

FLEXINVERTER SOLAR: General Electric offers the FLEXINVERTER SOLAR, an advanced solar inverter solution that is FLEXiq enabled. With a power range of 3.0 – 3.9 MW, this inverter stands out for its high-power density and impressive efficiency. The FLEXINVERTER SOLAR delivers optimal performance, utilizing the FLEXiq technology to ensure seamless integration and flexibility in solar power systems.

List of Top Solar Inverter Companies:

ABB

General Electric

Schneider Electric

Huawei Technologies Co., Ltd

TMEIC (Toshiba & Mitsubishi Electric)

Solar Inverter Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Solar Inverter Market Size in 2025 | USD 17.019 billion |

Solar Inverter Market Size in 2030 | USD 22.721 billion |

Growth Rate | CAGR of 5.95% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Solar Inverter Market |

|

Customization Scope | Free report customization with purchase |

Solar Inverter Market Segmentation

By Type

String Inverters

Micro-Inverters

Grid-Tie Inverters

Others

By Solar Panel Type

Monocrystalline

Polycrystalline

Thin-Film Solar Panel

By End-User

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others