Report Overview

Global Milk Powder Market Highlights

Milk Powder Market Size:

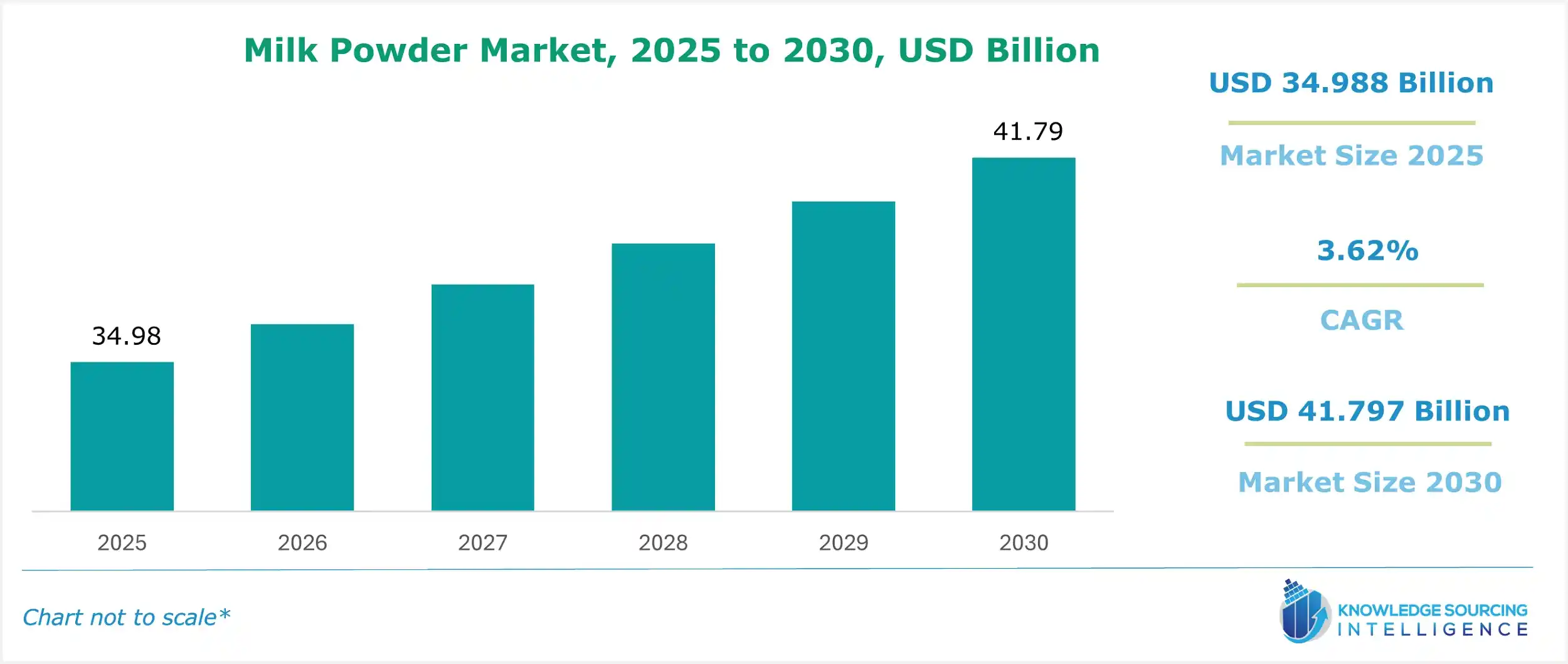

The global milk powder market is estimated to grow at a CAGR of 3.62%, reaching USD 41.797 billion in 2030 from USD 34.988 billion in 2025.

Global Milk Powder Market Introduction:

The milk powder market is pivotal in food manufacturing, serving as a versatile ingredient in bakery ingredients, confectionery ingredients, and dairy beverages. Its long shelf life and ease of reconstitution make it ideal for ready-to-eat foods and nutraceuticals, enhancing nutritional profiles in sports nutrition and functional foods. Milk powder provides essential proteins, vitamins, and minerals, supporting texture and flavor in baked goods and confections while meeting the demand for convenient, nutrient-dense products.

The global consumption of milk powder is a result of various nutrients, including vitamin B12, thiamin, and significant protein content. Skim milk powder is also a healthy and abundant source of protein. In addition to being a good source of calcium, it is also a rich source of selenium, phosphorus, magnesium, potassium, and zinc, among other important minerals. It is also low in cholesterol and promotes weight loss, making it the perfect product for those who have obesity and heart disease.

Further, manufacturers are also using sophisticated technologies to improve production processes, yielding better taste, solubility, and shelf life, hence appealing to a broader spectrum of consumers, especially health-conscious people and families who need convenient and nutritious dairy alternatives.

For instance, in November 2023, Nestlé revealed it had created N3 milk. It is extracted from cow's milk. N3 milk contains the nutrient properties found in milk. Some of these include proteins, vitamins, and minerals. Also, it has a certain percentage of prebiotic fibers, a reduced content of lactose, and has over 15% less calorie count. The company released its first products in a new portfolio of powdered milks for the Chinese market under the N3 brand. This offers a complete cream and a skimmed milk version that is high in protein to support the wholesome diet of the entire family.

Global Milk Powder Market Trends:

The milk powder market is evolving with global population growth and urbanization driving demand for versatile dairy solutions. Disposable income growth fuels premium product adoption, while health & wellness trends boost infant nutrition demand and clean label dairy preferences. Convenience food trends favor milk powder in ready-to-eat formulations. Sustainability in dairy emphasizes eco-friendly production, with traceability ensuring supply chain transparency. E-commerce dairy sales are rising, offering direct consumer access. Supply chain resilience addresses disruptions, ensuring consistent availability. These trends highlight the market’s shift toward health-focused, sustainable, and digitally accessible dairy solutions, meeting diverse consumer needs in a dynamic global landscape.

Global Milk Powder Market Overview & Scope:

The global milk powder market is segmented by:

- Type: The market is divided by type into non-fat dry milk or skim milk powder, whole milk powder, and buttermilk powder. Skim milk powder leads the industrial sector because of its high protein and low-fat content. Whole milk powder is preferred in cooking and beverages due to its richer flavor and creaminess.

- End User: By end-user, the market is segmented into key verticals such as household, commercial, and industrial. The industrial segment is the largest share in the market because of the increasing consumption of milk-made products, which is leading to extensive use of milk powders in industries such as infant formula production, bakery, and confectionery, among other industries.

- Distribution Channel: By distribution channel, the market is divided into online, supermarkets and hypermarkets, convenience stores, and others. The market's distribution is changing with supermarkets and hypermarkets leading in volume because of their accessibility and product range. Online shopping for dairy products is expanding rapidly as more consumers choose digital options.

- Region: Geography-wise, the Asia Pacific is expected to take a substantial share of the global milk powder market due to growing trends in health and wellness, the growth of online retail, and strategies focused on sustainability across the region. Further, with robust demand across sectors and innovative supply chains, the industry is poised for continued growth in the region during the projected period.

Top Trends Shaping the Global Milk Powder Market:

- Increase in Digitalization and Online Platforms

Brands are using digital marketing and e-commerce channels to reach out and interact with consumers directly in the competitive market. This is driven by an increase in online shopping and an increase in the penetration of internet connectivity. Moreover, the participants of the market are also investing in scaling up the production of milk powder to achieve economies of scale, increasing their profitability, and ensuring a consistent supply to meet growing global demand.

Global Milk Powder Market Growth Drivers vs. Challenges:

Drivers:

- Diversified Product Offerings- People are becoming more interested in milk powder consumption because of the development of cutting-edge technologies that enable the nutritional milk content even after the drying process, and extremely trace amounts of fat that make it low in calories.

According to the 2020–2025 United States DGAs issued by the INCA, USDA, and HHS, the only secure and advised substitute for people in the United States who cannot or prefer not to utilize breast milk is commercial. Reckitt also gained permission from the US FDA in August 2022 to import 150 metric tonnes (about 331,000 pounds) of baby formula base powder from the company's nutrition factory in Delicias, Mexico.

Additionally, there is a rise in demand due to its abundance in complete proteins, which helps in the development and maintenance of lean muscles, which is increasingly consumed by athletes. Further, countries all around the world have been importing milk powder to satisfy the rising demand for the product.

Additionally, India's MY 2023 production of skimmed milk powder (SMP) is predicted by Foreign Agricultural Services (FAS) to be 740,000 metric tonnes (MT), up about 6% from the USDA's official estimate for 2022. This increase is projected because of 2023's strong export demand and high prices. The growth is ascribed to increased domestic demand brought on by rising incomes.

In addition, the companies are targeting their marketing towards launching new products with the labels of natural or organic. The participants focus on the unique selling propositions to enhance sales of their products. The businesses are also introducing fortified milk powders, providing customers with more nutrients and appealing to health-conscious consumers and families.

- Rising Demand for Infant Nutrition and Changing Dietary Habits: Another significant driver is the growing demand for infant nutrition and health-based dairy products. The increasing global birth rate, rising awareness about child nutrition, and higher spending capacity among middle-class families are contributing to a surge in demand for infant formula based on milk powder. Additionally, milk powder's high protein and calcium content support its use in nutritional supplements for various age groups.

In this regard, as per the data by the World Population Prospects by the United Nations Department of Economic and Social Affairs, India had 23,209,489 births in 2023, China had 8,899,881 in 2023, Nigeria had 7,509,758 in 2023, Pakistan had 6,882,058 in 2023, and Indonesia had 4,482,359 in 2023. High birth rates in these top five countries significantly boost demand for infant formula and nutritional milk powders, key applications of milk powder. This demographic trend supports sustained market growth, especially in Asia and Africa’s expanding consumer base.

- Growing Innovation: Innovation in dairy processing technologies, such as spray drying and packaging improvements, is also enabling manufacturers to produce high-quality milk powder with better solubility and nutrient retention, thereby enhancing product appeal and market growth. For instance, in May 2025, the world's top dairy company, Lactalis, announced the PRIDE Family Milk Powder's debut in Malaysia, a significant step in its goal to provide high-quality, everyday nutrition for future generations.

In addition, in a significant move to strengthen agricultural and industrial cooperation between Qatar and Algeria, Baladna Trading and Investment W.L.L., a division of Baladna Q.P.S.C., has signed a shareholder agreement with the Algerian National Investment Fund. Signed on September 19, 2024, the agreement opens the door for the establishment of a dairy and milk powder production project in southern Algeria, which is expected to grow into one of the biggest agricultural endeavors in the area.

Challenges:

- Price Volatility: The cost of raw milk and other key ingredients for milk powder production is highly volatile, influenced by factors such as weather conditions, dairy farm output, and global events like pandemics or trade restrictions, which could impact the market growth.

Global Milk Powder Market Regional Analysis:

- North America: Milk powder is a versatile ingredient that can be used in a variety of bakery and confectionery products, such as cakes, cookies, pastries, ice cream, and yogurt. The increasing demand for these products is expected to drive the growth of the milk powder market in the North America region, such as Canada and the USA. Moreover, as reported by the Good Food Institute, there are an estimated 65 million lactose-intolerant people and 5 million dairy-allergic people in the United States. These consumers are looking for plant-based milk powder as a lactose-free and dairy-free alternative to dairy milk.

Furthermore, the rising disposable income and changing dietary habits of consumers are expected to drive the demand for milk powder in the US. For instance, in May 2023, Lactalis Ingredients launched a new organic whole milk powder. The powder is made from milk that comes exclusively from French dairy farms that comply with the specifications for organic farming. It is free from neutralizing agents, antibiotics, preservatives, and other additives.

Moreover, with rising product launches and increasing government approvals, the market for milk powder is anticipated to grow in the United States. For instance, in July 2024, Yili Group opened its first US flagship store in Los Angeles, California, as the company received FDA approval for various dairy products. The store is located in 99 Ranch Market, which is one of the largest Asian supermarket chains in the US. The FDA-approved products include: AMBPOMIAL, Youngfun liquid dairy products, Chocliz, Bitter Coffee, and Yili Ranch.

Global Milk Powder Market Key Developments:

- In June 2025, Canada granted Royal Assent to Bill C-202, which prevents trade negotiators from expanding tariff-free quotas or reducing tariffs for supply-managed products, in particular dairy items like milk powder. This is quite significant for protecting dairy markets domestically.

- On 1 May 2025, the Sale of Fonterra's units, including the Anlene milk powder brand, interest from large global firms

- As of May 2025, Meiji, Lactalis, and Saputo are among other dairy companies considering submitting bids for the acquisition of Fonterra's consumer brands and operations, including the Anlene milk supplement (a milk powder product). The value of the sale is estimated at NZ$4 billion.

- In June 2025, the State of Jharkhand opened its first dairy-based milk powder plant in Ranchi. Jharkhand's Chief Minister inaugurated the state's first milk powder manufacturing unit, Medha Dairy, in Ranchi. The plant has a capacity of 20 metric tonnes per day and represents an important first step for Jharkhand in becoming milk self-sufficient. This is a part of an ongoing commitment to dairy infrastructure development, which is led by the cooperative and NDDB.

List of Top Milk Powder Companies:

- Dairy Farmers of America

- Olam International

- Dana Dairy Group

- Darigold

- Fonterra Co-operative Group

Milk Powder Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Milk Powder Market Size in 2025 | USD 34.988 billion |

| Milk Powder Market Size in 2030 | USD 41.797 billion |

| Growth Rate | CAGR of 3.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Milk Powder Market |

|

| Customization Scope | Free report customization with purchase |

Milk Powder Market Segmentation:

- By Type

- Non-fat dry Milk/Skim Milk Powder

- Whole Milk Powder

- Buttermilk Powder

- By End-User

- Household

- Commercial

- Industrial

- By Distribution Channel

- Online

- Supermarkets/Hypermarkets

- Convenience Stores

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America