Report Overview

Multiple Myeloma Market - Highlights

Multiple Myeloma Market Size:

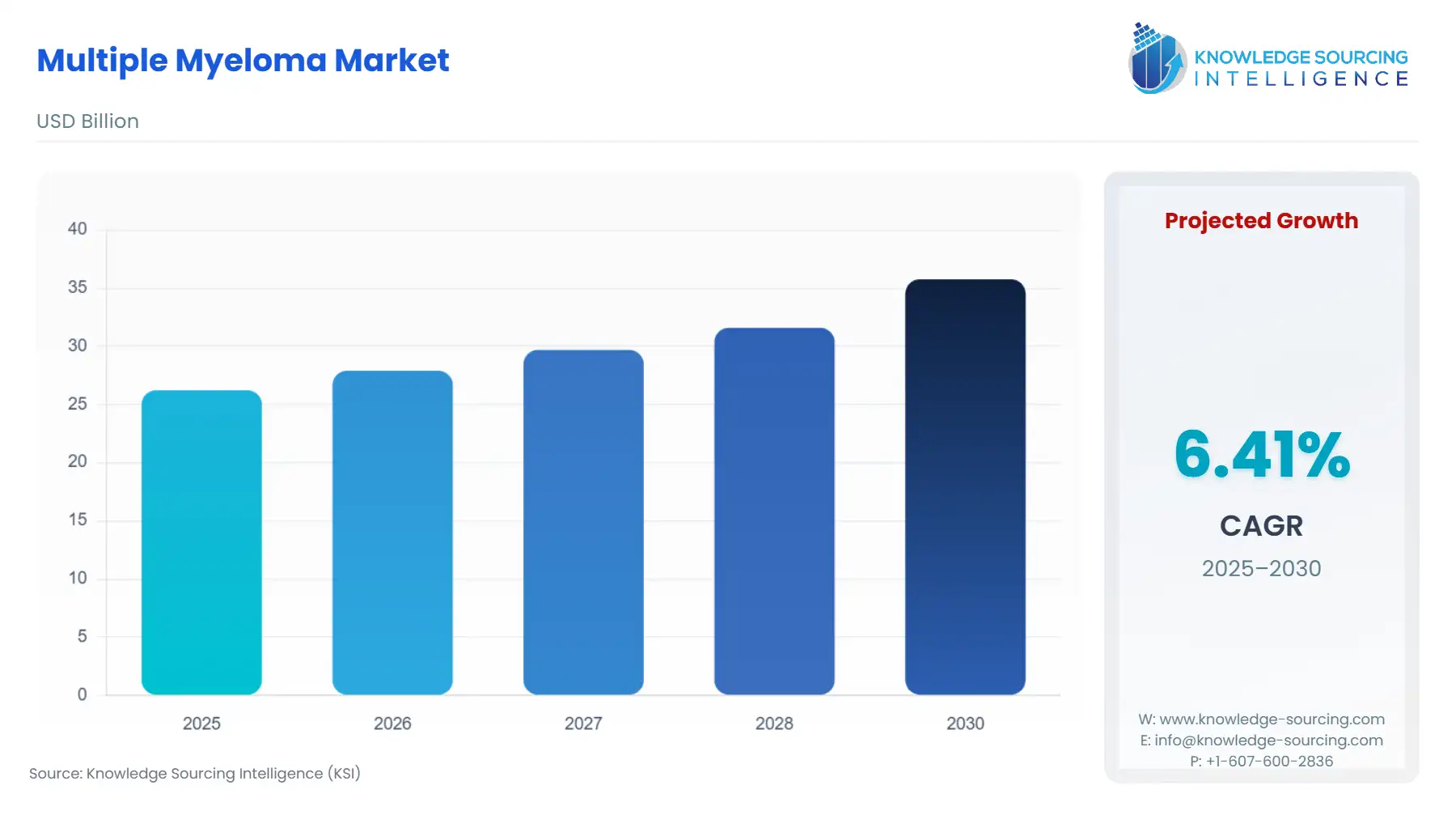

Multiple Myeloma Market is projected to expand at a 6.22% CAGR, reaching USD 37.67 billion in 2031 from USD 26.231 billion in 2025.

Multiple Myeloma Market Trends:

Multiple myeloma is the cancer formed in white blood cells which are also known as plasma cells. Cancerous plasma cells are accumulated in the bone marrow and these crowd the healthy blood cells causing multiple myeloma. The increasing burden of multiple myeloma disease along with the aging population and growing patient awareness about the symptoms and treatment are the major growth driver of the multiple myeloma market.

Multiple Myeloma Market Growth Drivers:

Increasing Prevalence of Multiple Myeloma

The growing prevalence of multiple myeloma is leading to an increased need for multiple myeloma treatments thereby boosting the market expansion. For instance, 159,985 new cases of multiple myeloma are diagnosed around the globe annually as per the International Myeloma Foundation and it is the second most common blood cancer in the world. According to Cancer Research UK, the United Kingdom experiences approximately 3,100 deaths related to myeloma every year, resulting in over 8 deaths daily. Additionally, myeloma ranks as the 17th most prevalent cause of cancer-related deaths in the UK, accounting for 2% of all cancer-related fatalities.

Aging Population

Multiple myeloma is more common in older adults, and as the global population continues to age, the incidence of multiple myeloma market is expected to bolster in the coming years. This demographic trend drives the demand for multiple myeloma treatments and related healthcare services. For instance, 61% of all myeloma fatalities in the UK occur in persons aged 75 years and older each year as per the Cancer Research UK. Moreover, between 2020 and 2050, the number of people aged 80 years or older is projected to triple and reach 426 million as per the WHO reports.

Growing Patient Awareness and Early Diagnosis

Increased awareness of multiple myeloma symptoms through various programs among both patients and healthcare professionals has led to earlier detection and diagnosis thereby propelling the multiple myeloma market. For instance, the AACR Runners for Research aims to raise $600,000 during Philadelphia Marathon Weekend this year. The provided funds will offer direct assistance to the AACR's mission of cancer prevention and cure, supporting multiple endeavors such as research, education, communication, collaboration, science policy and advocacy, as well as funding for cancer research. Moreover, every year, the San Fernando Valley Support Group joins the International Myeloma Foundation's mission of enhancing the well-being of multiple myeloma patients. Through their support, the IMF offers vital information and education, aids support groups, conducts research, and advocates for patients globally.

Increasing Research and Supportive Care

Ongoing research efforts have led to a better understanding of the disease's biology and molecular pathways. This has resulted in the development of targeted therapies and immunotherapies which are accelerating the multiple myeloma market. For instance, a clinical fellow in hematology and medical oncology at Columbia University was awarded the AACR-Bristol Myers Squibb Cancer Disparities Research Fellowship in 2022 to investigate the prevalence and risk factors of MGUS, a precursor to multiple myeloma that affects black people in sub-Saharan Africa. Moreover, enhancements in supportive care measures including the management of pain, infections, and other complications associated with multiple myeloma are also enhancing the overall quality of life for patients.

Multiple Myeloma Market Opportunities:

The multiple myeloma market presents several opportunities for growth and development. The approval of novel drugs by regulatory authorities expands the treatment options available to patients and provides an opportunity for market expansion and players. For example, the FDA granted accelerated approval to teclistamab-cqyv (Tecvayli, Janssen Biotech, Inc.) in October 2022. It is the first bispecific B-cell maturation antigen (BCMA)-directed CD3 T-cell engager. It is intended for adult patients with relapsed or refractory multiple myeloma who have undergone at least four prior lines of therapy. Moreover, advancements in genomic profiling and understanding of disease biology have opened up opportunities for personalized medicine in multiple myeloma.

Multiple Myeloma Market Restraints:

The multiple myeloma market has experienced growth and development however some restraints or challenges can impact its expansion. For example, multiple myeloma can develop resistance to certain treatments over time like many cancers. For instance, the survival rate of patients diagnosed with multiple myeloma is just 29% in the UK. This poses a significant challenge in managing the disease and may necessitate the development of new treatment approaches. Moreover, multiple myeloma is a complex disease with various subtypes and genetic characteristics, making it challenging to develop universally effective treatments. Further, some multiple myeloma treatments can cause significant side effects such as impacting patients' quality of life.

Multiple Myeloma Market Geographical Outlook:

North America is Expected to Grow Considerably

North America is expected to hold a significant share of the multiple myeloma market during the forecast period. The factors attributed to such a share are the increasing prevalence of myeloma cancer cases, government support for research and clinical trial, the presence of a strong healthcare system, and increasing awareness about multiple myeloma. For instance, in 2023, the American Cancer Society predicts approximately 35,730 individuals will receive a new diagnosis of multiple myeloma, and it is expected that around 12,590 deaths will be attributed to this disease in the United States.

List of Top Multiple Myeloma Companies:

Bristol-Myers Squibb (BMS) is a global biopharmaceutical company that focuses on the discovery, development, and commercialization of innovative medicines and therapies to address various medical conditions. It revealed the first findings from its multiple myeloma portfolio across targets and molecular techniques, as well as the presentation of fresh research in December 2022.

Novartis is a leading global pharmaceutical company headquartered in Switzerland. The company's diverse portfolio includes innovative prescription drugs, generic medications, vaccines, and consumer health products. It offers multiple myeloma drug Farydak which received EU approval in September 2015.

Multiple Myeloma Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Multiple Myeloma Market Size in 2025 | USD 26.231 billion |

Multiple Myeloma Market Size in 2030 | USD 35.784 billion |

Growth Rate | CAGR of 6.41% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Multiple Myeloma Market |

|

Customization Scope | Free report customization with purchase |

Multiple Myeloma Market Segmentation

By Type

Smouldering Multiple Myeloma

Active Multiple Myeloma

By Treatment

Chemotherapy

Targeted Therapy

Immunotherapy

Stem Cell Transplantation

Corticosteroids

By Diagnosis

Blood Tests

Bone Marrow Biopsy

Urine Tests

By End-User

Hospitals & Clinics

Homecare

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Others