Report Overview

Global Precision Medicine Market Highlights

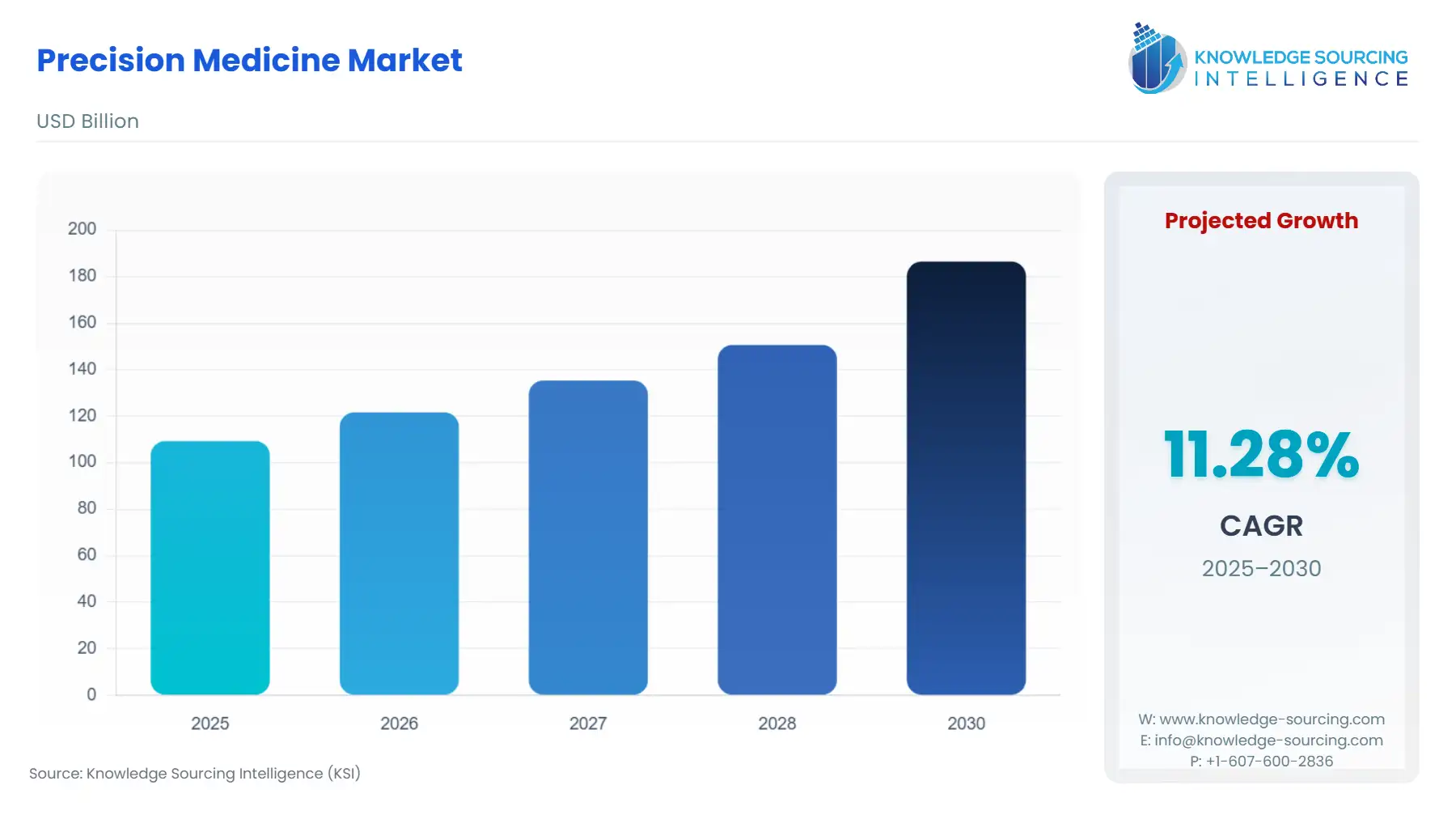

Precision Medicine Market Size:

The precision medicine market is expected to grow from USD 109.297 billion in 2025 to USD 186.506 billion in 2030, at a CAGR of 11.28%.

Precision Medicine represents a fundamental paradigm shift in healthcare delivery, moving treatment protocols from a generic, 'one-size-fits-all' model toward targeted, patient-specific interventions based on an individual's unique genetic, environmental, and lifestyle profile. The core of this market is the synergistic development of advanced molecular diagnostics, primarily Next-Generation Sequencing (NGS), and highly targeted therapeutic agents, particularly in the realm of oncology and rare diseases. This convergence has established an ecosystem where a drug's efficacy and safety are intrinsically linked to a corresponding diagnostic test, creating a highly interdependent value chain. The market's current expansion is not merely incremental but is being driven by the realization that molecular stratification of patient populations significantly improves clinical outcomes, reduces adverse drug events, and ultimately enhances healthcare system efficiency by minimizing wasteful prescriptions and ineffective treatments.

Global Precision Medicine Market Analysis:

- Growth Drivers

The escalating global burden of chronic diseases, particularly cancers and complex neurological disorders, creates a non-negotiable demand for more effective, targeted therapies. This necessity drives pharmaceutical investment in biomarker-driven drug discovery, which directly increases the demand for precision medicine tools like companion diagnostics and genetic testing. Concurrently, the demonstrable reduction in the cost of Next-Generation Sequencing (NGS) and related omics technologies democratizes access to comprehensive genetic profiling, converting sophisticated research tools into scalable clinical practice and facilitating wider patient stratification. Finally, governmental initiatives, such as the European Partnership for Personalised Medicine (EP PerMed), actively inject public funding into multi-national research projects, thus fueling technology development and accelerating clinical adoption through institutional demand.

- Challenges and Opportunities

A primary constraint on market expansion is the complexity and fragmentation of regulatory and reimbursement pathways for novel precision medicine products, especially for multi-gene sequencing panels and AI-driven diagnostic tools. This uncertainty significantly delays market access and slows clinical adoption, thus impeding demand. A significant opportunity, however, lies in leveraging advanced Data Analytics and Artificial Intelligence (AI) to integrate heterogeneous, multi-omics patient data from electronic health records (EHRs) into actionable clinical insights. Developing standardized, validated, and interoperable platforms to manage this 'big data' challenge will reduce diagnostic turnaround times and increase clinical utility, directly catalyzing demand for integrated digital health solutions that streamline patient stratification.

- Supply Chain Analysis

The precision medicine supply chain is characterized by a high degree of technological sophistication and is generally non-material-intensive. The chain is dominated by highly specialized, proprietary components: sophisticated sequencing instruments, complex biochemical reagents, and high-performance computing hardware and software licenses. Key production hubs for instruments and reagents are concentrated in North America and Europe, creating reliance on established global logistics for time- and temperature-sensitive biospecimen transport and consumables delivery. A critical complexity is the data supply chain, which mandates secure, compliant (e.g., HIPAA, GDPR) cross-border transfer of massive genomic datasets from clinical centers to centralized bioinformatics processing hubs, making robust data governance a non-negotiable dependency.

Precision Medicine Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Food and Drug Administration (FDA) / 21st Century Cures Act |

FDA approval of companion diagnostics (CDx) is the primary gateway, formally linking a targeted therapy to a diagnostic test and directly creating demand for that specific test as a mandatory pre-requisite for drug use. The Cures Act promotes R&D funding and accelerated regulatory pathways. |

|

European Union |

Regulation (EU) 2017/746 (In Vitro Diagnostic Regulation - IVDR) |

The IVDR imposes stricter requirements for the conformity assessment of in vitro diagnostic medical devices, including CDx. This increases compliance costs but standardizes quality and safety, driving market preference toward IVDR-compliant, commercial-grade assays over lab-developed tests. |

|

India |

National Genomics and Health Data Policy (Draft) / New Drugs and Clinical Trials Rules, 2019 |

Government plans to establish population-scale genomic programs (e.g., IndiGen) drive massive demand for sequencing services and bioinformatics infrastructure. The new rules formalize the regulatory environment for targeted drug trials, stimulating demand for localized CDx development and clinical trial support. |

Precision Medicine Market Segment Analysis:

- By Application: Oncology

Oncology retains its position as the unequivocal market leader, driven by the rapid, cumulative advancements in molecularly targeted therapies and immunotherapy. Cancer is fundamentally a disease of the genome, necessitating molecular profiling for effective management, which acts as the core growth driver. The segment's growth is directly correlated with regulatory actions: every FDA approval of a targeted drug (e.g., tyrosine kinase inhibitors, PARP inhibitors) is accompanied by a mandatory or recommended Companion Diagnostic (CDx) test. This co-development model establishes a guaranteed diagnostic market for each new therapeutic launch. Furthermore, the clinical adoption of multi-gene panel testing and liquid biopsy platforms for minimal residual disease (MRD) monitoring, driven by clinical guidelines from bodies like NCCN, continually expands the utility of precision diagnostics beyond initial diagnosis into treatment selection, monitoring, and relapse detection, fundamentally sustaining and diversifying demand. The need for these high-throughput sequencing assays is therefore inelastic, directly tied to the incidence of cancer and the approved therapeutic regimens.

- By Technology: Companion Diagnostics

Companion Diagnostics (CDx) serve as the vital link between therapeutic innovation and patient stratification, positioning them as an indispensable technology segment. The entire value proposition of a targeted therapy is contingent upon the accuracy and availability of its corresponding CDx, making regulatory necessity the primary and most powerful growth driver. The FDA’s clear definition and approval pathway for CDx create a formal mandate for their use, which compels oncologists and diagnostic labs to procure and implement these specific tests. Pharmaceutical companies actively partner with diagnostic firms to co-develop CDx, securing a guaranteed testing framework upon drug approval. This strategic pairing streamlines clinical trials, reduces the overall cost of drug development by focusing on likely responders, and, crucially, establishes reimbursement eligibility, thereby removing a major adoption barrier and ensuring sustained, high-volume demand from clinical laboratories globally.

Precision Medicine Market Geographical Analysis:

- US Market Analysis

The US market represents the largest revenue share, underpinned by substantial private and public R&D investment, a favorable regulatory environment via the FDA, and extensive reimbursement coverage for high-cost genetic tests and targeted therapies. Demand is primarily driven by the high prevalence of cancer and rare diseases, coupled with a healthcare system that rapidly adopts cutting-edge technologies. The concentration of leading biotech and pharmaceutical companies drives a high volume of co-development between therapeutics and diagnostics. Local demand factors include major academic medical centers establishing comprehensive genomic medicine programs, creating great internal demand for sequencing platforms and bioinformatics services.

- Brazil Market Analysis

The Brazilian precision medicine market faces challenges related to infrastructure and public healthcare access, but demand is accelerating in the private sector. The primary growth driver is the urgent need to address high-incidence conditions, particularly in oncology, with limited public healthcare resources available for advanced diagnostics. Adoption is concentrated in large, metropolitan private hospitals and specialized reference laboratories. Local factors include efforts by the National Health Surveillance Agency (ANVISA) to align regulatory pathways with international standards, which, upon clarification, will ease the introduction of approved CDx and sequencing platforms, thereby stimulating institutional investment and demand.

- German Market Analysis

Germany is a key European market, characterized by an advanced and highly standardized healthcare system. Demand is propelled by strong government support for biomedical research and a well-established reimbursement structure through sickness funds. Local factors include the integration of high-throughput sequencing into the clinical workflow through consortia and academic networks, facilitating the systematic collection and analysis of patient data. The stringent data protection regulations (GDPR) impose high operational costs on data analytics firms but concurrently foster demand for best-in-class, compliant data management and secure bioinformatics solutions.

- Saudi Arabia Market Analysis

Precision medicine demand in Saudi Arabia is being driven by significant, targeted government investment in national genomics programs aimed at addressing genetic and hereditary disorders prevalent in the region. The primary local growth catalyst is the desire to build a resilient, modern healthcare ecosystem, which necessitates the procurement of advanced sequencing equipment, particularly Next-Generation Sequencing (NGS) platforms, for centralized national laboratories. The requirement is therefore institution-led, focusing on building capacity for population screening and large-scale genetic risk assessment programs within key university and public health centers.

- China Market Analysis

China is poised for rapid expansion, leveraging massive domestic R&D investment and a vast patient population. The core growth driver is the convergence of high disease burden and ambitious national technology goals. Local factors include the establishment of large-scale, government-backed biobanks and national genome projects, which create immense, sustained demand for sequencing consumables and data analytics infrastructure at scale. The regulatory framework, governed by the National Medical Products Administration (NMPA), is streamlining the approval process for innovative medical devices and targeted drugs, accelerating market entry and direct consumer access, thereby stimulating market demand.

Precision Medicine Market Competitive Environment and Analysis:

The Global Precision Medicine Market is a highly competitive, bifurcated ecosystem. It is divided between major multinational pharmaceutical companies that develop the targeted drugs, and specialized technology/diagnostics firms that provide the indispensable companion diagnostics, sequencing platforms, and bioinformatics solutions. Strategic collaborations, mergers, and acquisitions are endemic, primarily aimed at achieving the vertical integration necessary to link the therapeutic and diagnostic aspects of precision medicine seamlessly. Competitive success hinges on achieving regulatory approval for paired products, establishing broad reimbursement, and building scalable, compliant data infrastructure.

- F. Hoffmann-La Roche Ltd

F. Hoffmann-La Roche Ltd (Roche) is strategically positioned as a fully integrated leader in precision medicine, commanding significant influence across both the therapeutic and diagnostic value chains. Through its Pharmaceutical and Diagnostics divisions (including the acquired Genentech and Foundation Medicine), Roche executes a co-development strategy, launching targeted oncology drugs (e.g., Alecensa, Venclexta) alongside proprietary companion diagnostics. The Diagnostics division supplies core instruments and assays, such as the VENTANA platform and the cobas family of molecular instruments. This vertical integration allows Roche to control quality, accelerate market entry for paired products, and drive consistent demand for its diagnostic tools every time one of its targeted therapies is prescribed globally.

- Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. operates as a crucial enabler of the entire precision medicine ecosystem, focusing strategically on providing the foundational tools, platforms, and services required for multi-omics research and clinical testing. The company’s core offerings encompass Next-Generation Sequencing (NGS) instruments (Ion Torrent platform), reagents, mass spectrometry, and a broad portfolio of specialized diagnostic assays, including the Oncomine Dx Target Test for non-small cell lung cancer. By providing the essential infrastructure for both research and clinical labs, Thermo Fisher captures consistent demand from pharmaceutical companies for drug discovery services and from clinical centers for high-throughput, validated diagnostic workflows, maintaining a highly diversified revenue stream across the value chain.

- Novartis AG

Novartis AG maintains a powerful strategic focus on developing targeted therapeutic agents, particularly within oncology and gene therapy, which drives indirect demand for precision medicine tools. The company’s pipeline emphasizes therapies that rely on genetic stratification, such as the Kymriah (tisagenlecleucel) CAR-T cell therapy, which necessitates advanced cell handling and patient monitoring. Novartis focuses on building a deep therapeutic pipeline in highly specified patient populations, which inherently requires the development or procurement of highly specific Companion Diagnostics and advanced molecular testing services to identify the appropriate patient cohorts, thus creating consistent external demand for diagnostic innovation.

Precision Medicine Market Developments:

- November 2025: The FDA approved Thermo Fisher Scientific's Oncomine Dx Target Test as a companion diagnostic to identify Non-Small Cell Lung Cancer patients eligible for a newly approved targeted therapy. This formalizes a mandatory diagnostic step, immediately creating new market demand.

- October 2025: Roche completed the acquisition of 89bio, Inc., expanding its presence in the metabolic and liver disease space. This merger leverages Roche’s diagnostic capabilities to accelerate precision approaches in these critical and complex disease areas.

- December 2024: Roche commenced a tender offer for Poseida Therapeutics, Inc., a clinical-stage gene therapy company. This acquisition enhances Roche’s cell and gene therapy capabilities, bolstering its long-term strategy in high-precision, curative treatments.

Precision Medicine Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 109.297 billion |

| Total Market Size in 2031 | USD 186.506 billion |

| Growth Rate | 11.28% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Precision Medicine Market Segmentation:

- By Technology

- Data Analytics (including AI/ML)

- Bioinformatics

- Gene Sequencing

- Genomics/Functional Genomics

- Proteomics

- Metabolomics

- Digital Health Technologies

- Companion Diagnostics

- By Application

- Oncology

- Central Nervous System

- Immunology

- Cardiovascular

- Rare Diseases

- Infectious Diseases

- Respiratory Diseases

- Metabolic Disorders

- Hematology

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America