Report Overview

Offshore Wind Subsea Cable Highlights

Offshore Wind Subsea Cable Market Size:

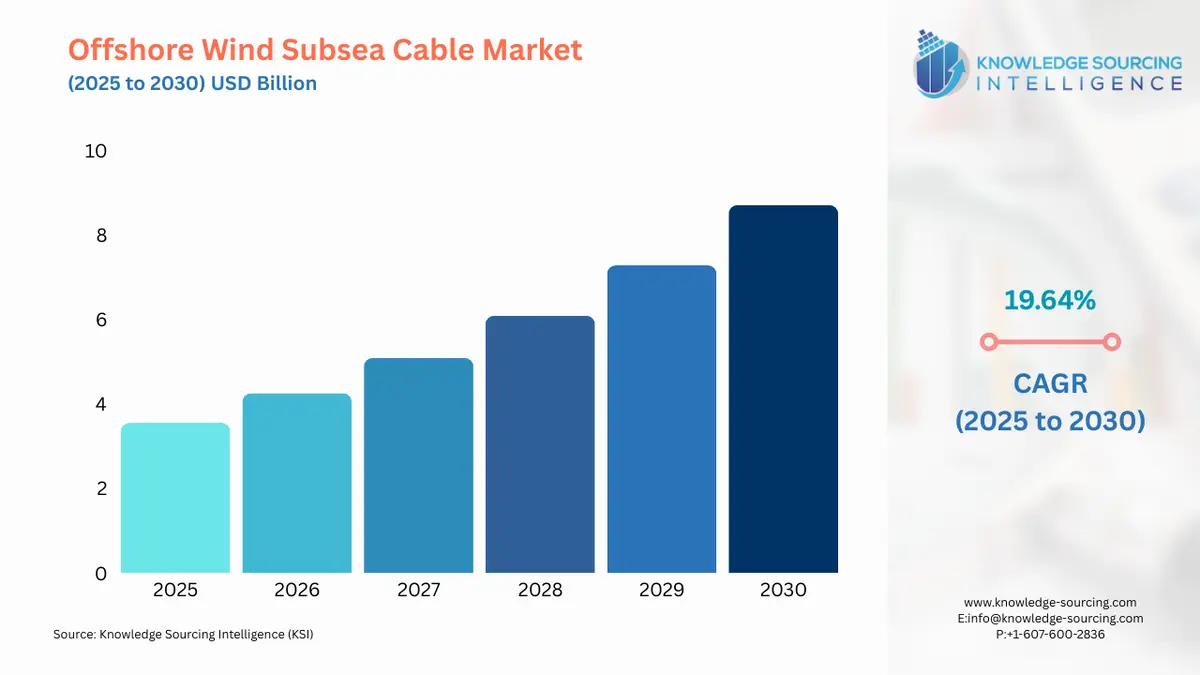

Offshore Wind Subsea Cable Market is expected to grow at a 19.05% CAGR, achieving USD 10.118 billion in 2031 from USD 3.554 billion in 2025.

Offshore Wind Subsea Cable Market Trends:

An offshore wind subsea cable is a vital component of an offshore wind farm. The subsea cable plays a crucial role in transferring the electricity generated by the offshore wind turbines back to the mainland power grid. It serves as the interconnector between the offshore wind farm and the onshore power infrastructure. The growing offshore wind capacity and the potential of subsea cables are major growth factors of the offshore wind subsea cable market. Moreover, government initiatives and technological advancements are further expected to propel the offshore wind subsea cable market.

Offshore Wind Subsea Cable Market Growth Drivers:

Growing Offshore Wind Capacity

The offshore wind sector has been expanding rapidly with many countries setting ambitious renewable energy targets. The increasing installations of offshore wind turbines are expected to accelerate the offshore wind subsea cable market. For instance, in 2021, the global offshore wind sector achieved a record-breaking year with the installation of 17,398 megawatts (MW) of new projects. This significant deployment pushed the worldwide installed capacity of offshore wind energy beyond 50 gigawatts (GW) according to the Wind Energy Technologies Office (WETO).

The Potential of Offshore Wind Subsea Cable

The potential of subsea cables is vast and extends beyond their current application in connecting offshore wind farms to the onshore grid which is simulating the offshore wind subsea cable market. For example, subsea cables enable the interconnection of cross-border projects by facilitating the exchange and sharing of renewable energy resources between nations. Moreover, subsea cables can connect offshore energy storage systems such as underwater compressed air energy storage or pumped hydro storage to the onshore grid. These storage systems can help balance the intermittent nature of renewable energy sources and ensure a stable energy supply.

Advancements in Offshore Wind Technology

Technological advancements in offshore wind turbine design and construction have led to larger and more efficient turbines. These larger turbines require higher capacity subsea cables to transmit the increased electricity output to shore. The Levelized Cost of Energy (LCOE) for offshore wind has been declining due to various factors including technological advancements, economies of scale, and increased competition in the sector which is also boosting the offshore wind subsea cable market. For instance, according to the US Department of Energy, a 13% decrease in the anticipated levelized cost of energy for commercial-scale offshore wind projects in the United States, ranging from $61/MWh to $116/MWh, led to a 13.5% increase in the U.S. offshore wind pipeline in 2021 compared to 2020.

Wider Availability of Offshore Wind Resources

Offshore wind farms can harness stronger and more consistent wind resources which enhance the overall energy output compared to onshore wind farms. The availability of favorable wind conditions in offshore locations encourages the development of large-scale offshore wind projects driving the offshore wind subsea cable market. In 2030, it is projected that there will be 60% more installed wind power than in the Moderate Scenario for fixed-bottom and floating wind capacity. A 270 GW and 16.5 GW global offshore wind development is projected for 2030 according to the NREL report.

Environmental Concerns and Energy Transition

With increasing concerns about climate change and the need to transition from fossil fuels to renewable energy sources, offshore wind energy has become an attractive option. Governments and energy companies are investing in offshore wind projects which are driving the demand for offshore wind subsea cables. Between 2011 and 2020, global investment in the energy transition increased from under $300 billion per year to nearly $500 billion annually as per the World Economic Forum report. Moreover, during the period from 2011 to 2019, the global wind energy capacity grew approximately threefold. The UNDP states that in order to achieve climate goals, annual energy-related CO2 emissions must decrease by 70% below current levels by the year 2050.

Government Initiatives and Support

Many governments worldwide are providing financial incentives, subsidies, and regulatory support to promote offshore wind development. These incentives aid in boosting the offshore wind subsea cable market. Investment in offshore wind capacity attracted 8% of the total energy investments between 2013 and 2022 as per the IRENA. Moreover, according to the EIA's 2021 report, eight states of the USA have implemented offshore wind energy policies that aim to deploy a minimum of 39,322 megawatts (MW) of offshore wind capacity by the year 2040. Additionally, the MNRE (India) has set medium- and long-term goals of 5 GW by 2022 and 30 GW by 2030 for the expansion of offshore wind generating capacity.

Offshore Wind Subsea Cable Market Restraints:

The offshore wind subsea cable market has experienced growth and development however some restraints or challenges can impact its expansion. For example, the installation of subsea cables can have environmental consequences on marine ecosystems. The laying and operation of cables can disturb the seabed and affect marine habitats, raising concerns over potential impacts on marine life, including endangered species. Moreover, subsea cables are susceptible to damage from fishing activities, anchors, and other marine operations. Repairing and maintaining these cables require specialized vessels and equipment, which can result in higher costs and downtime for the wind farm.

List of Top Offshore Wind Subsea Cable Companies:

JDR Cables is a company that specializes in the design, engineering, and manufacturing of subsea power cables and umbilicals for a variety of industries. In the fourth quarter of 2022, JDR in Cambois began constructing a Continuous Catenary Vulcanization (CCV) line.

Nexans, founded in 2000 is a prominent player in providing a wide range of power cables, systems, and services. It offers offshore topside, marine, and ship cables.

Offshore Wind Subsea Cable Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Offshore Wind Subsea Cable Market Size in 2025 | USD 3.554 billion |

Offshore Wind Subsea Cable Market Size in 2030 | USD 8.711 billion |

Growth Rate | CAGR of 19.64% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Offshore Wind Subsea Cable Market |

|

Customization Scope | Free report customization with purchase |

Offshore Wind Subsea Cable Market Segmentation

By Cable Type

Single-Core

Multi-Core

By Conductor Type

Copper

Aluminium

By Application

Inter-Country & Island Connection

Offshore Wind Power Generation

Offshore Oil & Gas

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others