Report Overview

Oil-Gas Cable Market - Highlights

Oil-Gas Cable Market Size:

The oil and gas cable market, at a 5.73% CAGR, is expected to grow from USD 5.693 billion in 2025 to USD 7.954 billion in 2031.

Oil-Gas Cable Market Trends:

Oil and gas cables are specialized cables designed to facilitate the transportation of oil and gas between different locations. Ethernet cables, variable frequency drives (VFD) cables, and control and instrumentation cables are the three primary cable types widely utilized in oil and gas applications. The rise in oil production and increasing exploration activities are expected to bolster the oil-gas cable market growth.

Oil-Gas Cable Market Growth Drivers:

Exploration and production activities bolster the oil-gas cable market growth.

The demand for cables in the oil and gas industry is driven by the exploration and production activities that are integral to the extraction of oil and gas. These activities involve the intricate process of extracting valuable resources from beneath the earth's surface, requiring the establishment of comprehensive cable networks. These networks play a crucial role in facilitating the smooth and efficient transportation of the extracted oil and gas from the extraction sites. According to the U.S. Energy Information Administration, in March 2023, crude oil production in the United States stood at 393,561 barrels witnessing a 5.8% increase from 371,378 barrels in November 2022.

Increasing global energy demand drives the oil-gas cable market expansion.

The growing industrial and household energy requirements have created a simultaneous surge in the need for highly efficient cable infrastructure to facilitate the transportation of oil and gas resources. This demand is fuelled by the essential role that oil and gas play in powering various sectors of the economy, including manufacturing, transportation, and residential consumption which as a result positively impacts the oil-gas cable industry growth. According to the International Energy Agency, the global oil demand is expected to experience a significant increase of 6% from 2022 to 2028, reaching a level of 105.7 million barrels per day (mb/d). This anticipated surge in oil demand reflects the growing energy needs across various sectors and regions worldwide

Investment in oil and gas infrastructure stimulates oil-gas cable market growth.

Significant investments are being made in the development of oil and gas infrastructure, including pipelines, refineries, and storage facilities. This investment leads to an increased demand for cables to support the construction and expansion of these facilities, thereby supporting the oil-gas cable industry growth. As per the Indian Brand Equity Foundation, in May 2022, ONGC (Oil and Natural Gas Corporation) disclosed its intention to allocate a substantial investment of US$ 4 billion between FY22-25 to bolster its exploration endeavors within India. Additionally, in March 2023 press release, Kuwait Petroleum Corporation’s deputy chairman stated that the nation’s “Duqm refinery” project is set to be operational by the year-end and will process a substantial volume of 230,000 barrels of crude oil products each day.

Shifts towards renewable energy restrain oil-gas cable market growth.

The increasing global transition towards cleaner and more sustainable energy sources, with a strong emphasis on renewable energy, energy efficiency, and decarbonization, is having a notable impact on the demand for conventional oil and gas infrastructure, including cables. As a result, the growth of the oil and gas cable market is projected to decelerate as the industry shifts its focus toward the expanding utilization of renewable energy sources.

Oil-Gas Cable Market Geographical Outlook:

Asia-Pacific region is predicted to dominate the oil-gas cable market.

The Asia-Pacific region is home to major oil and gas producers such as China, India, and Australia, which is driving significant demand for cables in their exploration and production activities. Secondly, rapid industrialization, urbanization, and infrastructural development in countries like China and India lead to increased energy consumption and consequently, a greater need for efficient cable networks. According to Energy Information Administration, in 2021, China's national oil companies (NOCs) achieved a significant increase in natural gas production, estimated at approximately 7.4 trillion cubic feet (Tcf). This marked an 8% growth compared to the previous year, showcasing the expanding capabilities of China's NOCs in meeting the rising demand for natural gas within the country.

Oil-Gas Cable Market Company Products:

EN 50288-7 -: These specialized cables provided by Eland Cables are specifically engineered to establish electrical instrument circuits and facilitate seamless communication services within process plants, such as those in the petrochemical industry. Their design focuses on ensuring reliable and efficient connectivity for critical instrumentation and communication systems, enabling smooth operations and data transfer in industrial environments.

TRATOSMART AMP: Tratos offers the TRATOSMART AMP (Alternative Marine Power Cable), a highly resilient cable designed specifically for low-voltage shore connection (LVSC) applications. This specialized cable is utilized to efficiently provide ships with electrical power directly from the shore, ensuring a reliable and secure power supply during port stays

RE-2X(st)YSWBY PiMF Dca: TKF Cable’s RE-2X(st)YSWBY PiMF Dca, which are high-quality cables with exceptional electrical properties and low capacitance to ensure minimal signal loss. These cables are specifically designed for various industrial installations such as oil & gas and process industries. They are suitable for installation in cable trays, and conduits, and can even be directly buried underground. TKF cables offer reliable and efficient transmission of electrical signals, making them an ideal choice for demanding industrial applications.

List of Top Oil-Gas Cable Companies:

Eland Cables

R&M Electrical Group Limited

Tratos Group

TKF Cables

Siechem Technologies Pvt. Ltd.

Oil-Gas Cable Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

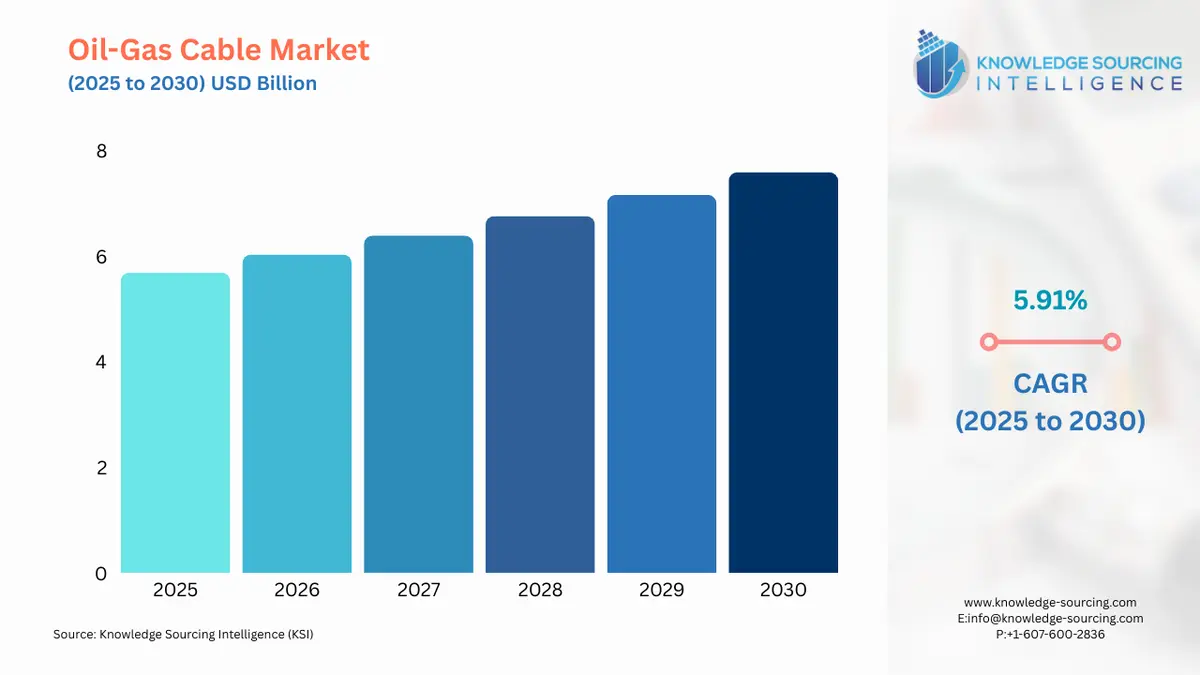

Oil-Gas Cable Market Size in 2025 | USD 5.693 billion |

Oil-Gas Cable Market Size in 2030 | USD 7.587 billion |

Growth Rate | CAGR of 5.91% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Oil-Gas Cable Market |

|

Customization Scope | Free report customization with purchase |

Key Segment:

By Type

Ethernet Cables

Variable Frequency Drives (VFD) Cables

Instrumentation and Control Cables

By Material

Polyvinyl Chloride

Thermoplastic Elastomer

Polyethylene

Others

By Application

Pumping

Process Control

Pipeline Management

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others