Report Overview

Organic Acids Market Report, Highlights

Organic Acids Market Size:

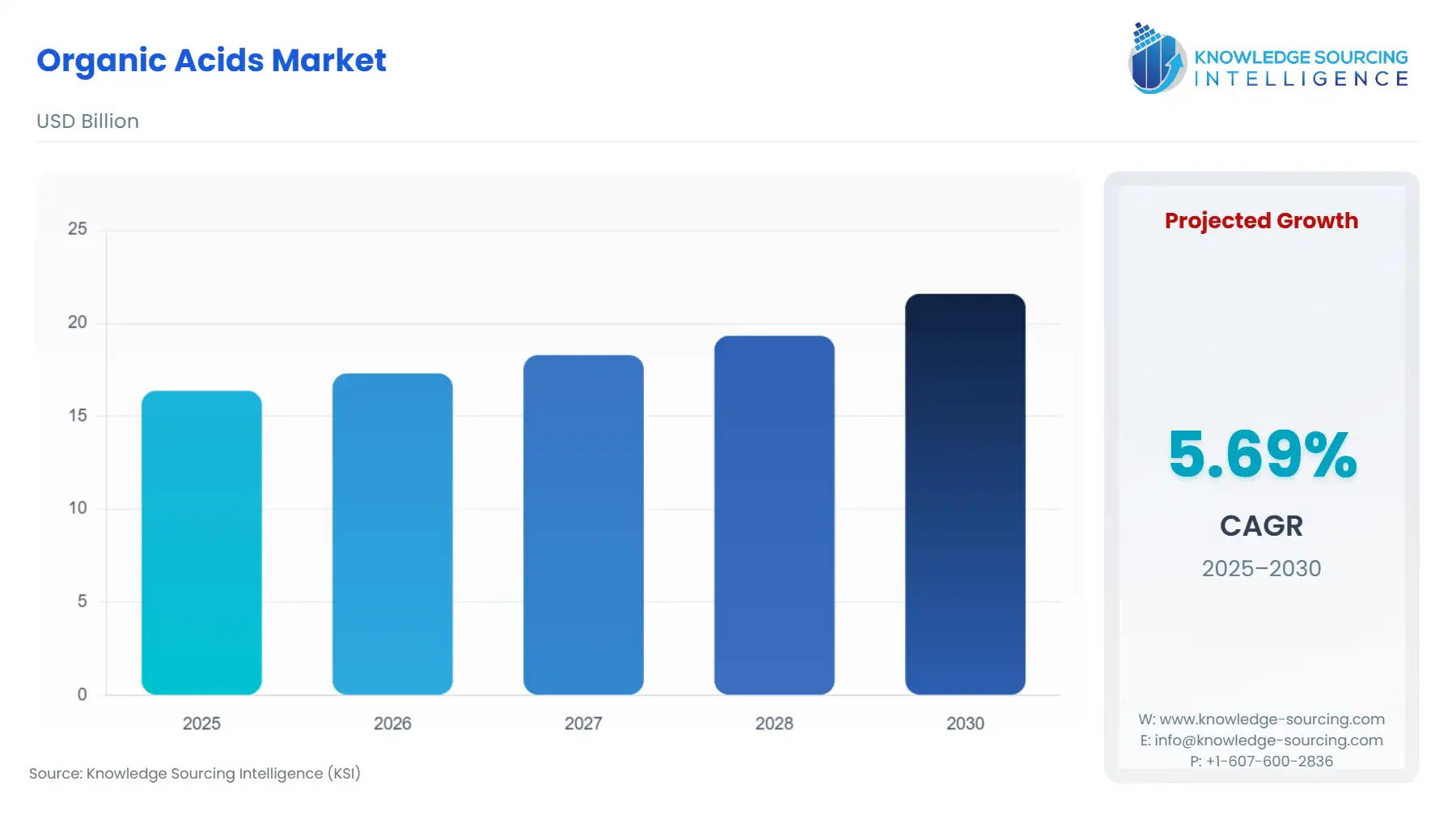

The Organic Acids Market will reach US$21.582 billion in 2030 from US$16.368 billion in 2025 at a CAGR of 5.69% during the forecast period.

Organic Acids Market Trends:

An organic acid is a chemical substance that has acidic properties. When compared to mineral acids, organic acids are weak acids that do not entirely dissociate in water. Formic acid and lactic acid dissolve in water, but larger molecular mass organic acids like benzoic acid are entirely insoluble in a neutral state. Lactic acid and formic acid were originally generated by fermentation, but developments in biotechnology and chemical synthesis have supplanted the previous fermentation technique. In addition, other agro-industrial wastes such as cassava bagasse, coffee husk, apple pomace, soybeans, sugarcane, corn cobs, press-mud, citric pulps, wheat bran, and kiwi fruit peel are being used to produce organic acids.

The primary reasons driving demand for organic acids are their growing applications in the healthcare sector and the high growth being observed across different industrial sectors. However, the synthesis of synthetic organic acids from nonrenewable sources (simultaneous fermentation and product recovery) entails environmental risks, leading to the introduction of rigorous laws governing their usage, and stifling market growth. Increased Research and development to produce efficient organic acids from bio-based sources will provide new market growth possibilities.

Because of rising disposable incomes and the global expansion of the economy, the global organic acid market provides market participants with several prospects. Organic acids are widely used in the petrochemical industry, primarily in the manufacture of intermediates and end-use petrochemical products. Furthermore, the expansion of the pharmaceutical sector is a component that contributes to the market's expansion. However, tight limitations on the synthetic manufacture of organic acids in North America and Europe are impeding the growth of the organic acid market.

The Asia-Pacific holds a significant market share since it is the fastest-growing regional market. The rising demand from countries such as China, India, Thailand, and Korea's healthcare, food and beverage, and textile sectors, in turn, provides significant potential for the organic acid market to maintain its rapid rise. Furthermore, because the product is intermediate and bio-degradable in nature, it has been extensively accepted by industries for a variety of applications, including polymer resins. The large market size, along with rapid growth in the Asia-Pacific region, is critical for the expansion of the organic acid market.

Organic Acids Market Growth Factors:

- An increase in applications of organic acids

The primary applications of rganic acid include food and drinks, personal care items, and medicines, which have received a lot of attention in recent years. Acetic acid, citric acid, lactic acid, and fumaric acid are the most common organic acids used in plastics, tanning, textiles, paper, metal, medicines, fragrances, herbal pesticides, colours, and dyes, lubricants, food and beverage applications, and cosmetic production. Formic and acetic acids are the most commonly utilised acids in medicinal and industrial applications. During the forecast period, the market for organic acids is anticipated to be driven by increased demand for multifunctional skincare products. Furthermore, due to their benefits over other feed acidulants, acidulants such as malic and fumaric acids are replacing antibiotics in animal feed. Fumaric and malic acids benefit animal health by regulating bacteria development in the digestive system. Moreover, in response to growing concerns about the use of antibiotic growth promoters (AGP) in animal feed, producers are turning to organic acids as alternatives.

Organic Acids Market Restraints:

- Environmental concerns

Acetic acid can be a dangerous chemical if not utilised in proper and safe proportions. Acetic acid is used in pesticide formulations as a herbicide to suppress weeds on fruits; it is also used to prevent mildew and inhibit bacterial development in feed. However, excessive acetic acid concentrations in pesticides or animal feed can be hazardous to animals, plants, and aquatic life. This is one of the most significant problems that organic acid producers confront. Furthermore, because of environmental concerns and legal requirements, the use of propionic acid in herbicides is steadily declining. Many herbicide formulations containing propionic acid were formerly utilised in many industrialised nations. Various of these items have been banned in some countries owing to the presence of harmful contaminants.

The global organic acids market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various organic acids, such as citric acid, lactic acid, acetic acid, and fumaric acid, while exploring applications across industries including food and beverages, pharmaceuticals, agriculture, animal feed, and chemicals. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Organic Acids Market Segmentations:

Organic Acids Market Segmentation by type

The market is analyzed by type into the following:

- Acetic Acid

- Formic Acid

- Lactic Acid

- Propionic Acid

- Citric Acid

- Ascorbic Acid

- Fumaric Acid

- Oxalic Acid

- Uric Acid

- Malic Acid

- Tartaric Acid

- Others

Organic Acids Market Segmentation by source

The market is analyzed by source into the following:

- Biomass-Based Sources

- Agro-Industrial Residue

- Chemical Synthesis

- Molasses and Starch

Organic Acids Market Segmentation by application

The market is analyzed by application into the following:

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Industrial Applications

- Personal Care & Cosmetics

- Agriculture

- Packaging Industry

Organic Acids Market Segmentation by end-user

The market is analyzed by end-user into the following

- Food & Beverage Industry

- Animal Feed Industry

- Pharmaceuticals & Nutraceuticals Industry

- Personal Care & Cosmetics Industry

- Chemicals & Industrial Manufacturing

- Agriculture Sector

Organic Acids Market Segmentation by regions:

The study also analysed the organic acids market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Organic Acids Market Competitive Landscape:

The global organic acids market features key players such as Cargill, Incorporated, Archer Daniels Midland Company (ADM), BASF SE, The Dow Chemical Company, and Celanese Corporation, among others.

Organic Acids Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by type, with historical revenue data and analysis.

- Market size, forecasts, and trends by source, with historical revenue data and analysis.

- Market size, forecasts, and trends by application, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-user, with historical revenue data and analysis across various segments.

- Organic acids market is also analysed across different regions, with historical data, regional share, attractiveness and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the organic acids market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Organic Acids Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Organic Acids Market Size in 2025 | US$16.368 billion |

| Organic Acids Market Size in 2030 | US$21.582 billion |

| Growth Rate | CAGR of 5.69% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Organic Acids Market |

|

| Customization Scope | Free report customization with purchase |

Our Best-Performing Industry Reports:

Navigation

- Organic Acids Market Size:

- Organic Acids Market Key Highlights:

- Organic Acids Market Trends:

- Organic Acids Market Growth Factors:

- Organic Acids Market Restraints:

- Organic Acids Market Segmentations:

- Organic Acids Market Competitive Landscape:

- Organic Acids Market Report Coverage:

- Organic Acids Market Scope:

- Our Best-Performing Industry Reports: