Report Overview

Tartaric Acid Market - Highlights

Tartaric Acid Market Size:

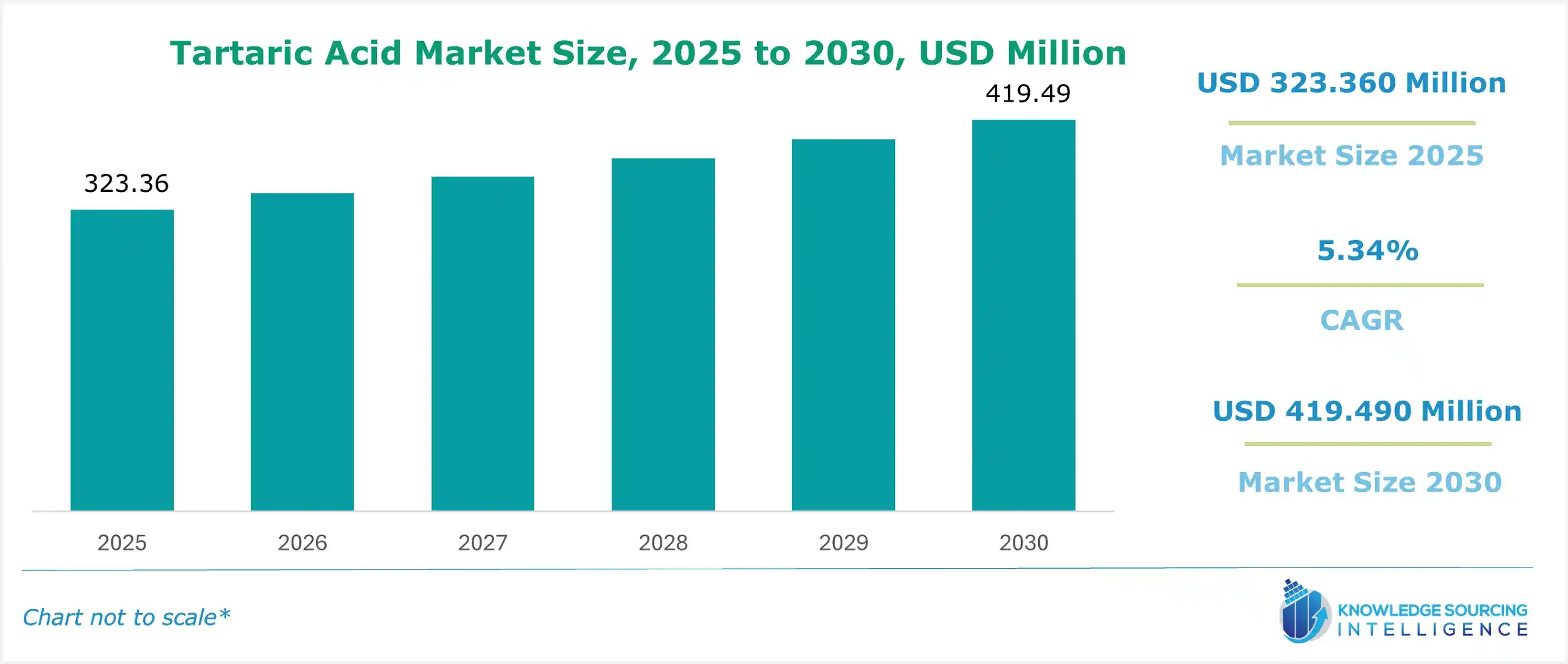

The tartaric acid market is estimated to foresee significant growth with a CAGR of 5.34% and is anticipated to grow from a market size of USD 323.360 million in 2025 to reach a market size of USD 419.490 million in 2030.

Tartaric Acid Market Trends:

The global tartaric acid market is experiencing steady growth due to its wide-ranging applications across food, beverage, pharmaceutical, and cosmetic industries. Known as a naturally occurring organic acid, tartaric acid is primarily derived from grapes and plays an essential role in several industrial processes.

In the food and beverage industry, tartaric acid is widely used as an acidulant, flavor enhancer, and preservative. Its ability to regulate acidity and stabilize formulations makes it indispensable in processed foods, carbonated drinks, and candies. One of its most prominent uses is in winemaking, where it helps stabilize wine, enhance taste, and prevent the formation of potassium bitartrate crystals, commonly referred to as "wine diamonds." Tartaric acid also ensures proper pH balance during fermentation and improves shelf life in various beverages.

In the pharmaceutical industry, tartaric acid serves as a buffering agent, effervescent base, and complexing agent in medications. It enhances the solubility of active ingredients and is commonly used in chewable tablets and soluble powders. Its natural origin and safety profile make it a preferred excipient in both prescription and over-the-counter drugs.

The cosmetic and personal care industry is another significant contributor to tartaric acid demand. It is used in exfoliating products, face peels, and creams, thanks to its ability to promote cell turnover and maintain the skin’s pH balance. As a type of alpha hydroxy acid (AHA), tartaric acid gently removes dead skin cells and improves skin texture.

The market is benefiting from increasing consumer preferences for natural and organic ingredients. As a naturally sourced compound, tartaric acid aligns well with the clean-label movement and the growing demand for sustainable, plant-based ingredients in consumer products. Additionally, rising health awareness and interest in digestive wellness have supported the inclusion of tartaric acid in functional foods and dietary supplements.

However, the market faces potential challenges from fluctuations in grape harvests, as most tartaric acid is produced as a byproduct of winemaking. Unfavorable weather, disease outbreaks, or changes in vineyard outputs can influence raw material availability and pricing. Moreover, supply chain disruptions in major producing regions can impact global availability.

Despite these challenges, the outlook for the tartaric acid market remains positive, underpinned by its multi-industry utility, clean-label appeal, and increasing global demand for natural compounds. Continuous innovations in food formulations and personal care products are expected to create further growth opportunities in the years ahead.

Tartaric Acid Market Growth Drivers:

- Growing use of tartaric acid in various industries

Tartaric acid is used in wine manufacturing and is also gaining a rise in demand for its application in the food and beverage industry due to its antioxidant properties. It is also used in the pharmaceutical industry for medicine preparation and to improve the taste of oral medicines.

Furthermore, taking into consideration the rising living standards and health care concerns, there is a growth in the consumption of protein & sports drinks and nutritional bars, which also aids demand for tartaric acid for its application as a food preservative and flavor enhancer. It also finds its use in the cement and construction industries because of its anti-solidifying and set-retardant agent characteristics. These factors boost the tartaric acid industry’s growth at a steady pace. Other uses include the use of the acid as a pH adjuster in the cosmetics and personal care industry and as a chelating agent in soil, fertilizers, and metal cleaning.

However, the increase in government regulations related to the use of synthetic tartaric acid in the food and pharmaceutical industries is expected to impede market growth in the forecast period. Industry players are adopting strategies for increasing their market share in the global tartaric acid market. Acquisitions act as the key strategy adopted by players in the tartaric acid market to expand their geographical outreach.

- Rising use in the cosmetics & personal care industry

Tartaric acid is used as a pH adjuster in personal care products to control the pH of the finished beauty products. With the growing interest in cosmetics among many women at the international level, the market is further poised to grow at a significant pace in the forecast period. This is mainly attributed to the fact that these women are highly interested in the exploration of a wide range of beauty products available in the market, further leading to the high market demand for cosmetics and personal care commodities.

Additionally, the introduction of many independent brands along with new and innovative ideas in the field of cosmetics to remain beautiful or become beautiful is adding to industrial growth. The increasing craze for cosmetics is not limited to the younger population only, but it is being widely experienced among older adults as well. Hence, the vendors or suppliers in the cosmetic industry have been provided with immense opportunities to produce a variety of cosmetic goods for this group of society as well.

Furthermore, big brands are adopting certain strategies where they are involved in the acquisition of smaller brands to enhance their product outreach and bolster their brand value. The main reason is that young companies with innovative products are known to pose a threat to the bigger brands, hence, through acquisition at a high valuation, big companies can expand their product portfolio as per the consumers’ demands and are capable of providing a huge range of cosmetic products coupled with unique and appealing packaging, triggering the impulse buying behavior of these customers.

Tartaric Acid Market Geographical Outlook:

- The tartaric acid market is segmented into five regions worldwide

Geography-wise, the market of tartaric acids is divided into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. Tartaric acid finds solid markets in North America and Europe and has a presence in significant industries concerning food and beverages. The market is gaining importance due to increased demand in these regions for natural, organic products.

The growing middle-class population is contributing to boosting cosmetic sales, especially from the emerging economies of the world, providing a huge consumer base. According to the OECD stats, the global middle class is projected to increase from a size of 1.8 billion in 2009 to a size of 4.9 billion in 2030.

By the end of 2030, the Asian region is estimated to hold the maximum middle-class population, where it is expected to represent more than 60% of the global middle-class population, and over 50% share the basis of middle-class consumption. China and India are expected to account for the maximum share of the middle-class population and consumption in the forecast period. According to the National Bureau of Statistics, the middle-class population in China is projected to grow at a rapid rate, especially in the big cities, and at the same time, is expected to contain the most active consumer group for the purchase of cosmetic products, further creating a high market demand for tartaric acid during the manufacturing process.

Tartaric Acid Market Key Developments:

- In March 2025, BIOKING announced its debut at the 28th FIC Exhibition in China and showcased its core product, tartaric acid, under the theme of "green environmental protection, natural health." The tartaric acid product series of the company is developed with 25 years of expertise.

List of Top Tartaric Acid Companies:

- Alvinesa Natural Ingredients S.A.

- Tártaros Gonzalo Castelló, S.L.

- Derivados Vínicos SA

- Distillerie Mazzari S.p.A.

- Tarac Technologies

Tartaric Acid Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Tartaric Acid Market Size in 2025 | USD 323.360 million |

| Tartaric Acid Market Size in 2030 | USD 419.490 million |

| Growth Rate | CAGR of 5.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Tartaric Acid Market |

|

| Customization Scope | Free report customization with purchase |

The tartaric acid market is segmented and analyzed as follows:

- By Type

- Natural

- Synthetic

- By Application

- Wine

- Food & Beverages

- Excipient

- Antacids

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

Navigation

- Tartaric Acid Market Size:

- Tartaric Acid Market Highlights:

- Tartaric Acid Market Trends:

- Tartaric Acid Market Growth Drivers:

- Tartaric Acid Market Geographical Outlook:

- Tartaric Acid Market Key Developments:

- List of Top Tartaric Acid Companies:

- Tartaric Acid Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 11, 2025