Report Overview

Oscillator Market - Strategic Highlights

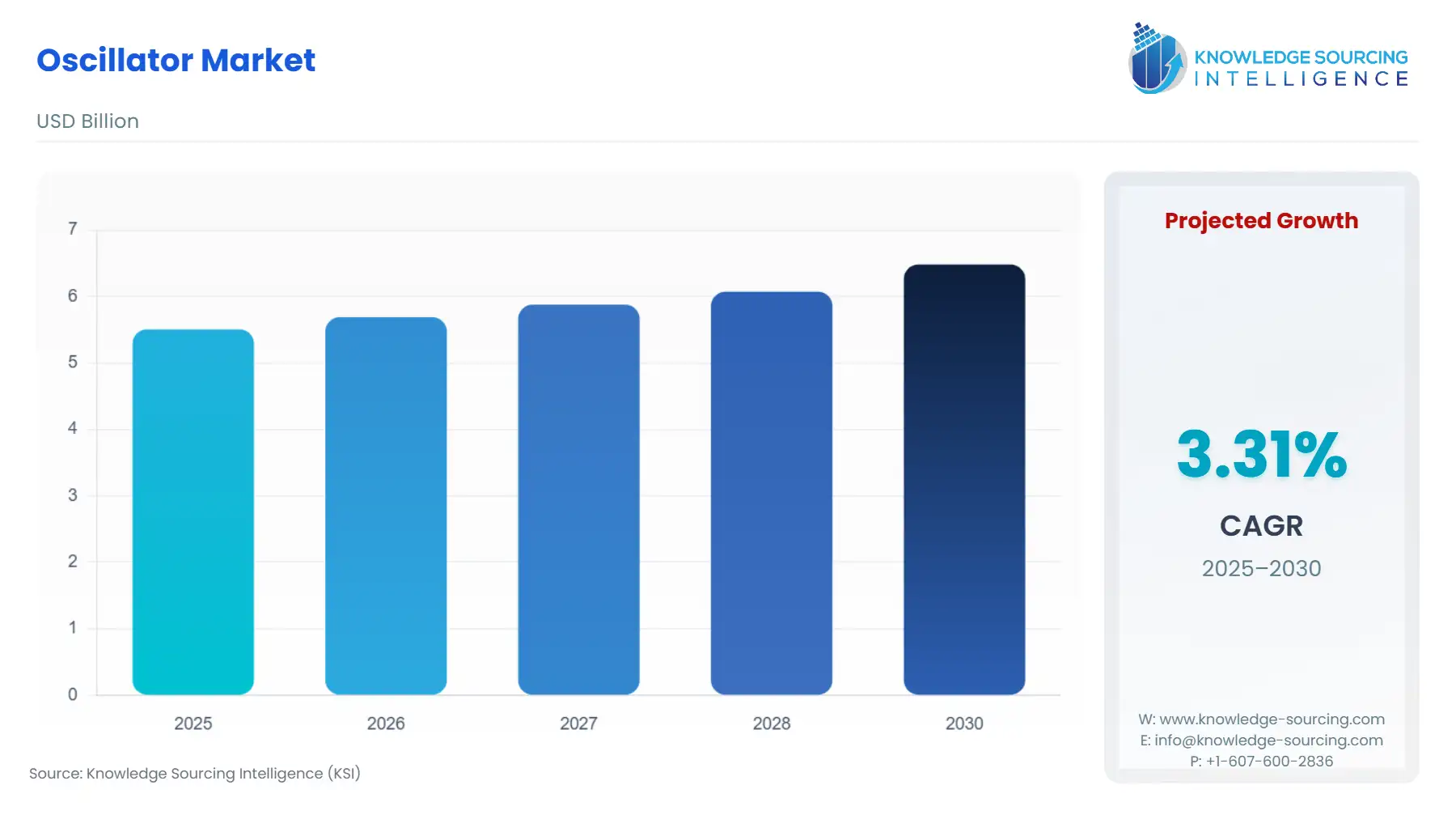

Oscillator Market Size:

The oscillator market is projected to grow at a CAGR of 3.31% to reach US$6.483 billion by 2030, up from US$5.508 billion in 2025.

Oscillator Market Introduction

The oscillator market is a critical segment of the frequency control devices industry, providing essential timing components for electronics across telecommunications, consumer electronics, automotive, aerospace, and industrial applications. Oscillators generate precise, stable electrical signals at specific frequencies, serving as the heartbeat of electronic systems, from smartphones to satellite communications. The market encompasses the crystal oscillators, MEMS oscillators, and silicon oscillators, each offering unique advantages in terms of precision, size, and robustness. As global demand for high-speed connectivity, IoT devices, and autonomous systems surges, oscillators play a pivotal role in ensuring reliable performance in applications requiring accurate timing, such as 5G networks, automotive radar, and medical equipment. The oscillator market is driven by technological advancements and the need for compact, energy-efficient solutions, positioning it as a cornerstone of modern electronics.

The crystal oscillators market dominates due to its high stability and low phase noise, critical for telecommunications and aerospace. SiTime’s Elite X MEMS oscillators introduced enhanced resilience for harsh environments, targeting automotive and industrial applications. Similarly, silicon oscillators, leveraging CMOS technology, offer cost-effective, programmable solutions, as seen in Microchip Technology’s 2024 DSC6000 series for IoT devices. The frequency control devices market benefits from the global 5G rollout, with Nokia’s AirScale portfolio relying on crystal oscillators for precise timing in base stations. Asia-Pacific, particularly China and Taiwan, leads the market due to massive semiconductor and electronics production, supported by initiatives like “Made in China 2025”. Europe’s focus on Industry 4.0, as noted by Siemens, drives the adoption of MEMS oscillators in smart manufacturing.

The automotive sector increasingly relies on timing components for advanced driver assistance systems (ADAS) and vehicle-to-everything (V2X) communication, with NXP’s S32K microcontrollers integrating silicon oscillators for automotive-grade reliability. The MEMS oscillators market gains traction for its robustness and small footprint, ideal for IoT and wearables, as highlighted by STMicroelectronics’ MEMS timing solutions. The aerospace and defense sectors also drive demand, with crystal oscillators ensuring precise timing in satellite navigation, as seen in Thales’ GNSS advancements. The integration of smart timing components with IoT and AI aligns with Industry 4.0, enhancing real-time monitoring and synchronization in industrial systems.

Numerous factors drive the market expansion:

5G and IoT Expansion: Frequency control devices demand surges with 5G and IoT growth.

Automotive Advancements: ADAS and V2X drive the adoption of MEMS and silicon oscillators.

Technological Innovation: Smart timing components enhance precision and efficiency in electronics.

The market growth is restrained by:

High Development Costs: Complex RFIC design for crystal oscillators increases production expenses.

Miniaturization Challenges: Shrinking timing components complicates manufacturing and reliability.

Key Factors to Consider When Choosing an Oscillator

Selecting the right oscillator for a specific application requires careful evaluation of several factors:

Frequency Stability and Accuracy: Crystal oscillators offer superior stability for applications like 5G, while MEMS oscillators suit rugged environments.

Size and Power Consumption: Silicon oscillators are compact and energy-efficient, ideal for IoT and wearables.

Environmental Robustness: MEMS oscillators withstand vibration and temperature extremes in automotive and industrial settings.

Phase Noise and Jitter: Low phase noise is critical for frequency control devices in telecommunications and radar.

Cost and Scalability: Silicon oscillators offer cost-effective solutions for high-volume consumer electronics.

Difference Between an Oscillator and a Crystal

A crystal is a piezoelectric component, typically made of quartz, that vibrates at a precise frequency when subjected to an electric field, serving as the core frequency-determining element in many frequency control devices. It provides raw frequency stability but requires external circuitry to function. An oscillator, in contrast, is a complete electronic circuit that integrates a crystal or other resonator (e.g., MEMS or silicon) with amplification and feedback mechanisms to produce a stable output signal. Crystal oscillators combine a quartz crystal with circuitry for high-precision applications, while MEMS and silicon oscillators use alternative resonators for robustness and cost-efficiency. For example, SiTime’s MEMS oscillators replace crystals in automotive applications for better shock resistance. Oscillators are thus complete systems, whereas crystals are components within them.

Oscillator Market Overview

An oscillator is a mechanical or electronic device that operates on the principle of oscillation, which is the regular energy fluctuation between two entities. Many types of technology use oscillators, including computers, clocks, watches, radios, and metal detectors. Crystal oscillators are frequently used in safety-critical applications, including braking control, anti-lock braking systems, airbags, and tire pressure monitoring systems (TPMS).

The push for precision, enhanced safety standards, and rapid data transmission is fueling the adoption of crystal units and oscillators. The integration of WiFi and Bluetooth chipsets in smartphones has significantly increased oscillator demand. Growing support for diverse consumer product applications is expected to further propel the oscillator market's expansion.

The consumer electronics sector is a key driver of the oscillator market. Oscillators are increasingly used in products like cable television systems, personal computers, digital cameras, radios, smartphones, and wearables, providing high-frequency stability, quality resonance, and low-temperature drift. These components enable critical wireless features in smartphones, including cellular, Wi-Fi, FM, Bluetooth, and GPS. Rising consumer electronics production and smartphone adoption are set to accelerate oscillator market growth.

The Asia-Pacific region will dominate the oscillator market throughout the forecast period, driven by major semiconductor manufacturing hubs in China, Taiwan, and South Korea. In April 2022, Teradyne Inc., a leading supplier of automated test equipment, delivered the 7,000th unit of its J750 semiconductor test platform to a prominent Chinese manufacturer of microcontroller units (MCUs) and security integrated circuit (IC) chips, underscoring the region's prominence in advanced semiconductor production.

Some of the major players covered in this report include Murata Manufacturing Co., Ltd., Seiko Epson Corporation, Kyocera Corporation, Rakon Limited, Tai-Saw Technology Co., Ltd., Morion, Inc., among others.

Oscillator Market Trends

The oscillator market is evolving rapidly, driven by advancements in frequency control devices for 5G, IoT, and automotive applications. Miniaturization is a key trend, with silicon and MEMS oscillators shrinking to meet compact device requirements, as seen in Microchip’s DSC6000 series for IoT wearables. Frequency stability remains critical, with crystal oscillators providing low phase noise for 5G base stations, as in Nokia’s AirScale deployments. Shock and vibration resistance drives MEMS oscillators' adoption in automotive ADAS, with SiTime’s Elite X offering robust performance in harsh environments. Supply chain resilience gains focus, with NXP’s localized production of hybrid oscillators mitigating disruptions. Hybrid oscillators, combining crystal and MEMS technologies, balance cost and performance for industrial applications, aligning with Industry 4.0 trends. These trends ensure the oscillator market meets diverse, high-precision needs.

Oscillator Market Drivers

Expansion of 5G and IoT Technologies

The rapid rollout of 5G networks and the proliferation of IoT devices significantly drive the oscillator market, as frequency control devices are essential for precise timing in high-speed communications. Crystal oscillators provide the frequency stability required for 5G base stations, as demonstrated by Nokia’s AirScale portfolio, which relies on timing components for low-latency performance. MEMS and silicon oscillators support compact IoT devices, with Microchip’s DSC6000 series enabling energy-efficient wearables. Miniaturization trends in Asia-Pacific, driven by China’s “Made in China 2025” initiative, boost demand for hybrid oscillators in IoT applications. The frequency control devices market thrives as 5G and IoT expansion demands reliable, high-precision timing components.

Automotive Advancements in ADAS and V2X

The growth of ADAS and vehicle-to-everything (V2X) communication propels the oscillator market, with MEMS and silicon oscillators offering shock and vibration resistance for automotive applications. NXP’s S32K microcontrollers integrate silicon oscillators to ensure reliable timing in ADAS radar and V2X systems, enhancing vehicle safety. Miniaturization enables compact integration in automotive electronics, while frequency stability supports high-frequency radar operations. Europe’s focus on autonomous vehicles, aligned with Industry 4.0, drives demand for robust timing components, as seen in STMicroelectronics’ MEMS timing solutions for automotive-grade reliability. The oscillator market benefits from automotive innovation, ensuring frequency control devices meet stringent performance requirements.

Technological Innovations in Oscillator Design

Advancements in frequency control devices, particularly MEMS and hybrid oscillators, drive the oscillator market by enhancing performance and versatility. SiTime’s Elite X MEMS oscillators offer superior shock and vibration resistance, catering to industrial and automotive applications. Hybrid oscillators, combining crystal and MEMS technologies, balance frequency stability with cost-efficiency, as seen in Kyocera’s timing solutions for telecommunications. Miniaturization and smart timing components align with Industry 4.0, enabling IoT-enabled monitoring for real-time synchronization, as in Abracon’s compact oscillator series. These innovations ensure the oscillator market meets diverse needs, from consumer electronics to aerospace, driving adoption of timing components.

Oscillator Market Restraints

High Development and Manufacturing Costs

The oscillator market faces challenges due to the high costs of developing and manufacturing frequency control devices, particularly crystal and MEMS oscillators. Advanced RFIC design for crystal oscillators requires precise fabrication processes, increasing expenses, as noted in Microchip’s DSC6000 series production. Miniaturization demands sophisticated equipment, raising costs for silicon and hybrid oscillators, which limits adoption by smaller manufacturers. Supply chain resilience issues, such as material shortages, further escalate costs, as highlighted in STMicroelectronics’ production challenges. These financial barriers slow oscillator market growth in cost-sensitive applications, despite the long-term benefits of timing components in high-precision systems.

Challenges in Miniaturization and Reliability

The push for miniaturization in frequency control devices poses significant challenges for the oscillator market, as shrinking timing components complicates reliability and performance. MEMS and silicon oscillators, while compact, face issues with frequency stability under extreme conditions, as noted in SiTime’s development hurdles for IoT applications. Hybrid oscillators require complex integration to balance size and shock and vibration resistance, increasing design costs, as seen in Abracon’s compact oscillator challenges. Crystal oscillators, critical for high-precision applications, struggle with size reduction without compromising performance, limiting scalability in wearables and IoT. These challenges hinder oscillator market growth, particularly in high-volume consumer electronics.

Oscillator Market Segmentation Analysis

By Type, the Crystal Oscillator segment is growing significantly

Crystal Oscillator dominates the oscillator market due to its superior frequency stability and low phase noise, making it essential for high-precision applications in telecommunications and aerospace. These oscillators, utilizing quartz crystals, provide unmatched accuracy for frequency control devices, critical in 5G base stations and satellite navigation. Nokia’s AirScale portfolio relies on crystal oscillators for precise timing in 5G infrastructure, ensuring reliable data transmission. Their robustness and compatibility with smart timing components drive adoption over MEMS and SAW oscillators, as seen in Thales’ GNSS solutions for defense applications. Crystal oscillators support Industry 4.0 trends, enhancing synchronization in telecommunication and industrial and IoT systems, cementing their leadership in this market.

OEMs are expected to hold a large market share

OEMs lead the oscillator market as they integrate frequency control devices directly into electronic systems for consumer, automotive, and telecom applications. These demand crystal and MEMS oscillators for their reliability and miniaturization, as seen in Microchip’s DSC6000 silicon oscillators used in IoT devices by major manufacturers. OEMs in Asia-Pacific, particularly in China, drive demand through large-scale electronics production, supported by “Made in China 2025” initiatives. Their preference for smart timing components with supply chain resilience outweighs the aftermarket, as OEMs prioritize timing components for new designs in consumer electronics and semiconductor applications, ensuring market dominance.

By Application, the telecommunications industry is experiencing a large demand

The telecommunications sector dominates the oscillator market, driven by the global 5G rollout and emerging 6G research, requiring precise frequency control devices. Crystal oscillators ensure frequency stability in 5G base stations, as evidenced by Nokia’s AirScale deployments. MEMS oscillators and voltage-controlled oscillators support high-speed data transmission in telecommunication infrastructure, with Kyocera’s solutions enhancing network synchronization. Miniaturization and shock and vibration resistance make timing components ideal for telecom equipment, outpacing consumer electronics and automotive applications. This sector’s growth, particularly in Asia-Pacific, is fueled by investments in 5G and IoT, as noted in China’s telecom advancements, solidifying its leadership in the oscillator market.

Oscillator Market Key Development

In May 2025, Abracon released its AR36CPT series of Rubidium oscillators, incorporating Coherent Population Trap (CPT) technology. This product is a significant development in high-precision timing, as it leverages atomic clock technology to provide unparalleled long-term stability and accuracy. The use of CPT technology allows for a smaller form factor and lower power consumption compared to traditional atomic clocks, making them suitable for a wider range of applications. This innovation is crucial for synchronization in telecommunication networks, military systems, and metrology, where superior precision is essential.

In May 2025, Abracon introduced its AMMLP series of low-power MEMS oscillators, designed for applications where ultra-low power consumption and high resilience are critical. MEMS technology offers superior shock and vibration resistance compared to traditional quartz oscillators, making these products suitable for industrial, automotive, and wearable devices. This product family, available in multiple package sizes, enables engineers to design more robust and energy-efficient battery-operated devices. This development reflects the broader market trend of transitioning from quartz to MEMS-based solutions for their durability and miniaturization benefits.

Oscillator Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$5.508 billion |

| Total Market Size in 2031 | US$6.483 billion |

| Growth Rate | 3.31% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Oscillator Market Segmentation:

By Type

Crystal Oscillator

SAW Oscillator

MEMS Oscillator

Voltage Controlled Oscillator

By End-User

OEMs

Aftermarket

By Application

Consumer Electronics

Semiconductor

Automotive

Industrial and IoT

Telecommunication

Medical Equipment

Others

By Geography

Americas

US

Europe, the Middle East, and Africa

Germany

Netherlands

Others

Asia Pacific

China

Japan

Taiwan

South Korea

Others